Many around the Country are asking what a Home Price “Recovery” will look like and what will create it. If you have been home shopping on The Eastside close to the 520 Bridge, you are likely amazed at the strength of that market in recent weeks.

Kirkland 98033 is not the only market experiencing this phenomenon, as I first noticed the activity and price increase in the Cherry Crest neighborhood of Bellevue 98005. But since I recently represented a buyer client who closed on a home in Kirkland 98033 near Downtown in the Lakeview Elementary School area about a block from Google, I am focusing on this area first.

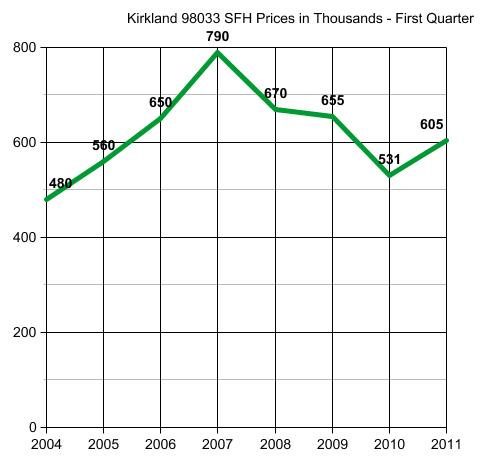

While back in October and for the 4th Quarter of 2010 we were talking about whether home prices in King County overall were running in late 2004 levels or early 2005 levels,

Kirkland 98033 has bounced up to February 2006 levels!

Before you jump to the conclusion that this segment simply had a lower % of Short Sales and Bank Owned Property…not so. A full 42% were “distressed” properties. Even with that drag of an additional 5% to 6% down created by the “distressed property sales”, the prices are running at February 2006 levels.

None of us are holding our breath for prices to reach peak levels, and I don’t anticipate that happening for many years. But if you chop off the extreme peak of 2007, home prices in 98033 are clearly recovering nicely.

WHY?

There are several contributing factors.

1) Google – opening in 98033 in late 2009 and hiring a significant number of people in recent times.

2) High Elementary School Rankings – While all of the schools in 98033 don’t enjoy the highest ranking status, those closest to Google and Downtown Kirkland do. Peter Kirk Elementary, Lakeview Elementary and Ben Franklin Elementary, all in 98033, help support and boost home values in these areas. To be fair and balanced, I did not segregate these schools in the stats and included all school areas of 98033, at least one of which ranks fairly low.

3) Anticpated 520 Bridge Toll – The soon to be imposed Toll to cross the 520 Bridge has had an impact on home prices closest to that Bridge. Some have moved from Seattle over to the Eastside to avoid the Toll. Some who work on the Seattle side, but prefer Eastside Schools to Seattle Schools, have moved as close to the Bridge as possible to cut down on fuel costs and time delays to compensate for the negatives of the toll.

Kirkland is clearly one of the best places to live in the Seattle Area, and always has been, especially the area closest to it’s Downtown on the Lake. The reasons for that are many, and the subject of another post.

So yes, the Recovery is clearly “Cherry-Picking”.

A few other amazing facts. Of the 44 homes sold in the First Quarter of 2011 in 98033 that were NOT short sales or bank-owned properties, 18% sold in ONE WEEK or less with 23% selling in two weeks or less and a full 50% selling within 90 days. Clearly though the distressed properties were very high at 42%, they were not creating a huge drag on the non-distressed properties. The median for non-distressed properties was a whopping $646,000. Very close to the full median price of 2006 overall.

This is what a “Recovery” looks like. It doesn’t reach peak…but…it looks pretty darned good to homeowners in 98033.

********

(Required disclosure: Stats in this post are not compiled, verified or published by The Northwest Multiple Listing Service.)

One of the non-statistical influences is that of market psychology. We have had several new purchases placed at our office this week and one of the agents we have worked with for years is reporting that the last two homes she made offers on for a client missed out. Some very close friends of ours also were not quick enough. Agents talk to each other, buyers talk about missed opportunities with friends and us escrow folks see it all and talk shop with clients at the closing table. Could this translate into the market psychology of moving the local housing stock or just a seasonal up tick? I’d like to know what the pending stats are in Sno. co. Time will tell.

I’d have to say seasonal uptick on that Tim. But the median price range for Snohomish is dramatically different from the areas where I work, and the area that is the subject of this post.

For non-distressed single family homes sold in Snohomish in the last 90 days, the median price is $292,000. Bank-Owned and Short Sale properties represented 47% of all sales with the median sold price for the Bank-Owneds down from $292,000 for non-distressed home sales to $200,000, with short sales at $235,000.

At those prices, especially the bank-owneds, it’s hard to separate end-user purchases from investor purchases. In the higher price ranges that are the subject of this post, there is very little investor interest, making it easier to track “seasonal uptick”. Investors by and large are not influenced by seasonal factors. If anything the seasonal factor works in opposite fashion, with Spring Bump being the least favored time-frame for investors, generally speaking.

Are you seeing many investors buying cheap family homes in the $200,000 or less price range in Snohomish so far in 2011?

Amazing. Cherry picking statistics to show what you want it to show. And real estate brokers wonder why they are so distrusted and disliked. This article is another attempt at pumping up the market to get buyers to jump back in. Won’t work just like the articles of the last couple years. We’re serious buyers in the Kirland area and the fact is prices are coming down and will continue to come down. How do I know this? Well for starters, in the last few months we found a couple properties we liked and made offers lower than asking but at a price we thought was fair. Both times, we could not close the sale as the sellers wanted more than we would pay. As of today, both properties are still on the market and one has reduced their price to what we offered while the other lowered theirs to less than what we offered. They both came back and asked if we were still interested but we’ve now recalibrated and not willing to pay what we feel will be 10% lower by the end of the year. So, keep up your positive outlook rather than face reality as you will need it to keep motivated in the coming months ahead. We will eventually get the place we want but will not pay based on emotion, just what is reasonable and fair which is a good 10% less on average than the asking prices today.

Good for you, keep waiting, keep making low offers. It seems that we are a few more months away from seeing what the direction the Real Property market will take, but all indications are that it will continue to decline.

Mike,

I wish you luck with meeting your objectives. Kirkland’s a big place, and there are clearly parts of Kirkland that are still soft, even in 98033, as I mentioned in the post. Rose Hill for one. The elementary school does not have the same ranking as Franklin, Kirk and Lakeview, and it’s not a “walk to town” location.

Finding the right house at the right price is not easy, as you know. If you have only found one or two that are “passable”, but not good enough for you to actually buy, you make my case.

Personally I’d much rather see someone rent in a better area than buy in a lesser area to get a bargain. So no, I’m not trying to influence people to buy vs rent.

As to “cherry picking”? ABSOLUTELY! Cherry Picking is what I do for my clients. Always have. Always will. If you are not cherry picking, I would have to ask why not? For every 100 homes on market there may be one worth buying…so why wouldn’t you be “cherry picking”?

Early clients of mine- Hilliker father & son- Madison Park builders

taught me to buy what I really wanted and/or needed. Pay little or

no attention to the market- because the same thing will not ever

come by again. Here’s one of the MP apartments I did for them. J-

http://farm6.static.flickr.com/5182/5571527734_97a4400c4a.jpg

I wouldn’t say “pay little or no attention to the market”. But buying a house just because it is the best bargain price is almost always a huge mistake for a family vs an investor.

Pretending the market is better or worse than it actually is, serves no one. Pretending the market in 98033 mimics King County as a whole, just is not the case.

A- Your “buying a house just because it is the best bargain price

is almost always a huge mistake for a family vs an investor.”

is certainly true. With lower prices. they have a better chance of

winning (getting a house that works for them).