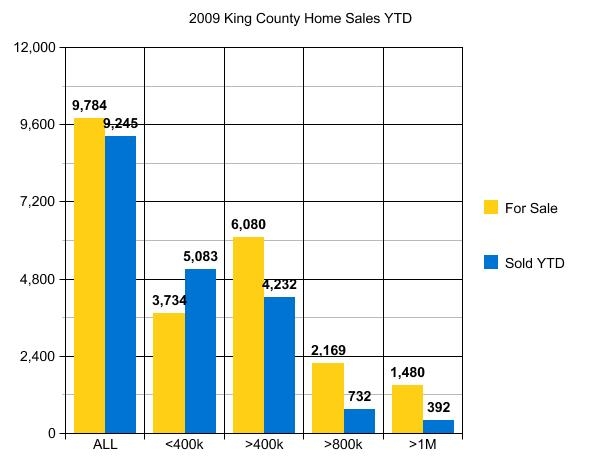

While I am not seeing any huge surprises in the market overall in King County, there were some jaw-dropping results in individual neighborhoods.

While I am not seeing any huge surprises in the market overall in King County, there were some jaw-dropping results in individual neighborhoods.

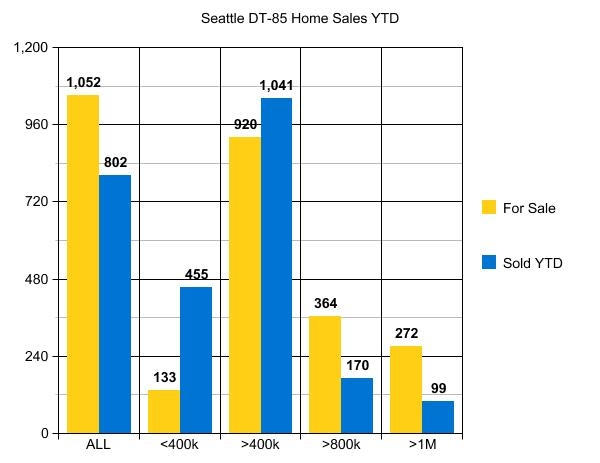

Amazingly great results from Downtown through 85th in both the first and second price tiers.

Amazingly poor results in Kirkland’s 98033 vs 98034 zip codes. Those areas are usually reversed in terms of performance.

Redmond did not perform as well as they did last year. Bellevue only doing well in the lowest price tier.

All of King County still struggling in the over $1M market, with no exceptions.

The clear winner by far shown in the 2nd graph here, as compared to other parts of Seattle and the Eastside. Those figures of only 133 for sale in the lowest price tier, with 455 sold YTD, is beyond anyone’s wildest dreams for this market. My guess as to the dismal results for 98033 is that most of the cheapest homes used to be sold for lot value…and there are few takers for building lots and tear downs these days. The remainder of the problem is likely that homes are just overpriced, and buyers are getting much better at finding true value, vs negoatiating off of list price. This is sending the 98033 buyers into 98034 for better values and larger and nicer homes for the money.

I will be doing some in depth studies of the neighborhoods from Downtown through 85th to see if Queen Anne is outperforming Capitol Hill or if Fremont is outperforming Green Lake. Overall…as a group…clearly the best neighborhoods in terms of consistent performance which could be the hedge one is looking for against further price declines.

(Required Disclosure – The data used in this post is not compiled, verified or posted by The Northwest Multiple Listing Service. Hand calculated by ARDELL.)

Hi Ardell – Interesting post. Thanks. I believe the real story regarding the health of our real estate market has less to do with the number of sales and more to do with the overall “value” of our neighborhoods. Here in Kenmore, my neighbors are complaining that several short-sales have eroded years of home equity and, if one looks at his/her tax assessment for 2010 in King Co. (I’m sure there are exceptions), the property values have dropped (a lot……). If one is an optimistic broker or busy short-sale real estate agent these days, things are looking up. If one is a bubble-head, it’s the dawning of the age of terminal renting. It will be interesting to see what the market looks like by the end of this year.

James,

Those lower tax assessments are not the exception, they are the norm. It’s a County decision to cut back on the labor intensive appeal process. It will not result in lower taxes nor is it reflective of true value changes.

Tax values are too close to market value in 2009, closer than they are supposed to be. We should be running at sale price 1.3 times assesseed value…not 1.03 or .90 times assessed value. The cost of appeals is not worth riding that line too closely for the County.

The factor will move back to 2004 levels in 2010. My best guess is 1.2 to 1.3…won’t know for sure until we get there…but I’m pretty good at educated guesses.

“I believe the real story regarding the health of our real estate market has less to do with the number of sales and more to do with the overall “value

Here’s what I think is the crux of the matter- as Ardell defines it above: “The remainder of the problem is likely that homes are just overpriced, and buyers are getting much better at finding true value, vs negoatiating off of list price. This is sending the 98033 buyers into 98034 for better values and larger and nicer homes for the money”.

Jerry,

One of the problems in a weak market is sellers look at their neighbors to determine price, but buyers look at what their money can buy in a much larger area. Rarely does a buyer look at the same geographic area when determining what to buy, as the seller does when determining an asking price.

It’s hard to impress on a seller (in some price ranges) that of the 300 people trying to sell in that price range, 100 will sell and 200 will not sell at all. It’s a matter of whether or not it is going to be sold period…more than “at what price”. In the $1M plus price range, there are clearly a lot more sellers than buyers. The competition is fierce.