NOTE: This is just my interpretation of the new GFE and I am only a mortgage originator and blogger. This post is just based on my opinion. Please check with your compliance department at your mortgage company to learn about the GFE requirements.

Previously, I reviewed page 1 of the 3 page good faith estimate which will be required for all residential mortgages effective with applications as of January 1, 2010. We’re moving on to page 2 of the new good faith estimate and comparing it to the old Good Faith Estimate that I (and many) have used.

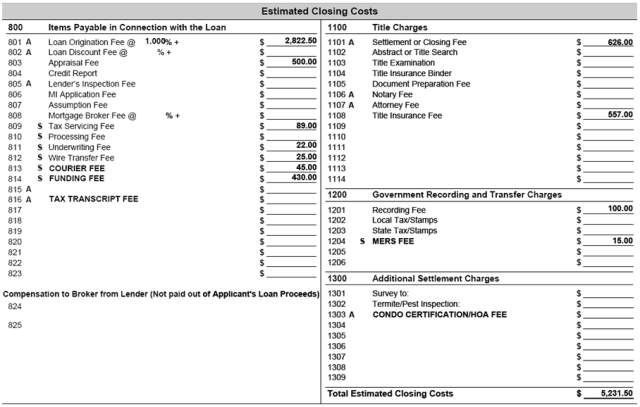

The current good faith estimate, which is to be retired at the end of this year, provides a line itemization of closing costs.

Section 800 of the dear old good faith estimate for the most part contains what the new good faith estimate is now on page 2 of the HUD’s Good Faith Estimate.

What used to be line itemed in Section 800 of the old GFE is now for the most part, lumped together under “Your Adjusted Originated Charges” less third party fees. When you look at the current (soon to be retired GFE); I’m basing this on lines 801, plus lines 811 – 814 even if the seller is paying the fees…by the way, there is no place on the new Good Faith Estimate that shows the seller credit…but if you don’t disclose the funds for closing, I guess HUD feels that point is moot!

Block one of the Good Faith Estimate cannot change–once a GFE is issued, unless it qualifies for a “changed circumstance” or the GFE “expires”, the Mortgage Originator is bound. A “changed circumstance” is not as easy as it sounds…and warrants a post of it’s own. They must be documented on only the fee impacted by the changed circumstance is allowed to be modified. Mortgage originators should be prepared for banks/lenders to balk at your explanation of the changed circumstance–expect to have to “eat the cost” difference if the bank doesn’t “buy it”.

Quick reminder, this post is just to compare a specific FHA scenario based on a current and the new GFE–so if a LO has discount points or YSP, this would look different and it will take a follow up post to review it.

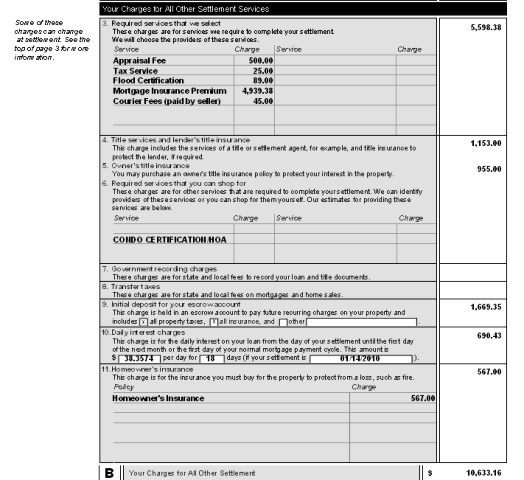

The next section on the new GFE is “Your Charges for All Other Settlement Services“.

Block 3 of this section are items the lender selects and that the borrower cannot. Since this scenario is an FHA loan, it includes the FHA upfront mortgage insurance. This section is subject to the 10% tolerance in aggregate “bucket”. On my old GFE, comparing estimate to estimate, these specific fees would be found on lines 803, 809 and 902.

Block 4 is for the lenders title insurance policy and the escrow fee/settlement services. They’re now lumped together. It doesn’t matter if it’s the same company or not. If the borrower selects a provider from the list provided by the lender, it’s subject to the 10% tolerance. If the borrower deviates from the list, there is no limit to how much the fees can adjust. If the lender does not provide a list, there is zero tolerance from the good faith estimate to the HUD-1 Settlement Statement. I suspect that some big banks will use this to try to capture title or escrow business. On my old GFE, these fees were shown on lines 1101 and 1108.

Block 5 is a doozie. HUD does a great job contradicting themselves with whether or not the owners title insurance policy fee needs to be disclcosed here. In Washington State, this is typically a fee charged to the seller. Yet it really appears as though HUD wants this cost disclosed to the buyer EVEN IF THEY’RE NOT PAYING IT. This fee is not on the old GFE.

Block 7 are the recording fees and is shown in section 1200 of my GFE. Even recording fees that the seller typically pays may be disclosed here. This is shown in section 1200 of my old GFE.

Block 8 is for “excise tax” and it’s my understanding that the only county in our area where the buyer actually pays a portion of excise tax is San Juan County. If I’m wrong–please correct me!

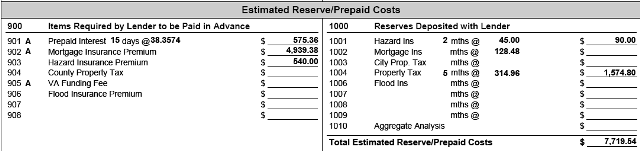

Old/existing Good Faith Estimate below shows the items the lender requires to be paid in advance (prorated interest, 1 years home owners insurance for a purchase and the upfront FHA mortgage insurance) and the left and what is required to start the reserve account. NOTE: this is my personal GFE (generated from Encompass).

Block 9 discloses what is charged to start your escrow reserve account (line 1001 and 1004 on my old GFE).

Block 10 is the prorated interest based on the day the loan is closing (line 901 of my old GFE).

Block 11 is the estimated (in this case) annual home owners insurance premium which is disclosed on line 903 of my old GFE.

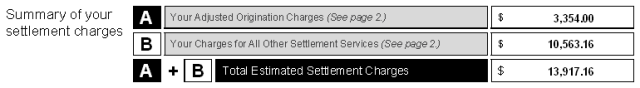

If you add the “adjusted origination charges” (Box A) to the “your charges for all other settlement services” (Box B), you come up with a “total estimated settlement charges” (which also includes the owners title insurance policy which is not paid for by the buyer in these parts). Again, this does not factor in any seller credit–the only credit factored into the new GFE is in the form of YSP (yield spread premium).

I’m going to miss you, Old Good Faith Estimate! The two things home buyers ask most from the lender (after what’s your rate) is “how much is my payment going to be” and “how much money do we need for the down payment and closing costs”. HUD’s new GFE answers neither.

Pingback: Top 10 real estate posts of the day for 12/24/2009 : Tempe real estate and free home search

This form will only confuse an already frustrated borrower. This documnet in it’s current form doesn’t provide all relavant information needed, why disclose fee’s that the seller is required to pay? Why not continue to show a total payment inclusive of escrow items and where other than the details of trans will the borrower see an actual cash needed to close which will now include seller costs to inflate the number. It will correct the so called bait and switch guys because they will now have to charge what they quote, but beyond that it’s a big miss in my book.

I have no answers for you, Scott. I do know that our office is creating a “pre-application” form which will include total monthly mortgage payment and funds for closing.

Today I was preparing two good faith estimates for one of my returning clients–one is a 15 year amtz and the other is a 30yr. It’s odd knowing that we just have a couple days left before this dear ol’ GFE is retired.

Very interesting… in Virginia the buyer pays for Title Insurance (Block 5). I did not know that this changes from state to state.

From what I understand, it can and does. 🙂 In Washington State, typically the buyer pays for the “lenders policy” and the seller pays for the “owners policy”.

In Kansas City, the Buyer also pays for a “lender’s policy” which is usually a flat rate of around $200 or so. In other words, if the Buyer is paying cash then they pay NONE of the title insurance policy. The Seller always pays for the title insurance policy and it’s figured on a sliding scale based on the amount of risk (i.e. purchase price of the home).

Jason, in Washington State the buyer typically pays for the lenders policy as well, which is a much reduced rate (simultaneous issue) than the owners policy. With the new GFE’s, our closing costs are going to look significantly higher with this added fee THAT THE BUYER DOESN’T PAY FOR! Garrr don’t get me going so early in the morning. 😉

Rhonda, don’t you think it is odd that they now make us give a summary of all the costs (new GFE), but then take away all of the pathway as to how you go there. The old GFE did that very well. It definately makes more questions and causes more confusion for the average consumer. I think you MUST present the new GFE along with a detailed breakdown of the fees and charges to go along with it. Even though the Powers that be don’t require it. Our company has come up with a form that shows all the break down of fees. rough stuff!

We have a break down of fees too. If I could have been on the team for developing the new GFE, I would have had it resemble the HUD-1 so a borrower could take it to the closing table and have everything line up side by side–no surprises and no having to learn a new form. At least then the HUD-1 Settlement would be a little familar to a borrower.

Supposidly borrowers found the summary of charges less confusing…however HUD has included charges that don’t even belong to the borrower in many parts of the country (like owners title insurance policies and excise tax).

It’s ironic that one of the goals of HUD was to create a uniform document so that borrowers can shop and because of the liabilities associated with the new GFE, many LOs will not issue them for shopping purposes–the result of HUD’s new GFE is that many banks, mortgage companys and even loan operating systems have created forms for the purpose of a “pre-GFE” tool. And it’s not all about protecting ourselves from liability when you’re dealing with an uncommitted client, it’s also about being able to provide reliable information the borrower is seeking–such as total monthly payment and funds for needed closing–both are missing from the new GFE.

completely agree. the one thing the change does do is it makes very clear that the lender is obligated to the new GFE. the Pre-GFE forms will be obvious that they are not official forms.

the days of a Loan Officer putting our horrible, under quoted GFE just to get the client should nearly be wiped out. that may be the only good thing about this.

I am a home buyer caught in the transition between the old and new GFE and it has made the last three days something close to a living hell. We started the loan process the last week in December and will close the end of January. These new forms damaged the very good relationship I had with a good and reputable lender but reading some of the blogs has confirmed that the seeming crazy things my lender was telling me are in fact true.

-My first shock was how much higher the settlement charge total compared to the closing costs total. After three days of call and emails I see that my costs have risen a little due to increases from my lenders service providers but at least not the $1,500.00 that I originally thought.

-I still have not been able to determine my “Estimated Cash Required at Closing” from the info on the new form. I’ve done my own estimate that appears to be $500.00 more that what I expected using the old GFE. The omission of this information in the new GFE is beyond understanding!

-Im still confused on the new line of “Owners Title Insurance”. Why show costs the seller will pay? I dont care as a buyer and it is making it very difficult to know what cash to have available at closing.

The new GFE is bureaucracy at it’s worst and I pray there is enough backlash to cause this form to be updated quickly; bad time to be throwing a government wrench in an improving housing market.

Scott

Scott, I’m dealing with the same scenario…clients of mine that I’ve been working with since late 2009 just bought a home and I had to provide the new GFE–I’m sure it looked like a gross case of bait and switch since suddenly I had a $1000+ owners title policy that they will not pay for and upfront FHA mortgage insurance of over $7500 which will be financed. I wrote a post for you and used your comment–many have no idea how this will impact them until they are in a transaction.

Meanwhile, Mortgage Professionals must figure out how they’re going to deal witih this document HUD has created so that it does not create distrust with our clients.

Here’s your post: http://raincityguide.com/2010/01/09/home-buyer-says-dealing-with-the-new-good-faith-estimate-is-close-to-living-hell/

What do you do if when you go to close your percentage between the good faith estimate and Hud charges is over the 10%.

Hi Sarah, it is the accumulative sum of specific fees that cannot exceed 10% of what was quoted on the Good Faith Estimate. Page 3 of the 2010 GFE has it listed:

Required services that we select (such as apprasial, upfront fha MIP funding fees, VA funding fees, tax service charges…). BOX 3 on page 2.

Title insurance and escrow fees IF you use a company that was disclosed on the lender’s written list. If you do not use one of those companies, then this is NOT part of the 10% tolerance and the there is no limit to what the title/escrow fees can be between the GFE and HUD. BOX 4 & 5.

Required services that you can shop for IF you use a company from the lenders “written provider list” BOX 6

Recording fees. BOX 7

Page 3 of the HUD-1 Settlement Statement will actually compare costs side by side.