Unfortunately most agents are trained to have a buyer make a list of everything they want in a home as the first step in the home buying process. Left to their own devices without this “push” in the wrong direction, RARELY does a future home buyer start by making a long list like that. It is a “sales” tool to lock you into a close-able position. Don’t buy into that logic by handing a “salesperson” a big list of what you “want”.

Three of the most common “first steps” to buying a home in my 20 years in this business have been:

#1 – Highly Ranked Schools

There is always a lot of controversy surrounding the topic of “best schools” as determined by a ranking system or online school ranking site. Still, many parents use these sites when determining where they are going to be buying a home. My clients tend to use a combination of these two sites:

GreatSchools.org ranks the schools on a scale from 1 to 10. Yes, I have actually seen a school on The Eastside ranked as “1” on a scale of 1 to 10. Makes you want to go peek in the windows and see what the heck is going on in that school. There is also a “star” system, but that seems to be generated by parents whose children already go to school there, so take that with a grain of salt and read the full comments of the parents vs the “3 star” or “5 star” ranking.

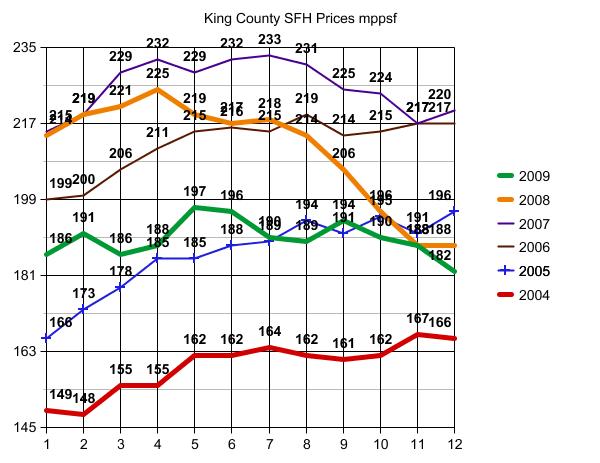

There may not be much difference between a 10 ranked school and a 9 ranked school…but clearly there must be a difference between a 10 ranked school and a 4 ranked one. If you love a house in an area serviced by a school ranked from 1 to 4, at least go to that school to try to determine why it has such a low ranking. You WILL get more home for your money if the school is ranked lower but each buyer has to decide where their priorities lie. For many…it is best school their money can buy vs best home regardless of quality of school, and the price per square foot of the home will often reflect that difference.

Another site my clients use, and they usually use both sites for comparison purposes, is:

SchoolDigger.com I like the 1 to 10 ranking system of GreatSchools.org better than the 1 to 5 ranking system of SchoolDigger.com, but I LOVE the display on a map of the schools with “balloons” showing the school ranking. Gives you a better visual of where that you can then match up to a home search map tool. I wouldn’t use these sites to look for homes though. The best real estate search tool for many, many reasons is Redfin.com, but my guess is if you are reading a real estate blog like this one…you already know that.

Even if you do not have children in school, you need to be aware of the impact of school rankings on home values so that you are using the correct “comps” when determining a fair price for a home. You don’t want to use a 10 ranked school as a comp for an offer to be made on a home in a 2 ranked school! Unfortunately, even appraisers haven’t learned that one yet. Be ahead of the curve. Do not be fooled into thinking that “School District” is the ONLY criteria to be used. There are often major variances within a school district.

Some School Districts like Lake Washington School District have a great online map of each school’s boundaries. Boundaries do change from time to time, so be sure to check with the district once you have found a home. Give them the exact address and know that if you are on the border between two schools vs dead center in the middle of the defined area…well, change happens and likely more near the edge lines. This is most important for people planning to have children or who have very young children who are not yet in school.

#2 – “Close-in”…or not “close-in”.

Wanting to buy a house that is “close-in” is more often a “move up buyer” request than a 1st Time Homebuyer request. Sometimes it is the opposite. They bought “close-in” and now want to be far away from “it all”. Unfortunately some learn the hard way how important it is for them to be close to or far away from…something. Everyone’s something is different. First Time Homebuyers tend to look at the WHAT vs the WHERE, and often end up someplace they hate being, causing them to rethink that where and move “out” if not “up”. In fact going from a bad “where” to a good “where” often means moving UP in Price but DOWN in home quality, size and amenities. The wrong where often results in more home for the money, which is why First Time Homebuyers tend to choose them more than experienced homebuyers.

You will often see “Great ‘close-in’ location!” in a real estate ad. What “close-in” means is different in each area. On the Eastside it could mean close to Microsoft, close to Redmond Town Center, close to Downtown Kirkland. On the Seattle Side it usually means you can walk to a coffee shop (and other shops). For those who don’t expect to walk to work, “close-in” could mean a reasonable bus or drive commute time. NOT “close-in” is a little easier to describe than “close-in”. If you have to drive for a half hour to get some milk…you are NOT “close-in”.

There are many variances on this “close-in” theme, and they are as different as people can be different. It’s a personal decision that you REALLY need to spend a lot of time thinking about. Some people hate the noise level of being too “close in” to shops that can also have very noisy restaurants and bars with drunk patrons very late into the night. Some people like to walk to enjoyable amenities, but be as far away from work as reasonably possible. Some people like to be very close to work, but in a private and quiet location when they get home and NOT close in to noisy businesses.

If there is ONE HUGE MAJOR MISTAKE of homebuyers that stands far and above beyond the rest of the mistakes you can make, it is to look at “a house” and make an offer on it, without adequately discovering what is around it. The MINUTE you think you may want to make an offer on a house, spend as much time as possible around that house before negotiations are complete and the home inspection “out” phase is passed. Park your car in front of the house and take long walks in every direction. Say hello to the neighbors. Don’t be afraid to do that! You don’t need to 3rd degree them with a list of questions, nor should you do that. But you should knock on the door and meet the neighbors to see if there is anything alarming to you about them. Why don’t people do that? No one wants to be “close in” to a problem neighbor…no one.

It’s very simple to get “drive times” now without having to leave your computer. Just put in the address of the home and various destination points into a service like Bing Maps and it will give you the estimated drive time. Be sure to double check that during rush hours IF you plan to be driving to and from during rush hour.

#3 Style of Home

Once you determine your suitable where(s), it is time to study the potential whats of that where that are IN YOUR PRICE RANGE.

IMPORTANT NOTE: Many homebuyers are afraid of Future Home Values. Take note that IF you buy a split entry home for too close to the max price for that style of home, you will not likely be able to get paid back for those improvements when you sell.

Yesterday I posted some rather harsh realities for people who want to be “close to Microsoft Redmond Campus” as in within a 2.5 mile radius of 148th Ave NE and 36th. Of great significance is the age of home possibilities.

As you can see in the chart above, a large majority of the homes available and sold in that area were built more than 20 years ago. So wanting a house not more than 10 years old within a mile or two from work at an affordable price may look great on your “WANT” list…but easier said than done. That is why it is important to study the makeup of the area you choose, before going out to look at homes.

Besides the age of home, the style of home is also an important factor. You may “like” granite counters and stainless steel appliances…but that is NOT “real estate”. Way too many people choose a home by its “finishes”. A newer 2-story home that has laminate counters and ugly carpet MAY be better than a less favorable home style with hardwood floors and granite counters, depending on your needs and price range.

BIG NOTE: IF YOUR BEDROOMS (AT LEAST 3 OF THEM) ARE NOT A FULL FLIGHT OF STAIRS ABOVE YOUR KITCHEN AND LIVING AREAS…IT IS NOT, NOT, NOT A 2-STORY HOME! I have met many a seller in a Split Entry or 1 story with basement who said “we have always called it a 2-story home”. Reverse floor plans, and I have seen several on market recently, are a little harder to define. If the view from the main level on a reverse floor plan is knock your socks off awesome…well, let’s just say it better be.

Here are 3 examples of how to look at the general range of possibilities before going out to look at homes to buy.

In the pie chart above you can see that the majority of homes in that area (within 2 miles of Microsoft) regardless of price, may be a home style that you simply do not care for. It is important to know that before going out to look for your “ideal home” in an area that may not have it in your price range. Do you go further out to find “it”…or do you stick to living near work? A personal decision you should make before going out to look at homes. Have a backup plan!

Besides availability, there is a matter of cost. Below I charted all of 98052 using the current YTD median home price of $540,000 as a guide. This first pie chart below breaks down the style of homes sold so far in 2010 costing $540,000 or less in Redmond 98052. Often 2 story also equals “newer home”. Not always…but often…on the Eastside vs in Seattle proper.

Once I go over the median home price, the breakdown of home style changes dramatically, as shown in the pie chart below. This is VERY important to home buyers in the first group. IF you bought the highest priced Split Entry home UNDER the median home price…note that NO Split Entry Homes were sold above that median price YTD 2010. Future home appreciation is not simply about “the market” as a whole. There is a point at which there simply is no room for upward movement given you simply cannot compete with newer homes and newer home styles regardless of how you may improve that home.

It is pretty simple to graph out your potential and likely choices in your price range in the area you hope to live. It’s OK to look for a needle in a haystack…you just have to know that before you begin the process. What has NEVER happened in the past, is not likely to happen in the near future. If 1% of the people were able to do what you are trying to do, that is important to know the same as it is important to know if 60% of the people were able to do that in recent history.

You clearly will be able to change what you “WANT” a lot easier than you can change the makeup of homes built in a given area. If it never was built, you likely can’t buy it. So do your homework before you step out the door and get caught up in making quick on the fly changes in your overall home buying plan. Be prepared and you will make a wiser choice.

********

(required disclosure: The stats in this post and its graphs are not compiled, verified or posted by The Northwest Multiple Listing Service.) They are hand calculated by ARDELL.