When you get the opportunity to buy a house “worth” over a million dollars, for fifty to seventy cents on the dollar, you have to ask yourself if you can “afford” it before you say WooHoo!

When you get the opportunity to buy a house “worth” over a million dollars, for fifty to seventy cents on the dollar, you have to ask yourself if you can “afford” it before you say WooHoo!

#1 – Real Estate Taxes may be too high

Often people ask why so many pending sales don’t close. There are many reasons, one of which is that lender pre-approvals show a purchase price vs. a monthly payment. Reality is that your lender is NOT qualifying you for a purchase price, but for some reason they think it is easier for you to understand a price vs. a monthly payment. They then make assumptions as to other costs, and convert their communication to you, the agents and the seller, to a Purchase Price. (This was not so when I started in real estate, and someone should change that.)

So you have a pre-approval to buy a house for $650,000 with a 20% downpayment. What that really means is the lender “assumed” taxes of approximately $6,500 a year and homeowner’s insurance of $650 a year. Now you go out and find an amazing, super-great deal! You have the opportunity to buy a house assessed at $1.2 million for “only” $650,000! WooHoo? Maybe not. The annual real estate taxes are $11,000 a year vs. $6,500 a year and the homeowner’s insurance is $1,100 vs. $650. That means your monthly payment is $412.50 more each month for that particular “$650,000 house”, than your lender assumed when you were pre-approved.

Your income needs to be $15,000 to $18,000 more per year, for you to be able to afford that particular $650,000 house.

There are two possible consequences. One is that the loan will “kick out” early enough for you to get your Earnest Money returned, assuming you have a good Finance Contingency. The other is that you planned to buy with a payment of $3,400 a month, but end up being approved for a payment of $3,800 a month, with no recourse.

It’s possible that you could appeal the assessed value with the County, but I’m not hopeful that will work this year. I clearly wouldn’t recommend anyone promising you can have the taxes reduced to a level commensurate with the lower Purchase Price, unless you are buying in California. In King County Washington this is NOT a good year to bet that you can prove that the purchase price of $650,000 is a good reason for the County to lower your assessed value of record. Nor is it a good year to think that lower assessed value will equal lower taxes. The County has already notified owners that they are dramatically reducing assessed values (not taxes). 2010 is a particularly bad year to rely on being able to get that tax bill dramatically reduced, in my opinion.

The only sure course is if the bank-owner would have the assessment and taxes reduced prior to sale, in order to obtain a buyer for that home. But I strongly doubt that will happen. Anyone who can’t afford the $11,000 tax bill that comes with that “great deal”, should not be buying that house.

#2 – The “carrying costs” may be too high

When a lender pre-approves you for a Purchase Price of $650,000, they do not consider annual use and maintenance costs. Unlike real estate taxes and homeowner’s/hazard insurance, the lender makes no assumptions as to utility bills and other maintenance and repair/replacement costs. In King County a $650,000 house is generally about 2,900 square feet. A house for $1.2M is usually about 4,400 square feet, and often on a much larger lot.

Before you buy that 4,400 sf home on an acre+ lot for $650,000, instead of a 2,900 sf home on 1/4 acre, be mindful of the extra cost to heat and maintain that larger home on that larger lot, in good condition, over a period of years.

#3 – Cheaper, bank-owned, new construction may not be “complete”

Most recently we are seeing builders losing their construction projects to the bank. The bank then puts the house on market “as-is”. Yes, the prices can be awesome! But will your lender finance the “new home” without it being completed? There are programs available to provide funds for purchase and rehab or completion, but are you ready to be your own “general contractor”? Even if you think you can handle it, will the new lender allow you to be your own “general contractor”?

Again, two possible consequences. One is you don’t qualify for the new financing, including cost to complete the home. Again, hopefully that consequence “kicks in” early enough for you to get your Earnest Money back under the Finance Contingency. Another possibility is that the things that need to be completed do not cause the sale to fail, but you end up with a house like the one pictured above. No landscaping, temporary construction fences or barriers, no garage doors…and no money to comply with the neighborhood rules to get your new home in good order in the timeframe required by the CC&Rs.

Once you enter into a Contract to Purchase, you may not be protected against “biting off more than you can chew”. Before you enter into a contract to purchase that “screaming deal”, make sure you can handle all the “issues” that come with.

I am stunned to wake up to the news that President Barack Obama has won The Nobel Peace Prize, while I slept. The range of emotions and thoughts running through my mind are hard to pin down to a reaction to this.

I am stunned to wake up to the news that President Barack Obama has won The Nobel Peace Prize, while I slept. The range of emotions and thoughts running through my mind are hard to pin down to a reaction to this. Back in June, a young man

Back in June, a young man

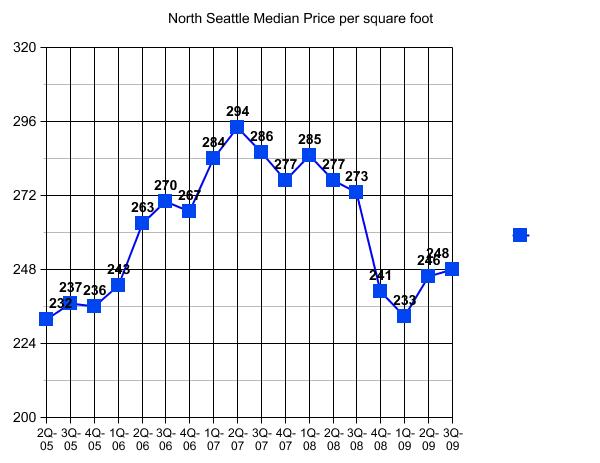

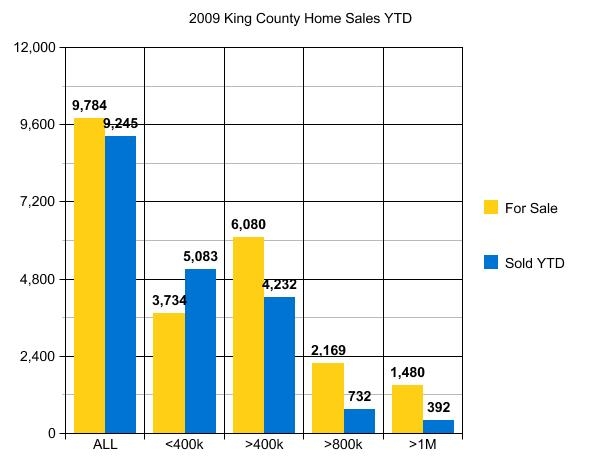

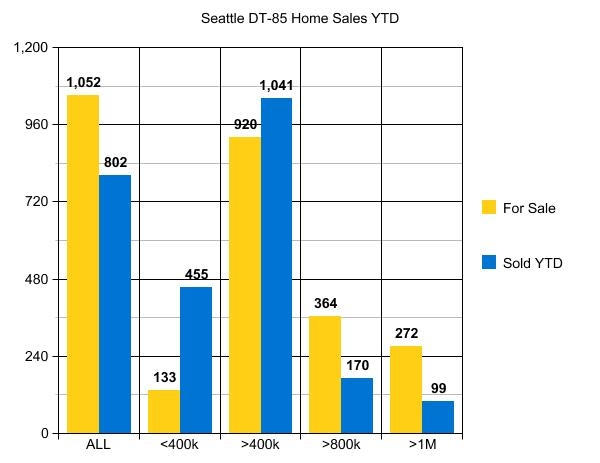

While I am not seeing any huge surprises in the market overall in King County, there were some jaw-dropping results in individual neighborhoods.

While I am not seeing any huge surprises in the market overall in King County, there were some jaw-dropping results in individual neighborhoods.

An alternate title for this post might be “The seller doesn’t ‘have to’…anything”.

An alternate title for this post might be “The seller doesn’t ‘have to’…anything”.