Why did so many people buy houses they couldn’t afford? I’m not talking about people who bought 5 houses to “FLIP”, or the cash out refinance issues. I’m talking about the basic Buy A House to Live In IT bunch who never did a cash out refinance.

Well…on 2nd thought…let’s leave those cash out refinance people in, as this “study” may explain WHY so many NEEDED to do a cash out refinance, and use their home as an ATM machine.

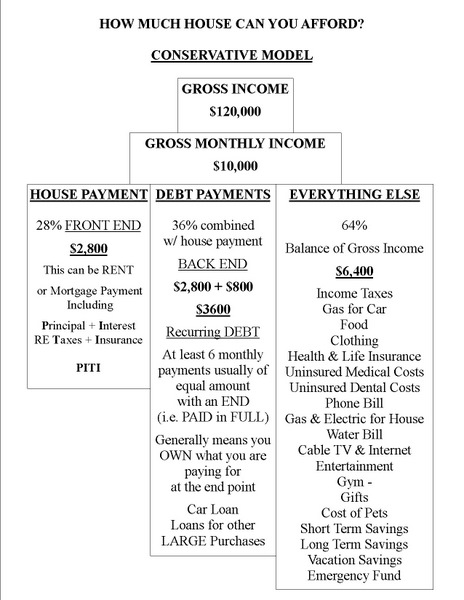

Let’s start with the basic MODEL and examine where everything started to go sideways.

Qualifying Ratios ONLY WORK well when THE MIDDLE COLUMN is in sync.

Now that the dust has settled and we are not looking for some ONE to BLAME, let’s look at the REALITY of what, exactly, is broken…so YOU can fix it. This is about you, as a buyer of a home, as you are the only one who can proceed on the RIGHT basis. No agent or lender can sort out that middle column for you. You must make the extra effort to QUALIFY YOURSELF!

Here’s what happened, in a nutshell. EVERYONE’S BACK END WAS OUT!!!

Used to be, looking at my Chart inserted in this post, that IF YOUR DEBT PAYMENTS caused your TOTAL of housing payment + Debt to exceed the “back end allowance”, your housing allowance was REDUCED accordingly.

EXAMPLE: Housing payment $2,800 (column one) Debt + Housing $4,000 (vs the allowable $3,600 in the Chart’s middle column) equalled a REDUCTION in allowable housing payment from $2,800 to $2,400. 28% of Gross Income was ONLY the allowable amount IF your housing payment plus monthly recurring debt payments did not exceed 36% on a combined basis.

If you do not understand this up to this point, PLEASE, PLEASE ask questions as you should NOT be buying a house if you do not understand this. If you are not capable of understanding the basic accounting framework of home buying and home ownership, then do not buy a house. It really is THAT simple.

The Middle Column went out of whack when people started using their Credit Cards for Column Three items. Before ATM cards, people did not do that. Credit was for buying a home and LARGE purchases and MONEY was for buying everything else. Front End + Back End assumed that no one would buy a carton of milk or a loaf of bread on a credit card. Front End and Back End assumed that no one would use a credit card to go to a movie theater.

That said, what YOU need to do is look at your Total Credit Card debt and separate the balance into “used for LARGE purchases” vs “used for column three expenses”.

The Lenders and the Real Estate Agents really can not do that for you. So what they DID (which proved to be disastrous) was EXPAND the back end ratio to include the usage of credit cards for column three expenses. This started when people LEASED cars vs buying them. Given you did not OWN the car at the end…this shifted the car payment from a column two expense to a column three expense.

Column Two is for large PURCHASES! Leasing a car is NOT a “purchase”. Seriously…that was the EVENT that created a huge disconnect for Qualifying Ratios, combined with people not making a distinction between when they were using a Credit Card vs an ATM card for minor purchases. Going to the movies is not a LARGE PURCHASE worthy of using a Credit Card vs a Debit Card.

There’s an old saying: “One Step Forward; Two Steps Back”. What I am suggesting here is that we have taken Two Steps Forward, and need to take One Step Back. Reconstruct your Credit Card debt to LARGE purchases only. Do not buy a house until your small purchases and living expenses of Column Three are NEVER “financed”.

If you NEED to buy your food with a credit card…you should not be buying a house. It’s THAT simple.

********

Column Three went out of whack for a number of reasons, mostly related to Column Two events as noted above. The MAIN Column Three disrupt, not associated with Column Two, is about EARMARKED savings.

Used to be people had a “Christmas Club” savings account and a “Vacation Club” savings account and an Emergency Fund Savings account that was never touched except for dire emergency (and then repaid BACK into the Emergency Fund), and a Short Term savings account for “luxury items” and a Long Term Savings Account for retirement.

Buying a boat was a “luxury item” vs a “Large Purchase”. “Large Purchase was a refrigerator, a washer and dryer, a bedroom set, etc. Things you needed long term, not things you WANTED long term. You saved for a Luxury Purchase – a large item that you WANTED and you charged a NEEDED large item to spread out the payments.

Two things largely contributed to the demise of Americans saving money and saving it in an earmarked way. One was the change from the standard 5% interest bearing passbook savings account. The other was the expansion of bank charges per account, that caused people to lump their savings into one account vs earmarking it by spreading it out among several designated purpose accounts. There was never a charge for a “christmas club” or a “vacation club”, and with 5% interest, people saved for those things vs charging those things.

A third thing that changed was the ability for a homeowner to convert their non-deductible charge card interest to deductible “mortgage” interest via a “cash out” refinance to “consolidate” debt. Seemed like a financially “smart” thing to do…until your house was “upside down” and you needed to do a short sale. Ask yourself how many short sales are done to “forgive” the car loan and the student loans that were combined into their Mortgage Amount? That is a frightening thought, and not about a HOUSING Crisis at all!

Is there any hope for a true FIX? The answer is likely HIGH INTEREST RATES are needed. When interest rates are high, people save more. When interest rates are high, people put the right amount of forethought into buying a home.

For that reason I have to say that keeping interest rates low and fixing the economy all at the same time is an oxymoron. I don’t want to see interest rates go to double digits, but until interest rates are back in the 7% to 8% range, I don’t see much hope for an overall “fix”. BUT, hopefully, if you “get” what I am saying here, you can at least fix it for YOU.

Also, an up front Tax Credit to REPLACE the Mortgage Interest Deduction would go a long way to preventing homeowners from creating an Umbrella Loan for their Car and Education and other non housing related debt, in order to qualify the interest paid as a “mortgage interest” deduction.

If you understand the chart above, and keep your “back end from falling out”, you will clearly be a Giant Step ahead of most of your Peers. It’s a NEW Decade. 2011 is the year of One Step Back to Sound Principals and reliable fundamentals. Good Luck with that. If you don’t understand any part of this, please ASK!

Happy New Year!

The 2009 Version of the “same” principals

Can you modify the ratios from those in the Chart?

Half the battle is “won” when you know WHEN you are STRETCHING, and by how much.

Ardell, great food for thought heading into the new year. As long as I’ve been in housing, using gross income as the litmus test for affordability leads to gross distortions of what truly is affordable.

In my view, the number one destructive wealth building purchase is financing a car(s). Serial refinancing and rolling closing costs during the bubble also created long term financial problems to serve short term “wants” (vacations, driveway toys, additional housing etc). I see loan applications from all over the country these days and it still amazes me how people that make a very healthy income have absurd Debt to Income ratios.

The true hope for a fix is for people to live within their means, pay cash for as much as possible, buy a home they can afford and pay it off. Until people really look at their year end mortgage statements and look at how much interest they paid to the lender will they realize how important it is to pay it off as soon as possible.

It may mean no vacations for a while or delaying something you’d really like but as Dave Ramsey says: “If you will live like no one else, later you can live like no one else.”

A- A lot of people- including us- started our way up

the house ladder when rates were truly low- 4.25%.

The difference between what you paid and what you

got on Savings was 2%- & that’s what made it work.

You are reminding me of a scene in the airport when I was going to L.A. to see my girls.

A baggage guy stopped dead in his tracks and yelled:

“If you want to retire someday, STOP taking so many damn VACATIONS!!!” 🙂

I like this post because it also answers the question, should the bank give you a loan mod or approve your short sale. To that end I have to disagree that Gross Income is a bad start point. I had someone call me the other day to ask me to do a short sale because her payments were 50% of her income. BUT she was voluntarily putting a HUGE chunk of her Gross Income into a 401k, and then expecting the bank to believe she couldn’t afford to make her mortgage payment.

Gross Income has ALWAYS been the start point, and I don’t see a need to change that. Clearly if people stayed at 28%/36% ratios, we would NOT have a Credit Crisis or Housing Depression.

Using Gross Income has not been the culprit. Lenders giving people a 49% and higher back end has been the problem.

Pingback: Why the Lender may “reduce” Your Gross Income | Rain City Guide

Ratios weren’t even a factor on many loans, such as stated or no income verified…which added to the situation where we find ourselves.

Reserves (available savings after closing) will wind up playing more of a roll in the future…in my opinion. Borrowers should be planning on “what if” I’m not able to work (health or termination) or “what if” the house needs an emergency repair. Too many buy using every last penny they have in savings as down payment without thinking about just how expensive owning a home may be.

Glad you brought this up, Rhonda. Reserve Requirements on a Jumbo Loan can be ENORMOUS! Way beyond anything even I would expect. Saw one recently where the reserve requirement was 10% of the loan amount. Yes…knowing what the lender will expect in reserve balances at closing is a very important point!

Too many real estate brokers do not understand debt-to-income ratios. This post is a breath of fresh air. 28/36….we can’t go back to 1985 today. If we did that, the entire housing market would collapse. So instead the government via Fannie Freddie and FHA, is slowly tightening ratios….but very slowly.

Jillayne,

Thanks for the comment.

Whether or not lenders “go back” to “that”, I think it is important for home buyers to know when they are or are not “stretching”. Most public lender “pre-qual” sites do still use 28/36 with an ability to “stretch”.

Anyone can say that they are willing to sacrifice more greatly by stretching. But too many are thinking that a 49% back end should leave them enough money to do “everything else”…when it does not. Hence the serial refinances. Best to start conservatively and then stretch as both needed AND wanted.

The right to know how high above 36% is very important to most families who never knew that 36 was and still is the “conservative” stance.

Ardell, one question that I always ask buyers is how much payment they would be comfortable making for their total mortgage payment (PITI)… often they would qualify for a much higher figure…but just because someone qualifies for a higher payment, doesn’t mean they should “go to the max”.

Rhonda made an important comment that impacts Column Two in the cart of this post.

I noted in Column Two that Recurring Debt is a debt for a large purchase with 6 months or more left prior to paid in full. IF you are using the 36% back end of the Conservative Ratios in that Graph, that is still OK and recommended by me.

BUT know that if you are maxing out your back end to what a lender will actually allow, Per Rhonda they recently have changed to include ALL debts with no allowance for “almost paid in full”.

I have two credit cards that I had not used in a year and decided to start using them for groceries and gas instead of cash and pay the balance off monthly. This was just to improve my credit score through timely payments. (I don’t have a bad credit score, just want it to be the best it can be)

Obviously a lender will see that minimum payment. Would I expect to see those minimum monthly payments affect my back-end? In theory you can stretch that small balance out over more than 6 months. Or would the history of paying off the balance allow the lender to ignore those minimum payments?

Dweezil,

The general criteria for a back end calculation is to use the required monthly payment. Not the outstanding balance and not the monthly payments you actually make. I have never seen an underwriter ignore a card with a balance and a minimum monthly payment due, quite the contrary. If you are riding high on ratios, they may impose a “what if” you maxed that card out? Same is true if you have no car loan. Some Underwriters will assume that even though you paid off the car you drive today, over the course of a 30 year mortgage, you will need a different car someday.

If you are applying for a mortgage with a 28% front end and 36% back end, that would not be a problem. But if your back end is at or above the Lender’s allowance (which is much higher than 28/36) The fact that you have available credit you can use the day after closing can sometimes be a factor.

In the total picture, if the underwriter is uncertain as to which way to go, approve or deny, seeing groceries on your credit card could influence that decision. But if you are buying a home well within your affordability, it would not matter at all. Also, these days, most loans go through an automated process and don’t kick into an actual person looking at your loan, unless it is a Jumbo Loan or your criteria causes your file to spit out of the automated process.

The Loan Process generally involves a total picture, so that the details are only used if you are “on the fence” as to the underwriter’s decision. No credit history at all can be an issue, so I understand what you are doing, but my advice would likely never be to buy groceries and gas on a credit card. Better to show you have available credit you don’t need than to use than to appear to need to use it for everyday needs.

What you are doing was more common before ATM cards. People used the credit card as a convenience and paid the balance off every month. But now that ATM cards can be used with the same convenience, using “credit” vs “debit” card usually means someone “has to” and has no available money.

Ardell,

Thank you for all the feedback. I will stop using the cards for the sole purpose of payment history as it seems like it will do more harm than good. It feels like the whole credit/loan business makes it impossible to guess what’s the ‘right’ thing to do for yourself.

Regarding having a card that you could max out after closing. It could also be seen as room for emergency expenses and an ability to weather any storms, so you’re kinda damned if you do and damned if you don’t.

Generally speaking Dweezil, you just do the right thing, and that is good enough. Buying your dinner on credit vs cash is not “the right thing” any way you slice it.

There’s an old quote: ““A banker is a fellow who lends you his umbrella when the sun is shining and wants it back the minute it begins to rain