Earlier today I posted my thoughts on the King County Housing Market for 2010 and received this question on twitter:

@VAF_Investments asks @ARDELLd – This downward price expectation kind of goes against your view late last year… What’s changed?

Generally speaking, my clients are making a short term decision to buy a home to live in based on a compelling reason in their life, vs a long term market timed decision. Consequently, in my world, the question becomes “If I am going to buy a home in the near future, when is the best time to do that? What is the best strategy?

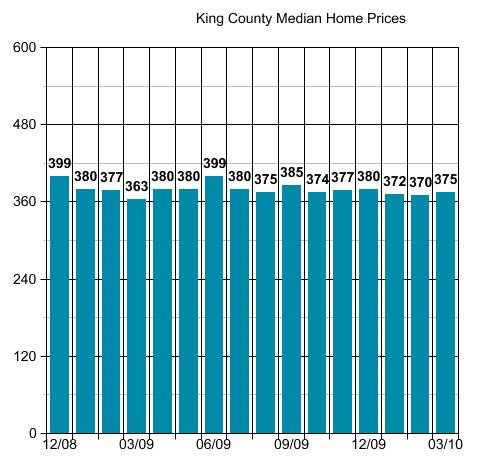

In February of 2009 there was no question in my mind that March closings would likely be the lowest point of 2009. When I “called that bottom” I was greatly surprised that it made front page news, because it seemed like a great big “duh” to me at the time. The graph above shows you how that prediction played out through to present day.

New Year…New Clients…New Bottom Call. Last year I had a few clients purchase homes who I told to wait in 2008 and late 2007. In 2009, I didn’t tell anyone to “wait” but I did tell a few people not to buy at all, and am still doing so. The minute someone says “I’m planning to sell it in 3 years” I do a big “Excuse Me?” One client wanted me to graph “appreciation” for each year over the next three years…I asked him to save me the time by sticking a big fat zero on that for me in each of the three columns on a net basis.

What’s different this year? LOTS! Many people bought in anticipation of the Homebuyer Credit ending. I was at the gym yesterday and a young agent on the next treadmill was telling his friend that buyers had to hurry up before the credit expires. If every agent is telling every buyer to buy before the credit expires, how can they possibly NOT think that the market will go down after it expires? Boggles my mind that the same people saying “you must buy before April 30” are the same people saying the market will not go down AFTER that point.

There are many other factors, of course. But the Homebuyer Credit is not a small one in the big picture. The title of the PI Article last year was “Agent Predicts Housing Slump’s Demise”. In 2010 the “training wheels” will come off. The oxygen supply will be removed, and we will see what the market will do when caused to “stand on its own two feet”.

I don’t think the market will fall dramatically without further government intervention, because I think if it DOES fall dramatically there WILL be continued government intervention. So yes, I do expect Homes Prices will be lower than the median price of $362,700 from March of 2009, at least at some point in the 4th Quarter of 2010, and possibly before. I don’t think we will see another 20% – 25% decline in prices, not because the fundamentals are stronger, but because I believe the government will come up with another plan if needed, to prevent that from happening.

Remember, most of the market decline transpired under the previous Administration. This new regime has proven its desire and ability to stabilize, if not grow, the market. I do think they will let this credit expire, and I do think they will decide what to do next…after they see how the market reacts to “pulling the plug”.

Before they decide what to do next…don’t be surprised to see a “new bottom” where median home prices in King County fall below $362,700. At this moment, without all of the March closings counted, the median for the first Quarter is $370,999 (maybe a little higher if I take out the houseboats) and at $372,475 for the month of March to date (this down from the $375,000 it was a few days ago). If I take out the houseboats and mobile homes…it is $375,000.

(The stats in this post are not compiled, posted or verified by The Northwest Multiple Listing Service)

thanks for the market update Ardell. Great comment re agents pushing buyers to jump in before the tax credit expires, but, Oh, by the way, the market will probably drop after that.

I agree with your assessment that “the regime” will yank that plug. The next wave of foreclosures may have a bigger impact on pricing than the credit expiration. Time will tell

Conor

Last time when the tax credit was to expire in November 09, the regime extended it to April 2010. As a result, most buyers stopped looking all of December (already not a big buyer month), January and most of February. I only hope that the current tax credit will be allowed to expire without any chatter about a possible extension. I want to see the true nature of the market. And, I don’t want the regime to prop up the market again. The cost to the tax payer does not justify it.

Gerhard,

I totally agree with the decision to extend the tax credit into 1st Quarter of 2010, and in exactly the manner that they did. You can’t stop a support at the beginning of a cyclical dip. The market would fall whether you stopped the credit or not (as it did) because the market pretty much always falls that time of year. Why take the “political blame” for a natural event?

Ending the credit at the beginning of Spring Bump makes perfect sense. Spring Bump should carry it to at least flat or just slightly down. If the market takes too severe a nose dive come 4th Quarter, well, new game plan. Do what you need to do, people.

It’s not about the cost to the taxpayer at all, Gerhard. It’s about the health of the economy. There are plenty of other frivolous uses of taxpayer monies than can be cut both in and out of this Country, rather than let the American economy tank. On the grand list of what they spend money on…preventing the American Economy from tanking takes precedence over…many, many other things they spend gobs of money on.

Conor,

Markets always involve a variety of “reasons” why they go up and down. I still think the new regime will respond to any significant fallout from any one of those issues. They did not prop up the market only to have it tumble, otherwise “they” will be perceived as having “wasted” a shit-load of money. That really can’t happen, nor would I expect “them” to let it happen.

I absolutely agree that the government will continue it’s intervention if the market collapses once current stimulus measures are withdrawn, I have to wonder though, what more can they do?

They’ve essentially shot all of their bullets at this thing and overall prices continue to decline, even in the face of restricted supply. While it is true that the rate of decline has abated, I’m left to wonder if letting the market organically heal isn’t the best option out there.

Scott,

I think people expect “bottom” to equal “up”, as in V shaped “recovery”, and that is an erroneous expectation. Look at my chart. How can you call that “overall prices continue to decline”? That is just not true. They didn’t go up, they won’t be going up, and it isn’t even rational thinking to “hope” they will go up. But the raw numbers are right there on this page, and they do not remotely reflect what you are saying as to home prices “continuing to decline” after the credit. They did not.

Flat is a whole lot better than the steep decline that preceded it. A WHOLE lot better. No doubt in my mind that we would be 40% to 50% down vs 22% to 25%, if the government had not interceded. Will that happen eventually, no, I don’t think so. Once you stop a speeding bullet in it’s tracks, it does not continue at the same pace if you let it go.

Organically healing from here may be 3% to 8% down IMO. If there had been no supports, I think the downside would have been double what it was, especially here in the Seattle Area. Other areas started down well before us. So the national fixes, which likely would never have happened if the Country was in as good shape as Seattle at that time, stopped us at 22% down or so. I think we can sustain another 3% to 8%. Beyond that, the government will likely intercede again.

Huge point is Seattle has an incorrect perspective. The “fixes” are not aimed at Seattle…they are aimed at the majority of the Country. By all accounts most of the States are back to 2001 to 2003 pricing, while Seattle is enjoying only April 2005 rollbacks. We should be the last ones to be whining. What the government does to fix Nevada…helps us, and frankly, we don’t deserve it as much.

I base the comment “overall prices continue to decline” based on data from Housing Tracker. Median price is not a great measurement tool, as any change in the sales mix skews the results.

My point is that even if the government wants to intervene if prices resume the pre-stimulus tragectory, the impact is likely to be marginal at best, and at a significant cost to the taxpayer. I wonder if the political will exists to throw more money at the problem as opposed to letting it heal on it’s own.

Scott,

There’s a big difference between “letting it heal on it’s own” and letting it go to hell in a hand basket. Prices did not continue to fall. The weighting of the mix between distressed properties and non-distressed properties is what “skews the results”, not median home prices given a large enough sampling like “King County”. In smaller geographic samples, yes, but not a whole year’s worth of data for a whole County as large as King.

In areas that have 10% distressed properties (most of the areas where I work are about that) prices are not continuing to fall (to date since 3/09). In areas with high and increasing numbers of distressed property, “the market” will continue to fall. The hardest hit areas are those with massive amounts of new construction where entire communities are homeowners who are upside down. Those communities do not largely exist in the close in Seattle Area, except as to new high-rise condo projects. That is why I always do my stats for single family only.

New construction generally will continue to fall, given people can no longer buy expensive properties without substantial down payments, in the higher price ranges that new construction tends to fall.

In communities that were built out prior to 2003, where most people had a down payment, and current values exceed the overall buy in price of those owners who bought when they were new, prices are not falling.

Lacking a good reason besides market conditions, such as everyone bought at peak, the market home prices did not go down in 2009. The median is not skewed “up”…if anything it is skewed “down”.

As to the political aspects, Scott, consider this. Would taxpayers support “we are going to pull all troops out of Iraq and Afghanistan, saving billions of dollars. We are going to take a fraction of that money and solve our housing crisis problems.” Do you think there would be a strong outcry against THAT?

Well done post and replies, Ardell. I agree that both Buyers and Sellers should assume flat prices for the next three or four years, and make their decision on that basis. This may be the proverbial ‘stable’ market, and we all need to get used to it.

My question is that if we assume prices will decline after the current tax credit expires, will the decline be to an extent that it would be better to buy after the creidt expires, or would it be better to buy now with the credit. It seems you are saying it would be better to buy after the creidt expires.

Shawn,

The credit stays consistently at a given number $8,000 or $6,500 depending on whether or not you currently own. The Sale Price moves and so the credit’s relationship percentage-wise is one of the factors.

For Instance: a $200,000 purchase and an $8,000 credit would weigh towards getting the credit more than an $800,000 purchase and a $6,500 credit. You have to weight the % gain of the credit against the estimated % loss of the property.

I had a former client call me a few weeks ago about buying via lease purchase. I told him to wait until (at least) 4th Quarter 2010. Since a lease purchase doesn’t close by the June deadline, even if you contract by the April deadline, he would not be eligible for the credit. So in his case, makes no sense not to wait for price declines and better properties to be more desperate and offer lease purchase arrangements after the credit expires.

The biggest issue is overpaying to rush toward a deadline. If you buy for 10% more than a property is currently “worth”, you lose 10% even if the market stays flat through the 4th Quarter. So being very tough on pricing to hedge against future declines is much more important than the credit.

So you have to way the credit’s % of sale price against the properties % of sale price to value…

In the middle of something, but I guess that’s a fast way to say “it depends” 🙂 Don’t push yourself into something you won’t like for 7 to 10 years, just to get a credit. Don’t push yourself into something that may be over-priced, just to get a credit.

Thanks Ardell. This has been very insightful and helpful.

I plan on looking for a home in September. And buying sometime before the end of 2010.

Why buy, why wait? I want to move from the condo we are renting because it is too small, the kids are not allowed to play on the grounds, and my wife refuses to move to rent, she will only move to buy. Further, we are planing a two month vacation this summer (for her and the kids) and me the last week of July to mid Aug. So, I just can’t rush for the credit, too much going on.

However, I do feel more comfortable wating from what you have said here.

Shawn,

The only problem with “looking in September” is inventory often starts to go off market for the holidays or to wait until “next selling season” …usually starting October 15th. So be sure to keep a “watch-list” in case you want to approach something that goes off market.

Otherwise…your plan sounds good!

Ardell:

Nice work, and consistent with my guesses (absent the meticulous data).

I have been following a different metric:, namely the median home price vs the median household income.

Nationally, it has returned to pre-bubble ratios (about 3X the median HH income), but the Seattle area, while down considerably, has quite a ways to go to reach that (4.8, last measured 1Q 09). It falls in the company of San Fran, LA, San Diego and New York (and Salt Lake, oddly).

Any coherent explanations for Seattle joining that group of cities, or more to the point, remaining in their company?

Pingback: When will housing prices recover? A national look. | Rain City Guide

Roger,

The majority of my clients so far this year are move up buyers with substantial downpayments. So income ratios to sale price vs loan amount doesn’t make a lot of sense to me. That scenario would assume everyone is a first time buyer with an FHA loan…and I don’t find that to be the case.

It’s not so much a scenario, but broad data regarding median home prices and household income. So far as I know, the data does not factor in loan amounts, LTV, or loan type.

The data is pulled from Harvard’s State of the Nation’s Housing annual study.

http://www.jchs.harvard.edu/publications/markets/son2009/index.htm

The ratios range from a tragi-comical 0.8 (Saginaw MI), to an eyepopping 8.6 (Honolulu).

One can make general inferences about desirability of a place to live. On the whole, I’m sure I would rather live in Honolulu than Saginaw MI, as would many others.

And somewhere in the mix, an influx of retirees buying homes must have an influence (lower HH income doesn’t necessarily mean lower HH wealth), but I don’t think wealthy retirees are flooding to Salt Lake City and San Fran.

Nor do I know of any data that suggests retirees are moving in significant numbers to Seattle. Not saying they are not, just haven’t seen any data.

Still trying to figure out if our higher ratio is a more or less permanent shift (like many CA coastal communities), or temporary. If it helps, the shift to the higher ratio began pre-RE bubble, and seemed to have co-incided with the previous tech bubble.

I know you are probably weary of the endless debate over Seattle home prices, but I hope my question (and data) is viewed in the light of honest inquiry and discussion, not bubble baiting!

Roger,

The reality is that the studies done measuring home prices against income point to a different problem. The problem isn’t the home prices. The problem is that too many these days do not view the home they buy, whether it be their 1st, 2nd or 3rd home, as the home they will live in for many years to come.

Harvard Studies, and most any income to home price study, generally updates a base of data first obtained back when most people bought a home they could afford…and stayed there. As their income increased people would stay in the homes and use the excess, disposable income for other things in life.

The big change in home prices is that there seems to be a trend of always moving up to a bigger and better house, as one’s income increases. It is not unusual for a family to have moved a dozen times these days. Think back to the generations who bought a first house as a “stepping stone” and then a 2nd house that they stayed in their whole lives.

We are now seeing a shift to people buying homes with a long term outlook…and while that shift was created by housing woes…it is a change for the better.

Interesting.

I haven’t studied critiques of the data used by the Harvard study.

Haven’t seen the data for the increasing moves to bigger more expensive homes, but anecdotally it jives with the changes I’ve seen in my lifetime. I have seen data showing sq footage has steadily increased.

A secondary factor pushing multiple home changes is the job market. In the 50s, 60s and 70s, jobs tended to stay put longer (manufacturing), and workers stayed at those jobs longer. Since then, the rate of employment (and career) change has been way up, often necessitating a move. Sometimes, that is to a bigger, more expensive home.

When home building begins again, I wonder what the sq ft trend will be? Up to the crash, it had steadily moved upward.

Another factor in the Seattle area could be that many people that move here for work have already accumulated significant wealth (compared to other areas), and with that wealth, they buy more expensive homes, with larger down payments, and lower payments.

And yeah, kids can be great motivators. They cost me the last two moves!

I believe that we’re in the early stages of an “L” shaped recovery. Elongated recovery due to the excess inventory from many bad loans yet to be foreclosed… Therefore, there is no reason to rush out there to buy property unless its a necessity held for the long term.

Two of my clients are pregnant. That seems to be a strong motivation to get a bigger place. A third has a little boy who just started walking and needs a yard.

Kids can be great motivators.

i agree kids will make you move and get a bigger place.

I feel that this housing market will decline over the summer as I still think many “sellers” are expecting too much for their houses. My mantra is that if you are in good profits with the house you are selling, sell it now and move on. This is not a time to play gamble and say that house price will go up in the next 4 months.

I am watching and some of the houses we considered in 2008/2009 are already a bunch and sometimes just thank Ardell from saving us of buying the house.

Ardell, soon you will see we will get active again with different params

Thanks Srini. I still love the line you posted in a comment some time ago that by the time Ardell and your wife find something worth moving to, you will be an old man. Something to that effect. LOL!

It’s always hard to sell a home that the owners love, or to find someone a house who loves their current home. Much easier when people hate their current home 🙂