When my clients send me a home they want to see and ask for my thoughts, I often respond “nice house; seems a little over-priced to me”. Sometimes they wonder how I know that before seeing the house.

Using general statistics to establish an immediate reaction to price, gives you a good starting point for home valuation.

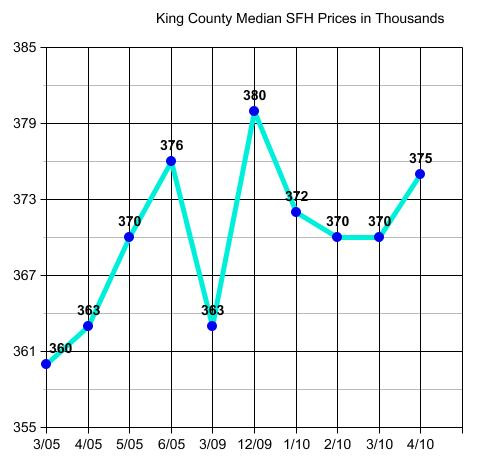

The above graph is a good “cheat-sheet” for shoot from the hip value reaction. We can see that the recent history bottom of 3/09 is equivalent to 4/05 pricing.

One of my clients sent me a property, nice one, and I quickly checked to see that the owner bought it brand new in the summer of 2004 for $600,000 and the asking price is $750,000. “Looks a bit over-priced” because it was brand new when they bought it, so they didn’t (or shouldn’t have needed to) remodel anything. We are at May/June 2005 pricing (as you can see in the above chart).

The market didn’t increase by 20% from Summer of 2004 to Spring of 2005. New homes depreciate as 2004 new carpet is now 2010 old carpet. 2004 new paint and hot water tank are now heading toward the down-slope of their life expectancy period.

By all accounts asking 20% more for a home bought new in 2004 is not likely realistic. Median home price in June of 2004 was $340,000. Current month to date median price is $375,000. so that would put that property bought for $600,000 in June of 2004 at $660,000 to $665,000 today before applying depreciation. ($375 divided by $340 times $600 = $660) So my gut reaction to a $750,000 asking price is that it is almost $100,000 over where it should be.

That doesn’t mean that someone won’t pay $750,000 for it. The only question is…Is that someone who will pay about $90,000 too much for it…YOU?

(Required Disclosure: Stats in this post are not compiled, posted or verified by The Northwest Mulitple Listing Service.)

Ardell- In my experience, Sellers are almost always going to overprice their homes in order to maximize their return, Seller’s Agents are almost always going to underprice said homes in order to make them sell easier and faster. So the actual price is usually somewhere in between. Applies to used cars, most transactions- nicht wahr? (Isn’t that true in German- a most useful phrase in any language). JG

I don’t know Jerry…I just got back from finalizing a contract for one of my buyer clients. There were multiple offers and the highest price didn’t get the house. Best all over terms has been the case for my last two buyer clients, mainly because it really makes zero sense to overprice a home these days. Appraisers are not very generous right now…so finding a buyer who is willing, only to run into problems when it’s time for the appraisal…can can take you down a road that leads to a place you don’t really want to go.

I’ve always considered setting the right price one of the most valuable things the many RE Agents I’ve used have done for me- and the main reason I’ve hired them. Please fix my typo in #345958. Thanks, Jerry

It’s intuition based on experience followed by working the numbers. Ray Brandes, a builder who did some 70 projects for me, would look at a project I had just laid in front of him, I’d see a number jump into his mind. He’d never tell me what it was until he had done his homework confirming same. (Click below). JG

http://knol.google.com/k/jerry-gropp-architect-aia/a-long-term-architect-builder/246qxuxd260sm/106#

It also depends on how long ago I studied every house in the area. Just closed on this house in March:

http://www.redfin.com/WA/Kirkland/404-11th-Ave-W-98033/home/462374

And studied everything within walking distance to Downtown Kirkland that was for sale and even some that were not for sale for 8 to 10 weeks prior…most every day, and by going inside most every house in Kirkland. So a number would “jump into” my mind more quickly for another client there right now…than in some other areas.

But then…no matter how “smart” we are…we can never be smarter than the market. Odd things happen sometimes.

As to Ardell’s: “But then…no matter how “smart

Hence the beauty of the market, a home is valued at whatever somebody is willing to pay for it. Nonetheless, great post, Ardell.

Alex,

But isn’t “what somebody is willing to pay for it” influenced by what the buyer’s agent advises the buyer to be willing to pay for it? Yes…I agree that some buyers are willing to overpay. But they should still know when they are doing that…how much they are overpaying.

Someone emailed me a couple of weeks ago that the appraisal came in $35,000 short on a relatively lower priced home. It was a buyer in another state who was losing $12,000 Earnest Money. If they had known it was $35,000 over-priced when they made the offer, and they should have, the situation would have been different. Knowing that in advance before his Earnest Money was in jeopardy, would clearly have been better for that buyer.

Yes, what a buyer will pay should be in large part due to their representative’s advice. Will it always be that? No. Some buyers low-ball against their agent’s advice, and some overbid (and I have seen many agents full of glee, as their commissions suddenly increase.. obviously not in this market, but in the past surely).

Sorry to hear about that client losing his earnest money. With more and more scrutiny on banks (and their appraisers), it’s never a sure thing until it closes.

Each property has a value. The buyer, or agent, can ever change that value, they can only change the price. Then we would be talking about using comparative sales analysis to determine a value. What we are seeing now is pretty clear, value and price are two very different things.

This is the $500 rusty nail argument. Just because some one is willing to pay $500 for a rusty nail it doesn’t mean that the nail has a value of $500.

Alex,

You said “Sorry to hear about that client losing his earnest money…”

It wasn’t my client. It was an email to me from someone out of my area with a big mess on his hands. The big problem in that scenario was he DID agree to the higher price knowing it didn’t appraise there…but I think then didn’t have the cash to make up the difference between sale price and maximum amount that could be financed.

He thought he had enough “contingencies”, and buyers need to know that there is usually NO contingency that protects a buyer from not having enough cash to close.

Too many buyers are led to believe that contingencies protect them against every possible scenario. Just not true.

Hmm, sounds like this buyer could have benefitted from legal advice (and any others who believe contingencies protect them in all circumstances)…

😉

Hi Craig,

I absolutely advised him to consult an attorney before handing over 12 grand 🙂 I really thing the finance contingency should state (as I have seen in other states) very boldly THIS FINANCE CONTINGENCY DOES NOT PROTECT YOU FROM HAVING INSUFFICIENT FUNDS TO CLOSE ESCROW!

I’ve never seen a finance contingency that covers “cash to close” deficiencies. This particular situation was exacerbated by the fact that the buyer DID have enough cash to close until he agreed to continue to buy it when it didn’t appraise. I’m sure an attorney could get him his money back given he likely didn’t understand he would have to make all of that difference up with additional cash in the short time they gave him to make the decision to proceed when it did not appraise.

Ardell, wouldn’t “funds to close” be covered by the finance contingency? A loan is not approved until the funds to close are sourced and verified… I suppose if a buyer decided to gamble or spend those funds after they’re verified and after the financing contingency has been waived, that would be a huge issue (knock on wood…not one I’ve encountered).

David said: “Each property has a value.”

Each property has a “range” of value. No one can value a property “to the dime or penny”. No one should trust anyone who says they can value a property to the dime.

I once hired an agent to represent me when I was moving across the Country. The day he said “I won’t let you pay a dime more than the property is worth” is the day I fired him.

You mean price range. The value can be determined in a number of ways; cost value, rental income value, views have a value, garages, condition, or location. You can even use some lot pricing if you need a base, but there is a value to every little thing about a property. Appraisers use value added criteria all the time.

David,

No…I mean “value” range.

Sorry Ardell, that’s not the way it works from how you structured your post. You are talking about the price some one will pay. Your chart is based on sales data.

Value is what a property is actually worth. We would be discussing economic value. The lot, the dirt, can have a value established by sales prices because it is somewhat constant. That’s even shifting as more, and more lots are developed in questionable areas, like farm land, wet lands, or slopes.

After the lot price is established everything else has an absolute value.

David,

Whether or not a home’s value can be pinpointed exactly is not really a matter of “opinion”, David. Real Estate 101 states that home valuation is an “artform” and not an exact science. I don’t like to “argue” with you, but it is a well known fact that no one can pin a home value down to an “absolute” to-the-penny dollar amount. In fact a market moves constantly. So even if you pinned it down to the exact value on the day of appraisal (which is not possible) it will have moved by the day of closing.

If you look up the definition of “appraised value” you will see that it is most always an “estimate” or an “opinion” and never an absolute number as fact.

To a penney or dollar is a leap. We are in a time when mortgages far exceed the value of properties. It will be this way for a long time now.

Prices will continue to fall to more realistic values, as are compared to wages, ability to pay, and value of a household’s over all net worth. It is a science to determine what will make the most sense for people’s quality of life.

The discussion is only about defining terms. Value is based on tangibles, price is for the asking.

David,

I’m looking at a property tomorrow with clients that both the tax assessor and the bank who financed it, and now owns it, pegged as over $1.2 million based on the “tangibles”. Now they can’t sell it for less than half that “value”.

Valuation is clearly an artform, as you can put those same “tangibles” in the same place in a different configuration and get a completely different value. Two five bedroom houses, one with the bedrooms up and one with the bedrooms down may appear to be equal based on pure tangibles…but they obviously are not.

Based on the pure tangibles appraisal-style it has all the things of a $1.2M house…and yet…whomever lent $1.2 on it was not looking at the right things. On paper…it may have been worth $1.2. But to any valuation expert…it never was worth that.

You have just now hit the nail on the head. Banks lent way too much money based on prices rising, market trends, and projection of actuaries.

Taxes are taxes, they are as much money as a government can get out of the citizens. There is no market, rhyme, or reason, in determining taxation.

The property you are looking at has a value. You can determine that, make the offer, and use tangible reasoning, or logic to make your case.

The bank can either listen to reason, or look for another sucker to give them the gift of way too much money.

“Is that home over-priced?