King County Home Prices, and what is causing them to go up or down, is dramatically different from one area to the next. I often think about the many who track short sales and bank owned sales, and the growing number of them, who think that these distressed property sales pull the median home price down. That is not always or even often the case in many areas.

North Seattle and Bellevue School District median price per square foot numbers would actually be LOWER if there were no short sales or bank owned properties in the mix. In Bellevue School District, the current median price per square foot would be $330 vs. $338 if there were no short sales or bank owned properties selling. The median price per square foot of a home not in distress is $230, bank-owned $298 and a short sale $268. Given the median asking price of homes for sale there is $899,000 vs. the median sold price of $563,500, the distressed properties of today and for some time into the future are more likely to be the most expensive homes that fewer people can afford to buy.

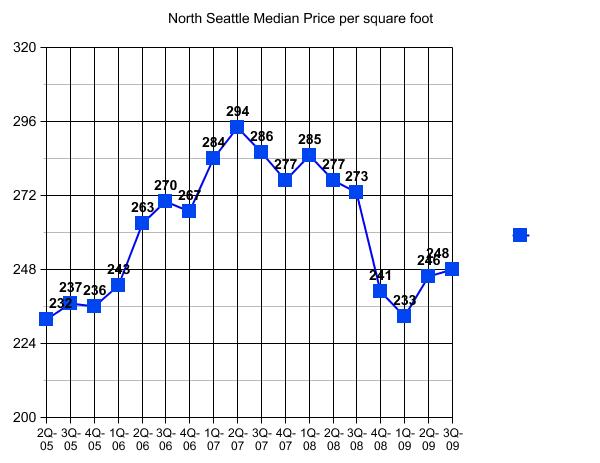

Now to Seattle North of Downtown.

Again, short sales and bank owned property sales in North Seattle are pulling the median price up from $244 to $248 in the 3rd quarter. Not necessarily for the same reason as Bellevue School District. More likely due to their being bid up or banks pricing them high and people thinking they are “a bargain” because they are “distressed properties”.

This is NOT the case with sales in Seattle SOUTH of Downtown where the median short sale sells for 15% less and the median bank-owned property sells for 25% less.

I’m working on volume and price stats to determine if the $8,000 Homebuyer Credit expiring will pull prices below “bottom” and for Seattle South of Downtown…no question that is a big yes. But for North Seattle and Bellevue School District (not finished with the rest of the Eastside School Districts) we just might see the bottom holding “post credit”. I’m still speculating on where volume of sales would have been in North King County, if there never were a homebuyer credit. And while I expect a 4th quarter price drop, I don’t expect prices to fall below the 1st quarther “bottom” of $233 median price per square foot.

Not finished with all of my predictions and stats yet. But thought it was very interesting that in some areas Short Sales and Bank Owned property sales are actually pulling median price per square foot UP…vs. DOWN.

(Required disclosure: Statistics not compiled, verified or posted by the Northwest Multiple Listing Service.)

Any movements upward will be met with a non-relenting pull downwards for many years to come. I urge anyone having to sell to place their home on the market and sell into this “upward” trend.

I forsee all of our home prices, at best, to trendline sideways with a downward bias. The low rates and bonus bucks offered by the Fed remains a gauze bandage on an arterial wound. Over 1/3 of homeowners with a mortgage are upside down and I remind everyone there is not enough cash in our home piggy banks to cover this negativity. Not to mention the additional 10% in fees here in Washington State to sell.

Short sales, foreclosure, and personal bankruptcy’s for many years to come.

If you must sell in the coming years get it on the market now with this slight upswing, price it very aggressively, and take your time in finding your next home. Time is on your side Buyers.

Ardell if you believe short sales and foreclosures are bringing property values up then WOW….great news for the sellers because we will see YOY drastic increases in short sales and foreclosures for at least 6 more years.

I personally don’t believe it……Sell into any positive momentum..Buyers be patient and let the home prices come down to you.

Ardell – This is definitely an interesting statistic. I too have followed REO and short sale properties, and have tried several times to make sense of REO agents and bank decision making. I’ve seen homes go through the trustee sale with an opening bid of $350k, get no bids at all, then get listed with an REO agent for 259k. This particular transaction was a head scratcher, because the bank could have sold the home for 260 at the trustee sale, and they could have saved the REO commissions!

In our profession, we are obligated by a fiduciary duty to work in our clients best interest, correct? So, how is it in the banks best interest to undersell the market so severely? Is the REO agent working in his/her own interest by pricing the homes so low? quick sale, and high volume business models are what they’re offering, but the bank is literally giving away money with this strategy. The worst part, is that they’re mostly giving away OUR money because of the bailout package…

Ray – I hear your point about our economy going in the dumps, but I think you should re-think your macro-economic view. Do you think our country might experience some inflation in the coming years? Historically when we go into this much debt, and we’re borrowing from the worlds nations, we will experience a high amount of inflation. Do you think someone might benefit from their leverage in real estate during this time?

Just my 2 cents for what it’s worth.

-Tor

Hi Tor! Absolutely.. Many will profit from real estate purchases in the coming decade. There will be GEMS that MUST be sold… That is why I advise Buyers to always look. Know their market area. Buyers will know when they find one.

I’m from Reno Nevada where I see homes that are down nearly 78%. Buying these new homes that are less then 5 years old for 60k and renting them out for 750-900 per month makes tremendous sense. I consider these Gems all day long because the cost to rebuild is far more.

However, here in the NW with just a 22% drop in home prices I still see far too many people jumping in thinking we have hit a bottom. There is no specific bottom to this Bubble. It will be a very long bottom with little to no appreciation for many years.

I attend the auctions with my investor groups every Friday morning. From 10-30 properties in the past to well over 150 each and every Friday is extremely frightening. We have turned tremendous profits in the last 6 months but we never purchase unless we can sell the next day for a profit. They spend ALOT of time researching because the last thing they want is a rental. Dead money is a nightmare for Auction investors. They would rather sell at a slight loss then tie up funds.

Yes, Tor inflation is a given along. However, for millions of people the Dream of Home Ownership has become a nightmare and remains so. It has become socially acceptable again to become a renter. Its also become socially acceptable to walk away from our commitments and when we choose not to we must continue to question WHY we continue to pay on all these upside down mortgages. Tor, the playing field is very unfair for millions of people who have done everything right.

Until all these upside homes come back prices are going no where but trendline down!

Hi Ray,

I think of you often when I’m doing stats. It’s amazing how different markets within King County can be. Seattle South of Downtown has been flat all year, but even there the bank owned property and short sale properties only moved the median price per square foot down by $1.00 in the 3rd quarter.

Run some stats instead of being alarmist and anecdotal…tell me what you see. What areas are you and your investors looking in…I’ll run some quick numbers on it. Tacoma? Pierce County?

I’m still working on other Eastside School Districts. I also want to pull out Seattle Downtown to 85th vs Seattle 85th and up.

Between you and Tim on Bubble I see more then enough stats. I hate to be an alarmist as well. I’m just one person with an opinion. Living here in the NW we will fare better then so many areas in the country. However, this will NOT stop further price deterioration.

I’m a student of the Capital Markets. I watch fund flows and look where the BIG PLAYERS are placing their bets. I’m far from alone in believing WFC will return to below 20.00 pps. When this occurs it will result directly from people walking away from their homes and huge spikes in short sales and foreclosures.

When the playing field is unfair for ALL participants people will leave the game. For us to believe people will stay in their homes over the next 3-8 years, while upside down 20-50%, is a prayer at best.

The FED has effectively softened the landing from a near collapse. That was their goal. However, we are left with millions of homes that will return to the banks in this coming decade.

When mainstream America finds out that investors/neighbors are getting free refi’s, and rates less then 5% fixed, for claiming hardship and not making payments for 6 months the boiling will be initiated. We are in a state of simmering now.

Furthermore when main-stream America realizes their neighbors stopped making payments on their Heloc 2nd’s (because they are upside down in their 1st) and the banks have nothing more they can do other then make settlements for 10-20% of the amount owed or wait for appreciation this will add heat to the fire.

Combine this rising taxes, unemployment, inflation, and so many other factors facing America it doesn’t matter if your in King County,Pierce County, or Douglas County (where I’m from).

Buyers/Sellers need to be educated and make their offers accordingly. The banks are still holding the deck of cards and continue to call the shots. Short Sales will become far more efficient in 2010-11. The banks will be forced to stream line the process due to the sheer enormity of homes.

Ardell, if the graphs and your research dictate we have hit a bottom then I’m wrong. I contend the bottom will encompass many years with further price declines. Sell into this rally home owners!

Ray,

I am a potential buyer in Eastside and I had a question for you.

“For us to believe people will stay in their homes over the next 3-8 years, while upside down 20-50%, is a prayer at best.” – While I agree that many people are under water, how many percentage of people do you think will encounter problems paying mortgage going forward?

Many of us bought houses from 2005 – 2008 but lot more people bought houses from 1990 ~ 2005.

I know better than to try to pick the bottom of the market and it’s hard for me to believe that home prices will drop to 2000-2003 levels. That’s why I am actively looking (involved in short sale at this time).

By the way, can anyone answer why Seattle is always lagging other markets (i.e. Calif)?

I also wonder if Seattle has only seen 20-25% price drop due to the quality of the mortgages.

Anyone’s inputs will be appreciated!

jobs jobs jobs…We have a very strong employment base here in the NW with the Ports, Fort Lewis, and Tech. We will not reach near the staggering declines of Nevada and Az.

“Sell into this rally home owners!”

Ray…it’s far from ” a rally”,and even if it were a rally, that rally is likely about over.

Ray – I think you’re underestimating the quality of people in this country. Just because you’re upside down in a house doesn’t mean you should hit the road and short-sell the bank. Telling anyone to “Sell Now” certainly doesn’t solve anything either, and believe it or not this market isn’t as volatile as one might think.

HOWEVER! The bottom line should be stated here… People shouldn’t treat their home like a commodity, rather a place to live, and somewhere they can stay for the long term. You shouldn’t buy a house because you want to double your investment, instead to start growing your roots.

-Tor

Housing is a commodity and that is the point.

People may buy babbling brooks and towering trees surrounded by a white picket fence, but the structure is attached to dirt that is a commodity. When people lose site of that we are all in trouble.

Ray’s in Nevada. Holy cow what a mess.

I’m going to tell a story because as long as Ray can ramble I guess I can get a free pass.

An investor client of mine has a friend we refer to as Brother Bob. Brother Bob lived across the street from his mom in Bellevue. He was selling his house there to buy a house in Henderson Nevada. My client flew my new wife and I down to Las Vegas for the week end so we could see Henderson. We met the Real Estate agent and I gotta tell you if we were new in town it would have been like spinning straw into gold. You could buy a place in the morning and sell it at sun down for a profit.

Never mind that employment is a little bit sketchy. Don’t ask about infrastructure or the two lane highway going in and out of the absolute middle of nowhere. When you ask about shopping you might as well consider Wal mart because those strip mall shops are long gone. At the time of the frenzy they opened up store fronts like nothing and today it’s all ghost town.

I love Las Vegas. I love the buffet, the shows, walking the strip, and casinos. I don’t gamble though and that’s exactly what I told Brother Bob. He bought the first house for $230K and the second for $260K. The same houses were $120K, OK maybe seven years before, maybe eight. The catch phrase of the industry at the time was that Real Estate doubles every seven to ten years.

Now Brother Bob’s Bellevue house sold twice in five years for a profit, but his two dream houses in Henderson were at $160K and $185K the last time I checked. In my opinion they are worth about the original $120K.

As far as the stats for short sales and REOs the going rate for a purchase in 2000 was about $150 per square foot and up to $225.

It looks to me like we have a long ways to go for a correction.

Here’s an article on homeowners bailing on underwater loans:

Strategic Defaults a Growing Problem

Tor, your missing the entire point. Your obviously not one of the Americans that are living in one of these upside down situations. Unless you are you shouldn’t throw stones.

Tor, we are a mobile society. We must move be it job, divorce, illness, or family situations. We are not the same generation as our parents.

“You shouldn’t buy a house because you want to double your investment, instead to start growing your roots.”—this is obvious, and America has learned this the hard way…However, you must understand the millions of people that are current holders of these underwater Mtg’s must sell at some point due to the above mentioned reasons. In addition millions will continue to walk because it is in the best interests of their family to do so. They will join the ranks of renters for a time and will again be homeowners down the road.

Tor, you obviously have not traveled and seen and touched what I have witnessed. Its always family first and the decisions that will continue to be made by millions of Americans may not fit your criteria of “quality of Americans” but let me reiterate we must not judge. We must understand the decisions families will make and not cast judgements.

Americans are NOT stupid. They are all coming back this decade Tor. I urge you to watch this video and understand why this is so.

http://www

I have been renting a house in the Issaquah Highlands for more than 2 years, I recently negotiated a $350 per month decrease in my rent. I am in a position to buy a house, but it simply is too risky and it is not a good investment. I have to agree with Ray Pepper on the future of housing. The Crisis is too big to sweep under the carpet and no real solution has been implemented. Home owners, of coarse, do not want to believe the reality of the situation. It’s a mess and it is unfortunate for all….

Ray,

Thanks for the link to the video. I bust up when the “sub prime” family came on. I’m sure others will be horribly offended (but not me!)

PatentGuy

yes the sub prime family is funny with the babies and smoking. I love it. I watched that video 5 times. I just love it. Its a great piece of work.

Yes, Ardell 10k. Makes me more happy then you will ever know. However, this is all on the back of the Fed Stimulus. Many call it “sacraficing tomorrow for today.” One glance at GOLD over 1000 tells volumes.

The story of the Greenspan Put and The Bernanke Bounce is still being written. I believe there are about 6 chapters left to the story as we enter the 3rd inning!

Ray,

The Dow hit 10,000…just sayin’ 🙂

Hi Ardell,

Back in 2007, you did an article on Seattle area appreciation tracking the prices of units in the Sixty-01 community. I’m curious to get an update on this since the bubble burst. What are current prices and how many sales have been happening and at what prices in this community. Thanks!!

http://raincityguide.com/2007/10/30/update-on-sixty-01-seattle-area-appreciation/

Curious,

I was there recently and a couple of times this year. I’ll get the stats for you but there were two things happening when I visited in 2009. One, there were more available rentals than usual and there were several for sale with no takers. One unit was on the market the longest had not rear exit. Usually there are sliding glass doors at the back of the townhome out to a raised deck or ground level deck. The one that was sitting on market the longest hand tall windows and no rear exit.

I’ll run the numbers and bring the info back here. My perception is that in this low volume period, 2 bedroom housing and 1 bedroom housing took a back seat to 3 plus bedrooms, since buyers were focusing on being able to stay for longer periods of time. But I will check my perception against the stats.

Curious,

Of particular note is a 2.25 bath townhome sold for $275,000 back in June that had a full remodel. Not sure how they reconfigured the baths to fit in a 3/4 bath on this unit which is generally known to have 1.5 baths. In one place in the photos it shows the 1.5 bath floorplan and then says “has to be remodeled to create 2 baths” from the one on the bedroom level. Seems it should say “has been” vs. “has to be”, since it is listed as a 2.25 bath. Can’t shed any light on that, but worth noting.

The highest price ever paid was in January of this year for a one floor unit that was remodeled that sold for $335,000. Not many places have highest price ever paid as a 2009 sale vs a 2007 sale. Of the 5 that sold for $300,000 or more, 3 were in 07, 1 in 08 and 1 in 09, again defying “peak” as being in 07 as to price.

In the $274,500 to $299,999 category there are 9 sold of which 5 were in 07, 3 in 08 and 1 in 09. Again showing the ability to achieve peak level pricing is there, moreso than in most any area or complex at this time.

Moving to sorting by recording date from most recent in descending order, there were 17 properties sold YTD in 2009 plus 7 pending. 9 of the 17 closed YTD had less than 2 bedrooms. There appear to be 17 townhomes for sale and the one that says “lowest price” seems to be the highest price 🙂 With almost two years worth of inventory on market, the competition is pushing on prices, so 2010 will likely be more of a down year than 2009 in this particular complex. Still, those with “real” remodels are beating the odds and peak pricing levels.

For the most part, pricing is running at 1.06 times 2009 assessed value and up, so let your assessed value (2009 not 2010 AV) guide you somewhat, coupled with interior improvements. Email me direct if you want more than that regarding 60-01. From what I’m seeing, prices are postioned to fall there over the next 6 months. With two high and two low sales there in the upper valued units, I think people running into appraisal issues, even if they can find a buyer at a high price, will be the problem with closings from here through Spring of 2010.

SC asks: “By the way, can anyone answer why Seattle is always lagging other markets (i.e. Calif)?

I also wonder if Seattle has only seen 20-25% price drop due to the quality of the mortgages.”

SC,

There were two layers nationally to the downswing. Seattle did not “lag” the Country. Seattle simply did not participate to the same degree in the upswing from 1998, and consequently on the first layer of the downswing.

Nationally, prices started their upswing in 1998 through 2005, a 7 year climb, with only the latter portion attributed to loose lending standards. Seattle’s upswing didn’t pick up steam until much later, and largely due to the loose lending standards. Most of the Country started down in 2005 before the mortgage meltdown, while Seattle was just picking up it’s largest phase of the upswing.

Beginning in July ALL markets subject to financing issues suffered somewhat equally, so markets already into the first layer of down had a double whammy result, while Seattle did not. That is why you see much of the Country back to 2003 pricing (having started down in 2005) but Seattle down to 2005 pricing by most accounts.

You mention Eastside, so I caution that the areas with more homes in the jumbo loan arena will continue to suffer for a long period of time. It is important to track not only volume of current inventory…but the price range of that inventory. Those areas with inventory that is top heavy as to price, will experience a future cram down as the market tries to absorb those homes without enough buyers able to afford the price tags.

Buyers dealing in the conforming loan price tier have less to fear regarding future pricing, than those dealing in prices near or past a million dollars where supply and demand will be out of sync for years to come. In the conforming loan price tier, buyers purchasing in areas with considerable new housing from 2005 to present will also experience above average price declines.

As you note: “Many of us bought houses from 2005 – 2008 but lot more people bought houses from 1990 ~ 2005.” Stability of an entire area will depend on the % of people who bought prior to 2005. So if you are looking at an area where most of the housing was built since 2005, the long term outlook for pricing will be more down. The financial health of the area will depend on the % of people who bought and or refinanced during the loose lending years.

So no…”quality of mortgages” is not the reason…degree of upswing from 1998 to 2003 is the reason.

ARDELL,

Thanks for your reply.

“Stability of an entire area will depend on the % of people who bought prior to 2005. So if you are looking at an area where most of the housing was built since 2005, the long term outlook for pricing will be more down. The financial health of the area will depend on the % of people who bought and or refinanced during the loose lending years. -> VERY GOOD POINT.

I also agree with you that Banks are leading people to believe that their inventory of distressed properties offer deep discount but from my experience, that has NOT been the case.

Most of the times, I found that regular MLS listings seem to be more attractive than REO/Foreclosures.

As a potential buyer on the eastside, this is bad news for me but I still want to stick to my guideline which is “I will only buy a house if it’s priced at 2003 level” Whether or not that will become a reality remains to be seen =P

Any comments will be appreciated!!!

SC…depends on your price range, so can you give me a range on that? Also, hard to pinpoint a 2003 price point, if you are only looking at property built since 2004…so age of property has some bearing. I have seen some 2003 price point solds on the Eastside, but they were not newer homes, unless those homes were very high priced homes.

For instance if you are looking at price of $500,000 or less and age of home as 2005 or newer…single famiy not a townhome…the odds are less than older home or a $1.8 million home.

Ardell,

Im looking for a SFR, $500K range (98004,98005, bridle trails) that were built in the 50-60s but remodeled.

The odds seem to be against me at this point but we’ll see what happens 🙂

Did you see the one that came back on market about 5 days ago? That one should close at 2003 prices. I can’t post the address, but email me if you can’t find it. If they would allow a subdivision of lot on that one, it would work or better for all.

People usually say that short sale is a great way to escape foreclosure… Maybe this is a reason for a price up?

Wow, that’s certainly counterintuitive to what I would assume short sales and foreclosures would do to a local market. Make me want to run the numbers here in Kansas City too.

I don’t expect this trend to continue in the 4th quarter, especially if the homebuyer credit is not extended or renewed.

In some areas, like Bellevue, the best deals are pulling up the median price per square foot of the area, even though the individual home is selling at a bargain price. That is because supply and demand is causing the highest priced homes to be in more trouble, so many of the highest sales are distressed property sales.

In other areas like Lower North Seattle, there are so few bank owned properties, that they tend to sell at or over market value, particularly when there are multiple offers. That area also has the lowest supply and highest demand in King County.

So it is still and clearly a Supply and Demand driven market.