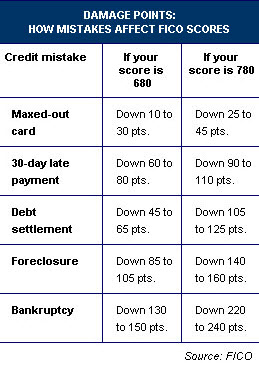

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true. Read it and weep.

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true. Read it and weep.

Hat Tip to Jay Thompson’s “The Phoenix Real Estate Guy”.I’m sure this chart will anger a lot of people with high FICO scores. Best I can attempt to explain this is Richard Gere will likely get a lot more flack if he spit on the pavement, than a homeless person might :). Or better yet, Tiger Woods will clearly get a lot more flack for his misbehavior than your next door neighbor.

Personally I think the Country would be better served if someone CHANGED the system vs. simply requiring lenders to EXPLAIN how it works. I screamed aloud the day risk based pricing via credit scoring passed. But people looked at me like I had two heads. I wish more people were screaming with me that day…

It’s really a mess and many consumers are unaware of what their credit scores are. To add to that, when creditors mis-report, they’re not held responsible–it’s an opps and we’ll fix it in 30 days.

Meanwhile, the consumer pays…

PS: Justin McHood is the author of the post at Phoenix RE Guy 🙂

My guess is that a Short Sale is a “Debt Settlement”, so we may finally have the answer to the question, How much more does a Foreclosure hurt your credit score than a Short Sale?

Answer is likely a max of 40 points, as it is more likely that someone would have a score of 680 or less by the time the short sale is approved.

Grrr… I’ve meaning to write on post on that… shall I do that now? I actually started yesterday and wiped it out…. it’s good follow up to your post. Folks need to remember that its the scoring is accumlulative…combine a late credit card or using over 50% of the available credit with a late somewhere else a few months ago and you’re going to get whammo’d.

I agree with Rhonda, creditors should be help responsible for miss information. I have alos found that the credit bureaus will miss report and then not update their reports for months on accounts that are corrected or deleted. I have had several write that items in a clients reports were deleted but then the items show up for 2-3 months on the report itself, effecting the score. It seems like they just do what they want when they want.

Credit scoring is the biggest sham going. I also think it is travesty that consumers are now paying with LLPAs. I don’t have a problem with LLPAs, but I think the tiers are too numerous. No way you are goign to tell me that a person with a 720 is significantly more risk than a person with a 741 especially when I can boost that 720 above 740 simply by having that borrower increase a credit limit or some other massaging.

I think there should be a law that says creditors should have to inform you in writing and by phone that they are going to report a negative item to the credit bureaus and then give you 30 days to resolve the issue before it can show up as a derogatory on the report.

I would say that 80% of the negative items on my clients credit reports are things that the borrowers didn’t even know. I see a lot of $30 collections and the like and this is the ONLY thing wrong on the report. these are people who piss that away in a week at starbucks and they would have paid had they even known about it.

I once had a client have his score drop by 50 points over a $3.00 30 day late…. Yes, you read that right. $3.00. This guy makes $300k per year and his credit score dropped below 680 over $3.00. He had a dispute over a transaction fee and the creditor reported him 30 days late for $3.00. To their credit, it was fixed after he called and raised hell but something like this shouldn’t have even made it to the bureaus.

and it’s going to be worse with fico 08

I think there needs to be a lot more transparency in credit reporting. I understand that the three different companies have different standards and formulas, so numbers for any one person will vary among the three.

But I will bet you cash money that if you took two identical files and ran them through the big 3, that you would get different numbers all the way around. Credit bureaus can’t and won’t tell you how your score is determined. At best you get vague numbers like you have in this article (which is better than nothing.)

Credit bureaus need to pull that old curtain back, reveal the man pulling the magic levers and let people actually see what affects their credit. I am sure that people would be shocked that things such as where you live, where you shop and I wouldn’t be surprised if race and familial status all affect your credit score.

Pingback: To the Students from the Dec 7th Foreclosure Class at PreviewP Northgate : ceforward.com

Pingback: To the Students from the Dec 15, 2009 Foreclosure Class at SKCAR Bellevue : ceforward.com

Pingback: To the Students from the Jan 13, 2010 Short Sale Class at SKCAR Bellevue : ceforward.com

Pingback: To the Students from the Feb 22, 2010 Advanced Short Sale Class at Preview P Northgate : ceforward.com

Pingback: To the Students from the March 25, 2010 Foreclosure Class at SKCAR Bellevue : ceforward.com

Pingback: To the Students from the April 1, 2010 Short Sale Class at JLScott Puyallup : ceforward.com

Pingback: To the Students from the April 6-8, 2010 20 Hr Prelicensing and Exam Prep class : National Association of Mortgage Fiduciaries