The #2 Question in Real Estate is Why Can’t I Find a Good House at a Fair Price?

The #1 Question we covered was How Much is THIS Home Worth? For those who find a house they want to buy, or may want to buy, the question is how much is it worth or how much should I offer on it?

But there are a fair amount of people having trouble finding a house they may want to buy.

OR they find a house they may want to buy, but not at the price they want to pay.

For those people the main question is Why can’t I find a GOOD home at a FAIR price.

At any given time, in any market, if you are looking for a home to live in vs an investment property, you will be lucky to find THREE good choices no matter how many homes are on market.

Every SELLER needs to BE #1, #2 or #3 and every BUYER needs to FIND #1, #2 and #3.

It really is that simple. The only difference between a Buyer’s Market and a Seller’s Market in that regard is the amount of time you have to find those. In a Seller’s market you may only have hours before #1 hits the market and has offers. In a Buyer’s market you usually have up to a week, unless you are trying to beat out everyone else.

In a hot seller’s market, good houses at a fair price are usually about 1 in a 100. In a buyer’s or balanced market, good houses are more often 2 -5 per 100. The only thing this tells you is you have to kiss more than a few frogs to find “the one”. Luckily most people are able to do that using the internet to narrow down the choices.

If you are thinking you are going to narrow down to 20 good houses and choose from those, you are likely incorrect. The danger in that thinking is that you will continue to lose out on #1, #2 and #3 while you are sorting the 20.

Worth Mentioning Here: #1 may move up to #1 after 650 days on market via a massive price reduction. So we are not talking about grabbing “new on market” necessarily. Very few homes come out of the gate at the right price.

Knowing which ones do and which don’t is what separates the men from the boys, and is likely the hardest part of finding a home to buy.

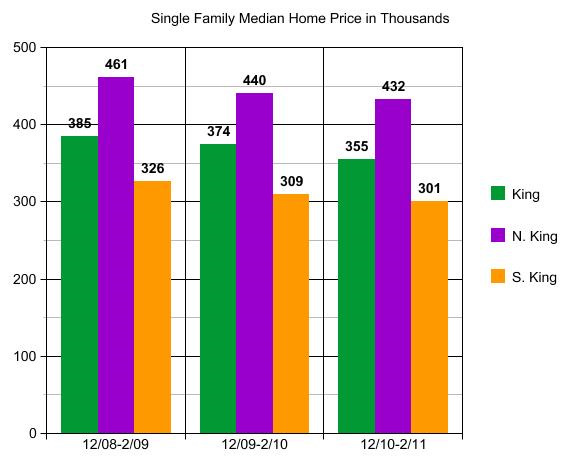

Last but not least is knowing what you want, and what a “good” house is and is not, and what a “fair” price is and is not. Easier said than done, but not as hard as you might think either. Likely the #1 mistake people make is looking at County-wide stats. As you can see from the charts below, that will likely lead you to overpaying in South King County and missing the opportunities in North King County.

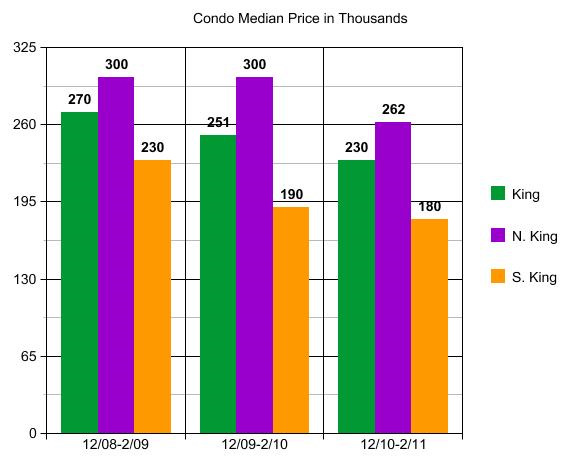

I haven’t been doing condo stats for a couple of years, but threw these in so you can see the variance between Homes and Condos.

Condo and Single Family Home prices are not always moving in the same direction, and clearly never to the same degree.

Back to the Question: Why Can’t I Find a Good House at a Fair Price? You might be pricing incorrectly or you may just be taking too long to make a decision. I’m not talking about taking too long to buy the right one, I’m talking about taking too long to sort the “wrong” ones into two piles. One pile is NO and the other pile is MAYBE, but not at this price.

It’s very, very difficult to find the one that is priced right out the gate. I can usually do that, but it is seriously very difficult, and most people don’t have the heart for that in a Buyer’s market.

If you have been LOOKING for the right house at the right price for a long time, you probably need to change the method of HOW you are doing the LOOKING.

********

(Required Disclosure: Stats in this post are not compiled, verified or posted by The Northwest Multiple Listing Service)

As usual, Ardell- Here you stay focused on

what should be the RE Client’s main goal-

separating the wheat from the chaff. Come

to think of it- that’s exacly what we did in

buying our 1955 Mid-Century Modern on

Mercer Island. It was a tear-down that was

usually rejected out of hand by all others.

Jerry,

In this market it is very difficult to justify the cost of expensive remodeling. Most people want to feel certain that they are gaining the same or more value than what they are paying for the improvement, and that is almost never the case.

Some cosmetic adjustments needed some can deal with. But the majority of people want to buy a home they can live in comfortably without any major changes needed.

I think part of that comes from how long they intend to stay in the home. Most do not see it as the place they will live in pretty much forever. I expect that was not the case with you? How long did you stay in the home after you made extensive improvements? How soon after you bought it did you make those improvements?

Ardell- We started the improvements well before we moved in

because it was really a tear-down. We’ve continued

for the 25 years we’ve lived here. It helps my being an

architect as you well know. I’ve helped a lot of people

do much the same kind of major and not so major redos..

In 20 years, I don’t think I’ve ever helped someone buy a home that needed a major redo. I try to find one that suits them “as is” for the most part. In some cases I need to find one that they CAN add to later.

Just today I was out with someone looking at homes on lots from 3,500 sf to 6,500 sf in Seattle all in the same lower price range of under $400,000. The one story homes on the larger lots seemed more easily expandable. Is that generally the case Jerry?

A- You- & your clients- are missing a bet.

More thah once, I’ve made a lesser home

into a very nice liveable one- that became

a stepping stone up the housing ladder. J-

A- It’s too bad that your system regards

any Link as a sign of Spam. I could

send you some pictures of my projects

that illustrate my “stepping stone” points.

Without cost factors, which you seem reluctant to give, that is not of much value, Jerry. Not many people have an extra $100,000 after closing. No one that I know does.

And yes indeed- “The one story homes on the

larger lots seemed more easily expandable” J-

Thanks Jerry. I’ve always been told if you want to add a bathroom or move the washer and dryer, it’s usually best to stick near where there is already water. Adding a master suite to a one story home easier than adding a second floor. Well, not sure about easier, but less costly. But when it comes time to do that addition, it’s often less costly and easier to move to a different house that has the things you need later.

As to your comment above that, it’s not a good time for anyone to view a home purchase as a “stepping stone” to something else. Even a 5 year hold is unpredictable. Best to buy something you can stay in 7 to 10 years.

Though it’s possible that my guesstimate for cost is high. Used to be adding a bedroom on a one story was about $20,000 and adding a full master suite with 5 piece bath was $35,000 or so. The bathroom often cost almost as much, and sometimes more then, the bedroom, depending on how fancy.

I would think today that would be more like $50,000.

Ardell- As usual, you and I look at things- including remodeling-

from opposite sides- which is good for RCG Readers bless their

hearts. In any case, you want what you’re staying in (living your

life in) to be as nice as possible and function well as an abode. J-

Jerry, if you won’t engage in any discussion of cost, the conversation becomes somewhat moot. Most people decide things based on cost and would not consider buying a house that needs remodeling without some rough parameters.

A kitchen remodel is usually between $35,000 to $50,000. Anything less is usually building new stuff around old cabinets, which I generally don’t recommend.

A bathroom remodel is usually around $10,000 unless it is a master bath.

A Master Bath remodel can be as much as a kitchen, if there is no master bath and $25,000 or so for one that exists, but needs extensive updating.

Finishing a basement on the Seattle side is generally not warranted if the ceilings are too lowj Jacking up the house to increase height has been done, but most found it to be cost prohibitive for the added value.

Without cost in the discussion, it’s just an advertisement and does not add value for the readers, IMO.

As to your “Without cost in the discussion, it’s just an advertisement

and does not add value for the readers, IMO”- we who create things

have a hard time explaining to those who deal with what’s already in

existence, that cost is indeed part of the equation but can’t be known

until the design is created. At that point, price things can be adjusted.

As you’ve said- “what is, is”.

Ardell- As you know there are a quite lot of foreclosed homes

on the RE market these days which often have been reduced

enough so there’s money available for creative remodeling. I

hate to say it but under these conditions, it makes little sense

to start from scratch on a vacant lot. And besides there aren’t

many good vacant lots unless you create one by demolition. J-

As to your “Without cost in the discussion, it’s just an advertisement

and does not add value for the readers, I’ve done a lot of low cost

informal home surveys in my time. With my many years of experience

as a “hands-on*

I have been to many homes, Jerry, where the owners paid a lot of money for “plans” but could not afford the cost to implement them. They are sitting on the dining room tables of homes for sale when the owners decided to sell the home vs proceed with the improvements. Some even try to add the cost of those plans to the price of the home, assuming the buyer of the home might use them and be willing to pay for them.

It seems as if people don’t know the cost of the improvement until after they pay for the plans, and a lot of money is wasted in that process.

All too true Ardell- something I’ve avoided pretty well.

I’ve had very few unbuilt projects in my long career. J-

Would it be normal to ballpark the cost of the change before drawing up the plans? Or do you mostly work with people who can afford what they want?

“ballpark(ing) the cost of the change before drawing up the plans?”

would always be part of the job- even for the most well-off clients.

Affluent people got that way by being prudent.

and Ardell- not all my clients have been affluent.

Many/most of them have been those appreciative

of what makes a good family home.

A- As to buying the Seller’s Remodeling Plans,

they probably don’t fit the new Owner’s ideas.

The point of buying another home is usually to

be able to make it fit one’s own needs. This is

where I’m often able to advise people before

the sale as to how the house involved could be

adapted to their own special needs.

I have seen them “given” to the buyer and have yet to see someone agree to pay for them. There was a home in Queen Anne Recently trying to include $6,000 to $8,000 for the plans, but the home was already over-priced without the cost for the plans, and the owners took it off the market and rented it out.

My clients bought a different house that didn’t need altering. One of the dangers of putting plans out on a table, is it gives prospective buyers the idea that the home is no good “as-is”. Trying to sell “what could be” generally doesn’t work out too well, unless the seller is willing to do the “could be” prior to closing. You see that once in a while with new carpet or new flooring or even a new roof, where the seller is willing to do it and pay for it, but wants the buyer to choose the color or style. You don’t see it often, but technically that’s not a bad idea.

Ardell- Yours above makes complete sense to me.

Our plans are defined as “Instruments of Service”

and have no value w/o the architect’s involvement.

This is how Architect/Owner Contracts are written. J-

I saw the need a lot more in CA where the lot could be as much as $3M and every house a potential “teardown” or 90% remodel project. Often the value of the lot has to support an extensive change in the house.

Usually my clients have more simple questions like “can I take this wall out” 🙂

This is excellent post.