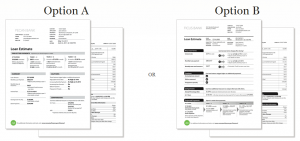

Consumers and industry professionals can vote on two options for the new Good Faith Estimate that was just released by the Consumer Finance Protection Bureau via their Know Before You Owe campaign.

Consumers and industry professionals can vote on two options for the new Good Faith Estimate that was just released by the Consumer Finance Protection Bureau via their Know Before You Owe campaign.

The CFPB is segregating the “vote” (perhaps “survey” is a better term) between consumers and professionals opinions on the two versions of the proposed mortgage disclosure.

I recommend printing the examples to really get a good look at them. They both appear to contain the same information, disclosed in different manners. For example, one features terms at the top of the page and the other has projected payments over 30 years at the top.

I’m noticing three improvements right off the bat over our current Good Faith Estimate (HUD’s attempt) which has been in effect since 2010:

- total mortgage payment: PITI vs PIMI. The new GFE will actually include proposed taxes and home owners insurance. HUDs 2010 GFE only discloses principle, interest and mortgage insurance (if any)

- funds for closing. Yes, it’s true…the proposed forms actually help borrowers know what funds they should be bringing in at closing. And it even factors…

- credits from lender or seller! The new form may want to just have this be “credits” since sometimes real estate agents contribute towards closing costs as well.

All three of these items have been sorely missed from HUD’s creation that we’ve been mandated to use since 2010.

Mind you, I’ve only had these forms in my hot little hands for about a half hour…it looks like they’re missing any place for rebate pricing (aka ysp as disclosed as a credit in Box 1, Line 2 of HUD’s GFE). This is a huge oversight in light of the Fed’s Rule on Loan Originator Compensation. I would also like to see a signature line added (this would eliminate documents that borrowers currently have to sign to state they have received the GFE).

And, if the CFPB is reading this post, I’d be a happy camper if they discontinued having the owners title policy (typically paid for by the seller in Washington state) being quoted on the GFE only to be credited back on the HUD. This has been confusing for our local consumers and mortgage originators should NOT be held liable for a cost that is not associated with their borrower. The owners title policy should be treated more like the excise tax: disclosed in areas when it is common practice the buyer pays that cost.

So what are you waiting for? Go check ’em out and let your opinion be known.

Rhonda, can you tell us (again) what the rules are regarding a Good Faith Estimate and a “worksheet”? Many lenders are sending worksheets, but doesn’t a “real” Good Faith Estimate have to be sent within x days of formal application for the loan?

What’s the official rule/law on this requirement for a GFE?

If a lender has all 6 points of information that HUD considers a loan application, the a LO MUST issue the GFE within 3 days. The 6 points of information are not what “most” would consider a “formal application”…it’s just data received by the LO triggers an application.

HUD recently came out with an update that states if a LO does not do this, it’s essentially considered as if they’ve issued a blank GFE and are liable for the costs/fees that exceed the tolerances. It’s ugly. I’m running out the door so I’ll respond more later.

From the last RESPA Roundup:

http://portal.hud.gov/hudportal/documents/huddoc?id=RESPARoundup-April2011.pdf

III. Loan originator fails to issue GFE

If a loan originator fails to deliver a GFE in clear violation of 24 CFR §

3500.7(a) and (b), the loan originator will have significant potential

tolerance violations at settlement. See RESPA § 3500.7(e).

Where the loan originator has not provided the consumer with a GFE,

when completing the HUD-1 comparison chart the loan originator’s

instructions to the settlement agent must indicate that the settlement

agent must fill in the GFE columns with $0 and the HUD-1 columns

with the actual charges from Page 2 of the HUD-1. If this results in one

or more tolerance violations, the loan originator may cure the tolerance

violation(s) by reimbursing the borrower the amount by which the

tolerance was exceeded at settlement or within 30 calendar days after

settlement.

As with other compliance areas, loan originators should adopt policies

and procedures to ensure that GFEs are delivered timely, in accordance

with the requirements of RESP

Thanks, Rhonda. How about locking the rate. If the rate is locked, shouldn’t the GFE be in hand by that time? Are the criteria the same for being able to lock as to the 6 points of info, or is that at the lender’s discretion.

Hi Ardell,

I’m back from my appointment 🙂

The Good Faith Estimate is reissued at the point of rate lock (this is a qualified “changed circumstance” which allows a GFE to be reissued) if one was previously issued. A LO has 3 days to issue a GFE after a bona fide “changed circumstance”. If no GFE was issued prior to the lock, then one is required at locking (3 business days to issue the GFE). It’s presumed that the LO has all the points required that create HUDs definition of a Good Faith Estimate.

Once a LO receives all of the following, the must issue the GFE within 3 biz days or they’re violating RESPA:

1) Borrowers name

2) Borrowers monthly income

3) Borrowers social security number to obtain credit

4) property address**

5) estimated value of the property

6) loan amount

7) any other information deemed necessary by the loan originator (this is vague and LO’s will get burned if they try to take advantage of this additional item. HUD originally started w/the first 6 items).

So if a borrower calls for a quote and provides all the info (1-6) above and allows their credit to be ran, the LO must provide the GFE withing 3 biz days whether it’s locked or not…and whether or not the borrower have decided on a loan program! Once those 3 days are up, the LO better issue or be out some bucks.

**LO’s do not want to issue a GFE if there is not a bona fide property address as HUD (in their infinite wisdom) will NOT allow the addition of an address as a “changed circumstance” meaning that the LO cannot issue an updated or correct GFE once a buyer finds a home (the LO is stuck liable with the cost the are above the tolerances allowed w/the GFE) –this is why the worksheets are being used with purchases until there’s an address.

I believe the cost to “cure” can no longer be paid by the LO and is paid for by the mortgage company (thanks to LO Comp)… but this is still very costly for the LO as the mortgage company is only going to pay for so many mi$takes before the fire that LO.

Here’s a related post on RCG about LO’s not issuing GFEs.

I understand that we have until May 27 to cast our vote/opinion on which disclosure document you prefer.

I think this is a step in the right direction and a bit surprised given Ms. Warren’s history. Nevertheless, I am all for simplification.

Instead of creating a new form, what we need is GFE that is basically a preliminary HUD-1. That way, all fees can be itemized and the consumer can see who is responsible for what fees. Then all they have to do is hold the LOs accountable like the new GFE rules.

This isn’t rocket science and I bet any group of three LOs sitting around could design a form that is simple to understand and works in an afternoon brain storming session.

The problem is these government agencies never ask real LOs who are actually on the street originating.

Russ, that would be such a no-brainer to have the GFE look like the HUD… I believe that NAMB really tried for that scenario but HUD thought everything needed to be “dumbed down” for consumers…which doesn’t say much for their opinion of the home buying public.

So a GFE that looks like a HUD is too confusing at the beginning of the process but the HUD works just fine at the closing? Freaking brilliant!

They literally could produce a Hud-1 without the seller side figures so they can use that space for explanations and it would be infinitely better than the stuff they keep coming up with…

I totally agree on the GFE replicating the HUD 1. In fact I have taken the GFE and turned it into a HUD 1 for my clients for many years. Getting my hands on the freakin’ GFE is the hardest part of that!

Many LO’s are not allowed or are strongly discouraged from issuing a GFE without having the 6 points of information (especially the property address) because of all the liabilty…it’s too bad HUD didn’t create a “pre-GFE” that a borrower could actually use for comparing the rates/fees of LOs. What we have now, due to regulations, prevents that. It will be interesting to see how the regulations change with the new forms.

Rhonda you give a lot of great information. I like seeing your posts. Thanks so much for what you do.

Thanks, Thach. One of the benefits of blogging is that it forces me to stay on top of everchanging underwriting guidelines. 🙂