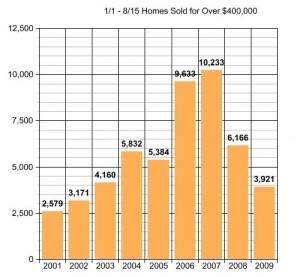

The graph below shows us how easy it was to spot that the market was going sideways in 2006 and 2007. How credible was it that almost double the amount of people could afford a house for more than $400,000 in 2006 and 2007, than in 2005 and the years prior?

I say we can expect the 3,921 homes sold for over $400,000 to increase to about 6,500. That will be the sign that the market has “recovered”. Recovery will be about volume recovering…not prices. If you remove 2006 and 2007 numbers from the chart below, and replace 3,921 with 6,500, that would be a natural progression.

These stats are from 1/1 to 8/15 for the years 2001 through 2009. Earlier today I was looking at the change in the number of homes sold for less than $400,000. In 2001 that segment represented 82% of homes sold. Affordability reduced by 50% by 2007 when only 40% of homes sold, sold for less than $400,000. We are now back up to 50% with more homes sold for $400,000 or less this year than last year.

So where is the market going? If 11,500 people could afford homes priced at $400,000 or less back in 2001 and 2002, it’s safe to assume at least that many people can afford to buy them now.

So recovery will look like 6,500 selling for more than $400,000 and 13,500 or so selling for under $400,000. Again, these numbers are for the period 1/1 to 8/15 to coincide with the numbers we have for the current year. These numbers also tell us that the housing credit went a long way toward bolstering the lower end of the market. Even though volume of sales is down from 10,458 last year to 8.686 this year, homes sold for less than $400,000 increased from 4,292 to 4,765.

I don’t think prices will go up and I don’t think the recovery will happen in terms of home prices. Recovery will be volume based, with over $400,000 improving by 60% to 65% and the under $400,000 market improving by nearly 3X what it is right now.

Required Disclosure: Stats are not posted, compiled or verified by The Northwest Multiple Listing Service.

Looking back at 2001 or 1990’s will have no basis for any predictability as to where we are heading. We are in a completely new world. The capital markets have been changed for at least my lifetime with the demise of (LEH/BSC/bailouts of AIG) and nothing will be the same in terms of investing and real estate going forward.

Investors will make billions at foreclosure auctions flipping properties throughout this decade and I strongly encourage all to go visit your county foreclosure auctions on Fridays and watch what I see every week.

Always look forward when investing and never fight the FED. The Fed has shown us in this last 120 days one of the largest bull runs in history and the power they yield. However, as we have learned, these moves end quick and leave many left holding the bag.

The history books are being written as we speak and how we recover will be an education for us all.

Looking back at 2001 or 1990’s will have no basis for any predictability as to where we are heading. We are in a completely new world. The capital markets have been changed for at least my lifetime with the demise of (LEH/BSC/bailouts of AIG) and nothing will be the same in terms of investing and real estate going forward.

Investors will make billions at foreclosure auctions flipping properties throughout this decade and I strongly encourage all to go visit your county foreclosure auctions on Fridays and watch what I see every week.

Always look forward when investing and never fight the FED. The Fed has shown us in this last 120 days one of the largest bull runs in history and the power they yield. However, as we have learned, these moves end quick and leave many left holding the bag.

The history books are being written as we speak and how we recover will be an education for us all.

Ardell, it wasn’t so much that more people could “afford” homes… during those times, there were many mortgage products that allowed people to buy homes they could not truly afford; such as stated income, interest only and options arms.

Ray,

I know you say you have never seen anything like this, but I have. This market is almost identical to the one I started in, in 1990 New Jersey. I’ve seen the City of NY almost go belly up and need a bailout. I’ve seen the banks almost crumble in the 80s recession with predictions only 3 banks would be left standing. I’ve seen new housing starts grind down to a complete halt, shortly after they had lines going around the block with prices raising every hour, and people still willing to pay those prices. I’m not sure how much of that made the history books, but the resemblance of this market to the early 90s is astounding. Relocation companies had to pay an employee for the loss on their house in order to transfer them to another area.

Most of the Country is at 2003 pricing…Seattle at 2005 pricing.

I loved that video you posted once where they were bulldozing new homes, somewhere in Phoenix I think. Yes, I think the builders got carried away with building houses in that over $400,000 market, and built more than there are people who can afford to buy them.

“how we recover” is already in the history books..no one really learns from that. I never thought I’d see the day when REITs were popular again, given the fiasco of the REITs in the 60s…still…people forget.

Given the grand scheme of things, that people who bought in 2005 or later don’t have a profit, but people who bought before that do, is not the worst example of housing crisis “in history”.

ok..maybe I’m too young…43….But, what I see is a 10 year supply of upside down homes that will constantly be short sailed off and foreclosed on by the banks that remain left standing.

I see sellers selling to become renters. pay taxes? upkeep? insurance? when renting is 1/2 the price?

The mantra of homeownership is severely damaged and the Capital markets I fear will retest their 6500 lows and when they do in the next 5 years we will see another spike down in property values.

But, hey…I’m just one silly Broker/Nurse with an opinion. Thank GOD there are still Bulls out there!

Ray,

I think we just live in different worlds somehow. I see young people wanting to own a house. All the things that you say and fear don’t seem to be part of the equation of falling in love and having a baby and wanting a yard for your 5 year old. I know a lot of reasons why people do and should rent vs. buy, but not a lot of people who given the choice, actually “want” that. Some, but not as many as you seem to. I also don’t see rents being 1/2 the price.. Sometimes I wonder if you and I live in the same Country. for the 12 year difference between us…we are world’s apart.

I remember the downfall of REITs from the late 60s even though I didn’t graduate from high school until 72. We just travel in different circles.

Yes, Ardell we are worlds apart. Most likely because our model brings to the table many sellers who are upside down and they feel our 100.00 or 500.00 listing will be enough to help them out of their dilemma. However, when we crunch the numbers its the same old story…short sale..

I find so many people now who would gladly give their home away and wish they were renters.

Just this last two weeks I was contacted by 2 different familes that stated their 2005 year 1500 sq foot home off Meridian (cookie cutter type) rents for 1000-1300 on CraigsList. Their payments (with 2nds) are in excess of 2000+. They cannot refi …and you know how the story goes.

I really wish you would have attended the seminar at SPU with Robert Schiller. Here are the notes. People just kept asking “What about my home here in the NW? What about Seattle?” Over and over he attempted to convey the same message. Its all coming back………

http://seattlebubble.com/blog/2009/04/27/robert-shiller-at-spu%E2%80%94psychology-and-the-housing-market/

Ray,

Yes, I am working primarily with buyers this year by design, so someone’s misery translates into someone’s blessing. I am helping people get into homes that couldn’t afford to buy anything last year, but because of the great misery you speak of, their family’s can get a home.

For those people, their mortgage payments of today are not double their rent cost. You are looking at subprime mortgage payments of yesteryear against today’s rent cost. Thanks for explaining that.

It reminds me of Chris Pirillos’s speech on “walking Venn diagrams”. We intersect where buyers meet those sellers. The reality is that no time in history should buyers of homes plan to be moving out of that home in a short period of time. Buying a home was never meant to be a short term venture. Not being able to sell your home for more than you paid for it…within 3-5 years of purchase, is not a new phenomenon for sure.

I don’t believe there is a builder/developer in the Puget Sound region that existed through the last cycle would say this correction is remotely similar in severity to the last. Today’s is far more destructive and damaging.

I totally agree, Tim, as to the Puget Sound region. But I clearly have worked through a cycle like this before in NJ. I remember some of the builder’s houses that were for sale. Most of the Country went through this then…just not the Puget Sound. Seattle is, in fact, “special”, though some don’t like to hear that. They did not have the big run ups from 85 to 89 that the rest of the Country saw, nor did they have the big run up from 98 through 2003 that the rest of the Country saw. But when looking for what may happen next, looking only at Seattle is not a broad enough perspective for us to assist our clients. Even now, “Seattle is Special” in that most of the Country is sitting at prices two years behind Seattle – 2003 vs. 2005.

There’s a difference between not being able to see something…and not looking for it so you can see it.

Ardell- as to your “Seattle is, in fact, “special

I once sold a house in Mercer Island is like the joke “I once went to Philadelphia…” I’m not a big fan of Mercer Island…but once sold a house there. I never do stats for Mercer Island.

Ardell this may help you see why looking at the past this time around is futile…..

Ray,

I don’t believe in futility.

agreed and let me add to that Nevada my home state. The carnage there took out ALL my builder friends who are much older then I. Not to mention retail, casinos, restaurants, should I go on……?

Ray,

In many ways “it is the best of times; it is the worst of times”. Earlier this year I say a man walk off with very little after selling his home, even though he put 50% down. By the time the house went on market he had no trash collection, no water, he was flushing his toilets with borrowed buckets of water. Yes, bleak. But by the same token a young family with a new baby was able to purchase that home. His loss was their gain.

There is no way to look at only one side of things in this business. It’s one of the reasons I don’t like to work with investors. I like to see Mr. and Mrs. Everyman benefit from “the crisis”. It’s very rewarding, and even the seller was happy (well, not happy, but happier) that a young family received the benefit of his loss vs. an investor.

Ah Yes…Satisfaction. I closed two homes this Friday and the Buyers were to say the least very excited.

Today I sit in a Lexus at 11am with 3 investors to tour REDC (www.auction.com) homes. They are equally excited.

I’m happy for all my clients but investors always buy me a great lunch and I can wear shorts…………

Things are really getting bad when satisfaction is defined above as sitting in a Lexus with three investors who will buy the agent a “great lunch”.

dont forget the shorts!~

As to Ray’s- “dont forget the shorts!~”, it’s the HomeLosers who are getting it in the shorts. This is Trump University RE “Ethics”– pure and simple.

You can be a Real Estate Vulture, too! –

Click here: http://tinyurl.com/mda6ss

LOL! We are working with a great couple who love Kim because he showed up last year in sweatpants at a house they liked, walked in and said “don’t buy this” and walked out 🙂 This year we are finding much better homes and values for them, but still not a time to buy without extreme caution.

I don’t “do lunch”. If we’re starving we stop and get a snack. I also don’t do Lexus. Lot’s of down to earth first time buyers. Some second tier…some first time investors…rarely full fledged investors or high end. We all do what we do best.

Ardell,

I’m just throwing this out there for thought. If in two years housing/employment continued to worsen and the young family you discussed was also flushing their toilets with borrowed buckets of water and were forced to sell. If you sold this home again to another young family with a new baby, would this still be satisfying? I’m not saying it’s gonna happen, but is definitely a possibility.

Hi Brady,

“Satisfying” would not be the right word there, as I would be representing the seller and not the buyer in that reverse scenario. In that particular case and most this year, while I would be sad for the family, I’m fairly confident that if they needed to sell they would not have to do so at a loss.

The going rate at present for property sold in the last six months within 1/4 mile of that house is $218 a square foot. They paid $185 a square foot.

The recent sold prices run from $360,000 to $550,000, they paid $310,000, $50,000 less than the lowest price paid recently.

If they called me today, I could sell it for more than they paid for it, at least high enough for them to break even on costs. A dirty house discount goes a long way, as the negative factor is easy to deal with in short order. Houses that are in good shape but don’t show well at time of purchase offer a great hedge against future market decline.

This family (and a few others I represented this year) bought based only on one income. Even if that one person loses their job, the liklihood that the two of them together couldn’t replicate that one income in the future, is very low.

Even if the market in that area decreases another 10% from $218 a square foot to $196 a square foot, they are still on the positive side having paid $185 a square foot.

I am very proud of them for “sucking up” the messy situation and recognizing the underlying value. Most people turned their noses up at the easily correctable negatives. Many wouldn’t even go inside. It was priced so low at time of sale (scheduled for foreclosure in less than 7 days) that there was a revolving door of buyers at the property on the day we viewed it and made an offer. Many left saying “it smells”, some wouldn’t even go inside. This is in a good neighborhood, great schools, remodeled home, all brand new windows, very little potential for future large cost needs.

The $8,000 credit went a long way toward cleaning the place up and putting in all new carpet.

I can’t protect people from all potential future realities, but all things considered, I think these kids are sitting on a lot more upside potential than downside risk.

There are many ways people buying in today’s market can hedge against future declines. Buying based on one income vs. two. Buying at the deepest discount the market has to offer. Most of my clients this year bought at prices much lower than others being sold in the same area at the same time.

I did caution them to be very kind and committed to one another, as there is nothing I can do when people are forced to move out because of divorce and breakups. My job is to help them see as far out as possible, and help them make better choices with me, than they might make without me. In that regard, I’m better than most at what I do. The market would have to go down an additional 15% from here, before they would have to be seriously worried. Could happen, but I’m not seeing anyone suggesting that is likely the case.

In my book, the best part of the previous ARDELL Post:

“I did caution them to be very kind and committed to one another, as there is nothing I can do when people are forced to move out because of divorce and breakups. My job is to help them see as far out as possible, and help them make better choices with me, than they might make without me. In that regard, I’m better than most at what I do. The market would have to go down an additional 15% from here, before they would have to be seriously worried. Could happen, but I’m not seeing anyone suggesting that is likely the case.“

Ray,

I know you say you have never seen anything like this, but I have. This market is almost identical to the one I started in, in 1990 New Jersey. I’ve seen the City of NY almost go belly up and need a bailout. I’ve seen the banks almost crumble in the 80s recession with predictions only 3 banks would be left standing. I’ve seen new housing starts grind down to a complete halt, shortly after they had lines going around the block with prices raising every hour, and people still willing to pay those prices. I’m not sure how much of that made the history books, but the resemblance of this market to the early 90s is astounding. Relocation companies had to pay an employee for the loss on their house in order to transfer them to another area.

Most of the Country is at 2003 pricing…Seattle at 2005 pricing.

I loved that video you posted once where they were bulldozing new homes, somewhere in Phoenix I think. Yes, I think the builders got carried away with building houses in that over $400,000 market, and built more than there are people who can afford to buy them.

“how we recover” is already in the history books..no one really learns from that. I never thought I’d see the day when REITs were popular again, given the fiasco of the REITs in the 60s…still…people forget.

Given the grand scheme of things, that people who bought in 2005 or later don’t have a profit, but people who bought before that do, is not the worst example of housing crisis “in history”.

ok..maybe I’m too young…43….But, what I see is a 10 year supply of upside down homes that will constantly be short sailed off and foreclosed on by the banks that remain left standing.

I see sellers selling to become renters. pay taxes? upkeep? insurance? when renting is 1/2 the price?

The mantra of homeownership is severely damaged and the Capital markets I fear will retest their 6500 lows and when they do in the next 5 years we will see another spike down in property values.

But, hey…I’m just one silly Broker/Nurse with an opinion. Thank GOD there are still Bulls out there!

Rhonda,

Yes, that is my point. It was easy to see what was happening. In fact my first blog posts in January of 2006 were urging people to learn how to qualify themselves. I disagree that it was “the products” because those products existed for many years, but were used properly and sparingly.

To a large degree, people getting into the business in droves, both your industry and mine, who didn’t know the purpose of those products and used them incorrectly, accounts for much of the madness.

Still it was a fairly contained and isolated event, as we can see in the graph. A blip that will work itself through. Last time it took from 89 to 95…so the predictions of 2013 are likely pretty reliable.

I am amazed that the DOW is over 9,000. I would have preferred it to stay in the 8,500 range and we may see it get back there before the end of 1st Quarter 2010. Big swings one way or another are not as reassuring as creeping markets, but we just may have to get used to big swings being the norm moreso than the exception, and adjust our expectations accordingly.

I have mixed feelings about what should happen with the housing credit.

A most informative post- with comments to match. As a graphics oriented architectural practicioner, I admire ARDELL’s graphs that appear along with her concise prose. I too, have seen all this happen- except the builder house bulldozing (I’d pay money to see more of that). J-

Thanks Jerry. I am having exceptional difficulty putting graphs and photos in last night and today. There was a typo in the grqaph which I corrected, but I can’t get the graph back into the post. I added it to the linkied post for now.

Have an appointment…will try again when I get back.

I remember Ray once saying we haven’t seen anything like this “in our generation”…reminded me that we are not all of the same generation 🙂

As to: ” remember Ray once saying we haven’t seen anything like this “in our generation

Tried inserting the graph into the comment…that didn’t work either.

Ardell: I just checked and none of your new graphics actually show up when you uploaded them. (They’re on the backend, but they’re blank). When looking at these “blank” graphics, I see a bunch of odd characters in some of the URL strings (plus signs and things). When you get a minute, try changing the name of the photos to something really simple (like “aug-update.jpg”) and reupload the grahic. That might solve the problem. In the meantime I added your previous graphic warts and all. 🙂

Whoops… When I wrote my previous comment I hadn’t realized that you emailed me the graphic. I just stripped out the “plus” sign from the name and the uploaded didn’t give me any issues!

Nice work!

No plus signs…got it. Thanks Dustin!

Shows how much work is involved in each RCG ariticle. Writing same and then presenting it takes a lot of doing.

Jerry,

It always amazes me when someone says “How’s the market doing?” as if the market moves in unison. The $400,000 and under market has increased volume YOY…AMAZING! The over $400,000 market is down significantly. People like simple, broad answers, but real estate is a lot more complicated than a single headline.

I do the stats for me and my clients…sharing a small piece of that info once it’s done, via a blog post, is actually the easy part. I do the work for my clients…not for the blog. Yesterday I did at least 6 hours of in depth research to make sure my head was in the game sufficiently to assist my clients well.

Blogging is just something I do while I’m working, and actually the smallest part of what I do. Once I have pages of stats, I enjoy sharing the parts that are not client confidentiality sensitive. I choose the pieces with the broadest messages for blogging, but the reality of this house in this place, is the more important part that I can’t share publicly.

The mechanics is only difficult when there are design changes or when I decide < means less than and html code says it means something else 🙂 So <$400,000 and $400,000+ in my graph titles is what screwed up the mechanics. Good to know.

Ardell-

As you know by now, you and I share a number of things in common. To both of us, taking care of our clients comes first and foremost and involves a lot of research. Posting shareable parts of these efforts is an important part of Real Estate, Architecture (and other) professionalism. I’ll soon be writing a new SeattlePI.com Blog- NorthWest Modern Homes– focused especially on Mercer Island.

Jerry,

It always amazes me when someone says “How’s the market doing?” as if the market moves in unison. The $400,000 and under market has increased volume YOY…AMAZING! The over $400,000 market is down significantly. People like simple, broad answers, but real estate is a lot more complicated than a single headline.

I do the stats for me and my clients…sharing a small piece of that info once it’s done, via a blog post, is actually the easy part. I do the work for my clients…not for the blog. Yesterday I did at least 6 hours of in depth research to make sure my head was in the game sufficiently to assist my clients well.

Blogging is just something I do while I’m working, and actually the smallest part of what I do. Once I have pages of stats, I enjoy sharing the parts that are not client confidentiality sensitive. I choose the pieces with the broadest messages for blogging, but the reality of this house in this place, is the more important part that I can’t share publicly.

The mechanics is only difficult when there are design changes or when I decide < means less than and html code says it means something else 🙂 So <$400,000 and $400,000+ in my graph titles is what screwed up the mechanics. Good to know.

Jerry,

Does it worry you that most if not all of Mercer Island is in that over $400,000 crowd that is still on the decline as to volume and price?

Ardell-

A decline as to volume and price is overdue on Mercer Island. It’s long been a “Super Dingbat*” builders’ playground. These operators come from all over to put up their overpriced dumb houses on our previously unspoiled building sites or to remodel existing houses. (You sure know how to push my hot button!). J-

A “Spec Builder” term, not mine.

I’m doing a bunch of stats for Sunday Night Stats and winner seems to be Downtown Seattle to 85th (just above Green Lake) all the way across East and West in the under $400,000 market. Best market by far looking at all of Seattle and Kirkland, Bellevue and Redmond on the Eastside. Single Family only…but likely lots of townhomes in that Seattle stat. I’ll get the graphs up later and wrap it together in a post tomorrow night.

Ardell-

As to: “Downtown Seattle to 85th (just above Green Lake) all the way across East and West in the under $400,000 market. Best market by far looking at all of Seattle and Kirkland, Bellevue and Redmond on the Eastside. Single Family only” this area of my native city used to be the prime “Starter Home” market.

Many of my custom home clients started out there. Then the already rich investors started buying them up a dozen at a time. I have a hard time seeing this as social justice. J-