First the graphs…

2018 Home Prices in Kirkland 98033

2018 Home Prices in Kirkland 98033

2018 Home Prices in Kirkland 98034

Category Archives: Housing Market

2018 Home Prices in Kirkland 98033

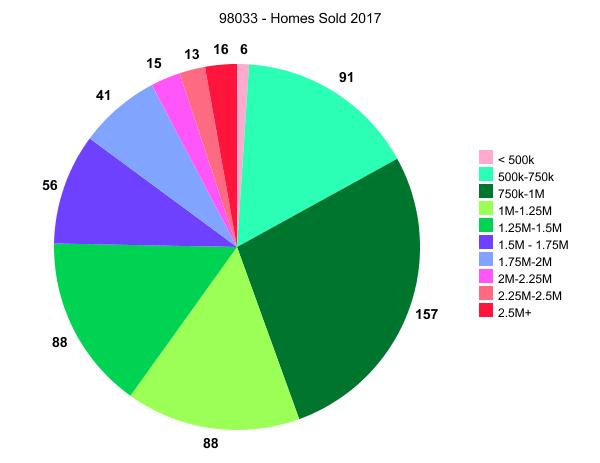

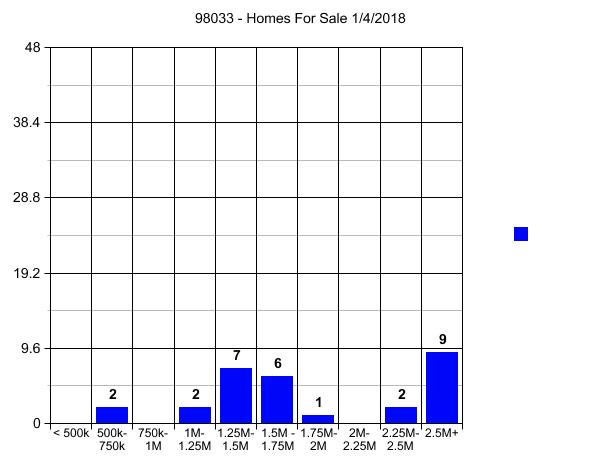

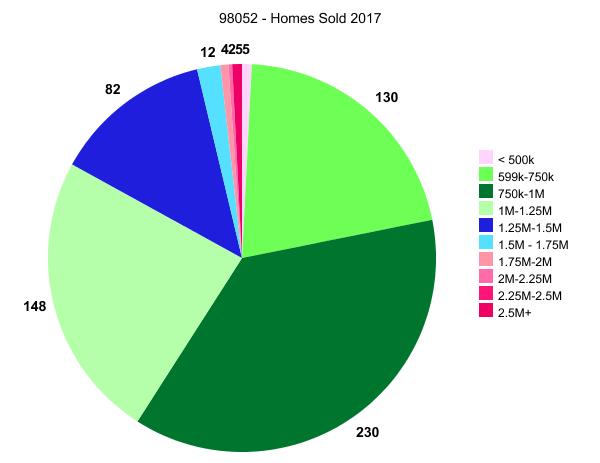

Of course there is nothing for sale, but not unusual for this time of year. The height of the For Sale and Pending graphs is the average # of homes sold in one month based on 2017 sales IF every month were the same. In 2018 in 98033 it will still be the same “what’s new this week” with everything coming on being sold in a week or less unless it is overpriced.

The main reason for me to post these by zip code snapshots this time of year is for people who need to know where they can afford to live. For instance if you want to buy a house vs a condo and you want to spend less than $500,000, now you know that only 6 properties sold in all of 2018 for less than $500,000, so you may be barking up the wrong tree in 98033. I will try to post this same data for the zip codes where I work, today if possible, to keep everything on an even keel.

I have coded the more likely price ranges in green tones, the not likely ones in red tones (but somewhat more for sellers than buyers) in the pink-red and the yes, but be discerning please, are blue.

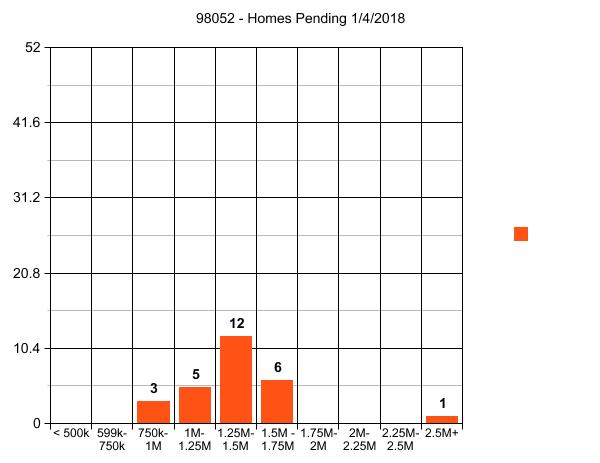

That inventory is non-existent should not be a surprise to anyone. Only FOUR houses for sale under $1.25 Million might be a bit surprising to some and NONE under $500,000 might be a surprise to some before reading this post and viewing the first graph.

The DOW just went over 25,000 this morning and there is no product for sale. Expect another big climb in prices in the first half of 2018.

More Zip Codes to follow in subsequent posts. Some will be Eastside and some will be Seattle, but only in places where I work, so mostly North of Downtown in Seattle plus Shoreline, Kirkland-Bellevue-Redmond, Issaquah-Sammamish and bit of Bothell on The Eastside.

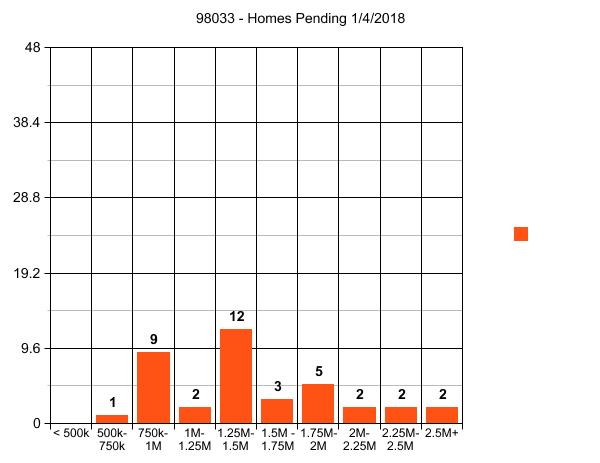

I posted the Pending sales as well so that people can see what recently sold but didn’t close yet. Not quite as bad as the For Sale stats, but still pretty dismal…or GREAT!…depending on whether you are a buyer or a seller.

ARDELL DellaLoggia, Sound Realty – 206-910-1000 cell – ardelld@gmail.com email

Required Disclosure: Stats in this post are hand calculated by ARDELL in Real Time and not compiled, verified or published by The Northwest Multiple Listing Service.

Related posts 2018 Home Prices in Kirkland 98034

Real Estate – Why DATA is the New Black

Early Friday evening one of my favorite long term clients asked me this question: “Why is the market so slow these days? I have an alert for ($) houses in (zip code) and I barely get a couple of hits every week west of (the freeway). Almost always tear-downs.” (actual specifics from his email removed)

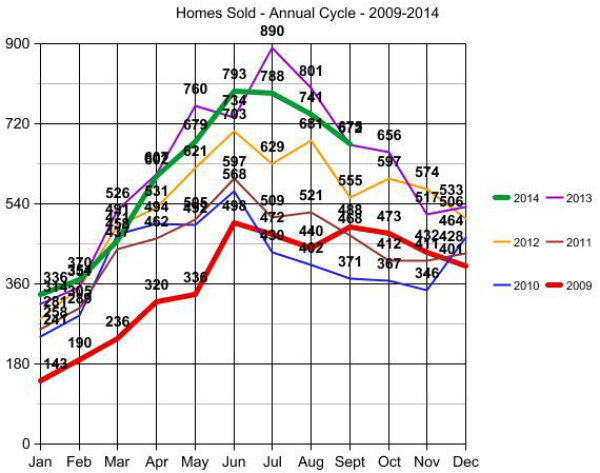

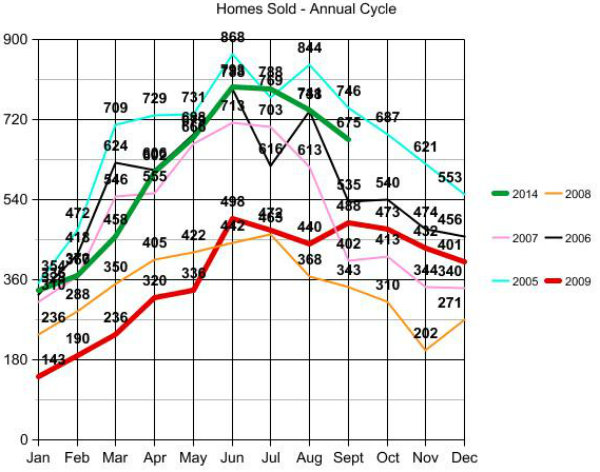

My first data set pulled was a line up the number of homes sold where I primarily work (North King County – North of I-90), by month, over the last 6 years from 2009 to 2014 YTD. This to answer only the first 8 words of his question “Why is the market so slow these days?” The easy answer would be “because it is past October 15th”. I test my knee jerk response by pulling all of the relevant data to be sure I am not answering like grandma in a rocking chair pulling some now irrelevant data from her long term memory bank. I also do this because I need to discover why this person’s current perspective may vary from the long term norm.

Something may recently have happened leading this person to believe that the standard progression is no longer the realistic expectation. I value his thought process as part of how I answer the question…by first pulling the data…lots and lots of data.

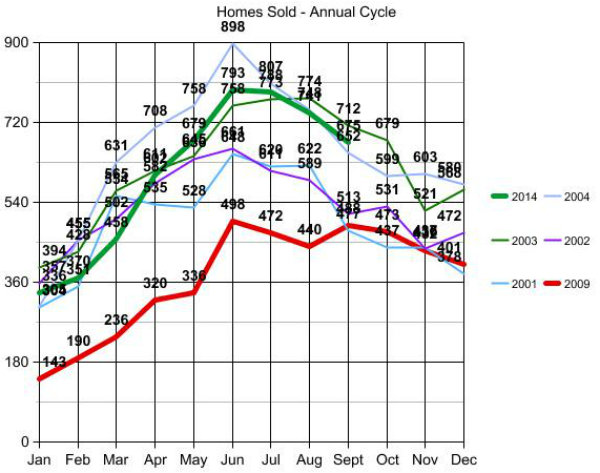

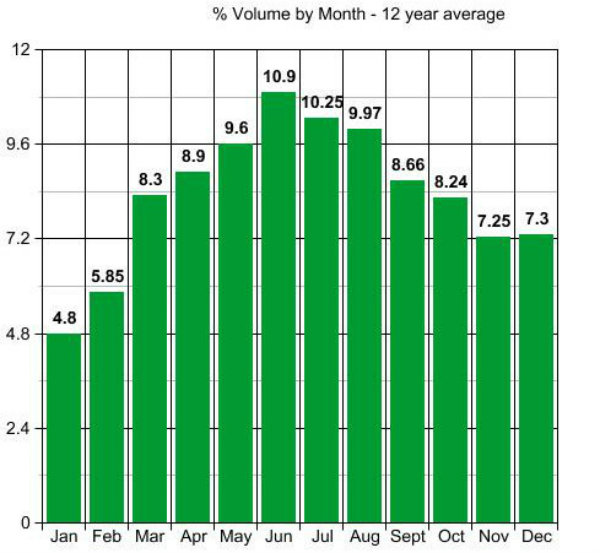

The line graph below documents the data pulled for the last 6 years. But as I almost always do when pulling stats, I went back 12 years because data expires! More on that in graphs 4 and 5. Since I almost never regurgitate already documented data from other sources, but rather only trust the data if I calculate it myself, I usually go back as far as my data source will allow, which in this case was 12 years.

First I test my perception that 2014 is not a low inventory year, even though there are tons of articles saying that inventory is low. Many articles talking about the frustration of buyers with “low inventory”. But look…no…my perception is indeed correct. The red line is the “low” or at least the first half of 2009 depicted in the red line. The green line of this year is not only NOT “low”…it is pretty close to the high over the last 6 years.

To be clear, I am using “homes worth buying” as “inventory” and the proof that they ARE homes worth buying…is someone actually bought them.

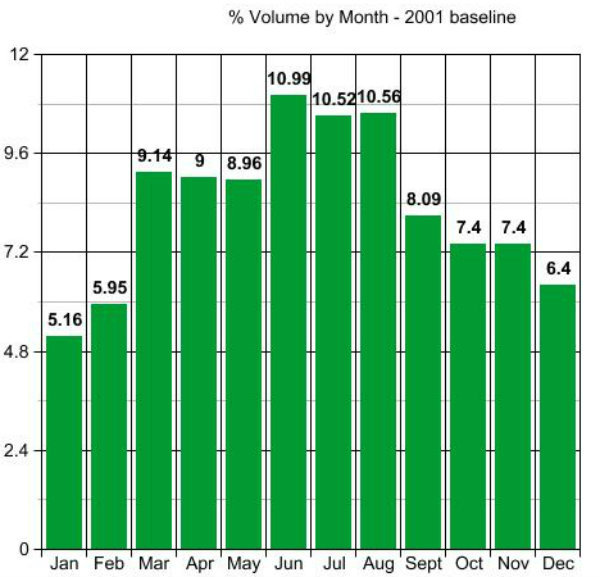

After I peruse some of the recent data as an attempt to start at the point where he may be coming from when asking the question, I dive into my own “expert opinion” perspective, which is my 2001 baseline. This information is really already carved in my brain, but since I turned 60 this year I figure it wouldn’t hurt to double check that my memory is still accurate. 🙂

I actually did all 12 years before honing in on the actual answer to the question, which comes from comparing 2014 with 2013 and 2013 with both 2001 and 2005.

To determine which were the correct comparison years, I had to first pull ALL of the data that the data source would allow.

While yes…my knee jerk answer of “because it is October” would have been correct, by pulling all of the data I can see from the variance of the actual stats from 2013 against the baseline of 2001 exactly why the question made 100% sense from this person’s perspective at the time he asked it.

This person, along with every average homebuyer, is looking week to week over a period of 6 months to 18 months for a home to buy. They have no “baseline perspective”. Their expectations come from more recent history’s actual activity, and rightly so, with no way to tell if the last 6 months was exceeding or under performing standard market expectations.

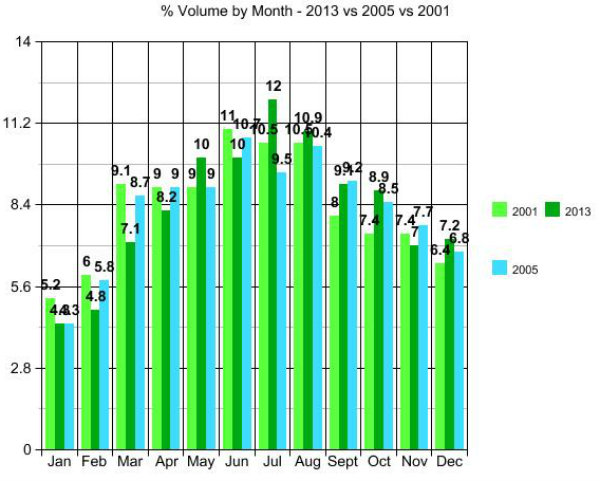

The bar graph below explains where the expectation may come from. I have 2005 in there just because it is the one year over the last 12 years when the most number of homes were purchased (ipso facto “available” to be purchased), so highest inventory year. But the key to answering the question is in the 12% of June 2013.

If you look at every piece of data on this page which looks at all 12 months for all 12 years in 6 different comparative charts…12% of a full year’s total inventory being available to buy in one 30 day period is pretty much unheard of! That was June of 2013.

I had another client who started looking in early 2013 and did not buy the house they could-should have purchased in June of 2013. After that they were progressively and continuously disappointed with the number of homes that came on market for months and months afterward. They had no way to know that the volume of homes coming on market since they started looking were many more than the normal market expectation.

In hindsight every subsequent month looked pss-poor in comparison. Pretty much all activity if you started looking in April of 2013, and didn’t purchase by June-July of 2013, is looking relatively dim. BUT in reality inventory is not dim. Inventory, the number of homes you can expect to choose from, is in fact currently performing at or over market expectations adjusted weekly for seasonality. All this can be gleaned from the 12% spike in that bar graph, noting the rational explanation as to why your expectations may be “off” by comparing relatively recent actual data against 12 years of data comparisons.

Basically that makes us both right. I’m right at “because it’s October” and the person asking the question is right to consider the options dim based on more recent relative comparison.

Posting the data and graphs that helped formulate the above. Worth noting, while I brought forward the Red Line year of 2009 to note inventory low point, the graph below shows that the 12 months of low inventory started in the 2nd half of the gold line of 2008 and proceeded to the lowest point of Jan and Feb of 2009, which some of my readers may remember as “my bottom call” that made front page news at the time.

Looking above and below at the thick green line of 2014 inventory against the high inventory years of both 2004 and 2005 you can easily see why all of the articles calling 2014 low…and actually they were saying that last year in 2013 as well, are simply not true.

While my analysis will continue to use 2001 as a baseline, you may want to use the bar graph below to set your expectations. This is the average good homes on market based on the average of 12 years worth of data.

I use 2001, as many of the variances over the last 12 years are influenced by Tax Credit Incentives coming in and out and artificial interest rate jockyings…not to mention all of the massive changes in loan approval criteria over this same period. For that reason 2001 is still the purist baseline by which to compare and contrast other market influences as they come and go from time to time.

WHY IS THE MARKET SO SLOW THESE DAYS?

Getting back to the first 8 words of the original question…because based on normal seasonal activity you can expect that there will be HALF the number of homes coming on market that are worth buying by December than in May. “coming on market” activity is the month prior to the sold month. So highest SOLD volume in June will = highest number of instant alerts of new listings coming to your phone in May.

Expect the numbers to increase from December through May and then begin a decrease through year end before beginning the next climb.

WHY IS DATA THE NEW BLACK?

Because it saves you time and reduces your stress to DRILL down the data from the general comparisons above and fine tune your actual parameters before you waste any time looking for something that doesn’t exist in the place where you are looking. That brings us to the 2nd and 3rd part of this person’s question ” I have an alert for ($) houses in (zip code) and I barely get a couple of hits every week west of (the freeway). Almost always tear-downs.” (actual specifics from his email removed)”

Only 25 houses were sold using a full $150,000 spread with your $ amount as the cap in the whole 6 months of “high season”. So expecting 2 a MONTH in low season let alone 2 a week…is an invalid expectation. Expect ONE really good one a month from here to February of 2015.

“Almost always tear-downs” means you are looking for a nice home at the price of the land alone. Again an invalid expectation. Changing your price to what that home will sell for there is not an option. Changing your choice of what to a tear down is also not a reasonable option.

The only answer to your dilemma is to change the where and not the price or the what.

(Required Disclosure: Stats in this post are not compiled, verified or published by The Northwest Multiple Listing Service.)

Selling a Home in King County 2014

Selling a home in King County has been fairly easy to do for most people since early 2012 when the market started taking off again. We don’t have the same momentum in first quarter 2014 as we did in first quarter 2013. There are still many more home buyers than home sellers, so supply and demand hasn’t changed much. What has changed is there is not the same sense of urgency to beat out interest rate increases.

In early 2013 interest rates were as low as 3.25% in many cases and there was a lot of talk about them going up to over 4%. They in fact did go up to 4.5% – 4.625% by mid 2013 and no one is talking seriously about them going up further from here to over 5%. So same supply and demand factors…decreased sense of urgency. (chuckling as I just got an email while typing this that rates went down from 4.5% to 4.375% confirming no worries that rates will increase much if at all from 4.5% or at least that worry is not being factored into the market.)

There has been a LOT of confusing talk about “low inventory” for quite some time now and even some recent talk that inventory is improving for home buyers. Not really the case IMO and as you can see from the arguing going on in the comments on that post. Most people are not buying that there are or will be a better selection anytime soon for most home buyers. That is continued good news for sellers and more frustration for home buyers. New on market if priced right…IF PRICED RIGHT the key phrase here, will still sell quickly in multiple offers. So not a lot of change in 2014…just a little less chaos.

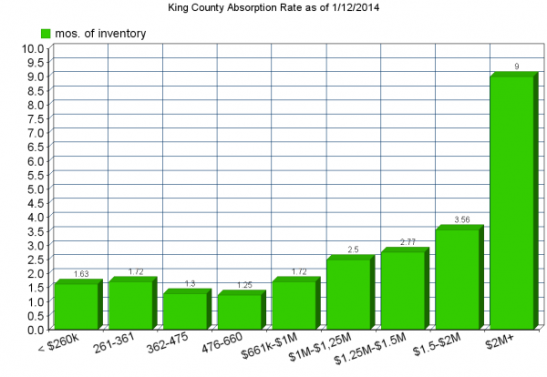

Now let’s talk about how inventory can be UP a bit on an overall basis and still be non-existent for MOST home buyers. The graph below illustrates this fairly well. Until you get to a million dollars, EVERY segment is running at less than 2 months of inventory. I would venture to say that probably 80% of those are homes no one wants…or someone would have bought them, except for the 20% or so that are very new on market and some of those are coming out the gate overpriced as well. Most sellers can still sell their homes in a week or less if they really put the right effort into selling their home, and keep the price at no more than 5% over the comps. So it goes without saying that for most buyers…there is nothing to buy.

As soon as something good that is priced right comes on market…still multiple offers after the interest rate increase to 4.5%. I haven’t witnessed it first hand so far in 2014 given it is early in the year, but that was the case throughout the 4th quarter of 2013, so no reason to expect that to change now. With less than 2 mos of inventory starting out the year, not likely we will get to any type of equilibrium as to sellers and buyers at all in 2014 except in the highest of prices. Even then…not so much in places like Clyde Hill where highest of prices still sells very well. More on that in the third price graph.

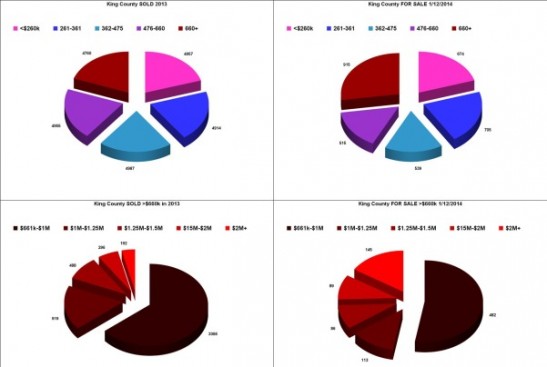

To better understand the absorption rate bar chart and why the price breakpoints appear to be “odd”, see the pie charts below. First using 2013 sold homes I broke the market into 5 pieces. So the first column above represents 20% of King County buyers. Each of the second, third and fourth columns also represent 20% of home buyers.

That puts 80% of buyers in the 1.25 to 1.63 months of inventory range. 80% of people looking to buy a home are looking at less than a two month supply of inventory and in many cases a 2 week to 5 week supply of inventory. Subtract the houses that no one wants…and you basically have NO inventory for 80% of the people looking for homes.

ALL of the last FIVE columns represent a breakdown of only the top 20% of the market. This in an effort to see where the inventory actually starts moving up.

It is not until you get to TWO MILLION and up that you actually see a buyer’s market. Everything up to $2 Million is a Seller’s Market at less than 4 months of inventory and for more than 80% of buyers less than a 2 months supply of inventory. Now let’s drop down to the last graph and check on home prices.

One of the reasons I check the stats at the beginning of each year is to test both my perception and also things I have been hearing and reading.

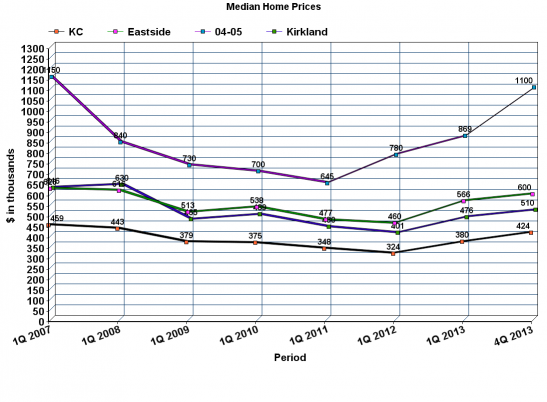

My perception was that Bellevue 98004 and 98005 were taking off like a rocket last year! To check that I added stats for just those two zip codes to my King County median price line graph. It is the purple line at the top with the light blue squares, and yes, my perception was correct. Up way out of proportion to the rest of the market. But the earlier part of the graph also showed a steeper decline which looked like “the bigger they are the harder they fall”. Still…almost back to peak pricing in 98004 and 98005.

The County as a whole also way up toward all time highs. Not quite there, but looking pretty “recovered” for now. As usual I am not really just “writing a blog post”, I am doing my own early work for my business. So in that regard I have to see how Kirkland, Bellevue and Redmond are generally faring compared to the County as a whole.

I need to study what is going on with Kirkland stats. For the Eastside line (green with pink squares) I combined 98033, 98034, 98011, 98052, 98004 and 98005. Not all of “The Eastside”, but a good balance of representation. It might make more sense to throw in more of the Bellevue Zip Codes instead of one of the three Bothell Zip Codes, but you can’t do that if you are going to track prices back to 2007. Kirkland, the blue line with the light blue squares, starts running under the main Eastside line. This because most of the large land mass annexed by Kirkland in 2011 was lower priced than the Kirkland before annexation. You see that dip between first quarter 2011 and first quarter 2012 when the median price went all the way down to $401k.

Considering that dip…for Kirkland to be back up to $510,000 is really quite amazing. I thought maybe the higher priced 98033 was carrying all of the increase similar to the big swing in 98004 and 98005. But not so. I tried to add that line here, but it just made the whole chart too confusing with all of the numbers overlapping. But the amazing part of the increase in Kirkland (which looks like a decrease because of the added properties) is that much of the increase happened in the annexed areas, especially in that part of Kirkland 98034 that used to be Bothell 98011. Back to why I added Bothell 98011 instead of more Bellevue Zip Codes. The later stats for Kirkland would automatically pull in some of what used to be Bothell 98011 prior to 2011, so the best answer was to keep all of 98011 in all the way through.

A little more explanation and graphs including Absorption Rate Data for Kirkland 98033, 98034, Redmond 98052 and Bellevue 98004 and 98005 in these links. Again just stuff I was working on for my own client reasons.

Home Prices Are Coming Down

Home prices are beginning to trail down toward year end with an abrupt 5% decline in the last 30 days.

While we are still at 12% increase for the year following the downturn, this is more than merely seasonal change, in my opinion. Every year has a “Spring Bump” that usually does not sustain at peak levels past June-July. A downturn in August is always expected and the market continuing flat to down to year end is also expected.

What’s different this time?

1) We are coming off a bubble created by home buyers vs home sellers. In 2012 it was a Seller’s Market where home prices were primarily driven by sellers asking more for their homes and the buyers complying with the sellers’ desire. 2013 increases were largely driven by buyers aggressively competing for the same homes. The buyers giveth and the buyers taketh away will be the message of 2013 from here to year end.

2) Mortgage interest rates increased by a full 1% immediately prior to this “seasonal” downtown. How much of this decrease is seasonal and how much is interest rate driven? Difficult to separate that out, but if you go back to reason 1 above we can see the market deflating the bubble created by those buyers who were racing to beat the interest rate increase. The race is over. Yes there are some buyers who are still trying to beat the next interest rate increase, but nowhere near the aggressive level of buying while mortgage rates were still under 4%.

3) The stock markets are dipping at the same time. This is not a small factor. Seattle Area Home Prices often if not always emulate the stock markets. When the stock market is going up and there is a slight downturn in home prices created primarily by seasonal factors..well than you can see it’s simply a seasonal correction. But when we are at the same time seeing stories like Dow Jones – Is the Bull Market Over? and S & P Corrective Phase Could Last Until Early October, we know that the Spring Bump correction phase will likely last until every drop of seasonal push is drained, which is usually October 15th.

We can expect a one week or two week robust period in September, because we always have one for usually no good reason. But the season is over…and then some. 2012 was a good year. 2013 was a year that was too good for sellers and not fun for buyers. 2014 should look more like 2012 than 2013.

Don’t expect anything but down from here to year end.

Selling Your Home – 15 Good Photos

Gone are the days when you can advertise “must see!” to sell your home, as if people have to come into your house as the first step in the home buying process. You can scream that from the roof top all you want, but unless you have a location that would cause anyone and everyone to come to and into your home, it’s all about the photos.

So where do your start? You start with The Three Basics – Paint -Floorings – Clean

Once you have your walls and floors together (see post linked above) you move to taking your “test photos”. Once you know which angles will end up in the 15 Photo Display, then you stage those “photo areas”. because it’s all about the 15 mls photos!

The cost to stage the above townhome was $2,500 BUT I staged it myself within the cost of Listing the home. I used that $2,500 as follows. $1,500 to refinish those now gleaming, satin finish hardwood floors on the main floor and $1,000 to have the place painted. We also put in all new carpet and the $1,000 to paint was for the main pro painter and did not include the prep-tape-helper. I use a painter who let’s me bring the “helper” myself, to save on cost.

Of course there are whole HGTV shows devoted to ALL of the steps that lead to FIFTEEN GREAT MLS PHOTOS.

I just try to give you a snapshot of the process…one blog post at a time. Both of the above homes are recent. The top one closed in December of 2012. The lower photos are of a Pending townhome over in The U-District. The top one sold in 1 day, the lower one in 2 days. The top one took SEVEN WEEKS to get ready for market. The lower one about THREE WEEKS.

So “SOLD IN ONE DAY” took from September 7th to October 25, 2013 to get it ready to list…and sold on October 26th as to Offer and Acceptance. The lower one “SOLD IN TWO DAYS” took from January 6, 2013 to Jan. 26 to get it ready to list…and sold on Jan. 28 as to Offer and Acceptance.

A few recent real life examples…to give you an idea of what it takes to get your house from Day One to SOLD.

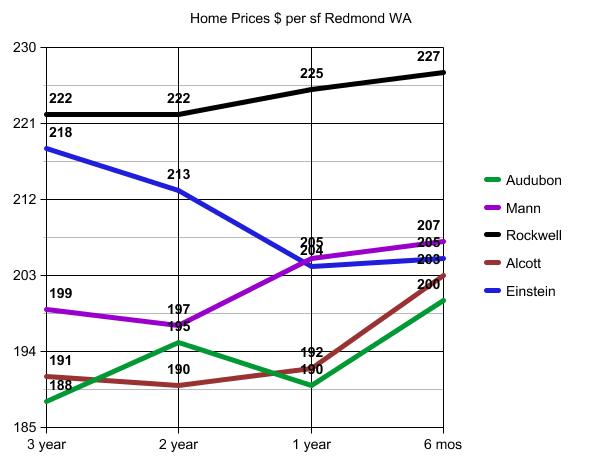

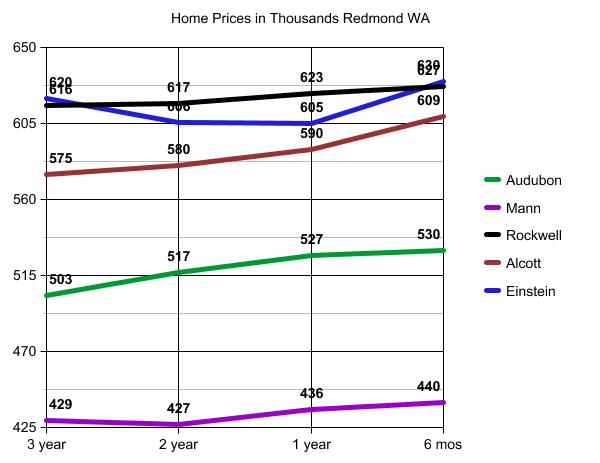

Home Prices in Redmond Washington

I was running some stats the other day for Kirkland, Bellevue and Redmond home prices and the graph below came out a bit oddly, as if all prices are trending to 200 to 207 per square foot. I say “oddly” because some went UP to there while others went DOWN to there.

That is not to say that median home price within these various Elementary School boundaries of Rockwell, Mann, Einstein, Alcott and Audubon are all running together. In fact there is quite a variance as shown in the graph below.

As noted in my original post the numbers are graphed from low to high in this manner vs to start from zero…which would show the flatter market consequence, would not permit you to see the actual numbers one on top of the other, so I caused them to spread more dramatically only for the ease of reading the underlying data detail.

Rockwell Elementary…very consistent as would be expected given its “close in” location to Redmond Town Center and the general lack of new construction of single family homes within its borders.

Mann elementary still one of the best “bargain” areas relatively speaking and when lucky enough to find a good house there like the one my clients purchased between 2 and 3 years ago, within the timeframe of the charts, Mann continues to be one of the best places to get a home at a fair price that is not too far out.

Einstein…well the fluctuation there is greater for a few reasons some of which have to do with the school and some of which has to do with the decline from “new” to “used” and the turnover of homes too quickly back 2 or 3 years ago causing the dip. But looks like it is recovering nicely from all that.

Alcott and Audubon tell the story of people being willing to go a bit further out to get a newerish house, as in not built in the 60s or 70s, with a large yard at a reasonable price. Clearly 98053 and Sammamish have both been the surprise change in market conditions in 2012. Even though “close in” is still preferred, the willingness to go out further for good house and great school like this one my client’s purchased this year with more land than being closer in was definitely a game changer in 2012 for Redmond.

********

Required Disclosure – Stats in the post and the charts and graphs herein are not compiled, verified or published by The Northwest Multiple Listing Service.

On a cumulative and median basis, prices are trending slightly up in the 3% to 6% range. But that is not to suggest that buyers need to panic, or sellers should be getting overly optimistic, as to potential sold prices.

2012 Real Estate Prices

The basic Real Estate questions in 2012 have been:

1) Are prices UP or DOWN, going UP or DOWN…at bottom, in recovery, recovered?

2) Is Inventory low…will it get better…where is the shadow inventory?

To answer these questions I am using data from the Lake Washington School District, as it represents a good mix of all possible “home” types. It also gives you a framework of how to develop a similar snapshot in your area of interest.

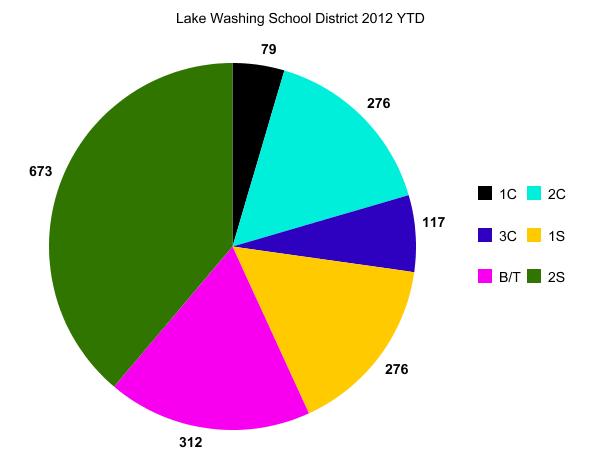

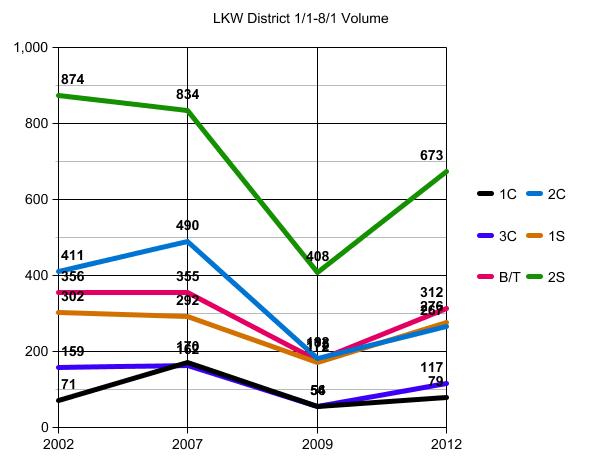

First let’s look at the snapshot of what people chose to purchase YTD 2012.

Key: 1C Black is One Bedroom Condo, 2C Turquoise-Blue is 2 Bedroom Condo, 3C Purple-Blue is 3 bedroom condo/townhouse, 1S Yellow-Gold is a 1 story home, B/T Pink is a Bi-Tri level and 2S Green is a 2 story home with or without a basement.

Let’s add to that some historical perspective to see if those current choices represent a shift of any kind.

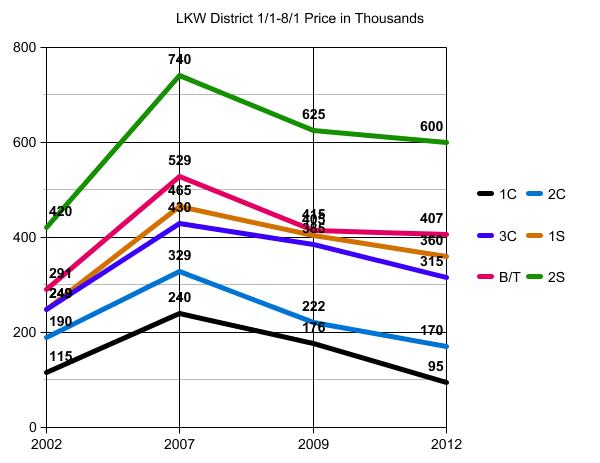

Now we add the impact of price changes on those volume graphs as to what people choose to buy…as prices change.

Back to the original questions…answered by Property Type in the order they are represented as to # of people choosing to buy them.

TWO STORY HOMES

First, let’s be clear as to what a “Two Story Home” is and is not. A two story home is where the children go UP to bed. It is not a 2 level home where the children stay on the same floor as the kitchen when they go to bed or when they go downstairs to bed. I say children as the Master Bedroom can be on the main floor in a two story home. A 2 story home can have a basement or not and in the graphs above these homes are represented in GREEN.

The 2 story home is by far the majority preference, if one can afford anything they want.

Prices have been pretty stable since 2009.

Prices are down roughly 19% from peak pricing.

Volume is pretty much fully recovered given we don’t expect volume to reach “zero down” levels.

Shadow Inventory is in 2 places for the 2 story homes.

First there are the homes ON market that are simply overpriced. Technically you have a 3.65 month supply currently “For Sale”, but only a one month to 1.5 month supply that is actually priced to sell based on current pricing. I’m being generous there allowing for homes to be 10% over where they need to be. A full 60% of 2 story homes for sale are priced at more than 10% of where they need to be…or above 110% of the price at which they will actually sell. These stay “in the shadows” and are basically invisible to those who are buying homes, until they have a price change.

Second are the homes that were bought in volume between 2002 and 2007 that are either underwater or just not yet offered for sale by the people who bought them. About half of those homes will come into the market in dribs and drabs over the next 3 to 5 years. Some will be short sales and foreclosures. Others will simply be homes bought from 2002 through 2006 or so that are not underwater. We don’t expect to see a huge surge of those coming on market all at once, so they should not impact the market by a large amount at any one given time.

Part of the reason for the decline in volume is that builders have shifted over to Northshore School District and Issaquah School District, due to the lack of available land. That probably won’t change in the near future.

TWO BEDROOM CONDOS, B/T SINGLE FAMILY HOMES & 1 Story Homes

Interesting that these three segments represent about the same market share as to real estate purchases overall.

The B/T Single Family Home is a Bi or Tri Level Home. It can be a one story with basement, a split entry or a tri level…sometimes a “multi level”. It is represented as bright PINK in the charts above.

Pretty much fully recovered as to volume, given they are not building more of these.

Prices have really leveled out well at 23% under peak pricing.

I don’t expect much MORE Shadow Inventory to come out of this class of housing that is not already ON market, but overpriced. A FULL 75% of these homes are on market…as overpriced…by a LOT.

The One Story Home has not yet settled into to a recovered position!

Still falling in both volume and price.

The Two Bedroom Condo is in the same boat.

Look at the 2nd graph and you will see these three housing segments, PINK, TURQUOISE & GOLD converging pretty much at the same point in 2009.

It’s important to note that there will be continual shift here for some time to come. When people can buy a B/T home for the same price as a 1 Story home…the 1 Story home suffers. Mostly due to the extra basement square footage in a B/T home. The 2 story condo taking the same place on stage is surprising…and being caused by the stability in price of the 3 bedroom condo-townhome.

LOTS of Shadow Inventory in the 2 Bedroom Condo and prices have much further to fall.

The 3 bedroom condos…mostly townhomes…are hard to call. They are running too close in price to the Single Family Home and way over the price of a 2 bedroom condo. I would have to say they are going to fall until they are closer to the 2 bedroom condo price than the Single Family Home price. But that’s a rough guess.

No Surprise…the One Bedroom Condo is dropping like a stone. They were pushed up in value and favor back when everything else was priced out of reach. For the most part people are just holding them as rental properties. LOTS of Shadow Inventory here, especially the underwater newer ones.

SUMMARY: The 2 story home and the Bi and Tri level homes have pretty much recovered and should stay relatively stable. Everything else has a long way to go before they have settled at a bottom as to both volume and price.

To determine where all that might be headed you might ask yourself these questions.

Looking at the price of a 2 bedroom condo at $170k and the price of a 3 bedroom condo at $315k…which would you buy? Is ONE additional bedroom worth an extra $145,000??? Probably not. That is what is holding up the pricing on the 2 bedroom condo, and why the 3 bedroom condo or townhome has further to fall.

Same goes for the 1 story home and the 3 bedroom condo-townhome. At some point the 3 bedroom newer townhome is winning over an old 1 story house without a basement…for other people not. These two have yet to come to an appropriate balance.

That’s it for now. The market should slow down a bit now that we are at 30 days to school starting. That is only as to new contracts and not August Closings. A good roundup of where we are…until we have the 4th Quarter results. in.

Everything should drop from here a bit and the big question is…Will the year END higher than it began?, and if so…in which market segments.

********

Data in this Post and the Graphs is not Compiled, Verified or Published by The Northwest Multiple Listing Service. The dates used per year are from January 1 to August 1 in each respective year.

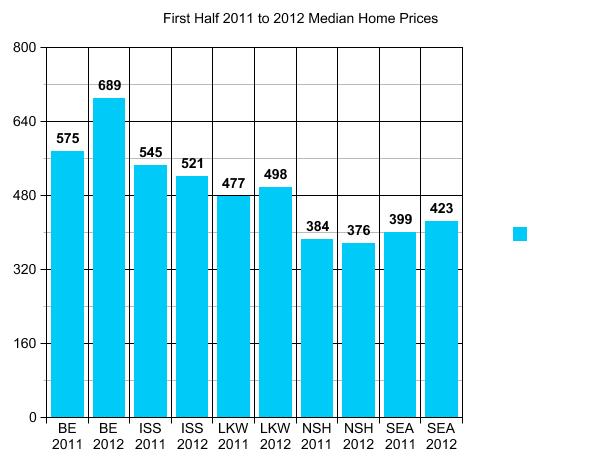

2012 Median Home Prices UP…and DOWN

Single Family Median Home Prices are UP 6% YOY for the First Half of 2012 in Seattle.

First Half 2011 @ $399,000 – First Half 2012 @ $423,000

Bellevue School District is the Big Winner at UP 20% with a Median Home Price of $689,000.

Issaquah School District DOWN 4%, Northshore School District DOWN 2%

Lake Washington School District UP 4%

Median Home Prices for First Half of 2012:

Bellevue School District: $689,000

Issaquah School District: $521,000

Lake Washington School District: $498,000

Northshore School District: $376,000

Seattle School District: $423,000

Northshore School District has become a pretty good buy lately, given many of the schools have shot UP in the rankings and the median Home Price is by the far the lowest in the mix.

********

Required Disclosure: Stats are not Compiled, Published, Verified or Posted by The Northwest Multiple Listing Service.

********

ARDELL 206-910-1000 ardelld@gmail.com ARDELL DellaLoggia, Managing Broker, SOUND REALTY

How to Buy a Home Stress-Free in a Seller’s Market

There is a lot of evidence out there, both statistical and anecdotal, that it’s a “seller’s market” in the Seattle area. And that is consistent with my own experience as well. The best example? (Or perhaps worst, since this post is from a buyer’s perspective…) I helped make an offer on a home in Mount Baker, the proverbial “tastefully updated bungalow” with lots of nice features. And it got quite a bit of interest. How much interest? Oh, only 13 pre-inspections, 10 offers, and a final sale price 20% over list. POW! Talk about getting punched in the mouth.

In other words, a bidding war. These situations are emotionally trying for any buyer, and are simply too stressful for some. So what to do if you’re a buyer who has no interest in a bidding war?

Tailor your strategy accordingly. First, don’t even look at a listing until it is at least 14 if not 30 days old. At that point, the odds of a bidding war drop dramatically. You are much more likely to have one-on-one negotiating that allows you to keep control over negotiations and gives you the ultimate ability to either buy the house or not.

But that leads to the next, and much tougher, question: How the heck do you find a good house in this market if you only look at old listings? Admittedly, it’s a challenge, but not impossible. First and foremost, don’t just rely on the pictures in the listing to determine if a house is worth a closer look. For whatever reasons, some agents don’t do the best job with the pictures. So don’t think that the pictures necessarily reflect the true condition, layout, and overall “gestalt” of the house. Instead, look for possible homes primarily by neighborhood, space/size, and price. Compile your list, and then go have a look in person regardless of what you might think from the pictures. Yes, you’ll end up touring more homes, but that’s the only way to find that “diamond in the rough” that will work for you but won’t give you a heart attack when making the offer.

Refusing from written papers and using our service you will notice a significant difference in the papers received. You will not have to change them anymore because the papers sent by us are unique, original and contain no mistakes or plagiarism. You will have an opportunity to get to know about all advantages of cooperating with us after placing your first order. So, don’t hesitate, register and place your first order!