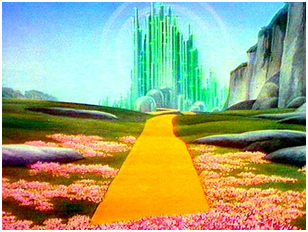

The yellow brick road heading into the Emerald City, has finally lost its shine and turned to stone this past week. If the combined dreariness of fall in the Northwest, Wamu’s funeral, and the Seahawks SLOOOOW start wasn’t enough for us to ask for Lexapro during our next doctor’s visit, the latest batch of bad news certainly is.

The yellow brick road heading into the Emerald City, has finally lost its shine and turned to stone this past week. If the combined dreariness of fall in the Northwest, Wamu’s funeral, and the Seahawks SLOOOOW start wasn’t enough for us to ask for Lexapro during our next doctor’s visit, the latest batch of bad news certainly is.

No sooner than the venture capitalists sound alarms bells and implore startup CEOs to save cash, slash costs, & stay alive, two of Seattle’s Real Estate 2.0 giants, Redfin & Zillow announce workforce reductions.

Zillow announced at 25% cut on Friday, while Redfin announced that it had laid off 20% of its employees last Monday. Granted, it wasn’t like things were much better in the Real Estate 1.0 world. My NWMLS database’s member table has about 3,000 fewer records than a back up from last year did. But it’s another sign that everybody expects a long & cold winter ahead.

If you were one of the few that got axed, I wish you luck finding your future life, beyond the yellow brick road.