[Editor’s Note: I get asked all the time if people from outside of Seattle can write for Rain City Guide and I always say no… I really like keeping RCG as a “Seattle” thing. However, recently Joe Salcedo of the Reno Real Estate Blog reached out to ask if he could publish a one-time post on RCG about his experiences with the Reno, Nevada market and the insights it might provide to the Seattle community… and I bit. I’ve published the article below. Enjoy! ~Dustin]

[Editor’s Note: I get asked all the time if people from outside of Seattle can write for Rain City Guide and I always say no… I really like keeping RCG as a “Seattle” thing. However, recently Joe Salcedo of the Reno Real Estate Blog reached out to ask if he could publish a one-time post on RCG about his experiences with the Reno, Nevada market and the insights it might provide to the Seattle community… and I bit. I’ve published the article below. Enjoy! ~Dustin]

In August of 2005, our real estate market crashed. It’s been five years and we’re slowly trying to get back on our feet. I’m here to share some of the lessons I’ve learned along the way; the prodigal brother, if you will.

I started with a blank page. One weekend after, baffled and fascinated and my curiosity violently piqued, here’s what I found out about your market:

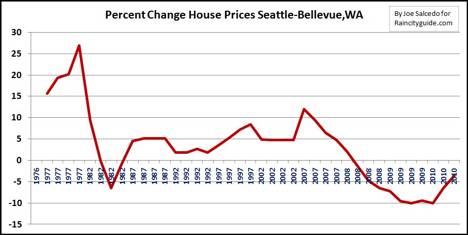

- If you waited until Seattle home prices went down in July 2007 (before you realized the market was having problems), you’re going to be at least one year behind. Check for other signals. Home prices take too long to reveal itself profitably.

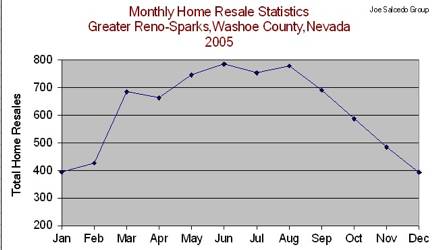

In Feb 2006, less than a year after the Reno real estate market crashed, I called an emergency meeting (coupled with other factors like plunging housing starts and declining home builder stocks) after being greeted by this chart:

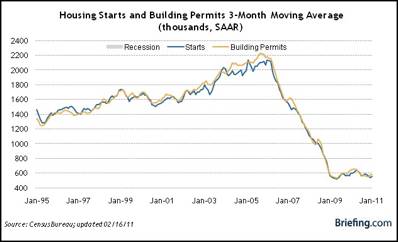

Yes, all markets are local but we all came from our mother’s womb. Like a bearish stock market pulling down three out of four stocks with it – (both weak and strong companies) – majority of real estate markets fall with the general market. Follow the home builder sector group in the stock market (Investor’s Business Daily tracks it every Monday). Check housing starts and building permitsto see a glimpse of the future:

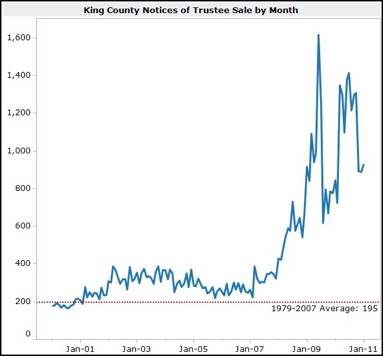

- For potential sellers: Consider cutting your losses short. If you’re barely making it with house payments (perhaps using borrowed money just to make it) and hoping that the market would change soon, perhaps it’s time to think about making some tough decisions. Distressed properties tend to pull home prices down further (see: notice of trustee sale graph below.)

If you’re comfortable with your mortgage payment (you bought a house on or before June 2005) and moving is too painful, it’s ok to stay; just know that based on present real estate conditions, it may take a few years before your house will appreciate from the price you bought it.

(From SeattleBubble.com)

- Short sales and foreclosures are like a mysterious disease that defies normal market cause and effect. Inventory could be down, demand up, but price still down. This has been happening in our market since 2007.

And like your resident queen, the author has made premature bottom calls by not taking into account the “black swan

This residential architect is inclined to agree especially with this pithy conclusion: “Short sales and foreclosures are like a mysterious disease that defies normal market cause and effect. Inventory could be down, demand up, but price still down. This has been happening in our market since 2007”.

Jerry,

Can you share a little bit on how this similar phenomenon is affecting your area…

Joe- In my many years of home design practice, I’ve seen

this mysterious unlinking of what should be happening with

what actually is happening. I’m glad to see your input up in

our SoggySound.

Being from Reno/Carson I know the bloodshed. However, we recently reentered the market in Carson City area where homes that were built in the late 80’s and sold for 130k new, we began gobbling up at 60k. They hit a high of 270k.

So far we just bought 3 but with rental rates of 900-1000 the value proposition is fine as a long term rental. Not to mention cost to build and the ease it is to get tenants out in Lyon County compared to here in Washington State.

I see no turn for the Reno/Carson market for many many years because of a HUGE lack of jobs and horrible wages. Its truly a beautiful area and without a doubt its where my retirement will take me.

Ray,

I shed a fat tear as it pains me to agree. (“I see no turn for the Reno/Carson market for many many years because of a HUGE lack of jobs and horrible wages. Its truly a beautiful area and without a doubt its where my retirement will take me.”)

Our Rental market, as you have said, is actually pretty healthy.

“Vacancy rates for apartments in the Reno-Sparks area dropped the six of the past seven quarters and are approaching stabilized levels.”

Value is there for cashflow turtles…as rent, as you said, go for $900-$1000. Not only in Carson, but also in older parts of Reno. (Mortgage wold be lower than having it rented out.)

I may not be bullish. But I’m hoping for a Black Swan Hope in the Reno Housing Market..

Joe,

As the Seattle area is vastly different (particularly, the local economy) from Northern NV, it’s fascinating why it had a similar mirror effect inspite of the strong local economic numbers.

When you say, “Like a bearish stock market pulling down three out of four stocks with it – (both weak and strong companies)” , is this your explanation for this “mirroring”? Hmmm…interesting..I never knew stocks and real estate intersected in this way.

I was equally surprised to learn a lot of lessons from the Stock Market…I guess human nature never really changed..

In my opinion, it was the general market falling down…it was too brutal that it eventually affected even stronger markets..it’s hard to go against the force of mother nature. Unless you really have a solid, reality based, calculated risk investment plan.

“Resident Queen”? Is that Ardell’s formal title? 😉 And I’m not so sure she’s conceded a “premature bottom call.” After all, we’ve actually seen some significant APPRECIATION in non-distressed properties — 11%! — since she called bottom.

Craig,

I did further research this morning, and I think I’m going to keep my opinion to myself. But I’ll say this…

King County Home Prices:

“May 2011: $345,000

February 2005: $342,500”

And I know Ms. DellaLoggia have been saying that home prices in your County may not go south of 2005.

Just from own experience it’s really hard to factor in the full impact of short sales and foreclosures in the market whether it’s 25% (King County) or 40% (Reno) of the inventory. We’ve never had this massive influx of distressed properties hitting the market. EVER. Even in the last major real estate downturn in the late eighties. That wasn’t even close to where we are right now.

That’s why In in my opinion, “To be safe, overestimate.”

Hey Ardell — its Hammer Time! Time to nail this guy….. 😉

That said, Joe, personally I agree more with your analysis than hers, but she does put on a good show.

Craig, you are such an instigator. LOL! Give the guy some slack.

His statement is erroneous, but hey, I don’t expect him to waltz in from Nevada and know Seattle or any and everything I may have said here in the Seattle area.

This is what I said in May of 2010: “Well, it’s pretty clear that we will hit 2004 pricing in the next 18 months to two years, and possibly as early as the 4th quarter of this year” , which turned out to be an accurate prediction.

Not sure why he’s calling me out with erroneous statements like “…And I know Ms. DellaLoggia have been saying that home prices in your County may not go south of 2005.”

I’ve got Kary “calling me out” on Seattle Bubble in half of his comments. Not sure why people “call me out” in their blog posts and comments. I guess it is because they want me to “come out and play”. 🙂

With all due respect Ms. DellaLoggia, you said that statement approximately four months after you said this:

“Several times I have been quoted as saying that prices will maintain at 2005 levels, and so far that has been correct. We have a considerable cushion between current home prices and 2004 levels here in King County.”

And I wasn’t calling you out in that statement, I was actually affirming it, relating to Tim’s post (scroll down to the bottom of the page). I was quoting him:

Again, I wasn’t calling you out, to the contrary, I was implying that you may be onto something to that statement you made in Jan 2010.

I don’t want to play by creating a Roger-Ailes-spotlight tactic on myself esp. on your behalf Ms. DellaLoggia.

That’s not good manners for people you invite over for dinner.

I am as inclined to argue with Ms. DellaLoggia as Cheech would want to verbally spar with Demosthenes.

I am not calling out anyone nor wanting to start an argument. Esp. at a place I invited myself into.

That being said….