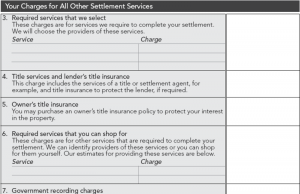

The new Good Faith Estimate will be required to be used on all new loan applications effective January 1, 2010. Part of HUD’s GFE may include a service provider list which consists of title and escrow/settlement providers (boxes 4, 5 and 6; section b on page 2 of the GFE). This list (if permitted by the lender) is important to the consumer as it will determine what the cost difference can be between the good faith estimate and the settlement statement at closing.

If a borrower relies on a service provider (title and escrow/settlement services) on the list given to them by their mortgage originator with the good faith estimate, there is a 10% tolerance. This means that if the cost at closing comes in more than 10% higher of the sum of those fees than what was provided on the good faith estimate, the lender will pay the difference (or credit the borrower) over the 10% sum of those fees. However if the lender permits and the borrower to shop for their own title and/or escrow vendor, the loan originator is “off the hook” should the fees come in higher at closing.

Per HUD “if no service providers are listed, then it is assumed the customer could not shop and fees will be bound by the tolerances” and that “lenders are responsible for fee requirements listed by their loan officers or the broker”.

If the lender “permits” the borrower to shop for title and escrow services, they must provide this written list which must include at least one service provider on a separate sheet of paper and then the lender is subject to the 10% tolerance (based on the aggregate of those fees).

I see this as a huge opportunity for the banks similar to what we’ve witnessed with HVCC. This is their big chance to control where escrow and title go–to them! Banks will state that they do not want to risk being off on their quotes with new binding good faith estimates and it’s my belief they will do their best to keep escrow and/or title “in house” or affiliated providers. Some mortgage brokers may find that they will have to use the banks preferred title and escrow vendors just as they do the banks appraisal management companies. Should this happen, we may see banks use low cost centralized services, similar to many bank processing centers (some are even located out of state).

How will borrowers know how to select or shop for a title and/or escrow company? Can they rely on their bank loan originator to help them select a title or escrow provider when the MLO (Mortgage Loan Originator) is directed to only have the bank’s providers on the list? The new RESPA laws will not allow MLOs to recommend anyone who is not on the service provider list. Should the consumer rely on their real estate agent to recommend the title and escrow provider (many brokerages have joint venture relationships)?

With a purchase, if the title and/or escrow service providers are other than those designated on the written service provider list, then it is presumed that the buyer/borrower selected those providers (even if it was directed by the real estate agents or seller) since the buyer agreed to the contract. With this scenario, the lender is not subject to the 10% tolerance in fees for those costs. Buyers may find a surprise comparing the good faith estimate at signing to the HUD Settlement Statment if the title and/or escrow company are different from what was designated on the purchase and sales agreement.

The new Good Faith Estimate may wind up being a huge set back for independent escrow companies and smaller independent title agencies who will most likely lose any relationships they have forged with loan originators who happen to work for one of the big banks.

By the way, if you are planning on selecting your escrow and/or title provider. You may want to start researching prior to your prequalification process with the mortgage originator. You may find that effective January 1, 2010 most mortgage originators will not want to provide a good faith estimate until you have committed to working with them as the new GFE’s are binding for the loan originator unless certain “changed circumstances” permit the MLO to issue a revised estimate. Per HUD:

“If a GFE is given during prequalification, the receipt of one of the six required pieces of documentation will not constitute a “changed circumstance.”

The loan originator is presumed by HUD to have the “six required pieces of documentation” if they issue a good faith estimate.

…I’ll be writing more about this on a future post.

The new Good Faith Estimate can provide a slight “transparency” marketing opportunity for a savvy broker. It’s basically a guarantee of fees, not rate. If you have an unlocked borrower and the YSP improves, that will be passed on to the borrower in the form of a larger credit. That’s transparent. On the banker side, they just “bank” the improved price and the borrower never knows.

Paul, How do you think the new GFE will impact escrow/title companies?

Pingback: Top 10 real estate posts of the day for 12/16/2009 : Tempe real estate and free home search

Yeah… This looks like more rules designed to push small companies out of business. Quite honestly I am pretty wary of using any service that a loan provider tries to direct me to.

Lending seems to be getting more difficult. It’s like the lender wants to direct the Real Estate transaction rather than the borrower.

Here’s been my take on lending for a little over a year now: with web based businesses, like Zillow, the mortgage is the prize, where the money is to be made. Even Lennox Scott talks about a one stop shopping concept in web based Real Estate. It does make sense that large companies would want this control of the transaction to direct people back to them. It seems by making things more complicated and difficult large companies can claim they are the answer, they will make things easier.

This is just one more little road block that is directing people to large institutional lenders.

“It’s like the lender wants to direct the Real Estate transaction rather than the borrower.”

It’s more like the banks/lenders have been burned by either mis-use of mortgage programs (either too sophisticated or subprime) and/or have been burned by fraud by mortgage originators, re agents and/or borrowers.

The banks/lenders are the ones who “hold the gold” and have signficant say in the transaction as far as whether or not they’re going to lend.

I’m not sure if I agree with you that this will direct people more to large institutional lenders. Many home owners are peaved with their banks for refusing to do loan mods or the “Obama refi” and I bet they’ll remember when it comes time for them to buy their next home.

I think the greed of big banks will be very evident should they try to keep control (ie revenue) of escrow and title.