Homebuyer Tax Credit closing date extension has passed both houses and is awaiting POTUS signature, which is expected to happen today. A homebuyer still had to be in contract by 4/30/2010, but the deadline to close as of yesterday will be extended to by 9/30.

Author Archives: ARDELL

Can Seattle Home Prices Drop “Another” 22%?

Can Seattle Home Prices Drop Another 22% was a question raised by many here in the Seattle Area, after Zero Hedge posted the Goldman Sachs forecast for Major Cities showing Seattle at a 22% drop by year end 2012. After calling for modest to almost no declines in several major cities, Goldman predicted a 22% drop for Seattle with the 2nd highest drop being only 12% in Portland, and even a 7% gain for Cleveland Ohio and a 5% gain for San Diego. That would put Seattle at minus 27% compared to San Diego for the same period.

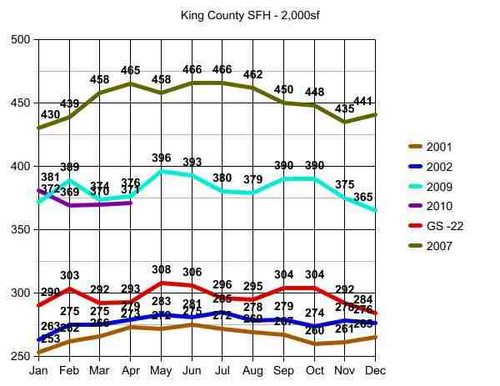

You can pick up Goldman’s rationale or lack thereof in that first link, we’ll stick to how likely it is that Seattle could drop “another” 22%. First let’s take a look at where a drop of that size would takes us, in the graph below.

Important to note that I made a slight modification of the raw data for the graph above to account for modest home size variances, equalizing the data as to size of home or price per square foot. The closest rounding point was a median sized home of 2,000 sf. The data is in thousands, so top left in January of 2007 would be $430,000 median home price for a 2,000 sf home and bottom left would be $253,000 for a 2,000 sf home in January of 2001.

I posted a full chart of all of the raw data for those who want to create their own charts and modifications showing actual median home prices for the years in the graph above, median square footage of homes sold in each 30 day period and the # of homes sold. This is for Single Family Homes vs. Condos and King County vs. Seattle Proper.

Back to the graph above in this post. The top line is Seattle Area Peak in 2007. The turquoise and purple lines are “where we are” in 2009 and 2010 without significant difference except for seasonal variances in that 18 month period. I ended these graphs and the data at April 30 2010 due to the switch out of mls systems locally, but am seeing reports that May came in above April at $379,000. So the raw data suggests there is the normal seasonal bump up in May, as additionally influenced by the final tax credit closings which will continue until after June closings, and possibly slightly beyond.

The red line is the hypothetical Goldman Sachs prediction scaled against 2009 data at 22% below in each consecutive month.

********

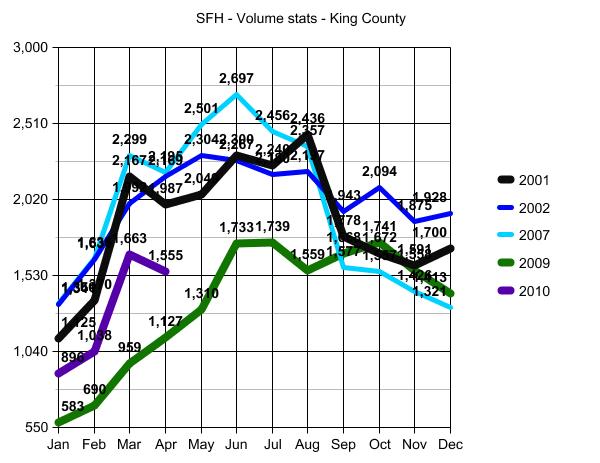

Before moving to conclusions, we need to visit the volume stats (graph below). I have been tracking volume for years in addition to price per square foot, as volume signals recovery or not more so than home prices alone.

Analysis is dependent on rationale of which data to apply, and for my purposes I have been using 2001 and 2002 as “Base Points” for two reasons:

1) 2001 is the earliest I will go when tracking home price and volume data, as Credit Scoring as the primary focus of lending pre-approval guidelines and risk-based pricing, was not a factor in the 90’s. Keeping apples to apples as to the number of people who can qualify to purchase a home, 2001 is a good start point.

2) 2003…toward the end of 2003…was the beginning of ZERO down/sub-prime lending standards. So all years from 2003 through mid 2007 will include an extra bump up as to volume and price created by that loosest of lending standards.

For both of the reasons noted above, it has been my long standing premise that volume of homes sold should be and can be expected to return to 2001 and 2002 levels as to number of homes sold.

One caveat: The number of condos built between 2001 and present is beyond proportional. Those additional “residences” in the form of condos and lofts in the Seattle Area will rob volume from the single family stats in some, and many, areas.

Note: In the second graph above, the volume of homes sold in October of 2009 (green line) exceeded the number of homes sold in October of 2001 (black line). This may not seem like something to view as a positive sign. But given the tremendous drop in volume as noted in January and February of 2009 to unprecedentedly low levels, surpassing 2001 volume stats by October of that same year was HUGE. Of course these numbers at both ends are influenced by the short breaks in the tax credit for home buyers in both January of 2009 and October of 2009…but still a significant signal reflecting that volume has the opportunity to recover to 2001 levels. NOT to 2007 levels! Volume cannot and will not recover to 2007, nor do I expect prices to do so until 2018 at the earliest.

Those who are waiting for a return to 2007 as to price and/or volume would likely have better luck betting on your favorite horse.

********

So, just how low will Seattle Area Home Prices go? Well first off let’s acknowledge that Seattle Area Home Prices WILL go DOWN. That seems obvious to me from the RAW DATA, but amazingly I still see many people questioning whether or not the market will go down at all from here. Hard to believe, but yes, some think the current level of $379,000 median home price is going to go up and not “EVER” down from there. One would think the credo of “home prices will never go down” was dismissed along with The Easter Bunny…but no. Some are still looking for a V-Shaped or U-Shaped “Recovery”. Sad but true.

A- Home prices will most assuredly drop by 4.3% in the very near future and likely by 4th Quarter 2010. (See blue square in the RAW DATA link above.) That is where home prices were in March of 2009 before the tax credit was renewed. So seems obvious without the credit, that is where prices will go back to…and likely lower than that without a new tax credit to prop up prices from that point forward.

B- The Tax Credit was meant to stop the downward spiral and eradicate the portion of loss created by momentum and NOT the portion of downward spiral created by fundamental economic problems. It was to eliminate the Fear Factor and the over-correction. Not the market’s legitimate decline point. Consequently the “safety net” being removed is going to create an additional drop of at least 5% in addition to the 4.3% drop noted above, which would take us to a drop of 9.3%.

C- Goldman Sachs is incorrect in its analysis of a 22% drop, because they do not apply the above A and B factors to all Major Cities. So their basic rationale is not credible, nor the number that emanated from that incorrect rationale.

D- Near the end of the time frame for the tax credit, home buyers were not as likely to enter into contracts with short sales and to some extent even bank-owned properties, for fear they would not close on time. Consequently, the median home prices were overly weighted to the high end of my bottom call. The mix of property from here through year end is going to push more toward the 37% under peak of that same bottom call vs the 20% side of the equation, with more “distressed” property in the mix. Not because of increased foreclosures, but because of more people being willing to buy them without a drop-dead-must-close date via the tax credit. It’s really just common sense, and pretty much a given.

Look for a 9.3% drop at some given point between now and the end of 2011. That would be any month in that period with a median home price of $343,753 or thereabouts.

As to 2012??? I expect a significant impact on price, with further declines, stemming from continued layoffs between now and the end of 2012 on a fairly large scale. But this last prediction borders on “the crystal ball method”. So let’s end with a 9.3% drop from $379,000 median King County home price by year end 2011, with an added caution that significant improvement to 2007 price levels will not likely happen before 2018.

In other words…”EXPECT the worst; HOPE for better than that.”

(required disclosure – Market Observations and all stats in this post and the graphs herein are the opinion and “work” of ARDELL DellaLoggia and not Compiled, Verified or Posted by The Northwest Multiple Listing Service.

Home Buyer Tax Credit close date extended?

Homebuyer Tax Credit Update 7/1/2006 Passed both The House and The Senate, so pretty much a done deal. Should be signed into Law by the President today.

********

NEW UPDATE 6-29 – Looks like this is going to pass as a stand alone Bill. Passed the house by a huge majority and the Senate is expected to pass it any day now…stay tuned

*******

UPDATE 6-25 The Bill did not pass. The vote was 57-41, three short of the 60 needed.

********

Just received this email. Seems to be “Breaking News”:

“NEWS FLASH Senate OKs new tax credit closing deadlineThe Senate has amended a bill to give homebuyers who were under contract on a home purchase by April 30 an additional three months to close the deal and claim the federal homebuyer tax credit. Extending the deadline for closing from June 30 to Sept. 30 would allow lenders more time to clear a backlog of 180,000 homebuyers nationwide, said amendment sponsor Sen. Harry Reid, D-Nev.”

All of my June 30 or before closings are closed, but I do have one we did not expect to be eligible for the tax credit, because it is a home being built which is not expected to be completed until August 31 or so.

If the closing date requirement is moved out to September 30, as noted in the quote, my clients will be eligible for the $6,500 credit (not the $8,000 one). Since we were at the showroom yesterday morning trying to decide on wood floors in the living room and dining room, which would cost less than this credit, this could be an important decision making factor.

Of course this is so “hot off the presses” that we need to verify and also wait for it to actually be confirmed and signed. But it looks like an extension to September 30 for closing is just about a given…just about.

Buying a Bank-Owned Home? Ball’s in YOUR Court!

Interestingly, the very same day that Craig wrote his post on assisting a buyer with a bank-owned purchase, I was closing on a very similar transaction.

One difference…mine closed. 🙂

It was even the same servicing company (so possibly and even probably the same bank-owner-seller), and also an FHA loan like Craig’s transaction. Two hurdles that Craig’s transaction may or may not have had was there were multiple offers (hard to win multiple offers if you are the only FHA buyer in the room) and the buyer’s lender at the last minute required that a new roof be put on the house, prior to closing, on a house that was only 14 years old.

I have to agree with Craig, it was absolutely grueling. It’s like being Ray Allen playing against the Lakers, but there is no one else on the Court except Ray!There were too many cooks in the kitchen on the seller side, and it was almost as if they wanted you to be late and wanted the transaction to fail. At the point where the buyer’s lender wanted a new roof on the house prior to closing, I honestly think the seller wanted to move to the back up buyer AND keep my client’s Earnest Money AND collect a $100 per day per diem for as many days as possible running through the Memorial Day weekend and beyond. This is why the SELLER should NEVER be ALLOWED to choose escrow! Somebody wise up and make a law about that!

Think about it. If escrow doesn’t close on time on a bank-owned…who suffers? Buyer can lose their Earnest Money. Buyer can pay $100 per day for every day that it is late (to the seller). So how can the seller be the one who chooses escrow, when the buyer is the one with so much at stake, and the seller with everything to gain if the buyer is late?

Of course my buyer clients did close. My buyer did not close on time BUT he also paid ZERO in per diem costs because I forced the seller’s hand to the point that they were in breach. This is not the first time I have done this with a bank owned, but it takes every ounce of my time and energy for days on end. You have to have your wits about you, stay on your toes, and play every single second, day after day, with the devotion of a Ray Allen or Rondo watching every single move and being always on top of your game. One false move…one split second of incorrect decision, is the difference between the client’s success and failure.

In this corner…the seller side…we have:

Agent for seller…Assistant for agent for seller…off-site transaction coordinator for agent for seller – Escrow Company chosen by seller with TWO closing agents, one working only on the seller side and one working only for the buyer side. FIVE layers before you even get near who the seller is, and the seller has at least a few people in between all those people and the actual selling entity/bank.

…and in this corner we have…ARDELL LOL! Kim and Amy helped do a few end runs on what the buyer was doing AT the house, like choosing new hardwood and getting estimates from painters, etc. I handled the contractual and escrow problems and the buyer’s lender issues…including lender wanting a roof ON the house prior to closing. Trust me, it is no easy feat to put a quality roof on quickly on someone else’s house without their permission. …and of course…then the rain came… If we were not ready to close the buyer would have lost his $10,000 Earnest Money and/or all those many days over the very long holiday weekend in per diem fees.

Like Craig, I can’t give a true blow by blow…but it closed and my buyer clients got the house at roughly $50,000 less than the house around the corner in the same neighborhood, that closed at roughly the same time. It was imperative that THIS be the house, as they maxed out at a price just short of what it would cost for all the things they wanted in a home, school and neighborhood. So a bank-owned was likely the ONLY way for them to get all of those things because of the bank-owned discount.

So yes…for many clients, buying a bank-owned is not only best…but sometimes the ONLY way for them to achieve their goal. The number one thing to remember to be successful in a bank owned transaction is The Ball Is ALWAYS In YOUR Court! You cannot wait ONE SECOND for the other side to do what they are supposed to do. You must do their work…yes they were the ones who needed an extension, but if I did not keep writing the addendums, because it was “their job” and not mine, it never would have closed! I had to do that three times. Banks NEVER answer…they never signed the extensions until it closed…pretty much at the same time.

You cannot ask…you cannot wait for them to answer…you cannot expect them to do what they are supposed to do. You have to run that ball across the Court like you are the only one in the room with the power to make it happen! You can’t worry about what’s fair and not fair…you just have to get it done and do everyone’s work , and figure out who has the authority to move it forward and who does not.

In my case the buyer also had all kinds of things besides dealing with the seller side that made it many times harder, even if it were not a bank-owned transaction. That was a bit distracting. But at the end of the day…it was all worth it, because I truly believe I could not easily find a replacement property for those clients in their price range. THAT is why you do a bank owned…because the discounted price makes it the BEST house for that client…and possibly the only one they can afford that fits their parameters. …and, of course, they also got the $8,000 tax credit on top of that. A grueling work load and struggle…but well worth it.

You don’t do it ONLY for the “bargain” of it…you do it because it is the very BEST house for them.

Similar story: Truliaboy gets his house and a puppy.

My 20th Anniversary in Real Estate

Today is my 20th Anniversary as a Real Estate Agent. Seemed like a milestone worth noting.

Today is my 20th Anniversary as a Real Estate Agent. Seemed like a milestone worth noting.

Still had my original photo taken back in 1990, so I thought I’d share it with you…yes back before cell phones. 🙂

My grandchildren are pretty much the same age as my children were back then. We didn’t use email…we didn’t even use faxes…and the mls was DOS with the only pictures available via the mls “book”.

We’ve come a long way, baby!

My “cell” phone in 1990 had a cord too.

The Good Old Days Weren’t Always Good…

“Cause the good ole days weren’t always good…and tomorrow ain’t as bad as it seems.” Billy Joel Keeping the Faith

Believe it or not…this is a post about Title Companies and Escrow Services and…my ever favorite topic: Homebuyer’s Rights. It’s a plea, really. A humble request for help from someone, or many someone’s, in authority.

In “The Good Old Days”, an agent ordered “Preliminary Title” AND “pre-opened” escrow, when they listed a property for sale. To encourage this practice, Title Companies offered the seller a discount for pre-ordering escrow so that the Title Company was guaranteed not only the Title Insurance business and money, but the right to be the Escrow Closing agent and earn that money in addition to the Title Insurance premium. A good business practice, I guess, and reasonably appropriate back when every agent represented sellers of homes and never buyers of homes.

You know…”the Good Old Days…(that) weren’t always so good”, when buyers were represented by no one, had no rights, and the Rule of the Day was Caveat Emptor.

In the present day in the here and now, meaning “The Seattle Area”, our basic Real Estate Contract has a provision for choosing Title Insurance Company that does not refer to anyone’s choice. Just a blank place for the writer of the contract (usually the agent for the Buyer – since buyers write and make the offer on this contract) to enter the name of the “Title Insurance Company”.

Then there is another line after it that says “a qualified closing agent of buyer’s choice:”

There are still some real estate agents, with the encouragements of added benefits to do so from Title Companies, who are PRE-ORDERING ESCROW before the buyer of the home is a known entity. Who CHOOSE the “qualified closing agent of buyer’s choice” in advance of the buyer being a known entity. Please stop that. And Title Companies…please, please stop offering seller’s agents and sellers “bribes” to encourage this practice of “pre-ordering” escrow in advance of the buyer being a known entity.

I agree that the owner/seller should choose Title Insurance Company, because the seller has to procure and pay for an Owner’s Title Insurance Policy and give it to the buyer in this area, as part of the means of conveying clear title to the buyer of their home/property.

And…it’s quite OK to “suggest” that escrow be X in the Agent remarks section. But to OUTRIGHT DEMAND THAT ESCROW MUST BE SELLER’S CHOICE instead of the obvious contract intent of “buyer’s choice of escrow”…well, frankly, it’s an antiquated and totally inappropriate activity in this day and age.

I know that Rome wasn’t built in a day and change takes time…but I urge you to at least move in the right direction so that tomorrow can, and will, be a better time.

Until then…I’m gonna Keep the Faith.

Don’t blame the Agent…if you are impatient.

There are a million articles written on the Top 10 Mistakes that Home Buyers make. Today…the biggest mistake one can make is to set a rigid time frame as to WHEN you WANT to buy. Let me re-phrase that in light of the email I just received below from someone who is not my client.

“Ardell, I am seeing many sellers hanging on to those 2007 prices. I mean wouldn’t being 12% below a 2007 purchase price be considered a little high? Properties are closer than ever now to late 2004 pricing aren’t they? Many houses we look at have asking prices higher than what sellers purchased them for in 2005 or later. I’m really getting tired of this.”

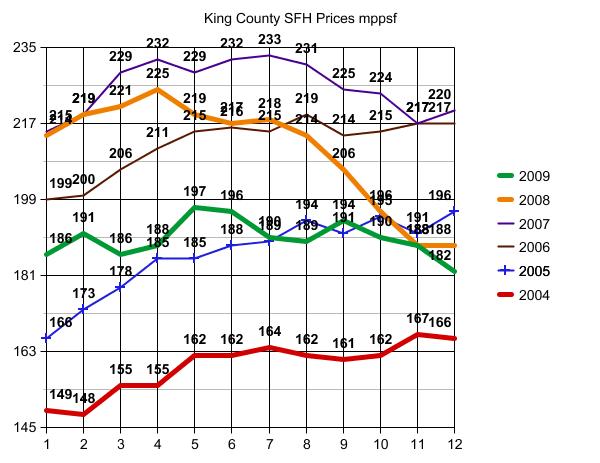

First let’s review the data again.

King County median home price is/was at $375,000 a week or so ago, up from $362,700 as of the end of March 2009, and WELL above “late 2004 pricing” of $337,500.

I’m not saying prices won’t get to late 2004 levels. In fact I think they will get there or pretty darned close in some, though not all, areas. But to go out EVERY weekend…looking at homes and hoping they would now be at 2004 pricing when they are not, will result in your “getting tired of this”. It would be like my getting tired of my diet for not having lost 20 lbs this week. I know that’s going to take some time, and getting “tired of this” is NOT an option if I am to achieve my goal by my daughter Tina’s wedding date in October 🙂

Now let’s see how the numbers fall in different areas vs. “King County” median prices:

98052

Late 2004 median home price = $409,995 – April 2010 = $610,000

98006

Late 2004 median home price = $507,000 – April 2010 = $591,500

98033

Late 2004 median home price = $469,000 – April 2010 = $479,000

98103

Late 2004 median home price = $400,500 – April 2010 = $435,000

98038

Late 2004 median home price = $281,950 – April 2010 = $299,950

98023

Late 2004 median home price = $244,975 – April 2010 = $249,225

98109

Late 2004 median home price = $598,500 – April 2010 = $460,500

98125

Late 2004 median home price = $319,750 – April 2010 = $360,000

Some surprising results there, and in many cases those numbers come up VERY differently than what I have been seeing touted in recent news articles as to which neighborhoods are “stronger” than others these days.

There are different reasons for these results in the different zip codes. For example, if you are hoping for 2004 pricing, but are buying a house that did not EXIST in 2004…well, in some areas new construction is not likely to fall into the level of a home built prior to 2004.

One thing “the comps” don’t tell you, is how FAR the MAJORITY of home buyers has shifted from 2004 to present. How many are buying more reasonably priced homes where they can afford to put 20% down and get a 30 year fixed mortgage based on conservation ratios, as example.

It’s not ALL about “the market”…nor is it ALL about “this house”. First step is to know exactly where the area you are looking in falls…and if NO SELLER “wants” to price there…you may just have to stop looking for awhile. Looking for “best price” in May of any year, is not particularly realistic. It is what I call “The Season of Hope” and “Hope Springs Eternal”. Best prices often don’t happen until around October 15th in any given year.

Start with a realistic objective and DO NOT WEAR YOURSELF OUT looking and looking. Take your time. Pace yourself. If lowest possible price is your objective…”Spring Bump” period may not be the time you want to choose for being in your new home. Buying in August – September – October may be a better bet if you want “better pricing”, especially if no new housing stimulus packages are forthcoming.

Remember…”Patience is a Virtue” and one often has to fight their initial gut instincts, in order to become “virtuous”.

(required disclosure – Stats in this Post are not compiled, posted or verified by The Northwest Multiple Listing Service) They are hand calculated by me, and April medians may include the first few days of May before we switched to a new mls system. I used 4/1/10 as the start point…but no end date, since the system stopped updating data around May 4th and converted to the new system that does not provide similar statistic gathering capabilities.

Washington State Flower – Rhododendron

The Rhodies are in bloom! A great time to visit The Arboretum in Seattle or the Rhododendron Gardens in Federal Way.

Many people from out of the area buy homes here with rhododendron plants and ask me questions about their care. The Seattle Rhododendron Society is a great source of info on the topic.

Here are some pics I just took of a variety of sizes shapes and colors in the front and back yard. Rhododendron are just one of the reasons Seattle “feels like home to me”.

Need a Master Bedroom Staged – Help please!?

I can’t find anyone who will stage just one vacant room. The rest of the house is fine, but the master bedroom is empty.

If anyone knows a stager who will stage a master bedroom in Kirkland/Bellevue, can you please have them give me a call at 206-910-1000 ASAP?

Thank you!

It’s The End of the World…as I know it.

Besides the fact that we will most likely be heading into 2004 price levels shortly, we are also switching mls vendors.

For the general public, switching mls vendors may not be noticeable at all, but for me it is “The End of the World…as I know it.” because I will no longer have access to hand calculating statistics for King County or any large area like Zip Code.

The New Matrix system will work on any browser, so I can carry the mls around on an iPad…I’m happy about that. But I will have to devise an entirely different method of conveying market strength and weakness using the new system in smaller quantity analysis.

Maybe not the end of the world…but clearly the end of the world as I know it.