This may seem like an odd analogy, but I remember this story about my Mom when she was having her 7th baby. She was in “a ward” with only curtains drawn around each bed. She overheard some people telling the lady in the bed next to her that she should have “her tubes tied”. They were explaining the procedure to her. My Mom jumped out of bed, ripped open the curtain of the woman next to her and yelled “I want one of those!!!” The people were embarassed and said, “I’m sorry but we’re only allowed to offer these to single women on welfare having their third child. You weren’t supposed to hear that.”

Yes…I’m suggesting that to some extent The Information Age is in part responsible for the Subprime Crisis. Subprime loans did not come into being in late 2003. 2003 is the year more people said “I want one of those!!!”

Couple that with the fact that the World as it IS has come to the conclusion that spinning words (like Death Tax vs. Estate Tax) is a persuasion tool. We used to say, “You can’t get a good loan, but we can find you a BAD loan, if that’s what you want.” Most people said, “No, thank you…we’ll wait.” Loans had letters that were easy to understand. A Paper = most lenders. B through D Paper was a different lender for buyers with one or a few correctable issues over the short term. Z Paper was basically the Mob with a license to lend.

People understood the alphabet, and they knew that a C-Mortgage was not as good as an A-Mortgage. Life was more Transparent back then. The need for Transparency today is largely due to the fact that professionals hide truth behind more persuasive language. Don’t get me started on Listing Agent vs. Agent for the Seller. Everytime I hear a buyer say “The listing agent was MY agent, looking out for me (and I heard it twice in the last 4 days) I want to scream. How the heck can you believe that “the agent for the seller” is looking out for you, the buyer? Maybe because they use the words “listing agent” for that reason. But that’s a different, though related, subject.

Couple that with small businesses (who only offered Sub-Prime loans) getting gobbled up by larger “one stop shops”. All of a sudden the lender could give you an A Paper loan or a C Paper loan without a loan denial in between. When there was a loan denial in between, the buyer had a legal out with the Finance Contingency. When the approval came…but it was for “a bad loan”, the buyer was locked into the transaction with no legal out.

Couple that with Real Estate Agents only caring if the buyer could get a loan, period…without caring on what basis. Couple all of THAT with the fact that many Finance Contingencies did not give a buyer “a legal out” if they could not get a conservative “A Paper” loan, but could qualify for a SubPrime loan.

There are many factors that contributed to this mess. Perhaps a fuller understanding of how the world changing in many and small ways led do the catostrophic consequence, will help all people who played a small part in the Country’s demise, change their small part in The Crime of the Decade. In the end it was mostly No victims; no villains, just a lot of small tweaks and changes that snowballed into a Crisis Situation.

Let’s go back to the world as it was for a minute.

1) Conventional Loan = 20% downpayment, 28% of gross income for housing payment, 36% of gross income for total recurring debt including the housing payment. An 8% spread for debt payments. If debt payments equalled 10%, then the housing portion was reduced to 26%. There were no Credit Scores. All credit issues were underwritten by hand and each and every negative item was explained by the buyer, in writing. A separate letter for each negative item.

2) FHA Loan = slightly more lenient terms and dramatically reduced downpayment requirement. The biggest reason to use FHA vs. Convential being the downpayment requirement, not the looser standards as to ratio and credit issues. Almost no downpayment – 3% vs. 20% at the time.

The first change was a long time ago! It started as a quiet whisper, like the people talking behind the curtain in the next bed from my Mom. Some people were getting loans with only 5% downpayment, conventional. When I started in real estate in 1990, most people’s perception was that they needed 20% downpayment or FHA. Few knew that they could get a 5% down conventional.

The beginning of all of these problems goes all the way back to there. Conventional lending guidelines made FHA less desirable. The primary purpose of FHA was low downpayment…no longer a big spread between the two.

THEN in the early 90s, the lenders started stretching ratios from 28% to 33% of gross income on “the front end” BUT the back end was only stretched to 38%, at first. Stretched ratios entered the scene ONLY for people with little or no debt payments (just like tubal ligations being only for single women on welfare). It had a stated and targeted “appropriate” audience.

When cars started costing more, lenders had to start figuring out a way for people to buy a house who already owned a car. In many cases in the early nineties (before car leasing became popular, and probably why car leasing became popular) most young couples who each owned a car, could not buy a house. The two car payments sucked up their whole back end ratio and subtracted from their front end ratio. “I thought we could get a mortgage for 28% of our gross income or 33% of our gross income?” “Well, yes…but the combined value of your two new cars is almost as much as the house you are trying to purchase!”

Everyone agreed that people needed both cars and houses…so ratios grew and grew and grew. So, Sniglet, the changes in FHA are NOT fascinating at all. In fact FHA hasn’t changed all that much. What’s happening is that lending standards on the Conventional side are creeping back to “The Way We Were”, putting the spotlight back on FHA, which is closer to the way IT was IF you cut out “automated” approvals.

Before you even think about buying a house, get your “other debt” issues down to no more than 10% of your gross income. If you make $45,000 a year and your wife makes $25,000 a year, and you each have a car with a $400 monthly payment, you are spending 14% of your gross income on car payments!

Of course this Rise and Fall story would clearly fill a book. But until everyone understands that a bailout or bandaid in ONE area only (or two) is not going to fix what ails this Country, we cannot have HOPE…and HOPE is what we need more than bailouts and fixes.

As I said in one of my previous posts: “2009 will not be a year of great change. It will be a year of Great Hope for Change, one small step at a time, via you and me acting the best we can in each moment.” Falsely creating hope with “Talking Points” and “Good News” articles is NOT the solution. Expecting any one source to be the Messiah, is NOT the solution. Every single person doing their part to improve the situation…is the only long term solution. That means YOU!

Stop looking for someone else to come up with an answer. Get out your teacup, and start emptying out your own little piece of the ocean.

I kissed a girl once. I was almost 50 years old and was in the middle of a divorce from a 20 year marriage. I just wanted to make sure before I started over again, that I wasn’t starting out on a faulty premise that had been “fed” to me. 2009 is the year to test your foundations…so that when “The Rocovery” does come…it isn’t the old mess wrapped up in a bright shiny red bow.

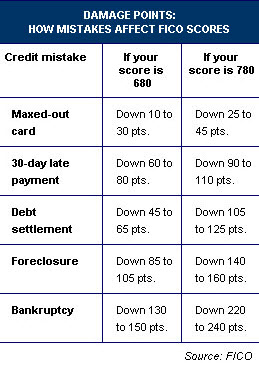

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true.

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true.