There are a million articles written on the Top 10 Mistakes that Home Buyers make. Today…the biggest mistake one can make is to set a rigid time frame as to WHEN you WANT to buy. Let me re-phrase that in light of the email I just received below from someone who is not my client.

“Ardell, I am seeing many sellers hanging on to those 2007 prices. I mean wouldn’t being 12% below a 2007 purchase price be considered a little high? Properties are closer than ever now to late 2004 pricing aren’t they? Many houses we look at have asking prices higher than what sellers purchased them for in 2005 or later. I’m really getting tired of this.”

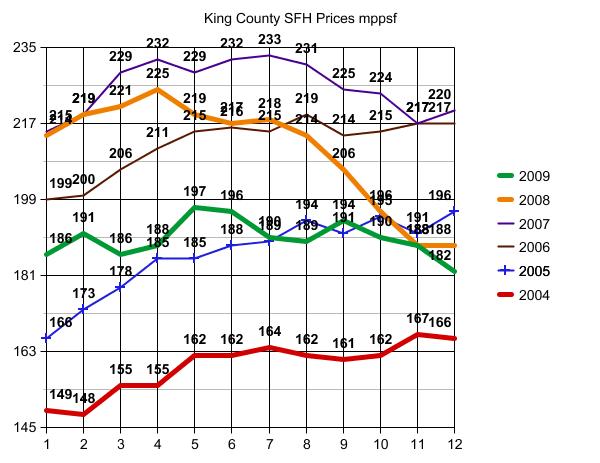

First let’s review the data again.

King County median home price is/was at $375,000 a week or so ago, up from $362,700 as of the end of March 2009, and WELL above “late 2004 pricing” of $337,500.

I’m not saying prices won’t get to late 2004 levels. In fact I think they will get there or pretty darned close in some, though not all, areas. But to go out EVERY weekend…looking at homes and hoping they would now be at 2004 pricing when they are not, will result in your “getting tired of this”. It would be like my getting tired of my diet for not having lost 20 lbs this week. I know that’s going to take some time, and getting “tired of this” is NOT an option if I am to achieve my goal by my daughter Tina’s wedding date in October 🙂

Now let’s see how the numbers fall in different areas vs. “King County” median prices:

98052

Late 2004 median home price = $409,995 – April 2010 = $610,000

98006

Late 2004 median home price = $507,000 – April 2010 = $591,500

98033

Late 2004 median home price = $469,000 – April 2010 = $479,000

98103

Late 2004 median home price = $400,500 – April 2010 = $435,000

98038

Late 2004 median home price = $281,950 – April 2010 = $299,950

98023

Late 2004 median home price = $244,975 – April 2010 = $249,225

98109

Late 2004 median home price = $598,500 – April 2010 = $460,500

98125

Late 2004 median home price = $319,750 – April 2010 = $360,000

Some surprising results there, and in many cases those numbers come up VERY differently than what I have been seeing touted in recent news articles as to which neighborhoods are “stronger” than others these days.

There are different reasons for these results in the different zip codes. For example, if you are hoping for 2004 pricing, but are buying a house that did not EXIST in 2004…well, in some areas new construction is not likely to fall into the level of a home built prior to 2004.

One thing “the comps” don’t tell you, is how FAR the MAJORITY of home buyers has shifted from 2004 to present. How many are buying more reasonably priced homes where they can afford to put 20% down and get a 30 year fixed mortgage based on conservation ratios, as example.

It’s not ALL about “the market”…nor is it ALL about “this house”. First step is to know exactly where the area you are looking in falls…and if NO SELLER “wants” to price there…you may just have to stop looking for awhile. Looking for “best price” in May of any year, is not particularly realistic. It is what I call “The Season of Hope” and “Hope Springs Eternal”. Best prices often don’t happen until around October 15th in any given year.

Start with a realistic objective and DO NOT WEAR YOURSELF OUT looking and looking. Take your time. Pace yourself. If lowest possible price is your objective…”Spring Bump” period may not be the time you want to choose for being in your new home. Buying in August – September – October may be a better bet if you want “better pricing”, especially if no new housing stimulus packages are forthcoming.

Remember…”Patience is a Virtue” and one often has to fight their initial gut instincts, in order to become “virtuous”.

(required disclosure – Stats in this Post are not compiled, posted or verified by The Northwest Multiple Listing Service) They are hand calculated by me, and April medians may include the first few days of May before we switched to a new mls system. I used 4/1/10 as the start point…but no end date, since the system stopped updating data around May 4th and converted to the new system that does not provide similar statistic gathering capabilities.

Ardell- As I’ve said before, I’m immensely impressed by how much expert effort you put into Real Estate as a Profession. Perhaps that’s why we’ve been able to have all of the interesting dialogs over the last few months. Jerry

…hope there aren’t too many typos in there…will check when I get back. Rushed the post up before heading to the studio to tape some radio spots for “Seattle Real Estate Now” making its radio debut next week from 4:30 to 5:00 daily on Business Talk Radio in Seattle.

And now comes- “Seattle Real Estate Now

Thanks Jerry,

The new mls system will make it more difficult. Amazes me how many of the “upgrades” are aimed at dumbing us down. Seems counter-productive.

I think people who write these systems think we “find homes” for a living. It’s sad, really.

I couldn’t agree more with “Patience is a Virtue”. And I believe that it would apply to both sides of the fence for both buyers and sellers.

I don’t know about that David. Patience on the seller side is more often a negative vs. a positive as in: I’m in no hurry to sell, so I’ll price it high and “be patient”.

I happen to know this is a “pet peeve” of yours…so was surprised to see you apply it to the seller side of the fence. 🙂

Has any work been done to see if the median homes compare between 2004 and 2010 in these zip codes. To use an example from the automotive industry let’s say people in 98052 were buying a Cadillac as the median car but in 2010 moved down to a less desirable Buick at the median. What I am trying to say is prices for product may not have changed the consumer at the median is just buying a smaller less attractive house in 2010 than was purchased in 2004. The case could very well be going the other way the median buyer is now getting a better house in 2010 than the median buyer bought in 2004?

I have, Peter. Though “better house” can’t always be measured in square feet, I have done many trackings over the last couple of years on a price per square foot basis vs. a median price basis and in 98052 specifically.

Under the new mls system I will be doing stats by zip code almost exclusively, since we can no longer get stats on a County-wide basis.

I have also done 2004 medians through 2009, eliminating in those subsequent years any homes that didn’t exit in 2004. I’ve also tracked homes built in 60s vs 70s, 80s, etc. The results shed a completely different light on where prices are going for given time frames of build.

I also did some for style of home comparing split entries to split entries and two story to two story. If 6 years ago people were buying more split entries than two stories…the numbers are impacted by the lesser home style vs appreciation/depreciation of the market as a whole.

I’ll try to do some stats along those lines again soon.

Yes, Peter, that was my question about a year ago. Actually, two years ago there was hardly anything under $200K. In 2008 tear downs were still selling for a good price, that changed. Then the median price stayed about the same and it was price reductions catching up so you were buying a better house for the same price.

Today, I don’t know. It all looks way over priced to me. I can’t imagine any one buying a house today who didn’t plan on paying it off completely.

What I mean to say is, we sold our house in January and we sold it for a pretty good price. We did not have to be patient though because it pended in 17 days. If we could not get that price we were going to HAVE to be patient because there was nothing we could do at any price lower than asking. We had only been in the house seven years and walked away with, after improvements, a 10% net gain. So sad.

Words from our current buyers agent are ‘Sellers agents and buyers are having a hard time seeing eye to eye on prices. Only a very small percentage of sellers are motivated to sell right now.’

We are now compelled to be patient in our search.

None of the pricing I see would help a buyer get anywhere near having something like closing equity.

I would guess the supply chain is not in the best shape.

What is one of the first questions you as a listing agent ask sellers? Would it be, ‘How much do you owe on it right now’? If you get the answer that sellers owe what it was worth in 2006 or 2007 because of purchase price or home equity loans then you discover the problem you are going to have with pricing.

Still frustrated still looking.

David asks: “What is one of the first questions you as a listing agent ask sellers? Would it be, ‘How much do you owe on it right now’?”

Not usually. We have a couple of ways to know that before we meet the seller. Our “tax” site view shows the mortgages and the Preliminary Title Report gives us additional info. Unless it is close to break even, there’s usually not much reason to fine tune it or address it for home valuation purposes.

In any case an agent would determine the likely sold price range first, to recommend an asking price. I then do the seller net proceeds as to costs not payoffs, showing how much is available for payoffs.

Usually if there is not enough equity to sell the property, I am telling them to stay put unless they can’t. Often at the end of the appointment we are coming up with a strategy for their staying vs selling. That is why inventory is relatively low for this time of year. Many who have the option of selling or staying are staying.

The reality is the seller decides what they want to ask at the end of the day, and then I decide whether or not I want to list it at that price. Many times that answer is no. I am watching one like that now. I just couldn’t believe in “that” price, so I gave him the name of an agent who might, and he listed it with her. It’s still for sale after a $40,000 price reduction and still not sold or pending.

If I can’t believe in that product at that price, I usually just step out, after giving them my considered opinions and advice.