Not every client asks me where they SHOULD live. But the question comes up from time to time, and often from family members who are considering jobs in more than one city.

I am answering a more complex one for a family member who hopes to purchase a home vs rent. Scenario is they are graduating with an RN and looking at:

Los Angeles $82,000 Salary

Seattle $74,000 Salary

Colorado $71,000 Salary

The issue when people ask me is usually whether or not the salary differential makes up for the difference in the cost of the housing in various places. The offered salary is $11,000 more in Los Angeles than in Colorado, but does that compensate sufficiently for the difference in housing cost? In the past the scenarios presented to me were about renting vs buying, and often the differential did make up for that difference in rental cost. But when someone is buying vs renting…not necessarily the case.

In this particular example I am looking at Entry Level housing, VA Loan with zero down and a family that already has two children and is planning to have more children. So I need at least 3 bedrooms on this entry level housing.

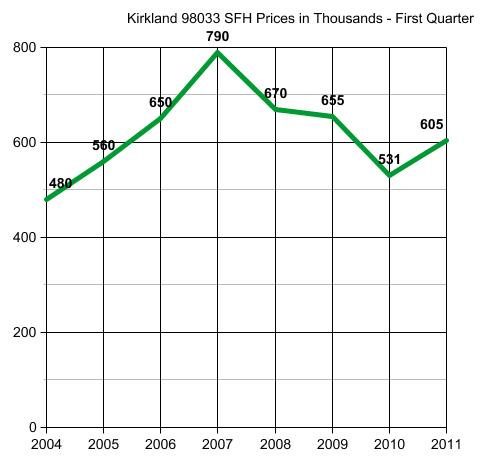

Starting with “Seattle”…I know that the person is interested in The Eastside Cities of Kirkland, Bellevue or Redmond. For this “entry level” example, I am going to use a home that closed on Wednesday for one of my buyer clients BUT putting in the loan scenario of the family member of mine who is asking the question.

Price SOLD is $355,000. Plenty of space and yard for a growing family. Cul de sac lot. Could use some updating, but no expensive fixes needed. Had one owner for 44 years since it was built, in 1967. A good indication that a family can live there indefinitely without needing to upgrade to a larger home.

Now we’re matching this home purchase up to the above RN Salary for “Seattle” of $74,000 for the person asking the question, vs the person who actually bought it the other day.

First we’ll use the “rule of thumb” of 3 to 4 times annual income for the loan amount. That would put the loan, based on $74,000 Annual Income, at $222,000 to $296,000. A little short based on Zero Down for this home.

I’m going to move this WA scenario over to a home I sold in Mt. Lake Terrace that is a similar home, big lot, with a one car vs two car garage, but that sold for $250,000 vs $355,000. Edmonds School District. A reasonable example for Mt. Lake Terrace or Brier.

Now we go back to our 3X to 4X Gross Annual Income “rule of thumb”. and we can fit $250,000 into that $222,000 to $296,000 equation without approaching the upper limit. NEXT we go into the actual real detail of payments, which isn’t worth doing if the Rule of Thumb = No Way, Jose.

Conservative numbers put monthly housing payment, whether that be rent or mortgage payment, at 28% of MONTHLY GROSS income. VA guidelines are usually 40/40 ratios, allowing people with no debt to put the entire debt budget on home. This Family is a Zero Down…but also a Zero Debt, so they can go somewhere between 28% and 40% as the housing payment.

I am not a Lender…so you have to check the ratios with an actual lender before making offers, but since I don’t recommend going to 40% on housing payment even if you have no debt…as you may incur debt at a later point, let’s proceed.

This family would have ZERO Closing Costs on the above $250,000 scenario as they can be included in the price with a Seller and/or Agent Credit to cover the Closing Costs entirely. So we don’t have to factor in Closing Costs on the WA scenario. That will change for the other cities.

Rates are very low today…too low to use for this scenario, so I’m going to pump the rate up to 3.75%. We are going to stack the VA Funding Fee on top of the price for Loan Amount and Payment purposes. That amount is $5,375. It can be fully or partially paid as part of the Closing Costs, but let’s assume a stack on this one taking the Loan Amount up from $250,000 to $255,375 at 3.75% is . Property Taxes are $250 a month. Homeowner’s Insurance is $50 a month.

NOTE: There are different VA Funding Fee rates for different scenarios. Putting 5% vs ZERO down can reduce the Funding Fee by almost 2%. I have used a rough scenario based on the person who asked the question. These Funding Fee rules change from time to time, are different for Refinance vs Purchase Loans, whether you were in Regular Military or National Guard and whether it is a 1st time or subsequent use of the privelege. See your local lender for specifics.

OK…back to the payment on the $255,350 Loan Amount at 3.75%. $1,182.57 for the Principal and Interest plus $250 for RE Taxes plus $50 for Home Insurance (Fire, etc.) gives us a monthly payment of 1,482.57. That happens to be pretty close to what the home would rent for, probably less than rent for this style of home in other nearby places like North Seattle or Lake Washington vs Edmonds School District. Not sure about Northshore School District, which would also be in the mix as to Bothell homes. But all in all, a good basic scenario.

Back to $74,000 Salary in WA and $1,482.57 a month housing payment. $74,000 Annual Gross Income divided by 12 gives us $6,166.67 Gross Monthly Income which puts $1,482.57 a monthly PITA at 24% of gross. At 40% of Gross Income the monthly housing allowance would be substantially more at $2,466.67. $2000 a month PITA would be a loan amount of $430,000. hmmmm.

Let’s go back to the Rule of Thumb. $430,000 is 5.81 X Annual Income vs 3 to 4 times Annual Income. Low Interest Rates do impact this rule of thumb issue, but still…going over 4X Annual Income just doesn’t look right.

Let’s go back to the first house at $350,000. That payment would be $1,679.41 plus taxes of $330 a month plus insurance of $75 a month would be $2,084.41 a month or 34% of monthly gross income. That’s really enough to spend on housing, and likely appropriate in this case as we are only using one income at an entry level salary. So the payment will become more affordable with some supplemental income from the other spouse and future raises.

So let’s say either of the above examples will work…as well as something in between.

That’s the hard part. Now let’s throw up a $250,000 home and a $350,000 home in Colorado in the Cities of preference as noted by the person asking the question.

Most Every Home in Parker Colorado fits the bill. No problem there. So Parker Colorado, even at a few thousand less in Salary down from $74,000 in WA to $71,000 in Colorado…very easy to get a house for $300,000 give or take.

This big 5 bedroom, 3,200 sf home in Parker is listed at $314,900 and there are plenty of others to choose from. Easy to see why Parker Colorado made the list of options.

Castle Rock, another choice in Colorado, is even lower priced. This new 3,530 sf new home is listed at $288,000. But Parker doesn’t seem so far out of the way, and is plenty affordable.

That’s all I can say about Parker and Castle Rock Colorado, as I don’t know the area at all. It works, so it would depend on the salary offers in the various locations. WA works. Colorado works. Now to L.A.

We have a bit more room here, as the salaries are higher by $10,000 or so as the average. Using the same 34% of Gross I used above vs the 40% allowance, and using $82,000 as Gross income is $2,325 for housing payment. Let’s use $1,900 after taxes and insurance. That gives us a home price of $400,000 allowing the extra $10,000 for VA Funding fee on top of the mortgage.

What does that buy in L.A. in the specific areas of interest?

It doesn’t buy us anything in Walteria, one of my favorite not too Ritzy places. 🙁

It doesn’t buy us anything in Redondo Beach, even when I throw in 3 bedroom condo-townhomes.

There are a few in NW Torrance that would work, but they are short sales, so not sure if that price is reflective of “the going rate” for the area.

This 3 bedroom 2 bath, 1,468 sf home at $365,000

This house looks nice, but you can see a huge electrical tower behind the house.

Obviously L.A. is not as doable as WA or CO, so the salary difference would have to be higher. If the salary offer in L.A. was double that of WA and CO…well we can revisit this. But for a small difference…may not be worth it.

Let’s find an L.A. house and work the salary backward.

Well…I can’t find any for sale BUT the GOOD NEWS is I did find a few in Redondo Beach that SOLD. So the answer is there are a few…but the sell very quickly.

This one sold for $419,000. It’s only 914 sf though. 3 bedroom, 1 bath, but small. Nice sized lot and yard though…and it is warm and sunny enough to be outside most of the time year-round, unlike WA and CO.

This 3 on a lot sold for $410,000. Nice Street. 1,612 sf with 3 bedrooms and 2.5 baths.

BOTTOM LINE: All three are potentially doable…enough so to put out resumes in all three areas and see what kind of offers come in. WA is probably the best option for several reasons. L.A. is doable IF the salary offered is high enough…OR…if you rent for a bit until the salary improves by raises. Parker vs Castle Rock is probably an excellent option. Depends on how close to the actual work site they would be.

The purpose of answering the question “Where Should I Live?” is not to really answer the question, but to give some food for thought. There are some other considerations like schools and safety, but I already know the not Colorado options well enough to factor that in and the Colorado Cities seem to have pretty much ALL good schools. There are a couple of exceptions in Castle Rock, and I still prefer Parker for several reasons, but most Castle Rock Schools are pretty darned good except for one or two.

Shooting this link to the person who asked the question. Hope it helped someone else with the general “thought process” and work through format. No matter where your thoughts travel as to “Where Should I Live?”, it’s not to hard to do a comparison based on Salary Differences and Home Price differences. The cheapest homes are not always the best choice…nor is the highest salary.

Of course I’d have to say WA vs CO, but to compete, I’d have to throw in a nice looking house for $350,000 in Duvall. 🙂

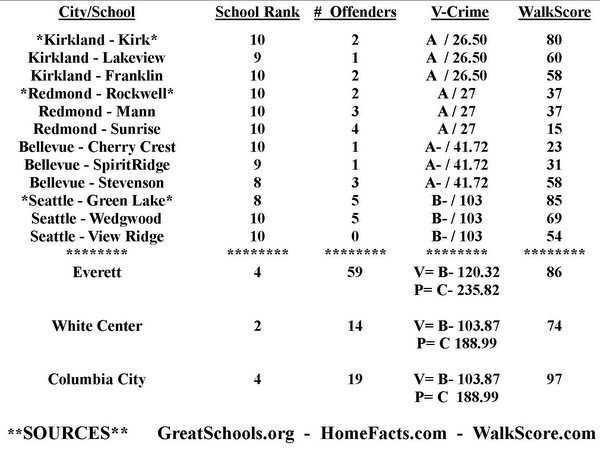

I am very happy to report yesterday’s news that WalkScore has added a crime overlay, something I have been asking for since WalkScore first came about.

I am very happy to report yesterday’s news that WalkScore has added a crime overlay, something I have been asking for since WalkScore first came about.

Many parents or “to be” parents use School Rankings as part of their Home Search Process, and I generally support that wholeheartedly. BUT something is amiss!

Many parents or “to be” parents use School Rankings as part of their Home Search Process, and I generally support that wholeheartedly. BUT something is amiss! Lots of people want a NEW Construction home, the same way they want a new car vs a used car. However starting the home buying process at “I want NEW” is just as wrong as starting the home buying process at “I want a foreclosure”.

Lots of people want a NEW Construction home, the same way they want a new car vs a used car. However starting the home buying process at “I want NEW” is just as wrong as starting the home buying process at “I want a foreclosure”.