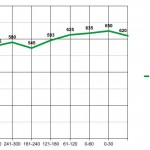

Home prices are beginning to trail down toward year end with an abrupt 5% decline in the last 30 days.

While we are still at 12% increase for the year following the downturn, this is more than merely seasonal change, in my opinion. Every year has a “Spring Bump” that usually does not sustain at peak levels past June-July. A downturn in August is always expected and the market continuing flat to down to year end is also expected.

What’s different this time?

1) We are coming off a bubble created by home buyers vs home sellers. In 2012 it was a Seller’s Market where home prices were primarily driven by sellers asking more for their homes and the buyers complying with the sellers’ desire. 2013 increases were largely driven by buyers aggressively competing for the same homes. The buyers giveth and the buyers taketh away will be the message of 2013 from here to year end.

2) Mortgage interest rates increased by a full 1% immediately prior to this “seasonal” downtown. How much of this decrease is seasonal and how much is interest rate driven? Difficult to separate that out, but if you go back to reason 1 above we can see the market deflating the bubble created by those buyers who were racing to beat the interest rate increase. The race is over. Yes there are some buyers who are still trying to beat the next interest rate increase, but nowhere near the aggressive level of buying while mortgage rates were still under 4%.

3) The stock markets are dipping at the same time. This is not a small factor. Seattle Area Home Prices often if not always emulate the stock markets. When the stock market is going up and there is a slight downturn in home prices created primarily by seasonal factors..well than you can see it’s simply a seasonal correction. But when we are at the same time seeing stories like Dow Jones – Is the Bull Market Over? and S & P Corrective Phase Could Last Until Early October, we know that the Spring Bump correction phase will likely last until every drop of seasonal push is drained, which is usually October 15th.

We can expect a one week or two week robust period in September, because we always have one for usually no good reason. But the season is over…and then some. 2012 was a good year. 2013 was a year that was too good for sellers and not fun for buyers. 2014 should look more like 2012 than 2013.

Don’t expect anything but down from here to year end.

I am not surprised that there was a down turn. Price appreciation was increasing much too fast to be sustainable. Annual price appreciation of 12 + percent just cannot create strong stable markets. As investors back out of the feeding frenzy, I predict that 2014 will remain moderately flat in order to stabilize the market.

Pingback: Back to school means softer home prices in Orlando | HouseDiver Capital

We don’t really see a drop of prices in the real estate market here in Quebec! I would admit that there are more houses for sale than there are buyers, and sometimes that can mean that it will take longer for a good house to sell! But we are lucky enough to see that the market is pretty stable!

We have seen a decrease in buyer activity in my market here in Massachusetts. I don’t know if it’s interest rate related or just a seasonal slow down.

I wouldn’t mind it if things picked back up before year end!!!

Interesting… looks like Pasadena California is tracking similarly. A 13.9% decrease in sales price in the last 30 days, but a 24% overall increase since January. Buyers are competing like crazy for same property and cash buyers are aplenty (1 in 3 sales.) However, the numbers do show a down turn. So… is it seasonal? Probably, but time will tell.