There’s a new designation available for real estate agents called “Earth Eco Bro

There’s a new designation available for real estate agents called “Earth Eco Bro

Category Archives: Real Estate Humor

Loan Originators Who Argue That Predatory Lending was Bad Should Welcome the New FRB Rule on LO Compensation Prohibitions

Under the final Federal Reserve Board’s loan originator (LO) compensation rule, effective April 1, 2011, an LO may not receive compensation based on the interest rate or loan terms. This will prevent LOs from increasing their own compensation by raising the consumers’ rate. LOs can continue to receive compensation based on a percentage of the loan amount and consumers can continue to select a loan where loan costs are paid for via a higher rate. The final rule prohibits an LO who receives compensation directly from the consumer from also receiving compensation from the lender or another party.

Under the final Federal Reserve Board’s loan originator (LO) compensation rule, effective April 1, 2011, an LO may not receive compensation based on the interest rate or loan terms. This will prevent LOs from increasing their own compensation by raising the consumers’ rate. LOs can continue to receive compensation based on a percentage of the loan amount and consumers can continue to select a loan where loan costs are paid for via a higher rate. The final rule prohibits an LO who receives compensation directly from the consumer from also receiving compensation from the lender or another party.

The final rule also prohibits LOs from steering a consumer to accept a mortgage loan that is not in the consumer’s interest in order to increase the LO’s compensation.

Though a lawsuit has been filed to stop the changes from going into effect, there has been legal research conducted by the FRB over the course of many years.

The FRB’s research found that consumers do not understand the various ways LOs can be compensated such as yield spread premiums (YSPs), overages, and so forth, so they cannot effectively negotiate their fees. Yes, some LOs spend many hours educating their borrowers but this is not true for all LOs.

YSPs and overages create a conflict of interest between the loan originator and consumer. For consumers to be able to make an educated choice, they would have to know the lowest rate the creditor would have accepted, and determine that the offered rate is higher than the lowest rate available. The consumer also would need to understand the dollar amount of the YSP to figure out what portion will be applied as a credit against their loan fees and what portion is being kept by the LO as additional compensation. Currently, mortgage broker LOs must do this, but LOs who work for non-depository lenders or depository banks are not required to disclose their overage.

LOs argue that consumers ought to read their loan docs and take personal responsibility for negotiating a good deal on their mortgage yet facts related to LO compensation are hidden from consumers when working with depository banks and non-depository lenders.

The FRB’s experience with consumer testing showed that mortgage disclosures are inadequate for the average random consumer to be able to understand the complex mechanisms of YSPs when working with mortgage broker LOs. Consumers in these tests did not understand YSPs and how they create an incentive for loan originators to increase their compensation.

For example, an LO may charge the consumer an LO fee but this may lead the consumer to believe that the LO will act in the best interest of the consumer. The FRB says:

“This may lead reasonable consumers erroneously to believe that loan originators are working on their behalf, and are under a legal or ethical obligation to help them obtain the most favorable loan terms and conditions.”

Consumers may regard loan originators as ‘‘trusted advisors’’ or ‘‘hired experts,’’ and consequently rely on originator’s advice. Consumers who regard loan originators in this manner are far less likely to shop or negotiate to assure themselves that they are being offered competitive mortgage terms. Even for consumers who shop, the lack of transparency in originator compensation arrangements makes it unlikely that consumers will avoid yield spread premiums that unnecessarily increase the cost of their loan.

Consumers generally lack expertise in complex mortgage transactions because they engage in such mortgage transactions infrequently. Their reliance on loan originators is reasonable in light of originators’ greater experience and professional training in the area, the belief that originators are working on their behalf, and the apparent ineffectiveness of disclosures to dispel that belief.

The FRB believes that where loan originators have the capacity to control their own compensation based on the terms or conditions offered to consumers, the incentive to provide consumers with a higher interest rate or other less favorable terms exists. When this unfair practice occurs, it results in direct economic harm to consumers whether the loan originator is a mortgage broker or employed as a loan officer for a bank, credit union, or community bank.

A Rebuttal to the RESPA Reform Poem

Over at Mortgage Porter, I posted a poem that one of my coworkers penned for humor about the new Good Faith Estimate. One of my readers, who wishes to remain anonymous, has submitted a rebuttal which I think is very worthy of sharing here.

Twas the week before Christmas

When a poem made its rounds

About a change in RESPA

That was about to hit the town

HUD said it was good

It would limit the greed

Protect all consumers

And a nation in need

A nation that was harmed

By the very same practice

They seek to preserve

Though we all pay though our taxes

Nation, wake up! We must awake from our slumber!

The path we were on will take us all under

If we do not learn, and learn today

It can all be gone

Like it almost was Columbus Day

Do you not remember? Can you not see?

What securitization, corruption has done to thee?

The stock market tanked

Foreclosures still run rampant

And they said, even so, you cannot make this happen

Assemble the lobbyists, consumer groups and more

Awake your Congressman, Senator

Or contributions no more

“Kill this thing, kill this thing,

National Association of Realtors Announces New Community Service Plan

The National Association of Realtors has announced a new community service outreach plan “Operation Home Rescue.” Realtor members will be opening their homes to families who have been displaced by foreclosure. Each NAR member will offer their basement, family room, third bedroom, and in the case of an already full house, their garage to families who may otherwise be homeless due to their own foreclosure. “We have a duty to help those less fortunate and in this case, some of these folks will likely be our past clients” said an NAR Spokesman. “We won’t be going out of our way to make their stay to terribly comfortable,” he said, “because these are our future homebuyers!” When asked about how a recent foreclosure effects a person’s ability to obtain a mortgage again, he said, “pretty soon, the lenders won’t have anyone else to lend money to, so they’ll have to take these homebuyers back again.” NAR representatives were not sure how the plan would work when the foreclosing homeowners are Realtors. “Frankly, I’d rather volunteer to take in their abandoned dogs or cats instead of taking in one of my competitors” said Sean Q., a real estate agent. Homeowners in foreclosure should contact the Realtor who sold them the home for more details.

In addition, a Realtor spokesman explained that a motion was made at the previous convention to add an article to the Realtor Code of Ethics which would have made it a Realtor’s ethical duty to make sure the homebuyer could actually afford the mortgage payments but the motion was defeated. “NAR is on record as being against banks getting in to the real estate business so we figured it was a good idea if we stay out of the banking business.”

NAR’s Operation Home Rescue outreach program provides a dual benefit of rescuing foreclosed families and then selling them another home which will help to clear out the inventory of homes for sale.

Top 10 Reasons NOW is the time to buy

#10 – You may lose your job. When you don’t pay your rent, they put you on the street in 20 days. When you don’t pay your mortgage payment, they don’t put you on the street for at least 8 months.

#10 – You may lose your job. When you don’t pay your rent, they put you on the street in 20 days. When you don’t pay your mortgage payment, they don’t put you on the street for at least 8 months.#8 – Many a marriage has been saved…by buying a house with two staircases.

*

#7 – You just read *page 114* of Harlan Coben’s “Promise Me” (see below), and you live in a “garden apartment”.

*

#6 – Your girlfriend is demanding equal treatment to your wife.

*

#5 – Your boyfriend is demanding equal treatment to your wife.

*

#4 – Your mother-in-law just bought a 1 way ticket to your apartment

*

#3 – Your bank account is bigger than your home office

*

#2 – God said: Your real estate agent, banker and mortgage rep all need you to buy a house, right NOW!. This is a direct message from God. No kidding.

*

*

NUMBER ONE: Your 4 year old is riding the dog, and dragging the baby around like a pull toy, because she needs a yard and swing set.

*

*

*Page 114* “lived alone in the same crappy “garden” apartment for more than a decade…they call them “garden” though the only thing that seemed to grow was the monotonous red brick…sturdy structures with the personality of prison cells, way stations for people on their way up or down and for a few, stuck in a certain personal-life purgatory.”

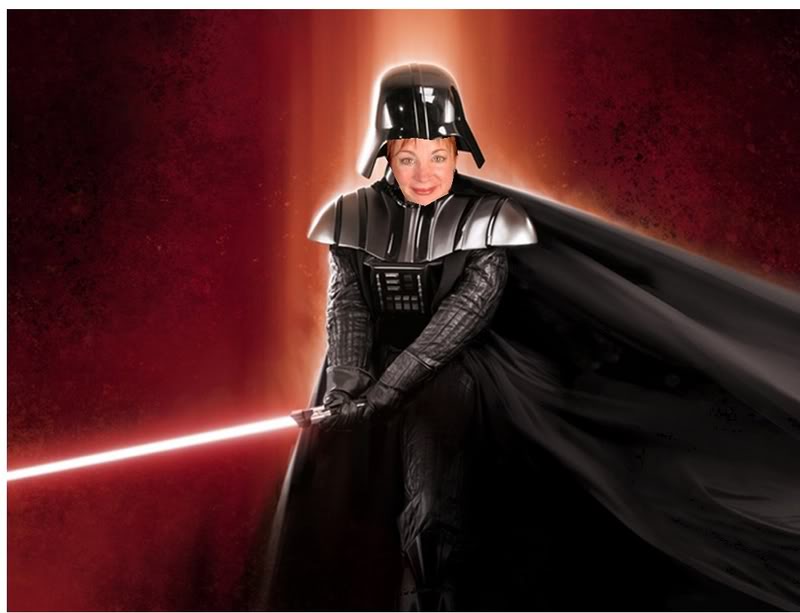

Introducing Jillayne D. Vader

Jillayne asks “How come I always get stuck with the Darth Vader topics?” (see comment 15).

Ummm….maybe you should remove your long black cape! 😉

You go, Girl!