NOTE: This is just my interpretation of the new GFE and I am only a mortgage originator and blogger. This post is just based on my opinion. Please check with your compliance department at your mortgage company to learn about the GFE requirements.

In a matter of days, all residential mortgage originators (we’re actually referred to as MLO’s now: Mortgage Loan Originator) will have to adapt HUD’s new Good Faith Estimate…warts and all. I promised Ardell that I would show her a comparison between the old and new GFE. I won’t be covering everything line by line on HUD’s new page Good Faith Estimate–I’ve done that all ready…so some parts of this three page extravaganza may be missing from this post.

Page 1

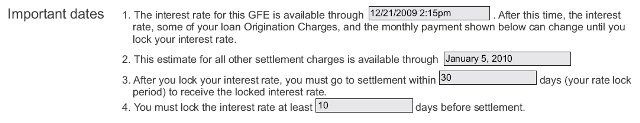

Important Dates (click on image to for better viewing)

This is a new feature to the good faith estimate. GFE’s now have an expiration date if not acted upon by the borrower and certain costs are guaranteed for specific time periods. Sounds great–EXCEPT I think you’ll find many MLO’s not willing to prepare a good faith estimate to the average “rate shopper” since HUD has spelled out that IF a good faith estimate is provided, it’s presumed that the mortgage originator has enough information to have a complete loan application.

In addition, line two states that MLO’s are held accountable for the third party closing costs they are using in their quote for 10 business days. So if I rely on an escrow rate sheet from Tim’s company, and they happen to adjust upward during those 1o business days and the consumer decides to proceed with the rate quote, I could potentially be on the hook for the difference. In reality, there is no way for a MLO to guarantee a third party fee unless they are willing to “eat the difference”.

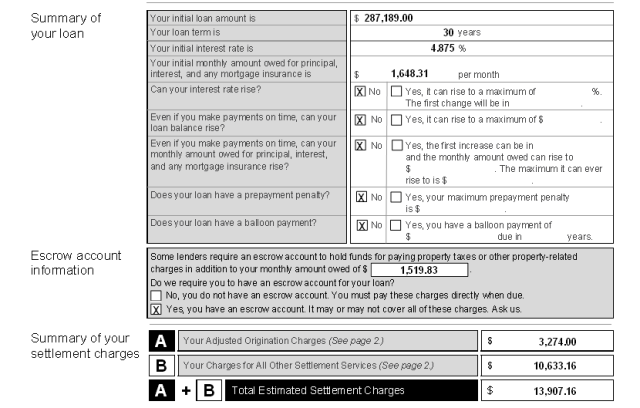

Summary of your loan (click on image to for better viewing)

This section gives you the basics of your loan. For this estimate, I’m using an FHA loan and as I mentioned in my previous post, some of the details may be wrong. For example, this references “initial loan amount”…as I write this post, I’m not 100% sure if this should be your base loan amount with an FHA loan or total loan amount (base plus the upfront mortgage insurance which may or may not be financed–perhaps that’s the fine detail: whether or not the borrower finances the FHA upfront mortgage insurance)…I’ve checked HUD’s FAQ’s (all 51 pages based on the latest update last month) and cannot see where this is addressed… anyhow… I went with base loan amount since other closing costs (such as origination fee) are factored off that figure.

Everything is pretty self explanitory…my issue with this section is the fourth line down:

“Your monthly mortgage amount owed for principal, interest, and any mortgage insurance is: $1648.31”

This payment does not include taxes or insurance. On the old/existing GFE, my clients actually see a total payment (PITI) of $2008.21. PITI is gone on the new Good Faith Estimate…I don’t who’s bright idea at HUD this was…now we have PIMI: principal + interest + mortgage insurance even though the borrower still makes the PITI payment.

Even the next section, escrow account information, restates the “PIMI” where the GFE could have at least stated what the estimated escrow payment (real estate taxes insurance) would be so that consumers could add these two figures together to come to their actual mortgage payment…but no…that might make a bit of sense.

The bottom of page one refers to closing costs that are shown on page 2…which I will address on the next post.

This new GFE is a sick joke. All it does is prove that the people in charge of making rules and regulating mortgages don’t know jack squat about mortgage lending. Who other than government thinks going from a one page document to a three page document is an improvement?

What is even more telling is that the mortgage industry doesn’t even understand this abomination, so how are consumers? No PITI? No cash to close? wtf?

I hope the new GFE isn’t a precursor to how our government is going to run our healthcare. Doh…

No place for seller contributions… it is a sick mess. Created to give the borrower a uniform document yet mortgage originators are discouraged from providing it for rate shopping. This document will create a bigger mess for HUD than what it had before. The unintended concequences are going to be huge.

I have seen a few wholesalers saying that pre-approvals cannot be issued without a property address now because I believe the property address is now required on the new GFE. This basically means that we are going back to old school where Realtors and consumers will have NO CLUE if they are going to qualify for financing until that contract is written.

I think what is going to happen is that lenders are going to have to use an unofficial form until everything is set in stone and then they will issue the GFE on the HUD form that can’t change.

If you issue a good faith estimate, it is PRESUMED (HUDs words from the FAQ) that you have the “6 points of information” that now creates a loan application (which triggers compliance docs)

I know, which means that lenders are going to issue everything a “gfe”. I know I ain’t gonna commit to squat until I have every single piece of information from all parties involved.

RESPA reform is very one-sided against mortgage originators.

It’s kind of an odd feeling whenever I prepare a GFE for a “rate shopper” or non-committed client right now because I know in just a matter of days, I cannot do that anymore without liability.

HUDs new GFE is really harms the consumer.

Rhonda,

These problems are so much bigger than just what people see on the paper of the GFE. The rules related to the new GFE are crazy.

Wholesale lender fees are included in the origination section which CANNOT increase. Circumstances that allow a change do NOT include changing a wholesale lender! I mostly bank my loans, but this is ridiculous.

I think this will really hurt mortgage brokers. They will either need to overstate wholesale costs, which are now considered part of their origination fee–and in that case, the borrower may not select them. Or the mortgage broker will be eating a lot of fees.

Some folks may say big deal (non mortgage people who don’t understand the nitty-gritty)…but whenever competition is eliminated, it hurts the consumer with higher rates/fees.

The banks are for this, I think… it works in their favor and they will use this to steer to their title and escrow companies (imo).

Brokers are TOAST. The fact that they have to show the YSP as an origination charge alone is going to steer away a lot of consumers even if the broker’s deal is better as most consumers aren’t going to know what they are looking at and will probably just completely miss that huge credit that eliminates the YSP. Talk about confusing.

Heck, I just lost a deal because the borrower thought my 5.25% rate with $1000 in fees was worse than a 5% rate with $4000 in fees on a $160k loan even after I explained that it was going to take 10.5 years to recoup that $3k in extra fees considering the rate differential was only $24/month.

You don’t make something already complicated, more complicated. In general, the public isn’t that savvy about real estate transactions and throwing more fine print, forms, and disclosures just makes it that much more confusing.

Absolutely this is set up in the banks favor. No one is promising anything at this point.

This is as good of a place for this comment as any. I was talking with a young professional woman in Charlotte North Carolina yesterday afternoon. She as a lease option on a condo she “loves” for $350K.

I was shocked by the price. It seems really high to me. Maybe, maybe, $225K, maybe, is what I would guess the price was, but $350K is really out there.

So we also talked about the amentities like the garden and the pool which are included in the Home Owners Association dues, so those really don’t add a value, that should be a discussion for another time.

To bottom line it, her condo pricing may not appraise for the purchase price. She knows that. She will need to find out, or the owner will need to find out, how a deal can be structured.

As a condo project goes 10 people could decide, in any day, or week, to send their condos back to the bank. A person can lose a job. Interest rates will go up one day by a point, or two, in a day.

This Good Faith Estimate doesn’t mean anything. Mortgage people will be paid less, and less, and fewer, and fewer people will be interested in generating loans. Banks will have to take over loan generation and float the costs over a broader income base.

The biggest mistake that mortgage brokers made was being too successful. Banks were stunned at the amount of marketshare they captured and now they’re doing their best to eliminate their competition…and they will with the help of our government.

It will be interesting to see if banks leave correspondent lenders (like Mortgage Master) alone or if they’ll sufficate us too. The big difference between correspondents and brokers is that we do have more skin in the game and in order to survive, correspondents will have to increase their net worth. FHA is raising the minimum requirement networth from $250k to $1mill and eventually 2.5 million in 3 years.

Yup. Banks got into wholesale thinking it would be a way to generate a little extra on the side. Little did they know that brokers would basically steal market share from them and grow like kudzu because brokers were so focused on keeping cost low. However, the brokers failure to police their ranks made it easy to make them the scapegoat.

With that said, greed is in fact good and it will be greed that will ultimately probably help the broker survive as long as the regulations don’t get too stifling. The banks are going to figure out that brokers still originate more efficiently than retail and in their quest for more money, they are probably going to get back into wholesale at some point.

I think what we get in this business is some pimple faced MBA says, “Hey, lets cut out the brokers… ” so the banks attempt to do it. Then another pimple faced MBA figures out “Hey, brokers make us money, lets do wholesale…” It is cyclical…

Pingback: Today’s Top 10 real estate posts of the day for 12/23/2009 : Tempe real estate and free home search

It looks like we are going to a “worksheet” that we can provide to borrowers that shows cash to close, Piti, and etc. completely non-binding and full of disclaimers. Also, our company is concerned enough about being bound to the official GFE that they are taking that out of the originators hands. It is a mess and I think it has huge unintended consequences for the consumer. Harder to shop, and harder to get….True brokers take the brunt of it though. I think they are very nearly being legislated out of business…

Our company is creating a form to show clients the itemized cost, total monthly mortgage payment and funds needed for closing too. As mortgage professionals and as a potential home buyer trying to make an informed decision, we need some sort of documentation to show various scenarios so that consumers can make an informed choice on their mortgage program. If we use the new GFE, it’s binding for 10 business days (third party costs).

Our GFE’s at our company will be prepared by the LO’s…and it was made loud and clear that if/when there’s a difference between the binding GFE and the HUD at escrow, it is the LO’s responsibility, not the proc’s or anyone elses. Our company is not taking the GFE’s out of our hands.

“The biggest mistake that mortgage brokers made was being too successful.” Whaaa? really? REALLY? The BIGGEST mistake?

Why on earth do we have this new GFE to begin with? “Because brokers were too successful” is NOT the first thing that comes to mind, after meeting literally thousands of Mortgage Broker LOs over the past decade.

I expect this response from you 😉

And I can tell you from consumers contacting me from across the country for help, after reviewing their GFE’s…mortgage bankers are not innocent either…hmmm WaMU, Countrywide, World Savings… no point in going on with that.

I firmly believe that if mortgage brokers had not captured so much market share and would have just hummed along adding bits to the greedy banks, you wouldn’t see folks like Jamie Dimon of Chase state that the biggest mistake they made was working with mortgage brokers. Really…banks created the programs, in the case of mortgage brokers–BANKS UNDERWRITE AND APPROVE THE TRANSACTIONS, PREPARE LOAN DOCS AND FUND THE LOANS. The fault of the mortgage broker was in originating the loan–that’s all they can do!

Mortgage broker originators have not been the main issue–it’s mortgage originators across the board regardless of the institution they work for.

Russ is right on with this statements. A lot of what’s going on is from the greed of the big banks…watch them gobble gobble more…they’re going to go after the escrow title biz next with this new GFE…and that industry doesn’t have the same lobby power as NAR to stop them.

Time will tell.

That’s a very NAMB.org party line response, Rhonda. Pointing the finger at banks because “all broker LOs do is originate” makes me sad to read.

Brokers, and NAMB itself could have done far, far more than what was done.

We have this new GFE for many reasons. Bank greed is oversimplifying a very complex problem.

The more 3rd party Mortgage Loan Originators continue to resist taking responsibility (as an entire group) the more federal laws and government forms will be put upon us.

As a side note, the two most important pieces of info that a consumer wants appear nowhere on the TIL disclosure form: The note rate and the loan amount. This is what happens when we let government tell us how to do our jobs.

Jillayne, are you saying that just because an originator works for a bank that they are deemed innocent and above taking advantage of a consumer?

I’m not giving a NAMB response–it’s my response and that’s all it is. I do not represent NAMB.

The form is flawed…it will be interesting to see if HUD will make corrections.

Interesting that Michael Brown says Originators won’t be completing this form. Wow. Talk about writing yourself out of a job. Why on earth would a consumer pay an originator a commission for not taking accountability for fees and for completing the GFE? That originator’s worth just went down several notches in my mind.

Jillayne, I’m hearing from mortgage bankers that they are being instructed to not complete the form until the borrower is commited and moving forward with the transaction… I’ve always stood by my fees but to be accountable for third party fees for a minimum of 10 business days is crazy.

Mortgage bankers and brokers are creating a separate form to use for “rate quotes”–this is what HUD wants us to do. It’s nuts.

“The fault of the mortgage broker was in originating the loan–that’s all they can do!”

Rhonda, remember the case study from class, Carnell v. KMC Funding? That LO brought forth this same defense when he was sued by the homeowner. Refresher for readers:

http://mortgagefiduciaries.com/2009/11/case-study-carnell-v-kmc/

3rd party LOs can do more than just originate. 3rd party LOs who are licensed under a broker owe the homeowner much more than just to originate.

Russ talks about brokers being squeezed out. The more an LO argues to limit his/her liability and duties to his/her client, the more the LO is arguing to be paid less.

You are right that LO’s will be paid less–Jillayne, if it’s a matter of misquoting or bait and switch–you’re damn right (and so is HUD) that the LO should step up. But when it’s being accountable for 3rd party fees IN THE FUTURE and not being able to provide an updated GFE unless there’s a qualified “changed circumstance”–I think that’s wrong. I actually like to provide updated estimates throughout the transaction, for example once I know who the title/escrow co’s are–can’t do that w/the new GFE…and since there is no place for funds needed to close on the GFE…guess it doesn’t matter anyhow (at least not in HUDs eyes).

Jillayne:

When did I argue that LOs should be limited in their liability? Brokers are being squeezed out but that has nothing to do with whether a broker acts as a fiduciary or not. I have long said that the brokerage industry took the rope and hung themselves with it. I have never argued against that position. However, I do understand that the elimination of the broker channel has NOTHING to do with protecting consumers. I don’t know of a single industry where consumers benefit from the elimination of competition.

The bottom line is that banks have not been able to compete effectively against brokers for a variety of reasons, so the only thing they can do is use legislation to tilt the playing field in their favor.

Brokers walked right into the trap and made themselves an easy scapegoat for the variety of reasons that you frequently mention. However, that does not change that this GFE and other regulations are designed to give banks an unfair advantage. Besides the brokers that are put out of business, the only other loser is the consumer.

OK, wait, you’re all off on some tangent that doesn’t sound good, but it’s not making sense.

There are two things: first the volitility of the market, and the second is shopping a loan.

I think I covered the volitility in my other comment, but loan shopping is pretty much dead. This is a save for an originator/sales person. Once you’re locked in that’s it. Banks would for sure like that.

My apologies: I have to do in-line comments. I have a very hard time going up and down trying to follow a conversation.

Rhonda,

“Jillayne, are you saying that just because an originator works for a bank that they are deemed innocent and above taking advantage of a consumer”

No, I am not saying that. I thought we were talking about mortgage brokers being squeezed out of the business and my comment was about mortgage brokers, not bank loan officers.

I frequently mention the two biggest predatory lender cases (settled out of court) were with companies licensed as a consumer loan company: Household Finance and Ameriquest. Wells Fargo has also had to face predatory lending charges and the stories we hear about Countrywide’s Full Spectrum Lending are horrifying.

All LOs no matter where they work must use the new GFE.

The form was designed with input from consumer groups, regulators, politicians, retail bankers, mortgage bankers, as well as brokers.

I’m not a fan of the inline comments either…I really liked the old style better (much like the GFE).

Yes, all LOs must deal with the new GFE…where it’s tough for true mortgage brokers is that the YSP issue. Plus from what I understand, if they have a GFE anticipating they’re going to use lender x with that lender’s cost and they use the GFE; then find out the borrower cannot go to that lender and they switch to lender y–if there is a difference in the “orgination fees” for the worse, the broker ate it. It does not qualify for a changed circumstance.

I’m not saying that banks created the form, I will say that banks are in our politicians pockets much deeper than NAMB could ever hope for.

Mortgage brokers gave their input to the form and it’s my understanding they were really trying to convince HUD to create a GFE that would correspond and appear very similar to the HUD1 Settlement Statement.

Imagine that–some congruency for the consumer.

Hi Russ,

How’s the weather in the midwest? “When did I argue that LOs should be limited in their liability?” Well I believe I was referring to Rhonda’s comment about how originators only originate and it’s the lenders who are more responsible for the outcome. If all LOs are doing is taking a loan app and they want no responsibility (i.e., liability) then the value of the LO will go down to that of a retail salesperson.

I don’t get the argument that the banks are behind this piece of legislation in order to get more business back from the brokers. If they want more retail business, all they have to do is to close up their wholesale lending divisions. Wait, they already did that throughout 2008 and 09.

The banks have to use this same form so I’m not so sure the banks have colluded to enact the new GFE form to get brokers out of the business.

Arguably, bank loan officers are in the same position as broker/consumer loan company LOs in having to guarantee 3rd party fees.

Banks aren’t in a very good financial position right now to just start opening up title and escrow companies in every county in the U.S.

Regarding the fear about third party fees, why not have a written agreement with your third party that if their fees go up after a GFE is presented, then the third party will eat the fee.

Any company is welcome to approach a third party with this idea. Bank, broker, Consumer loan company, credit union.

Third party companies have also seen their profits go down in 08 and 09. I bet they would love to have a chance at getting your business.

Call your third party provider before issuing the GFE and get a written quote from them and make it binding on them.

Jillayne, you might want to call a consumer loan company a consumer loan company/correspondent lender… I think it’s only in WA state are correspondent lenders called CLAs and it could be confusing for our readers outside of WA.

Its my understanding that some large banks are telling their MLO’s that they cannot refer to anyone but their arranged relationships (in house) title/escrow.

I honestly believe that this GFE will be the last straw for some LO’s combined with national licensing…and that’s fine with me. I’m sticking around even though I know I bark about this a lot… please keep in mind that my howling is really for the consumer–I don’t see how this benefits them one bit (with the exception of a uniform doc–but it’s a bad uniform doc and it’s creating “spin off” docs from banks, brokers and lenders which puts us back at square one).

Jillayne, here’s a scenario for you:

The borrower selects the title company which happens to be on your list of providers (maybe you recomended them; maybe the agent did but it’s the company on your list). After the GFE is issued, they decide to opt for an extended coverage owners policy.

Is the LO responsible for the difference in cost since (last time I heard) the title rate for extended coverage is 130% and we’re allowed 10% accumulative. Will I wind up paying for the difference over the 10% since I don’t believe this is a changed circumstance?

And another scenario all to common: the full spectrum of changes from underdisclosing fees to a borrower that changes their mind and cannot come to sign docs at your office after all. You think I’m going to pay to hire a Notary upwards amounting to 50% of our escrow fee to get the client signed? Wanna guess who will call on Title to eat fees? Um, you guessed it….agents and LO’s. (duck taping mouth to keep from uttering unmentionables).

The new GFE is going to absolutely cause problems, delay sale transactions, make locks expire due to MDIA and other issues. Going to be a train wreck. Talked with an independent today who is so fed up with the market, new GFE reg’s etc. …they have had it with the real estate industry and are closing. And no, it’s not amusing or cute to say “one less competitor.”

Tim, that’s how I feel… unsavory LO’s–you bet I want them gone…tru professionals–I want them around.

I know the FAQs state something along the lines of not being able to make escrow/title reduce fees… and local p&s agreements have a new addendum w/a built in extension for MDIA.

Everything is going to take longer with this poorly assembled document.

Maybe HUD had a bunch of people putting in their two cents but whoever was in charge of the final draft doesn’t have a clue about about real estate.

I feel badly for escrow having to deal with consumers who are going to take this GFE to signing with them (as HUD recommend in their 49 page “booklet”) and try comparing it their HUD1…it doesn’t make sense.

Can anyone answer this….Wells Fargo gave my cousin piti estimate…..first year of loan payments were as quoted….$995…..Wells F. just informed him that the tax amount was wrong and that he needs to make up for the difference for a year bringing his monthly now to over $1600….in a year it will drop to $1260….I really think this is wrong…..Like WF just wanted to get the loan closed and now my cousin is falling out…..borrowers rely on lender to get it right….they told him what payment would be and now…pow…….chadrealty@yahoo.com