This is Part Three of a series of articles on the foreclosure process.

This article does not constitute legal advice.

Foreclosure laws vary from state to state.

Homeowners in financial distress should always hire legal counsel. Call your local state bar association for a referral. Reduced or free legal aid may be available in some states. Ask for a referral from the state bar association or through a LOCAL HUD-Approved Housing Counseling Agency.

Loan modifications are becoming quite fashionable at the moment. With underwriting guidelines continuing to tighten, some folks facing financial distress and possibly foreclosure may not qualify for a refinance at the retail level, meaning, going back to the bank, credit union, or mortage broker that helped the first time around.

At the present time, loan modification salespeople are completely unregulated. This means a person can be working at Taco Time in the morning and selling loan modifications in the afternoon. This is similar to the situation with unregulated loan originators during the real estate bubble run-up. Advertisements that say, “Earn Six Figures. No Experience Necessary” are now making the rounds in the mortgage lending community. (Don’t believe me? Go to craigslist jobs and do a search under “loan modifications.” Current ads are saying: Make $15,000/month and Make $5,000/day). For the consumer, this means you are once again in the one-down position and it brings me great unhappiness to tell you that at this time you cannot and should not trust your loan modification salesperson. This problem stems from the unfortunate situation LOs face as their six figure income dried up during the subprime meltdown but their desire for a six figure lifestyle is still around. This is a systemic problem that our government regulators seems uninterested in addressing at this time. I’m predicting mass government intervention in foreclosures anyways. Perhaps the government is not worried about loan mod salesmen because they’re going to whack them with a big ugly stick quite soon.

In the meantime, we’re stuck with loan modification salesmen. The author of this blog post is of the opinion that consumers should be extremely wary of salemen asking for an upfront fee, even if they are claiming that all or most will be refunded if the modification should fail to be approved.

A loan modification is a good choice for a consumer whose financial distress is such that they are currently unable to pay their mortgage, prefer to stay in the home and not sell (I’m assuming owner occupied property), WILL be able to pay if the loan were modified at a lower interest rate or longer term, and the homeowner is able to fully document income and assets. The idea here is that it’s in everybody’s best interest to keep the homeowner paying the mortgage, even if it means lower bank earnings. (For other options, see part 2 of this series.)

Terms

Common loan modification terms include fixing the interest rate at a lower amount for a short period of time. 3 years, 5 years, 3 years with a gradual, stepped-up interest rate after the third year, longer amortization times such as amortizing the loan over 40 years instead of 30, are very common. Voluntary, principal balance haircuts offered by your bank are not common at this time, unless you are working with an attorney or an aggressive, pit-bull non-profit housing counseling agency. Before you think that a loan mod is the answer, take a long time to consider how much interest you’ll be paying over the life of that 40 year loan. If you’re thinking “I can just refinance later” there are many people who now have a foreclosure in their recent past, who were given that same sales pitch in 2006.

Past Predatory Lending

If you were a victim of predatory lending, your attorney can use the evidence to extract better terms for your loan modification. FIND YOUR ORIGINAL LOAN DOCUMENTS from the last time you refinanced or purchased the home: The original disclosures and then the final disclosures you recieved when you signed papers during escrow. If you cannot find them, call any local title insurance company. Give them your address. Ask them to pull the last deed recorded against your property. On that deed, the title company’s order number will be hand-written in the margin. Call that title company, ask them to pull your file, and to tell you who the escrow company was that handled your file. If your escrow company went out of business, your state department of financial institutions will have information on where those files are now.

State or Federal Law Violations

If your loan originator violated any state or federal laws when originating your loan, an attorney will be able to spot this information, which becomes extremely valuable when hammering on your lender to offer you the best loan mod terms, or to even bring action that will slow down the foreclosure process, buying you more time.

Process

Loan modification salesmen do nothing except collect a finders fee for finding and delivering you to the people who really do the work. The loan mod company will ask you to assemble a wide variety of documents similar to when you applied for the mortgage loan. Unless you went “stated income” the first time around. This time it will be different. Common documentation required includes two years of tax returns, two to six months worth of bank statements, 2 years of w-2s, paystubs for the last 4 months, a list of assets and liabilities, and a household budget showing the amount of money you CAN afford to pay on a monthly basis. The most important things lenders must analyze are 1) determining that the homeowner has zero assets/money in the bank and; 2) the homeowner’s ability to pay the modified payment. There will be a worksheet to complete in which you will lay out your monthly budget. This is the tricky part. You’ll have to prove that you cannot qualify to repay your current mortgage but that there is enough income coming in to qualify for a modified loan.

Legal Counsel

All loan modification candidates should retain their own, LOCAL legal counsel. Loan Mod salesmen will tell you that attorneys will cost thousands and thousands of dollars. In one letter, the salesman is saying that attorneys will charge tens of thousands of dollars. Wow. I’m scared now. I’m so scared that I polled a handful of local attorneys and found that loan modification charges range anywhere from $1500 to $2500 depending on how many liens there are against the home. In contrast, loan mod salesmen are charging anywhere from $3500 to $5000 UP FRONT and they use “a pool of attorneys” in god-knows what state. If you can’t do the math on that, then it’s time for you to think about renting.

Questions to ask a loan modification salesmen

1) What is your fee and how is it split between you, the loan mod company, and the attorney?

Failure to answer this question in a swift and forthright fashion is a big giant red flag.

2) What will YOU be doing for the fee you earn?

Listen to the answer very carefully.

3) What will the loan modification company be doing for their portion of the fee?

This question will typically be answered like this “They process the paperwork.” Now repeat question 2.

4) May I talk directly with the attorney?

If the answer is no, find a local attorney.

Finding a local attorney

Use your favorite search engine to find your local state or county Bar Association. Look for their “Attorney Referral Service” and seek out a real estate attorney or a consumer protection attorney. Make an appointment with a local attorney that you can talk to face to face. Trust me on this. Interview at least two if not three local attorneys. All may have a varying range of fees. Compare them with the loan mod salesmen’s fee.

Selecting a licensed loan originator to help you

In some states, it is not even possible for a loan originator or a Realtor to collect a fee for loan modification services. In Washington State and elsewhere, loan originators who work for a mortgage broker owe fiduciary duties to their clients. They are able to charge a fee-for-service (provided the fee is disclosed prior to the work being performed.) Loan originators who are still left in the business as of this writing, are generally likely to be somewhat more competent than Taco Time/Loan Mod salesman. But I am making an overgeneralization. A licensed LO has at the very least a nominal background in computing debt-to-income ratios and gathering documents. At this time, there are approximately zero loan orignators who have accumulated some experience performing loan modifications. This is because nobody needed one up until about the year 2008…..the industry just refinanced you over and over again. If you select an LO who owes you higher duties, you are more likely to select someone who is conscientious of these higher duties because if you are not well-served, the LO now holds higher liability. Fiduciary duties means that LO MUST put their client’s interests above their own interest in making a buck. They must set aside self-interest and work on behalf of you. Hiring a loan originator to do the paperwork-gathering seems reasonable. The loan originator MUST hand off your file at some point to an attorney. Consumers, please demand that the attorney be local. A fiduciary may not engage in secret fee-splitting deals. The fiduciary owes the highest degree of honesty and good faith to the consumer. The LO/fiduciary has a duty to answer you honestly about how much of the fee goes to the LO and how much will go to the attorney. A good scenario is to hire the LO/fiduciary to do the nominal processing work, for which you would pay a nominal “paperwork processing” fee and then pay your local attorney separately.

Working with Non-Profits

A HUD-Approved Housing Counseling Agency can help homeowners obtain a loan modification at no cost.

DIY

Lenders charge zero to perform a loan modification. If you’re an adventerous type that does not need hand-holding, call your lender direct in order to begin your loan modification. I still advise hiring a local attorney to review the lender’s loan mod paperwork with you.

Currently, 40 to 50 percent of all loan modifications are re-defaulting. This is astronomically high and will translate into higher bank losses and lost time for the homeowner to begin rebuilding his or her credit rating. This means some folks may simply need to re-enter the housing market as a renter. In part 4 of this series, we will discuss what it means to start rebuilding after foreclosure and in part five we’ll tackle what is surely ahead: massive government intervention.

Part one: Foreclosure; Losing the American Dream

Part two: Options for Homeowners Facing Foreclosure

Part three: Loan Modifications

Part four: Government Intervention in Foreclosure

Part five: Foreclosure; Letting Go and Rebuilding

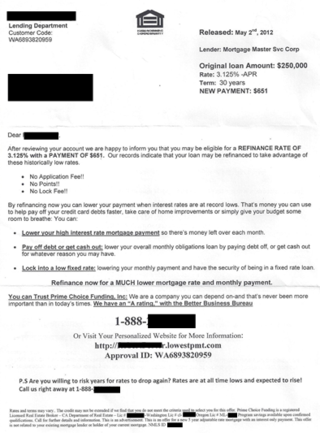

I just published about junk mail that I received on my blog… but it doesn’t even compare to the piece of garbage we received in the mail today. In fact, it was so bad, that I decided to call them to learn more about their services.

I just published about junk mail that I received on my blog… but it doesn’t even compare to the piece of garbage we received in the mail today. In fact, it was so bad, that I decided to call them to learn more about their services.