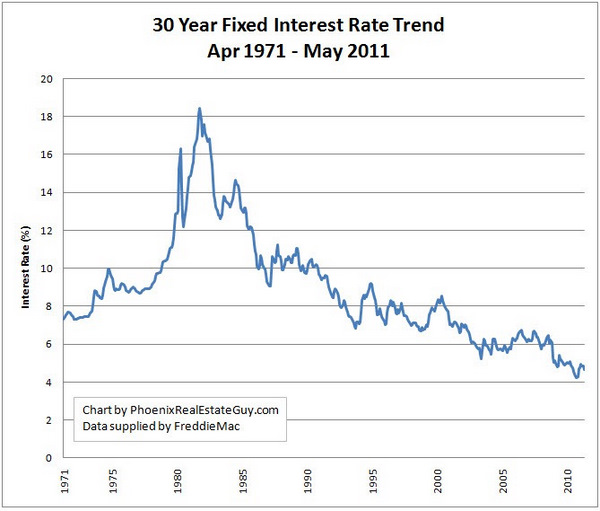

Interest rates have been very volatile in June. This Poll Post on Seattle Bubble and the chart below are a good reminder that interest rates were at 5.5% in the Summer of 2009 and at or above 6% quite a few times in 2007 and 2008.

I thought you might find this chart of where interest rates have been for the last 40 years of interest. I borrowed it, with permission, from my friend Jay Thompson’s blog.

Personally I think they will run between 4.5% and 5.5%, but that’s a pretty big spread for people looking at homes to buy. A 1 point spread on a $417,000 conforming loan is $255 a month.

Of more concern to me is the variance in Real Estate Taxes from one property to the next.

When you get pre-approved, make sure you know what payment vs Purchase Price you are being approved for, and what assumptions are being made as to Taxes and Insurance.

I looked at the 30 homes sold in King County for $500,000 in the last 6 months, and the range of Annual Real Estate Tax went from $3,600 on the low side, to $8,000 on the high side. HUGE SPREAD. The Real Estate Taxes could easily turn your pre-approval into a Failed Pending Sale.

Be sure to know the underlying basis of your pre-approval, and make adjustments as needed from one house to the next. If it’s a super-deal, the taxes may be out of proportion to the sold price.

Ardell, I would not be surprised to see interest rates eventually approaching the early 1980’s levels in the not too distant future. The dollar is trashed – much worse than it was back during the Carter stagflation era. If our Chinese benefactors decide they will no longer prop up our debt, the cost of borrowing will shoot through the roof. That seems like only a matter of time before they reach the point where it is better for them to stop pouring in good money after bad into the US Treasury.

It sounds an awful lot like Realtor-speak but anyone who can qualify for a mortgage to purchase a home should do it quickly. The sky isn’t falling but the fundamentals just don’t look promising for cheap interest rates to remain available for much longer.

Ardell- Once again your well-done graphs

tell the story that follows in just a few easily

understood words. J-

I think many will be surprised, following that 6% line, how rare it is for mortgage rates to be under 6%, let alone under 5%.

I see this quote from Rhonda this morning for a snapshot of where rates are today.

“quoting 4.375% 30yr fixed rate-term refi $175k loan amt 80%LTV w/740+credit…”

my quote had the apr included 😉 It is very important for buyers to understand that they are qualified based on the MONTHLY PAYMENT (including any home owners association dues)… many think that it’s the sales price but it really boils down to payment and how much they have for funds for the down payment.

This week should remain interesting with what’s going on in Greece.

As far as rates go, typically a good day in the stock market = a bad day for bonds, like mortgage backed securities (mortgage rates)…and when the stock market is tanking, you’ll often see mortgage rates improve.

Interest rates have been very volatile in June. This Poll Post on Seattle Bubble and the chart below are a good reminder that interest rates were at 5.5% in the Summer of 2009 and at or above 6% quite a few times in 2007 and 2008.

Elaborated in Graph nicely.

If we didn’t have the ads we do on RCG, I’d probably post rates again…but it’s too painful to see those tacky ads I hate so much. It’s actually been a couple weeks since I’ve posted rates on my blog, Mortgage Porter… with all the changes, it just takes too much time…by the time I’m done, rates have changed! If they change for the worse, I look great and if they change for the better, I look like my rates are too high…it’s not a winning situation 🙂

Dan Green just posted that rates are changing every 3 hours: http://themortgagereports.com/6348/mortgage-rate-velocity-spikes-changes

He doesn’t say changing from what to what though. Ticks me off! 🙂

Flat volatility:

4.5%

4.625%

4.5%

4.625%

4.5%

Truly “volatile”:

4.5%

4.625%

4.75%

4.875%

5%

OR

4.75%

4.625%

4.5%

4.375%

4.5%

A whole lot of hands waving in the air about changes every 3 hours vs every 4 hours? NO MENTION of what the rates are changing from to? Who cares if it is a flat up and down by only an 1/8th, back and forth?

My advice as to shopping rates has always been to wait until you have a signed contract so that you are “lockable”. Then set aside an hour to check rates with the lenders…all within the same time frame. Without the ability to lock the rate, the exercise is of no consequence. Checking with a different lender each day for 3 days is not the way to “do it”. Once you find “best rate” from a legitimate and lockable source, ask for THAT rate from your lender of choice. You don’t choose lender by rates. You offer the business at THAT rate to the best lender.

Ran into a situation recently where the lowest, by FAR!, rate quoter said it couldn’t be locked until after the appraisal was done. LOL! What a scam!

A rate can be locked once we have a signed contract. Ardell, it is nuts having rates change so often as Dan discusses on his post…when I have someone “shopping” and the rate they obtained 3 hours ago is no longer valid…I think that’s the point of his post. I’ve had rates change WHILE I’m trying to lock in my client…I think most people would be surprised at how the process *really* works.

Ardell, Dan just means we typically get a rate change announcement every three or four hours from at least one wholesale lender. Yes, the changes can be relatively small, but they are changes nonetheless.

Shopping mortgage rates is a sucker’s game. Consumers really have no idea how mortgages work and what exactly they are shopping for. It is really sad to be honest. It makes it very difficult for honest LOs to compete. Way too many consumers want to be sold a bunch of BS.

The one issue I have with your advice, Ardell is that telling consumers to shop after they have gone to contract is why banks no longer do real pre-approvals. The lack of commitment from borrowers makes pre-approvals a huge time sink and cost center for lenders. It literally takes me about 2 hours or longer to review a file properly (I am talking going over bank statements, sourcing deposits, reviewing tax returns, etc). I absolutely don’t want to invest that time if the consumer is just going to start rate shopping me against some phone officer working in a boiler room. If it is all about the final rate, then I rather just be the last person called so I am not wasting my time.

Agents have procuring cause to protect them, lenders do not have that luxury. It is literally like if one of your clients had you make an offer on a house after spending a few hours showing them properties and then at the last minute says “I am going to use one of three agents – which ever gives me the highest rebate”

Yeah, yeah…heard it all before. LOL!

How IS a consumer supposed to “shop rate” then? If you have better advice on how to get the lowest rate, let me know. For now my call 3 lenders in one hour after you are in contract stands.

If I have a client with an 800 credit score. 20/25 ratios and 40% down…they clearly should be shopping for lowest cost and rate.

You got a better way for them to do that…I’m all ears.

Telling them not to bother…don’t waste your breath.

Ardell, that is the point. You can’t shop for the lowest rate because the lowest rate doesn’t exist! It is a fallacy…

Consumers need to shop the loan officer and not the mortgage. A good LO will almost always get someone a competitive rate. The problem is that consumers and banks have attempted to commoditize a mortgage. A mortgage is a commodity but the actual act of getting/qualifying for it is not which is where people run into trouble.

In today’s environment, THERE IS NO SUCH THING AS A PERFECT FILE! There are nuances and quirks on every single deal. Any LO who says otherwise is full of sh*t. Where consumers run into problems is that there is absolutely no way for them to know what those nuances might be on their deal. That nuance might represent the .125% difference in rate. Of course, they won’t know that until their deal blows up 2 weeks before closing.

Instead of calling around asking about interest rates, consumers should be asking how long an LO has been in the business, who their typical clients are, what issues are on their file, asking for references, etc. Stop obsessing over .125%.

The goal of consumers should be to get a COMPETITIVE RATE, not the lowest rate. If you call around enough, you will eventually go from getting a great competitive rate from a good LO who will get your deal closed in a timely manner to getting lower rate quotes from inexperienced boiler rooms with no chance in hell of getting that deal closed.

Within .125% this way or that, I generally and often agree. But I deal with lots of buyers and lenders over 21 years…and shopping rate and cost is a reality. Recent example lender we wanted to use for other reasons said 4.875%. Everyone else was saying 4.5%…I got it knocked down to 4.625%. Good enough.

Lender said “why are you complaining about 4.875%? The buyer wasn’t complaining and didn’t care.” Well, because people don’t hire me to DO, they hire me to CARE. I always “care” when the situation calls for it.

For years lenders have complained about “rate shoppers”. Why should they not care about the difference between 4.5% and 4.875%? They clearly should care. If they don’t…then I care on their behalf.