I received a call the other day from a consumer who was in the process of purchasing a short sale home. The homeowner has defaulted on her mortgage and the trustee sale auction has been postponed a few times now that this buyer’s firm offer has finally reached the lender’s loss mitigation decision-maker. Once the offer was accepted by the seller, the homebuyer was surprised to learn that there’s a third party involved, a “Short Sale Negotiator” who is charging an additional $9,000 fee on top of the real estate commissions paid to both the agent for the seller and the agent for the buyer. The Short Sale Negotiator is demanding that the homebuyer sign an agreement that the homebuyer will be responsible for paying the $9,000 fee. The homebuyer emailed me asking what I thought of this additional fee and could I offer some advice.

The first thing I did was to find out the name of the Short Sale Negotiator company, the owner of the company, and the person who is doing the short sale negotiating. I discovered that the negotiation company is owned by the same person who also owns the real estate firm where the listing agent works. I also ran the name of the short sale negotiator and discovered that this person IS a licensed real estate agent.

Readers please note that WA State’s regulators recently changed the real estate licensing laws and there’s a great FAQ section here that answers the question: Does a Short Sale Negotiator have to be a licensed real estate agent? The answer is yes, or a licensed loan originator or otherwise exempt from licensing such as an attorney. (Clicking through from the link, scroll down to “doing business” and see the second question.)

So we have a licensed real estate agent who is earning money as a short sale negotiator who works for a company owned by the same person who owns the listing agent’s real estate company.

There are a couple of things that come to mind here. First of all, isn’t there a bit of a conflict of interest for the real estate broker/owner of that company? Where are your duties? To the home seller, whose listing you’re charged with overseeing, or are your duties to the buyer, a client who signs the agreement to pay your other company $9K? What are the duties of disclosure to BOTH the seller and the buyer?

For example, if I’m the seller in this transaction, charging a buyer an extra $9,000 out of pocket might preclude a number of qualified buyers to make an offer….unless I hold back this information until after the buyer has emotionally fallen in love with the home and is already arranging the furniture in his/her mind. That seems manipulative. Why not tell all possible prospects up front what the short sale negotiator’s fee is: Make it mandatory to display this extra fee in the PUBLIC comment section of the multiple listing service.

You might be thinking: “Yes we could disclose this god-awful fee to the public this but that’s not in the best interest of the home seller.” Well, okay but what happens if you end up attracting a lot of buyers but they all walk when told of this high third party fee? Now the listing agent has wasted everyone’s time. It’s like if someone asks me out on a date and then later he tells me he’s married. Come on! Hey, some women might say yes and it’s nice to know up front how big of an a-hole a guy is. I say the listing agent would actually be attracting the right kind of buyer if they disclosed that their Short Sale Listing comes with baggage. It seems to work fine for the married guys who post personal ads on craigslist day after day.

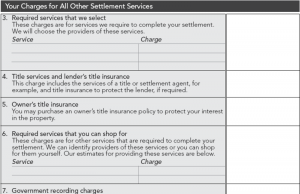

More: If there is an affiliated business arrangement going on between the two companies that are owned by the same person/people, then a RESPA-required Affiliated Business Arrangement disclosure form should ALSO be required so that the home seller and home buyer are aware of the dual company ownership. Part of that AFBA disclosure form should state that the homebuyer understands that buying this home means he/she does NOT have to use this particular short sale negotiation firm and is free to select another short sale negotiation company to do the same or similar work. However, since a ‘short sale negotiator fee’ might not necessarily be classified as a “settlement service” then this rule might not apply. HUD are you listening? It’s highly possible that the next time a federal regulator makes it out to Washington State, the Seahawks will have won the Superbowl. Knowig this, we should look to the state regulators for assistance.

For a home buyer, a big red flag would be if the listing agent demands that you use this affiliated short sale negotiator. Demanding that a buyer use a real estate broker’s affiliated company is a licensing law violation as well as a violation of federal law when those companies are a title, escrow, appraisal company, and so forth. So why not a short sale negotiations company also?

Even more: Is the listing agent receiving part of that $9,000 fee? One way of structuring this is for the owner of both companies to promise the listing agent something like this: “if the lender cuts your commission, don’t worry, I’ll give you a portion of that $9,000 negotiator fee.” Unearned fees are not allowed under RESPA.

Even worse: Is the short sale negotiator splitting the $9,000 with the home seller? How fast can you say “Mortgage Fraud is now a Class B Felony in Washington State?”

The other logical problem that comes up for me when I see an additional fee of $9,000 is this: what work is being done for NINE THOUSAND DOLLARS? That’s an awful lot of money. I could install all new vinyl windows in my 1959 house with that kind of money. I could put this in my teenager’s college fund. I could accomplish a lot with $9,000 so why would I want to pay that kind of money to a short sale negotiator? Is this like extortion/payola in order to get that particular house for that price?

Maybe not. What is this third party negotiations company doing for their $9,000? Wait, let me go find out. I’ll read their website. Gee, there’s nothing on the website telling a consumer what their company actually does for that fee but the pictures of their team tell me they’re all good looking guys under 30. Not that there’s anything wrong with doing business with good looking guys under 30 but it should make us wonder how much experience the negotiator has at short sale negotiating. In 2009 I believe we added ten million “short sale experts” in the real estate industry.

My advice to the consumer: Negotiate that fee down to somewhere around $1,000 to $2,000. If the home is that close to the auction date, tell your real estate agent that you’re going to buy the home at the auction if the lender won’t approve the short sale and if the negotiators won’t go for a reduced fee. Most of the third party short sale negotiators out there are paid much less than $9,000.

Here’s some help with the math: I asked the consumer to ask the short sale negotiator how many hours he’s spending on this file v. how many hours he’s working on those biceps. Consumer says the SSN said he’s spent 10 hours so far on this transation! !! !!! Wow! Well! Okay then, let’s divide $9,000 by 10 hours. That’s a going rate of $900 per hour. That’s probably close to the hourly rate charged by the Johnnie Cochran law firm for litigation cases and I’m fairly certain that this licensed real estate agent negotiator doesn’t have as much experience or education as the JC legal team. Counter back with $100/hour and settle around $200/hour max.

I am betting they’ll take the $2k.

Ask for the negotiator’s $2K to be put on the HUD I Settlement Statement as a seller’s closing cost. There’s a chance the lender will pay it. If not, the buyer needs to as himself: Is this house worth $2k out of pocket at closing? It’s also important for the buyer’s new lender to know about this additional fee. Insist that it’s paid out through escrow and shows on the buyer’s side of the HUD I Settlement Statement if the lender refuses to pay it as a seller’s cost.

Buyers: do not agree to pay any money after closing, on the side, without disclosing this additional amount to all parties including the lender.

Predatory Short Sale Negotiators: The world is watching you. I wonder if your dreams are haunted the way I was haunted after watching The Hurt Locker. Soon your predatory fees are going to explode in your face. Oh, and loan mod salesmen thinking that being a short sale negotiator is the next big way to “make six figures with no experience,” please go back to the used car lots. I’m sure there are some openings at the Toyota dealerships.