The King County Tax Assessor’s office recently added the photos they have available on line. It’s a pretty cool feature where you can possibly see the history of your home. I wrote a post showing old photos of my former home on North Lake in Auburn and how to obtain the King County Tax Assessor’s photos. However, I learned today is that the King County Tax Assessor’s office is also making note of the asking price on listing flyers and the comments are available on line under the “property details” section.

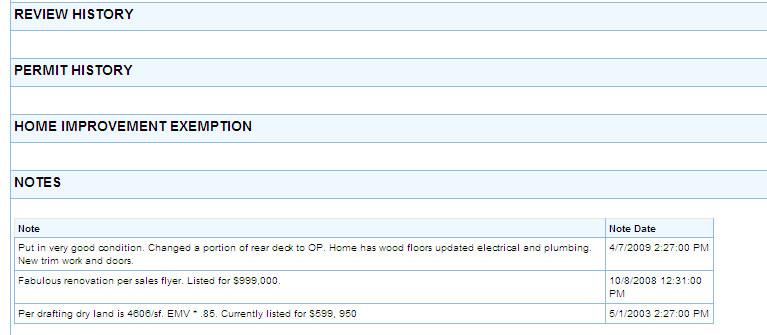

Check out how it’s noted on October 2008: “Fabulous renovation per sales flyer. Listed for $999,000“. This is not my home but I have knowledge of it and I can tell you that it never sold for anywhere close to that…in fact it never sold.

It’s amazing to me that King County is looking at listings and making notes such as this about any property. Sure enough, the following year, this property’s tax assessed value increased by just shy of $100,000 (or 12%).

Did the listing flyer impact the tax assessors opinion of value on this home?

I bet Barbara Sbisa Alsheikh (King County Office of Citizen Complaints/Ombudsman) will be able to provide information about this practice. Her email is Barbara.Alsheikh@kingcounty.gov

Nice find!

In a way, the assessors are merely doing our bidding…trying to efficiently perform their duties and assign valuation for taxation.

There will always be winners and losers.

Be careful indeed!

Roger, this home has never been worth $999k IMO… the sellers/listing agent were lobbing a price out there to see what they might catch…which was a whole lot of nothing.

How is the fact that it was once listed for $999k and that the flyer stated it was a “fabulous renovation” worth possibly jacking up their assessed value?

Denise, if you contact Barbara, please let us know what she says. 🙂

Interesting, I was surprised to see that stuff recently, when checking out the new KC assessor website. Also, check out Zillow for owner updated facts, regardless whether the houses are being sold or not. I guess people are (or were) proud of their homes, and wanted to watch Zillow ramp up their house values against their neighbors, lol! I wonder if KC will use Zillow “facts”, as well?

Another question for your contact at KC tax assessor office is this one. In addition to increasing assessment against listing value, do they also reduce assessment if listing shows less value than current KC does? I hope this new function doesn’t operate with the assumption “real estate value only goes up”.

Hmm I hate seeing overinflated prices just “to see what they can get” – that is the most frustrating thing because it wastes time and money for everyone involved.

That possibility alone might discourage sellers from overpricing their properties.

Roberta, lets hope… I think in this market, many home owners are very unsure of their home values…they don’t understand that it’s not how great their home is, it’s what their neighbors homes have sold and closed for.

In the case of the house above, the listing agent who had this home is notorious for taking listings at any price.

Well, I contacted the ombudsman and she forwarded to the division director, Debra Prins. I got a response today stating this:

“We do not use listings in our valuation modeling. We use closed sales within a defined time period, adjusted for time and deemed arms length transactions. All sales used in our valuations and those we did not use can be found in the area reports accessible on the Assessor’s web site.”

Meg, that’s interesting… I’m going to see if I can find what sales they use to determine that our home’s assessed value went up $60k for 2010… no comps that I can find using the title company.

The response Meg received is true to what I’ve been told regarding assessment valuations. I’d also be interested in what sold data was used for Rhonda’s place.

for the record, it’s not my home that I wrote about 😉

Has anyone appealed an assessment increase? Is it worth the time?

How about excise tax on property sold at a loss. Is there any appeal process?

I checked out tax assessor’s site and clicked the Area Report tab–very interesting–35 pages for a “mass appraisal” over basically the entire Alki area of West Seattle increasing the assessed values 5%. From what I can tell, comps are from as far back as 2008 with many sales removed where a lower sales price. For example:

~bankruptcy – receiver or trustee

~forced sale

~no market exposure

~relocation

~estate administrator, guardian or executor

~diagnostic outlier

I’m not sure what all these items mean–but they would most like count as a comp for any appraisal and impact home values… seems like the county is cherry picking on what comps to use to create an assessed value.

Barbara Sbisa Alsheikh came to my Coldwell Banker Bain (Capitol Hill) office and presented an awesome class on assessments. She’s a wealth of knowledge and I’d have known what I was in for I would have recorded everything she said. Here’s a resource (http://seattleavenue.com/2010/07/assessed-value-lags-the-market-how-was-your-seattle-king-county-property-value-determined) that I share about the timing of assessments, they’re very complicated/confusing for the public and also real estate professionals. Barbara would be an EXCELLENT speaker to have at our next REBarCamp in Seattle about “everything assessment”. Rhonda, for purposes of assessing a property they only want to use properties that reflect normal arm’s length sale activity (that’s why they don’t use short sales or foreclosures, forced sales, etc. as that information doesn’t reflect a normal arm’s length real estate transaction.

http://www.ValueAppeal.com is a site that can help you determine, and appeal your tax assessment. It’s a good resource for any one considering the appeal process.

IDK, it seems to me a tad imbalanced that, in the frothy years, multi-bid sales were qualified, whereas, today’s distressed sale is not qualified, not an arm’s length transaction. Just saying, seems to me that Rhonda is right… they’re cherry-pickin the types of sales.

thanks, meg… the tax assessor certainly didn’t void out sales with multiple bidders driving up the price 😉

Don’t believe anything you hear from the Assessor – Debra Prins says they don’t use listings?? The Assessor tries to use anything they can against you at the Boards of Equalization and Tax Appeals. The try to slip in listings at any chance they can. The BOE requires expertise or flat out luck to prevail. The BTA is becoming next to impossible to win. Check out the BTA recent hearing results on their website. They are now sustaining the Assessor at rate approximating 90%.

How do I know this – I was an insider at that place for many years. You have had 4 KC Assessors in the last 14 months – the place is riddled with problems. The Assessor and the BOE/BTA have one goal – sustain their value and make it stick, because gov. budgets are coming up short. The only chance for a fair playing field is in superior court. It is the only way to go in this environment.

Interesting… I was just re-checking this property and all the notes are gone! Hmmmm…..so much for transparency!

Very interesting, and not all that surprising. Last year, Lloyd Hara was examining whether or not “under assessed” properties could be billed for back taxes that they weren’t billed for.

http://tinyurl.com/26xsahs

In Pierce, Dale Washam is actively dealing with assessment issues, and it’s not pretty:

http://www.co.pierce.wa.us/pc/abtus/ourorg/at/at.htm

Where there is smoke, there is fire I guess. I think we’re going to see more of this in the years to come as the budget crisis lingers on.

Thanks for keeping an eye out Rhonda!