King County Home prices in 2010 will have to escape two mega foreseeable dip factors, in order to keep in the 2005 – 2006 price range. Early last year I called bottom and the end of the downward spiral, when median home price for King County was at $362,700. The year ended at at a median price of $380,000, and early closings for 2010 are running at an unsustainable high of $196 mppsf.

What to watch for in 2010:

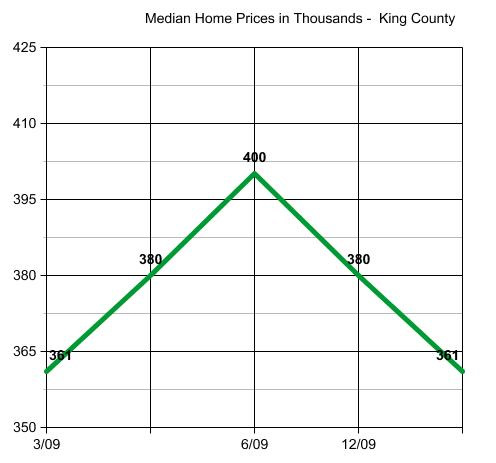

1) Prices should stay in the 5% this way or that range of $380,000. Expect a low of $361,000 to a high of $400,000. We reached that point in June of 2009 when it hit $399,000, and then backed off from there toward year end.

King County median home prices should stay within 5% of $380,000. If they move out of that range on the up or down side, it will be time to “take notice” of which way it is going out of the expected zone and why.

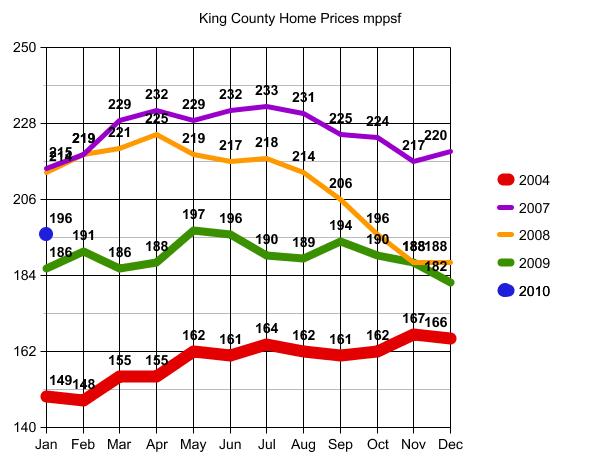

2) Even more important than staying in the 5% this way or that of $380,000 above, would be falling into 2004 price levels. Several times I have been quoted as saying that prices will maintain at 2005 levels, and so far that has been correct. We have a considerable cushion between current home prices and 2004 levels here in King County. For this graph I used median price per square foot, noting 2004 pricing as RED, the danger zone.

While I am still fairly confident that we will stay in 2005 – 2006 levels for the foreseeable future, I have a couple of concerns for 2010. The first, of course, is the end of the Tax Credit for Homebuyers. If we are high enough in that above $380,000 range as to median price by the time that happens, we should stay in the safe range when we take the post credit dip. If we trend down in the first quarter toward bottom, then the end of the credit will be a more worrisome event.

I am more concerned with how 2010 Assessed Values will impact home prices next year and beyond. While I agree that the County needed to back down those prices to cut back on the expensive appeal process, I see a dark cloud on the horizon. Many people have come to use County Assessed Values in some form or another when determining value and fair offer prices. The huge dip in Assessed Values from 2009 to 2010 could trigger a reaction from home buyers forcing prices into another downward spiral. We can only hope that people will look at Automated Valuation Models or “the comps”, instead of County Assessed Values. Dramatically reduced assessed values could have an unwarranted, unexpected and negative impact on home prices in the coming year. Only time will tell. That cloud may come and rain on us…or blow out to sea.

Barring a new event, look for home prices to be in the 2006 range for the strongest of neighborhoods and early 2005 range for the weakest of neighborhoods. Weakest being those with the most foreclosures and strongest being those with the least foreclosures.

East Home Prices by Style and Age of Home

North Seattle Townhome Prices by Zip Code

A Decade of Green Lake Home Prices and Sales Volume

(Required Disclosure – Stats are not compiled, verified or posted by The Northwest Multiple Listing Service)

Ardell-

You’re what’s called a “Chartist” in the Stock Market. It’s as good a way as any to forecast the future. J-

I think we’ll be between the purple and red lines for 5-7 years. Before my 20 years in real estate I was an Investment Officer and Banker for 20 years. But in those days it took hours to make charts with dot matrix and colored pens. They made a lot of noise, like a woodpecker. The chart was crafted by “computer” one colored dot at a time. I used to set it off and go to lunch. At least these days charts take less time to complete. Not the data necessarily, but the chart itself.

Interesting how 2007 and 2008 collide at the onset and 2008 and 2009 collide at the end. 2009 just bumps along “the bottom” like an inch worm.

Ardell-

I wondered where you got the ability to do these. I’ve done a few in my time and know what’s involved. J-

Good article.

While I do agree with you that home prices will NOT fluctuate too much, I would think that the tax credit expiration/increase number of short sales & foreclosures/mortgage rate increase/ high unemployment rate alone will outweigh the potential positives hence putting downward pressure.

That’s just my opinion.

But then again, Belleuve is HOT from what I am seeing.

If you don’t mind, could you summarize how you came to your “Bottom Calling” conclusion once again?

If you have a link, that’ will work too.

Finally, wouldn’t majority of average homeowners look to value his/her home via agent/market comp as opposed to a property assessment report from the city?

Renter in Bellevue,

Thank you. I’ll separate those issues in order to respond:

Tax Credit – From the activity I am seeing a lot of the push from the credit took place last year and much of the momentum moving into 2010 is not primarily from first time buyers. By ending the credit when the market is the strongest, we have a chance of detaching from it successfully. We will have a weak 4th quarter compared to 2009, but 4th quarters are supposed to be weaker. So if we see things fading in May, that will not be a bad sign. But if they fade in July or August…dare I say it…we would be back to a “normal” cycle.

Foreclosures and short sales – I wish there were more decent ones. I did a search of short sales and bank owned property in Kirkland, Bellevue and Redmond for clients recently, and could only find two under a million worth seeing. The high end is really starting to move on the short sales and bank owned homes. If we have more, I think the market will welcome them with open arms. Most of the market has moved down to the level of these “bargain” homes to the point where they don’t stand out as exceptional buys anymore except in the 1.2M plus market.

High Unemployment – Most of the homes I have seen selling short or turning into bank owned properties have not been the result of someone losing their job. As long as the stock market stays in good shape I think the broader economic factors are in control. If we see the stock market take a dive toward 9000, then I will be looking for the housing market to be impacted. New construction will continue to see very thin profit margins making builders think twice about buying land. But I see that as a positive giving more people the opportunity to buy tear downs and build houses without the extra layer of costs.

The weak market will linger…I don’t expect home prices to rise. I also don’t expect people will be willing to overpay for a home for quite sometime, so it is not a good time for sellers to be thinking they can jack up their prices anytime soon. It is still difficult to sell a house in this market if you don’t price it well and show it in the best possible condition.

As to Bellevue being “hot”, Kirkland, Redmond, Mercer Island and most anyplace where I find a good house priced well, my clients are not the only ones noticing. Houses that are positioned to sell are getting multiple offers, and it’s only January. But that could cool off once inventory expands.

My bottom call was February of last year. Kind of old news at this point. I’m just happy to have been right for this long 🙂 My guess is it won’t hold into 4th quarter 2010. I think the year will end with a slump.

As to Assessed Values there is a lot of confusion out there. Hardly a day passes that a buyer doesn’t refer to the 2010 assessed value. From now until July, I don’t think that will have an impact. But beyond that I am not so sure.

I appreciate the questions. Sorry to not elaborate on how I came to “the bottom call”. but it was a year and a half in the making. Part of it is following stats very closely for 18 months prior, but much of it has to do with what I see and hear out on the street. How buyers and sellers are handling themselves out in the market place. Buyers call the market, not agents or sellers. When buyers started jumping on certain prices…those prices become “bottom” by their actions. In the words of The Mentalist…I’m not clairvoyant…I’m just paying very close attention.

Many, many sellers are still not pricing their homes correctly. I hear some very odd rationalizations for unrealistic high prices every day. Sellers overpricing could stop the market dead in its tracks. Buyers are willing to buy a good value, but nothing will force them to overpay these days. They have the benefit of hindsight, and continue to be justifiably cautious.

Ardell,

Interesting stuff.

How does sales volume correlate to this? Hasn’t that fallen off the charts? I keep hearing about “shadow inventory” (a possible future banned word, like “shovel ready” from 2009) depressing prices.

What does the Seattle Swami predict for sales volume for 2010, relative to the past 5 years?

Roger,

As to prices, volume does not change my expectation from chart one as to median home price for King County being $360,000 to $400,000, for some time to come. Perhaps the first 3 quarters of 2010. Whether or not we will go below $360,000 in the 4th quarter depends on where we are in the third quarter as to pricing.

We had every possible scenario of volume in 2009. From very low in Jan and Feb…lowest, to abnormally high as to increase from there in the last quarter. So 2009 ran the potential gamut as to volume.

As to “relative to the past 5 years”, I don’t ever expect prices or volume to be what there were when anyone who could fog a mirror could get just about any mortgage they wanted. When I do volume expectations I go back to 2001 and 2002 levels. There is no reason why we shouldn’t rise to those levels, so the market has room to expand within reasonable expectations.

What I see as the potential holdup to home prices is lack of good inventory. I have a very difficult time finding a good house, realistically priced, for people who are more than ready, willing and able to buy a home. Prices will be influenced by quality vs. quantity of inventory. Generally speaking, January is always sad inventory, so let’s hope for the best on that. My fear is the good houses will come out too late if the homebuyer credit influences people only to April 30, and the good houses come out in May and June.

Shadow inventory is really not all that “invisible”. I am poking out shadow inventory for a client right now. It is not on market or in the stats or accessible by computer function in the normal way. I have to literally walk the streets like the old days before the mls. Spot the vacant houses, the ones half built and abandoned, and the age old identifier “tall grass”,etc… Shadow Inventory can be found and counted in small geographic zones, but it is only worth doing that for a specific client, and not on a broad scale to gather data for blog fodder.

The big news story will continue to be weak housing starts, because as I said earlier, profit margins for builders are thin. One day they may get used to thinner profit margin and proceed as usual. But most are wishing the days of 4X lot value would come back.

Much like the Lending Industry and Agent Population, many will simply leave to other fields, including builders who only got into the game when the game had abnormally high profit margins. There is still a lot of shake out as to industry professionals deciding “should I stay or should I go”. Until then there will be continuous whining that short lived, high on the hog “old days” aren’t coming back.

Anyone who thinks a “recovery” will be V shaped and swing back to peak pricing anytime soon, will be sorely disappointed. If the media keeps acting like we are in bad shape until and unless we get back there, or if sellers keep wanting to price near there, the recovery will be stalled as a result. This IS the recovery. There is no “second coming”.

Ardel,

I am being relocated from the midwest to Federal Way this year around this summer with my wife and 3 kids. I am looking for houses in the $250,000 – $350,000 that are the best value.

So my question is that what areas in King County have been hit the hardest by the housing bubble burst and what would be the optimal timing to buy a house this hear for minimum price?

I am coming out in May and I am thinking that even though my $6500 credit goes away, I think that there will be a drop in housing that will be more than $6500. I follow the graphs at altosresearch.com and I see a big dip when people though that the credit might go away. I was thinking if the credit really goes away this time, the dip could be larger.

Dean,

You should have no problem at all being close to work in that price range.

To answer your questions literally.

“what areas in King County have been hit the hardest by the housing bubble burst”

Not really relative to your home search issues. The areas hit the hardest by the bubble bursting were the ones with the biggest air bubble, and where financing didn’t simply convert from subprime to FHA, but from subprime to – OMG…we have no replacement product for most people to buy them at all. That being high end. That particular bursting bubble did not bring things into your price range. For the most part, in your price range, the shift went from subprime to FHA without skipping much of a beat.

That being said, there are good options in your price range…but for a different reason. let me answer your other question first.

“I think that there will be a drop in housing that will be more than $6500.”

Yes for houses in the higher price ranges for sure, as the $6,500 is a constant. A $650,000 house coming down 5% saves $32,500 vs. a $6,500 credit. A $250,000 house may come down 5% also, but that’s $12,500 with the same $6,500 credit. FHA (assuming you don’t have 20% down) is increasing the up front MIP from 1.5% to 2.25% on or around April 7, which adds $1,875 to the cost; So you lose $6,500 plus $1,875 for not buying before those changes. You lose $8,375 vs. gaining “up to” $12,500, and that price dip is not likely going to happen the week after the credit expires.

IF the market goes down 5% IF the credit expires, and I think both of those things will happen, it won’t be instantaneous. If you are coming in May and need to be in a house by June or July…not likely the market will play in fast forward that way. The market will likely hit bottom (where it was in March of 2009) by August – September, and then go down below “bottom” in the 4th Quarter.

Now for the good news, Federal Way is one of the hardest hit areas of King County generally. Not because of the rise and fall of bubbles, but because of the concentration of short sales and foreclosures. Much like North Bothell, if you can find a new housing development where the builder went belly up after selling 70% or less of the product, you can get a super deal. You will have “issues” for sure, but it’s a good time to buy those. People who bought in 2 years ago are underwater, the empty lots may stay empty for a few years, but the few completed houses are selling at a bargain from the bank who got handed 90% complete homes when the builder filed for bankruptcy.

I just did a quick search and 35 new and almost new homes within 5 miles of Federal Way (mostly Federal Way, Pacific and Auburn) sold under $350,000 in the last six months and the median price was $275,000. I used a minimum of 3 bedrooms and 1,700 sf and a few were almost 2,500 sf and 4 bedrooms.

If you are going “to be here” in May, and you are buying FHA, I would suggest buying one of those before the MIP goes up to 2.25% and during the $6,500 credit timeframe.

I just checked the Active/For Sale listings, and there are 36 on market right now. Many if not most are new construction presale, so take a trip soon if you want the home to be ready by May-June. I don’t work that area, so can’t be more specific than that, or tell you much about the builder’s rep etc. I don’t even know where “Pacific” and “Algona” are 🙂 but apparently within 5 miles of Federal Way.

If you are starting your new job in May…I’d say don’t miss the credit OR wait for the FHA MIP increase. My $.02

Hi, I was reading your answers and comments about the house market in Seattle, King county area. As of yesterday (4-30) evening, I sign the paper in getting a house in Wallingford, around the intersection of Interlake N and 45th NE St, 1120 sq ft, built in 2000. The listing price was 385,000. Since it was the first date on the market and I really would like to take the advantage of $8000 credit, my first offer of $377,000 wasn’t able to go as low as I had wished, which was $365.000. Sadly, the seller countered it and gave me a $380,000 in return. My agent told me that if I counter back with a lower price, it would definitely insult the buyer. In addition, my friends who went to see the townhome with me all believe that $ 380,000 is already a good value. As a result, I accepted that price, $380,000. However, as I read more information later, I realized that the assessed value of the house is around $320,000. Do you think I can still get a better price on a similar unit (i.e. a townhouse built prior to 2000, within 1.5 radius of the campus of University of Washington) if I wait till Aug or Sept, the later part of the 4th quarter? Do I still have the chance to withdraw the offer without penalty? From what I know, the buyer can retract the offer without penalty within 72 hours after she signs the offer/contract. Is that a correct information?

Town homes are a problem.

It has been my opinion that yes prices will soften below the tax credit level, and that the tax credit is the only thing propping up pricing, other than interest rates. Wallingford is another great area for rental property. If I were looking at a town home for $380, I would probably look at a duplex, triplex, or boarding house for a little more money.

Lee asked: “Do I still have the chance to withdraw the offer without penalty? From what I know, the buyer can retract the offer without penalty within 72 hours after she signs the offer/contract. Is that a correct information?”

There is no such 72 hour right. Do you have an inspection contingency?

The comps in that area are more expensive and built in 2005 for the most part. I’m wondering if that kitchen was remodeled after it was built. Do you know?

My best guess is it will appraise at that price. It’s a nice looking place. Not big square footage-wise, but 3 bedrooms 3.5 baths vs the new ones with only 2 bedrooms and 2.5 baths selling for a lot more than $380,000. It doesn’t have the “dated” look that others built in the 1990’s might have.

While it was built in 2000…I think it’s only been lived in since April of 2001. I don’t see anything selling anywhere near that low around there. If you offered $377,000 and went up $3,000…you lose the $8,000 credit if you buy something else…so sounds like you are $5,000 ahead…no?

Thank you all for replying to my questions!

Yes, Ardell, the seller lowered $5,000 (my first offer of $377,000 was $8000 less than the listing price), and one of the reasons that I didn’t counter back with another deal lower than $380,000 was because of the house being on the market only for the first day and 4/30 was the last day I could get the tax credit. In other words, I was really looking fwd to getting the tax credit and preventing the possibility of insulting the seller.

About the kitchen, I don’t know whether it was remodeled, but it looks pretty decent, with granite top, gas stove, and wood cabinets. Overall, the house is pretty nice and clean. The best thing about it is that it’s pretty close to Greenlake and Woodland Park. Yes. The owner lived there starting in 2001. You mentioned that you have not seen houses with this low price around that corner. I guess that is probably true. Another unit next to it, which is about 150 sqft bigger, is asking for 449K. Possible reasons of my unit offering prices could be that it is in the middle of the three units, the owner needs to sell it asap, or the owner got it with a lower price in 2000.

My other concerns about this unit-

1. It has smaller total sq ft, which means each room is relatively smaller too. Generally, a bigger house would might be more marketable if I am going to sell it in the future, right?

2. There’s a room that is only half above the ground, i.e. the basement connected to the garage. Will this be having humidity/damp problems, or higher flooding possibility? BTW, the house is facing north. Does this mean that it will get less sunshine?

3. You mentioned about the 4th quarter dip of 2010, the possible effects after the tax credit’s over. How likely is this going to happen to the houses in this area? Or, the houses within 1.5 mile radius of UW? In other words, I am wondering whether I should wait until this Sept or later, which there might be a 5% dip in the price (particularly with townhouses). But does that mean that I also have less good choices?

4. I was specifically told that there’s a 72-hour right to retract my contract without penalty. In other words, I will not go into the trouble of inspection, the earnest $ will not be taken/forfeited if I sign to say to give up the whole deal in that time frame. However, you are sure that there’s no such regulation?

Hope any of you can share your expertise and knowledge regarding to those questions. I will check this post frequently.

David, you are suggesting that other housing choices (rather than townhomes) would be a better investment. Yes. I do look into the possibility of renting out one of the rooms, but probably not more than that. Gardening is not my thing, due to frequent travel and little leisure time. These are the most significant reasons why I am looking into townhomes. Can you suggesting other house choices that require little gardening? (BTW, I am considering condos because of it HODs.)

In the State of Washington you do have the 72 hr right of rescission.

Town homes were permitted as affordable housing units. There is little land ownership without the benefit of a Home Owners Association. Town Homes, in my opinion will become less desirable than well priced condos that have strong Home Owner Association financials. In that area there are some concrete and steel small condo building conversions.

The thing about the University is interesting because that proximity has it’s own value. These town homes may do well. What I don’t see is appreciation from current values.

My buddy was going to sell a boarding house off of Latona and the comps came in at $425K. I encouraged him to keep it because he owns it free and clear. I’m just saying that those comps came in from 4 different Real Estate agents so there must be something to the numbers. It’s a house, big lot, and rents for $2400 per month. he maintains it well and his rents are notoriously cheap.

Sorry. There was a typo. Correction- “I am NOT considering condos because of their HODs.” Yea. With the crazy rental business around the U, it definitely makes more sense to keep the property than selling it. That explains why most of the houses around the U look so ancient and there are very little townhomes.

I think condo is definitely a good idea for retired and rich people, who can simply pay $ and get the association work things out for them. Most of the dues per month is about $500 and above. For me, that is like another replacement of my monthly rent, except giving it a different name. To end my rental life and prevent the gardening work, I decide that townhomes might be more suitable.

So, the 72 hours rule doesn’t apply to home buyers, who need to have a contract rescission?

There is no “contract” rescission. It is a right to cancel on the Form 17. If you do not word your request correctly you could lose your Earnest Money. So be very careful. Know what your right is and isn’t, so you can do it correctly IF you do it. Your agent should know how to do it correctly.

If someone wants to buy a house, you don’t tell them to buy an airplane 🙂

What a sense of humor, Ardell! But I suspect buying an airplane is easier than a house… there’s less gray area in that, right? So, I did sign Form 17, but not the Waiver’s section on page 5. I think that should be right. In terms of the earnest $, I will have to double check on that. Thanks so much for the information again!

David said: “In the State of Washington you do have the 72 hr right of rescission.”‘

David,

There is a 72 hour right of rescission after you sign off on refinancing a home. Not when you are buying a home. Where did you get the idea that there was a 72 hour right of rescission in a purchase and sale agreement to purchase a home?

Lee,

I asked Craig Blackmon to chime in here when he gets a minute regarding David’s claim that there is a 72 hour right of rescission of a purchase and sale agreement in a home purchase.

…I just realized David is talking about the right to cancel on the Form 17. I’m in the middle of two transactions that are exempt from Form 17s…so for those reading this, there is no “72 hour right of rescission” in any purchase agreement, and if there is no Form 17 requirement, there is no right to cancel on the Form 17.

For Lee, look at page 5 of your Form 17 and make sure you did not sign on the line that waives that right, at the time you signed it.

No, I didn’t sign on that one.

Lee,

You need to speak with your agent ASAP about your rights as to the Form 17 Seller Disclosure Statement. Possibly an attorney as well.

Oh for heaven sakes, the 3 day right of rescission is a muddled mess of RCWs. You’re referring to the right of Disclosure, which is of course valid. You also have the neighborhood review, for heaven sakes. Let’s be really clear that the RCWs are referring to “negotiated” contracts involving attorneys or agents. A Purchase and Sale is hardly negotiated any more, we are really in a time share contract contrivance of sales.

This is very much of a concern, that some one would come onto a blog looking for advice about a Real Estate purchase based on the $8000 tax credit that was drafted at the last minute.

There’s no contract here, no meeting of the minds. This person is asking about the value of a town home in Seattle. The value of a town home in Seattle is yet to be determined, but for sure it is extremely suspect. There are no Home Owners Association with town homes. There may be maintenance agreements, but they would have to be enforceable. In other words, in five to ten years you could have the most pristine unit in a set of buildings that are falling apart.

This is exactly why Purchase and Sale Agreements are written with so many outs. The buyer was influenced by an outside inducement. I’m not sorry that I would scream stop, get out, rethink, get your money back, and start over. At best this is a law suit waiting to happen.

David — your legal analysis is always interesting. For example: ” RCWs are referring to “negotiated

Exactly.

David,

My concern is that your misinformation is going to cause that person (Lee) to her lose their Earnest Money.

Neighborhood Review is not an automatic clause. She may not have elected a neighborhood review in her offer and/or the seller could have countered it out.

I am concerned that any information leading her to think she should have bought something else could be deemed as contract interference.

I am concerned that if she thinks she has a blanket right to rescind on ANY basis within the first 72 hours, as you stated and which is not true, that if she does have a legal out in her contract (and neither of us know what her contract says) that she will not use the correct legal terminology of a legal out when asking to cancel, causing the loss of her Earnest Money.

I understand there are many people in the Seattle Area (unlike many other major cities) who view attached single family homes as a problem. I am not one of them. I grew up in an attached single family home from the time I was 3 until I was 19 or so when my Dad died. Attached single family homes called row homes or townhomes are VERY common outside of Seattle.

My sister tells me the reason we don’t see old ones here is because of a big fire in the early 1900s. The one I grew up in in Philly was made of brick. In DC they are often “Brownstones”, but the opinion that they are odd and problematic is primarily a “local” viewpoint. In the rest of the world, not everyone’s single family home is detached, especially in major cities.

If you think everyone who bought a house last week has a huge legal out because they were acting in a manner to insure they would be eligible for the tax credit, if you think all of those people have some automatic legal out without losing their Earnest Money…you are clearly incorrect.

Neither of us knows how many days ago she received the Form 17 and if that right to cancel on the Form 17 or not is currently valid. She needs to speak with her agent and/or an attorney IF…and that’s big IF…she wants to rethink her decision about buying this townhome. She automatically loses $8,000 if she turns around and buys something else in the near future.

Lee,

I do not agree with David that condos are better than townhomes in Seattle. With townhomes that are single family, you are responsible for your home. Condos make you responsible for everyone else’s home. Huge difference. It is much easier to maintain your own home well, than to convince all of your neighbors to do so.

What’s interesting is this line of comments to a person asking advice from a blog. I’m not an attorney. I say that in every Real Estate transaction, and thank goodness I don’t have to be an attorney. It’s a Purchase and Sale Agreement.

Neighborhood Review, is a great example. I don’t like the fact that the guy down the street has a red car. What are you going to do? I’m not going to perform? What do you do? I was insane at the time, my agent misrepresented, a person on a blog told me that I didn’t have to do anything. What are you going to do? Keep the earnst Money, go to court, lose the deal, get trashed for being a batt head? Tie up your buyer, seller?

For goodness sakes.

The reason I mention the negotiated contract is because it has gotten to be “write ’em up” first and figure it out later. That is hardly a negotiation. It’s just a mess, what’s described here is a mess.

Lee, if you are at all unsure, get out, get your agent to get your earnst money, and take some time.

Any way you slice it, David, someone revealing the real why in blog comments is not a good idea.

The real why of what?

People buy a quarter, to half million dollar property based on sound reasoning. They create debt for themselves, and supposedly pay interest over 30 years.

In a commercial transaction there is a negotiation process. Documents pass back, and forth until they finally become a contract.

In residential Real Estate an agent tries to convince a buyer, and seller that they can, over the course of a few days, make a buyer, and seller perform according to what? Some chicken scratches on a boiler plate contract that the agent doesn’t understand, let alone the buyer, and seller? You want to convince people you are willing to go into court, and the judge will magically side with the agents, or the seller? Please.

Then Craig chimes in that an attorney should be consulted. A contract is a meeting of the minds. Every body should understand where they stand, what’s going on, and especially what they are buying.

I do expect many people will be backing out of contracts they signed to take advantage of the $8K tax credit. I don’t expect a rush of law suits because of it. What will happen is that sellers will whimper, and buyers will sigh some relief. Real Estate agents will be looking for other things to do.

David,

Making someone “perform” is not the same as keeping their Earnest Money. Will be interesting to see what Lee actually does.

Ardell,

What do you think of the Ravenna area (75th and 19th) for resale value? Have we seen the bottom?

-CJ

PS – GOOD BLOG