Opinion: The definition of what is a “loan and settlement cost” needs more clarity on NWMLS Form 22-A (revised 12/2009).

Background:

The most recent revision (December of 2009) of the Financing Addendum “Form 22-A

Opinion: The definition of what is a “loan and settlement cost” needs more clarity on NWMLS Form 22-A (revised 12/2009).

Background:

The most recent revision (December of 2009) of the Financing Addendum “Form 22-A

Is it just me, or do loan orginators routinely encourage bank fraud? First, the background: There are a variety of federal and state laws that make it a VERY serious crime to mislead a lender for purposes of getting a mortgage. At the federal level, 18 USC sec 1014 makes it a crime to “knowingly make any false statement or report . . . for the purpose of influencing in any way the action of” a commercial lender. (Emphasis added). The penalty? A cool million dollar fine and/or 30 years in federal prison. Yup, not a misprint: 30 years in Club Fed. On the state level, RCW 19.44.080 makes it a crime to “knowingly make any misstatement, misrepresentation, or omission during the mortgage lending process knowing that it may be relied on by a mortgage lender.” (Emphasis added). The penalty? Its a class B felony, so 10 years in the joint and/or $20 grand.

As indicated by these laws, as a society we cherish honesty to lenders and believe very strongly that anyone who is dishonest AT ALL in order to secure a loan has committed a very serious crime. The problem, of course, appears to be that nobody in the RE industry agrees. Rather, it appears that the RE industry treats this type of bank fraud (misleading a lender in order to facilitate getting a loan) to be something akin to taking a second serving of dessert: bad form, sure, but if nobody knows…

You may be thinking: “What on earth is Craig talking about? Everyone I know is honest and abides by the law!” Well, think further, and in particular think about a buyer’s inspection contingency response. The NWMLS provides a Form 35R specifically for resolution of the inspection contingency. By its terms, the 35R and any other notices or addenda relating to any modifications or repairs becomes a part of the contract, and of course the lender has the right to receive (and buyer has the obligation to provide to the lender) the entire contract.

How many agents out there have used the Form 35R to request repairs and/or price reductions? And have you gotten any feedback from the loan originator once he or she receives a copy of the signed form? I have. The 35R had the fourth box checked (buyer proposes modifications) and the text below, “Sale price reduced to $440k.” About as simple as can be — but apparently still likely to arouse the suspicions of the underwriters, thus complicating the process. The loan originator’s request? “Toss” the 35R and instead use a Form 34 for a simple price reduction.

The problem? That clearly violates the state law above, and probably the federal law too (at least it will when the buyer signs at escrow a statement indicating that he has provided the lender with all requested information, including a complete copy of the PSA). In other words, even LENDERS encourage violation of the laws designed entirely to protect lenders.

And one wonders how we inflated the housing bubble…..

Hopefully you’re following along with our 365 Things to do in Seattle WA…but in case you haven’t heard about it yet we wanted to pass along our day 41 to you. We are involved in a wonderful event raising money for local foster kids and the event is scheduled for this Sunday at Kirkland’s Tech City Bowl. Our team is: Striking Realtors and we’ll be dressed in our pajamas. We would love it if you could make a donation to help these local foster kids and when you do you’ll be entered to win a pair of Seattle Seahawks Tickets 3 rows from the field. Find out more about the drawing and the event on our 365inSeattle event and see how you can help.

[Editor’s note: I’m super excited to announce Sarah Payson as RCG’s newest contributor. She runs The Payson Group with her husband John Payson, who together are the first “M Agents” in Seattle. I recently had the chance to spend a day with them and was blown away by how two people could be both super-motivated and super-wonderful! One of the things that they will undoubtably bring to RCG is an active involvement in the local community… and an excellent example of that is their active Facebook Page: 365 Things To Do In Seattle that’s grown to over 7,700 fans in about a month. Seeing the success they’re having with this page, I asked Sarah if she’d start her RCG contributions with a post about that project. -Dustin]

Are you new to Seattle WA? Have you been here a while but are tired of the same old routine?

Are you new to Seattle WA? Have you been here a while but are tired of the same old routine?

We want to get you connected with your neighborhoods around Seattle and the Eastside, that’s why we started “365 Things to do in Seattle WA

We’ve had three months to work with the “new” good faith estimate designed by HUD. We had an even longer period of time to review this document, however in a mortgage originators defense, I will say that until you can use this GFE “in real practice”, you don’t truly know the nuances. With all the updates to the RESPA FAQs, I’ll argue that HUD’s in the same boat!

On March 18, 2010, HUD posted a new presentation “RESPA 2010 – Implementation Consistency”. I recommend watching the video with access to the slides. Vicki Bott, Deputy Assistant Secretary for Single Family Housing with HUD, covers the information more indepth than if you were to watch the slides alone. During this presentation, it sounds like we should have a newly revised set of FAQs for HUD soon. I’ve actually lost count on how many times it’s been updated…and a part looks forward to the revisions since I have hopes that some of the glaring issues will be addressed and remedied.

Here’s an email I recently received from a mortgage originator:

I have a question that I have been searching the internet for and was wondering if you might know the answer? … I have a rural development loan that I took an application for last week. I didn’t realize before I disclosed to the borrowers that the 2% up front mortgage insurance fee did not populate into my good faith estimate. The borrowers are aware that there is a 2% up front funding fee but since it wasn’t on my originally disclosed good faith, is there anyway to correct that? I mean, it isn’t like I am adding a fee that goes in my pocket or anything, it is a fee that is associated with the loan itself, for anyone who gets a government loan with a funding fee or upfront mortgage insurance.

First of all, I am in no way an expert on the Good Faith Estimate and I’m not a replacement of a mortgage originators compliance department or managers. This LO needs to immediately contact her manager and compliance officers at this point. Emailing a mortgage blogger isn’t going to resolve her issue.

HUD does have what is called a “restrained enforcement” period which is the first four months of this year, which is touched on during this slide show. I have no idea if this mortgage originators mistake would qualify her to call a “mullagan” or if she is obligated to pay the difference between the 2% loan fee factored into the 10% accumulative tolerence bucket. If so, she’s paying to have this loan close…it’s a very expensive mistake that most mortgage origintors cannot afford to make. On a $300,000 mortgage, the 2% fee is $6,000. According to HUD’s powerpoint (slide 5):

“Restrained enforcement…is intended to provide lenders and HUD time to understand the implementation gaps and interpretation inconsistencies and resolve them while providing RESPA benefits to the consumer…. Guidance will be rolled out to the industry regarding specific areas of restrained enforcement.”

I’m hearing that most lenders will not allow re-issue of a good faith estimate once they’ve received it. Mortgage originators are having to pay for upfront FHA mortgage insurance premiums (soon to be 2.25% of the loan amount) even though it was not a case of bait and switch–the borrowers knew about it and it was simply a human error. Good faith estimates can only be modified if there is a qualified “changed circumstance” which must be documented.

Our company is currently using Encompass 360 for our loan operating system and I can tell you that it’s been a lot of effort to make sure that loan fees not only populate, but actually show up in the section they need to be. The 2010 good faith estimate basically puts fees into 3 sets of buckets with different tolerances on how much those fees can change. The funding fee referenced in the email above is subject to a 10 accumulative tolerence. Assuming the rest of that mortgage originators estimate is perfect, she may be responsible for $5,400 ($6000 less 10%) assuming this is a bona fide transaction.

Mortgage originators must be very careful when issuing a good faith estimate. We cannot rely on our loan operating systems to spit out the correct information in the specific spot required. Here’s what I’m doing when I’m working with a client and the good faith estimate:

Most fees aren’t that huge…. I’m finding that I’m typically off very slightly between my good faith estimate and HUD-1 Settlement Statement. A little precaution will really pay off, my fellow Mortgage Professionals.

Last but not least, if you’re not getting the training you need, seek it out for yourself. Seek many–do not rely on your employer or their educators. Are they going to cover your 2% funding fee mistake? Learn from many different educators and formats…visit’s HUD’s RESPA webpage often! …this is what I recommend if you’re committed to sticking around this industry as a mortgage originator.

Good luck!

Earlier today I posted my thoughts on the King County Housing Market for 2010 and received this question on twitter:

@VAF_Investments asks @ARDELLd – This downward price expectation kind of goes against your view late last year… What’s changed?

Generally speaking, my clients are making a short term decision to buy a home to live in based on a compelling reason in their life, vs a long term market timed decision. Consequently, in my world, the question becomes “If I am going to buy a home in the near future, when is the best time to do that? What is the best strategy?

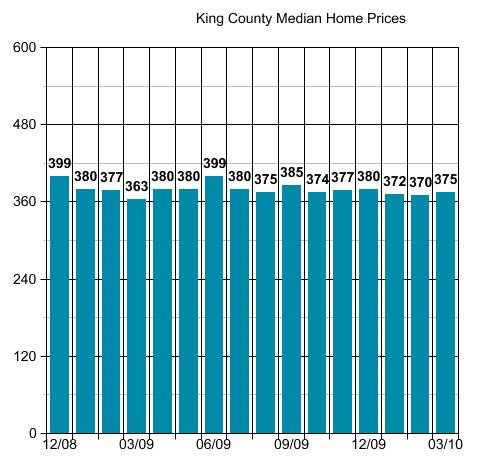

In February of 2009 there was no question in my mind that March closings would likely be the lowest point of 2009. When I “called that bottom” I was greatly surprised that it made front page news, because it seemed like a great big “duh” to me at the time. The graph above shows you how that prediction played out through to present day.

New Year…New Clients…New Bottom Call. Last year I had a few clients purchase homes who I told to wait in 2008 and late 2007. In 2009, I didn’t tell anyone to “wait” but I did tell a few people not to buy at all, and am still doing so. The minute someone says “I’m planning to sell it in 3 years” I do a big “Excuse Me?” One client wanted me to graph “appreciation” for each year over the next three years…I asked him to save me the time by sticking a big fat zero on that for me in each of the three columns on a net basis.

What’s different this year? LOTS! Many people bought in anticipation of the Homebuyer Credit ending. I was at the gym yesterday and a young agent on the next treadmill was telling his friend that buyers had to hurry up before the credit expires. If every agent is telling every buyer to buy before the credit expires, how can they possibly NOT think that the market will go down after it expires? Boggles my mind that the same people saying “you must buy before April 30” are the same people saying the market will not go down AFTER that point.

There are many other factors, of course. But the Homebuyer Credit is not a small one in the big picture. The title of the PI Article last year was “Agent Predicts Housing Slump’s Demise”. In 2010 the “training wheels” will come off. The oxygen supply will be removed, and we will see what the market will do when caused to “stand on its own two feet”.

I don’t think the market will fall dramatically without further government intervention, because I think if it DOES fall dramatically there WILL be continued government intervention. So yes, I do expect Homes Prices will be lower than the median price of $362,700 from March of 2009, at least at some point in the 4th Quarter of 2010, and possibly before. I don’t think we will see another 20% – 25% decline in prices, not because the fundamentals are stronger, but because I believe the government will come up with another plan if needed, to prevent that from happening.

Remember, most of the market decline transpired under the previous Administration. This new regime has proven its desire and ability to stabilize, if not grow, the market. I do think they will let this credit expire, and I do think they will decide what to do next…after they see how the market reacts to “pulling the plug”.

Before they decide what to do next…don’t be surprised to see a “new bottom” where median home prices in King County fall below $362,700. At this moment, without all of the March closings counted, the median for the first Quarter is $370,999 (maybe a little higher if I take out the houseboats) and at $372,475 for the month of March to date (this down from the $375,000 it was a few days ago). If I take out the houseboats and mobile homes…it is $375,000.

(The stats in this post are not compiled, posted or verified by The Northwest Multiple Listing Service)

One of the problems with today’s real estate inventory of homes for sale, is that it is difficult to determine if the asking price is a fair price. Today I received an email noting that the price of a home was reduced by $200,000. It is today $300,000 less than the day it went on market about three months ago.

Think about how scary that is to a would be home buyer! Someone could have paid $300,000 more for it than the asking price today, and who knows? That “new reduced price” could still be $300,000 more than someone will end up paying for it. This is particularly true of the home I am referring to in this post. (as an agent I cannot mention the address, and will have to delete it from the comments if someone else guesses it correctly. Let’s stick to the general point of the post and assume many homes fit this broad description.)

I want to talk to you today about a totally out of the box approach to buying real estate. It isn’t necessarily a new concept, it is simply the same strategy used in the hot market. In the hot market when there were 3 offers “in” when you wrote your offer, you automatically attached an “escalation clause” saying “I will pay X$ more than the highest offer up to X$ cap price”.

There are two homes on market, one each for two of my clients that my clients like, but we are agreeing that the asking price is too high for that home, and higher than any buyer will be willing to pay. In the meantime the seller is not ready to take an offer at what we consider to be a “fair” price for the homes in our “saved homes” watch list. We, the buyers and I, have attached a price to the homes that the buyer would pay, that is substantially less than the current asking price.

The way the market works generally, is buyers save these homes and wait for the price to come down. On the one hand they are afraid someone else will buy it at the price they are willing to pay. On the other hand they don’t want to get into a negotiation stance that might draw them above what they are willing to pay.

Let’s use a hypothetical. Let’s say the asking price is $999,950 and your price is $875,000. It would be fairly simple to put in an offer of $850,000 or X$ more than any other offer received with a cap of $875,000 in the next 30 days. Offer may be withdrawn anytime prior to acceptance or extended at the end of this 30 day period.

Many years ago during the last market like the one we are in now, I did something like this for a client. Slightly different. It was an abandoned very nice home. The owner did not have it on market as a short sale, they simply moved out when they stopped making their payments and moved out of State. The Bank had not foreclosed, and so the Bank could not sell the home or even consider offers to purchase. There were many people who wanted to buy the house. In fact one of the agents whose clients wanted the home, sent that client to me (which is how I got the client in the first place) as they could not determine how the buyer could get the house, it not being for sale. In fact half my business that year came from local agents who sent me situations they could not figure out in the weak market. Odd, but true 🙂

I wrote an offer at a ridiculously low price, which was also the highest price my client could afford to pay. The buyer was willing to give it his best shot, realizing that his best shot might not be good enough. I wrote the offer and sent it to the bank, who did not own it. I wrote a response time of 30 days. Every 30 days I had the buyer and his wife come into my office and rethink whether or not they still wanted that house at that price. If they said yes, I had them sign a short 30 day extension to the offer. This went on for nine months.

One day the Bank was within the time range when they could foreclose on the house. That’s one thing people don’t understand about short sales. The bank can’t always foreclose when they want to foreclose, and the person who put the offers into that file is not the person who opened the file to start the foreclosure proceedings. Banks can’t always answer your short sale offer when you want them to. The day the bank was ready to start the foreclosure process, they opened the file and found an offer inside with nine 30 day extensions. Rather than begin the foreclosure process, they called me and accepted my client’s offer.

There was never a for sale sign on the property as it was technically never for sale. My buyer client asked me to put a sold sign on the property so that would be buyers would stop going inside it while we were “in escrow”. I went over and put a sold sign up. Within two hours 21 people called screaming that they wanted to buy that house, but their agent or attorney told them they had to wait until after it was foreclosed on. One even told me he had already purchased new kitchen cabinets for it, and they were sitting in his basement.

I know there is an old saying that “the early bird gets the worm”, but in a market like this one we need to fall back on a completely different idiom. “patience makes perfect”. If you do the right things while being patient, you just might end up with a perfect result for you and your family.

Home Warranty: I just sent a text message to one of my clients who bought a new construction home almost a year ago regarding their “Builder Warranty”.

Home Warranty: I just sent a text message to one of my clients who bought a new construction home almost a year ago regarding their “Builder Warranty”.

A new home will have its fair share of minor settlement cracks and “nail pops” and many quality builders will come back at the end of the 1st year to fix these. Some will have a limit as to how many times they will come back to the home to fix them, so I generally advise my clients to read their warranty very carefully so as not to use up their total return visits in the first week.

Many, many times I have gone to someone’s home to list it for sale finding these settlement issues, and the owner never bothered to call the builder in the warranty time frame to have them corrected. Trying to fix them 5 years later is not only more costly, since the builder would have done it for free if that is provided in the warranty, but also more difficult to fix. Finding the exact paint color five years later can be difficult. The 5 year old paint on the wall or ceiling may not match even if you have the exact paint color.

One of the most important issues with these fixes is not the paint color, but the paint “sheen”. Often I will go to someone’s house and see everything “fixed” by the owner vs the builder, and even though they used the exact same paint color, the fixes have a shine, and the rest of the wall does not.

If you bought new construction about a year ago, take out your builder warranty and examine your home very carefully. Look around door frames, windows, drywall tape joints. Pull your furniture away from walls and look for “bows” in the wall from green wood having dried incorrectly. Often you can see this by examining the baseboard for gaps, and remember to look at both sides of the wall if you find this type of abnormality.

Maybe you can have your friends over for an “Almost One Year Anniversary – Find a Crack” party 🙂

There is usually a “drop dead date” in your warranty for these types of minor repairs, so be sure to PUT IT IN WRITING. Don’t just call the builder a week before your time frame expires. It’s too easy for someone to say you never called, or that is not what you called about.

Best to get your request to the builder, in writing, before the time frame lapses. Happy One Year Anniversary in your new home, often includes a visit from the builder to fix those things that tend to settle in the first year of a new construction home.

If you bought resale, with a one year “home warranty”, same story. If you have been “ignoring” a small problem that may be covered by that warranty, be sure to get a written request in before that warranty expires. You will be looking for different things if it is resale vs new construction, so read your warranty carefully. You might even want to have a full home inspection done, to make sure you don’t miss something.

Five to one, more people are asking me if they should sell their home vs. if they should buy one. That said, I have more buyer clients than seller clients. Those buyers are simply not asking IF they SHOULD buy. The most difficult scenarios are those who need to do both at the same time, who cannot buy unless they sell, and who don’t want to put their home on the market until they know where they will go if and when it sells.

Five to one, more people are asking me if they should sell their home vs. if they should buy one. That said, I have more buyer clients than seller clients. Those buyers are simply not asking IF they SHOULD buy. The most difficult scenarios are those who need to do both at the same time, who cannot buy unless they sell, and who don’t want to put their home on the market until they know where they will go if and when it sells.

I ask three questions when someone calls or emails me asking if they should sell (now).

1) Why are you thinking about selling it?

2) When did you buy it?

3) Have you “cash out” refinanced it since you bought it, and if so, when?

When you read articles like this one, and see that Seattle Area home prices are at April 2005 levels (I agree) and peaked in May of 2007 generally (I say July 2007, but close enough), it should tell you that if you purchased during that timeframe, and even between April 2005 and present, it is highly unlikley that you will be able to sell it without bringing money to closing.

Funny…no one talks much about “bringing money to closing” these days, though it happens probably at least as often as a “short sale”. Everyone assumes “upside down” homes are “short sales”, when in fact many sellers simply walk into closing with a check the same way that buyers do. Even people who are qualified to do a “short sale”, often have to bring money to closing. Just because the home sold for less than was owed, does not automatically mean that the difference was waived permanently or temporarily. Sometimes the owner pays it in full, and sometimes the owner pays it in part.

Let’s take a somewhat ludicrous example to make that point. Say the net proceeds of the sale is $500 short from covering all expenses. Likely that $500 is going to be paid by someone, and not worth going through the “short sale” process. Another example: If someone is making their payments, has $100,000 in the bank and makes $120,000 a year and is “short” $20,000, not as likely that the lienholders are going to approve a short sale. That “seller” should be bringing $20,000 to closing. This is VERY important for agents to understand as many are listing homes as short sales simply because the amount owed is in excess of current fair market value. That is NOT the only criteria to “selling short” without bringing the needed difference to closing. If the owner can choose to stay in the home if they are not approved for a short sale, if they have the means to stay and plan to stay if they are not approved, that home should really not be on the market.

Given the knowledge we have that current prices are at April 2005 levels, give or take, let’s apply that to a specific example:

Should you sell your home if you bought it in January of 2004, and are relocating with your family to another State? Let’s say it is a 2,400 sf home in Redmond in X neighborhood, for example. I see several sales in the tax records of 2,400 sf homes in that neighborhood in the 1st quarter of 2005, all selling at approximately $530,000 which is about $100,000 more than they sold for in early 2004. Cost of sale is about 8%, so let’s call expected net proceeds after sale and possible repairs at inspection at about $90,000. Always best to round down to worst case scenario. Let’s call it $75,000, because you don’t want to put your house on market with the highest of expectations. Great if you get them, but not great if you have a vacant house on market for 6 months because you “want” $90,000 net proceeds.

If you would sell it if you could walk away with $75,000 plus your down payment back, then yes you should probably sell it. One reason you might want to rent it is if you want to “leave the door open” to possibly coming back if you don’t like your new job in that new State.

If you refinanced that same house in 2007 for $650,000, then you likely want to rent it for some period if you can, so you can take the loss as a write off by turning it into a rental property vs. a primary residence before you sell it. Check with your tax accountant before putting it on market for sale.

I can’t go through a lot of examples here in the blog post, but know that:

Why are you selling it?

When did you buy it”

Did you do a cash out refinance after you bought it?

are the three most important questions to be answered, that the person who is advising you needs to know before answering the question.

If an agent says “YES! You should sell it!” without asking these questions before answering, that probably means they just want a listing so they can get buyer calls from the sign and advertising, and use your home as “inventory” to get buyer clients. 🙂

As the days wear on, we are learning more and more about HUD’s 2010 Good Faith Estimate. Yes, we’ve had the 2010 GFE to review for quite some time and HUD has offered several updates on their RESPA FAQs…however it seems to be taking a lot of practice, trial and error and communicating with fellow mortgage professionals and HUD to try to interpret what is intended and/or allowed with this new document.

HUD’s last revision to the FAQs made it loud and clear, in my opinion, that they want the Good Faith Estimate to be a tool for rate shopping… however unless the borrower has a bona fide property an address, this may not be possible. Why? As it currently stands, HUD will not allow later identification of a property address to create a “changed circumstance”. A “changed circumstance” (as defined by HUD) is required in order for a mortgage originator to be allowed to issue a revised Good Faith Estimate…otherwise, the mortgage originator is bound by that Good Faith Estimate until it expires (10 business days if the borrower does not express an intent to proceed with the application).

Per the most recent HUD RESPA FAQs from January 28, 2010 on page 17 regarding what qualifies for a changed circumstance:

Q&A 8ii: If a loan originator issues a GFE without identifying a property address, the subsequent identification of the property address, in and of itself, is not considered a changed circumstance.

If a mortgage originator issues a good faith estimate without a property address, they do so at considerable risk as the later identification of a property address does not constitute a changed circumstance. For example, a GFE was issued with the property address TBD and Block 8 = $0. The borrower later identifies a property and Block 8 should have been $2,000, but the originator cannot issue a revised GFE and is bound to the original GFE. Excise tax in most parts of King County is 1.78% of the sales price which would be a very bitter pill for a mortgage originator to swallow.

As a side note, it’s still hit and miss if lenders are disclosing seller paid excise tax on their Good Faith Estimates in Washington State. I’m hearing that some are making the mistake of not showing the owners title policy since it is also seller paid–this if flat out wrong–the owners title policy (even though it is paid by the seller) must be disclosed on the 2010 GFE.

I’m hoping for a revised FAQ soon (funny thing to hope for) where HUD may reconsider or clear this up. If they truly want home shoppers to be able to use the Good Faith Estimate to shop for a mortgage before they’ve signed a purchase and sales agreement…they need to provide us with more clarification…and soon!