With the new year, I resolved to talk less and do more about the “stacked deck” faced by buyers in the traditional real estate broker system. And since it’s still January…

One of the great benefits of getting my broker’s license has been getting to see how the broker system operates “behind the curtain.” While I’ve seen and learned alot, there is one “sales” tactic that is particularly odious, at least to the exten that it takes place without the buyer’s knowledge. And what is this tactic?

This is a clear-cut and unequivocal conflict of interest — can there be any reasonable argument to the contrary?

A conflict of interest is a fact of life, and that alone does not disqualify the broker from providing competent representation to the client. But a conflict must not be concealed from the client. Just the opposite: A conflict of interest must be disclosed, or the client is at serious risk of getting screwed. If the client knows about and agrees to this additional compensation, that’s fine. But if the buyer closes on a house that includes such an “SOC Bonus” without knowing of or consenting to it, the buyer has been done a tremendous disservice.

Needless to say, this type of SOC Bonus is relatively common and entirely consistent with MLS rules. No surprise there — the MLS was founded by “seller’s agents” because originally all brokers worked for the seller. So it should come as no shock that the system they developed seriously favors sellers. (Indeed, Ardell has noted previously that the “prime directive” of the NAR is to promote the value of property, and the only way you can do that consistently is by promoting the interests of sellers.)

So what can be done? Why, pass a law, of course! Ironically, an undisclosed SOC Bonus like this one is already arguably illegal under the current law (as a conflict of interest that must be disclosed). But I’d wager that an arguable interpretation of the existing statute doesn’t get much traction out in the real world, and the only solution is to amend the statute to specifically prohibit this practice.

Therefore, I propose an amendment to the relevant statute (RCW 18.86.080) that reads as follows:

(8) If a seller pays any compensation to a buyer’s agent or a dual agent, whether directly or indirectly, the full amount of the compensation must be disclosed to the buyer in writing before or at the time of signing an offer in the transaction.

Whaddya’ say, RCG Community — you got my back on this one?

Ultimately, it is the home buyer’s choice on which home to purchase though if the buyers felt they were “steered” into a home that offered a selling agent bonus then that is a different case. In Washington, it is common practice for sellers to pay the buyer’s agent’s commission. With that said, how is the buyer impacted by the seller offering a bonus to the buyer’s agent? I don’t disagree with the disclosure as transparency is needed for consumer protection though question the need of more paperwork in a tree killing industry.

Agreed, the last thing the consumer needs is more paperwork. I just reviewed closing docs for a buying client — what’s a hundred pages of legalese between friends? 🙂

That’s why I included the “at the time of making an offer” language, so that this disclosure could be included on the Form 21 (here in WA, the main body of an SFR PSA). If we added a line that said, “Commission to be Paid to Buyer’s Agent:” it would put the buyer on notice as to the compensation being paid by this particular seller. Would EVERY buyer appreciate this additional information? Of course not. But at least some will, and those that don’t really won’t have much to complain about if they didn’t bother to read and understand their contract.

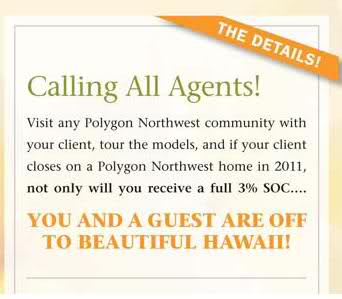

I think the buyer would be just as entitled to know if the agent for the seller were getting a trip to Hawaii from the buyer’s offer price.

Why disclose only commissions and incentives paid to the Agent for the Buyer? Shouldn’t all commissions, and to whom they are paid, be disclosed to all parties to the transaction?

You’ve lost me there. Why is it the buyer’s business to know what the seller is paying the seller’s broker? What does that have to do with the buyer at all? What harm is caused to the buyer if the buyer has no idea what the seller is paying the seller’s broker? I don’t understand…

Toby, I focused on your final sentence, but the one prior merits a response:

“With that said, how is the buyer impacted by the seller offering a bonus to the buyer’s agent?”

If one seller offers a bonus that is in excess of the “standard” commission, then the buyer’s agent has a powerful incentive to convince the client to buy the property with the bonus rather than some other. I mean, c’mon, who doesn’t want a trip to Hawaii?

Does this bonus ACTUALLY influence the advice given to the buyer by the buyer’s agent? Who knows in any one instance, but humans generally are susceptible to being influenced by self-interest, whether on a conscious or unconscious level. Indeed, this reality is the basis for the whole concept of a “conflict of interest.” You don’t get to resolve a conflict by saying, “Oh, that had no effect on me.” Its up to the client to decide whether they want to take the chance of it having an effect on their representative. If the client is OK with it, then fine. But the client must know of and consent to the conflict.

I agree that the buyer would have a “powerful incentive” to try and sell a home with a selling office bonus – I mean who isn’t enticed by shiny objects and the promise of Hawaiian vacations? I love Hawaii and wouldn’t mind going back on someone’s dime. With all being said, I have yet to work with someone who didn’t buy the home they truly wanted regardless of their agent’s commission. As mentioned earlier, full disclosure is an excellent idea when it comes to commission. Just think, we can have more people try to negotiate funds away from us 😀

The seller can offer the buyer an inducement, like a roof, or even a car, but offering the agent anything always bothers me. It taints the entire transaction. Even if it is disclosed it’s divisive, and promotes distrust of our industry.

And just to be clear the buyer is the one who brings the money to the table. The seller brings a promise, and a smile.

Well, I’m not going to disagree. It is a pretty shady “sales tactic” inconsistent with the modern role played by agents (as representatives of their respective clients). I’m not quite clear on how it is “divisive,” and IF it is disclosed I’m not sure it “promotes distrust” of the industry. But if I had to choose between non-disclosure — the current system — and barring the practice all together, that’s an easy choice.

If buyers agents are going to claim a fiduciary responsibility then they should probably disclose the incentive. However, any agent worth hiring isn’t going to be influenced by that incentive. The real issue imho is that consumers simply suck at picking good agents – the continue to hire their manicurist selling RE part time, bored housewives, and the like. These are the agents that are going to be influenced by such non-sense.

It is the same issue on the mortgage side. The good LOs could careless about extra SRP/YSP on various loan products. However, since consumers don’t shop for good LOs, they shop for lowest rate, they invariably walk into the Arms of the boiler room hacks that invaded our industry.

Russ, first and foremost your “probably” in your first sentence should be “absolutely must.” Failing to disclose this conflict of interest is 100% — actually 110% — inconsistent with acting as a fiduciary. So anyone who holds themselves out as acting as a fiduciary, but who does not AT LEAST disclose this conflict of interest, is failing to live up to their fiduciary obligations. Arguably, the mere existence of this conflict of interest (where the “fiduciary” has a personal interest in assisting the client to buy one property over another) is inconsistent with the fiduciary relationship and even client consent does not resolve it. But that’s a pretty extreme argument, I’m willing to accept that client consent to the conflict is sufficient. But not informing the client and not securing consent? That is definitely — not probably — a breach of a fiduciary obligation.

Second, you’re missing the point of the whole concept of a conflict of interest when you say, “Well, the good ones won’t be influenced anyway.” That’s not how you resolve a conflict. That’s like saying, “Hey, I’m ethical and good and always act that way, so I don’t have to reveal ANY conflict of interest because they will never impact my decision.” Seriously, that misses the boat entirely. EVERY client of EVERY agent should be entitled to learn of and consent to this conflict. Anything less — like a system where “good” agents can keep this information to themselves because they are not influenced by the conflict — will not solve the problem. Besides, who decides who are the “good” agents who can ignore conflicts of interest?

Well that comment shows why attorneys get paid by the number of words in a contract. Geez!

You have to disclose from the beginning; this house is offering the agent a bonus if you buy this house. If not right away, then when? After they love the house?

Anyway that you disclose that there is a buyer agent bonus it sounds cheap, taundry, back room, and sleazy. That’s the way I look at it.

I have, from time to time, offered a 4% commission to the buyer’s agent. Good agents throw that into the pot for the buyer. It’s an inducement that makes the agent a heroe, and a player in the scheme. Some agents have kept the extra 1% as a wink, and a nod. My duty is to my seller.

Offering the agent anything just seems suspicious to me. They are there to do a job that is tough enough without making the water muddy.

But there are often differences in rate of pay without bonuses, as some houses are lower than a perceived norm. The issue is simply that all commissions, both buyer agent and seller agent commissions, should be disclosed to all parties.

I generally make flat fee arrangements with my clients to remove all conflicts. Not only does that deal with bonus issues, it also removes any conflict of higher or lower price. The best policy is to remove the conflicts for yourself, regardless of whether or not those potential conflicts are of concern to your client.

Agreed! And you’re right, there’s more than one way to skin this cat (rhetorically speaking!) and structuring your fee to eliminate the conflict is as good as client disclosure and consent. Flat fees are an excellent way to do so.

“The issue is simply that all commissions, both buyer agent and seller agent commissions, should be disclosed to all parties. ”

I strongly agree, transparency is one way of trusting the agent and definitely the rate is much lower without the bonuses.

@ Ardell: Philosophically and economically, of course, you’re right that a buyer’s agent being compensated based on a percentage of the purchase price creates an inherent conflict of interest for the agent. However, the compensation scheme is so well-engrained in the real estate brokerage industry that the legislature decided to waive a statutory magic wand and specifically allow a “buyer’s agent or dual agent [to receive] compensation based on the purchase price without breaching any duty to the buyer.” RCW 18.86.080(6).

Doug – you are absolutely right. So why can’t the legislature re-wave that same wand to increase transparency and give clients the information they need to at least understand — and implicitly consent? — to this conflict? Just because the legislature deems this “not a conflict” does not mean that consumers should remain in the dark entirely about it.

Doug,

I just find it easier to round it to an even number most of the time. I do not find it to be any different though. I did a $20,000 flat fee for a client paying up to $2M or so. I found a house that met all of their needs as to home and location for $1.1M but they still opted to spend almost $2M.

The clients often look to spend more than they need to and I am usually pulling them back to something that costs a lot less that is almost the same. Some buy the least expensive and some don’t. But never have I seen that decision turn on the commission difference.

Still…it’s nice to remove that conflict and really very, very simple for any home buyer to do with most any agent. The myth that there is one commission for all agents who are “traditional” agents is just not true…but it makes for a good story by those who pretend it is true.

The average home buyer looking to spend $600,000 give or take on The Eastside can easily work a $15,000 flat fee with most any agent, removing that conflict of interest. It’s not really a discussion worth having as it is a “problem” that can be solved in about 60 seconds.

“The myth that there is one commission for all agents who are “traditional” agents is just not true…but it makes for a good story by those who pretend it is true.”

It’s more often true than not true, don’t you think? I think the term “myth” is seriously misplaced. It is a general rule with lots of exceptions. And since my model is very, very different, I need to explain how the traditional model works in order to demonstrate the difference. In doing so, you bet I talk about what a “traditional” agent charges.

Heck, Ardell, you are head and shoulders — and waist and knees — above pretty much every other agent I’ve ever met in terms of understanding this conflict. Why would some other, less knowledgable and less sophisticated agent agree to a flat fee to resolve a problem that the agent does not even know exists? Again, it’s not a “myth.”

Oh, and if you’re paying $15k to your agent (first to the seller, then to the listing agent, and finally to your agent) you are seriously overpaying. See my web site for more info (that’s better than inserting a link, right? 🙂 )

“It’s more often true than not true, don’t you think?”

Nationally, yes. For property priced under $350,000 yes. Well, yes and no as short sales and bank owned property is often lower priced and lower commission both.

I doubt there are many home buyers on The Eastside who aren’t working a commission agreement with their agent that is mutually acceptable to the buyer and their Buyer’s Agent. I think it’s less common in Seattle than on The Eastside.

Most of the agents I know on The Eastside understand that the Buyer Agent fee is established between The Buyer’s Agent and their client. Not sure why I see that less in Seattle. Possibly because the inventory has been lower as to best homes in best areas of Seattle and agents have to work through more bidding wars before something sticks.

Usually my higher commission is for someone who takes 6 months to a year or more before we find the right house at the right price or someone moving here from out of area who needs a lot more guidance.

Nationally it’s hard to tell as traditional agents are much quieter about what they do and don’t charge given we are told it is illegal to post or compare commissions. That makes them an easy target for claims of what they charge as they are not supposed to answer or defend themselves against those attacks.

…as to inserting a link…I’ll do it for you. It’s your post, I think you can do pretty much anything you want with “it”. 🙂

http://walawrealty.com/fees/commission-rebates-and-seller-savings-2011-1/?utm_source=seattlebubble&utm_medium=banner&utm_campaign=SB-rebates-01

Marc does an excellent job with his listings, BTW. His good efforts do not go unnoticed. Better than most traditional agents and a bangup job.