The FOMC, during a scheduled meeting, elected to reduce the Fed Funds rate by 0.5% from 1.5% to 1.00%. Unless you have a HELOC that is floating (attached to the Prime Rate) this does not directly impact your mortgage interest rates. However, it will influence mortgage rates based on how traders react (50 basis points is what was expected). If you’re a long time reader of Rain City Guide, you’ve all ready heard this song and dance.

Category Archives: Seattle Real Estate Stats

A World Series View Shot

Options for Homeowners Facing Foreclosure

This is Part Two of a series of articles on the foreclosure process.

This article does not constitute legal advice.

Foreclosure laws vary from state to state.

Homeowners in financial distress should always hire legal counsel. Call your local state bar association for a referral. Reduced or free legal aid may be available in some states. Ask for a referral from the state bar association or through a LOCAL HUD-Approved Housing Counseling Agency.

For homeowners who are facing financial hardship, denial is a warm, safe comfortable place to stay, where tough decisions can’t hurt and the decision-making process is put off one day at a time. There is FREE help available from your local state non-profit agencies.

Local, HUD-Approved Housing Counseling Agecies received 1.5 million dollars from Washington State when Gov. Gregoire signed SB 6272. State agencies are already whining that they are “overwhelmed”. Hmmm. How much of that 1.5 million dollars was spent hiring and training competent counselors and how much went into executive salaries, high paid consultants and task force meetings? There are plenty of out-of-work mortgage production people who are (at this point) probably willing to work at non-profit agencies. Put them to work. Perhaps I am in denial as to the extent of the problem at our state agencies. If so, agencies: please enlighten me and RCG readers. If the problems are with the banks and their ability to handle the calls, that doesn’t mean we throw more money at the state agencies. In part five of this series, I will ponder about massive government intervention. For now, we’re left dealing with the problems at hand.

If you are a homeowner reading this article, that means you’re starting to come out of denial. Maybe a friend or relative forwarded this to you. Welcome to raincityguide.com How are you? Don’t say “fine” through tears or clenched teeth. Not so good, right? Okay then. Is your financial distress temporary or long term? THIS is perhaps the most important question you’ll need to answer. This is going to require that you get real with where you are in life. Long term, permanent financial distress situations are going open up options that might be different for a homeowner who has a short term financial distress problem. Let’s try to break things down even more. Long Term: You’ve been laid off and have been unable to find work at your former pay level for along time and you have third party confirmation that the chances of being able to reach that pay level again are very low. Short Term: You’ve been laid off and have been unable to find work at your former pay level but your prospects are good or you’ve recently been re-hired at a similar pay level.

Reinstatement

If you are payment or two behind, which may happen with temporary financial distress, your lender will be thrilled beyond your wildest expectations to accept the total amount owed in a lump sum. Reinstatement often happens simultaneously with a forbearance agreement.

Forbearance Agreement

Your lender agrees to reduce or suspend your payments for a short period of time. These two options are good for people whose financial distress situations are temporary.

Repayment Plan

Your lender helps you get “caught up” by allowing you to take missed payments and tack them on to your existing payment each month until you are caught up.

If your financial distress is long term and will permanently affect your ability to continue making your payments:

Consider Selling

With home values going down, if you do have some equity remaining in your home, you may be better off selling NOW rather than waiting until next year when scads of REOs (already foreclosed-upon homes that the lenders must dispose of) will continue to hit the market, driving inventory up and home values down. If you owe more on your home than what the home can be sold for in today’s market, you have probably already heard of the term Short Sales. In this case, the lender is asked to reduce the pricipal balance and allow the loan to be paid off in order to facilitate a sale. Most lenders are not radically motivated to approve short sales unless foreclosure is imminent. This author does not recommend that you stop making your mortgage payment in order to force the bank to approve your short sale. All homeowners in financial distress should have an attorney holding their hand the entire time. If you have assets, you do not qualify for a short sale. Short sales are reserved for homeowners with NO MONEY and you will be asked to provide proof that you have no money. If you have money, this is a different kind of transaction. It’s called “Making Your Downpayment in Arrears” and you’ll be asked to bring that money at closing. Don’t ask anyone to help you hide your assets. Doing so may constitute mortgage fraud which is now a class B felony in Washington State. I could go on and on about short sales. If you need more education in this area, we’ve covered the topic in these RCG articles:

Short Sales

—-

Question From Today’s Short Sale Class

—-

Should You Buy a Short Sale Property?

—-

Is a Short Sale a Bargain?

____

Why Do Banks Take So Long to Approve a Short Sale?

Maybe you would prefer not to sell. Consider taking on a tenant or moving out into more affordable living quarters and renting out your home.

Refinancing is a tough road for homeowners in financial distress. On the one hand, they have been hit by some kind of financial hardship and this typically affects their credit score, which means lender’s rates and fees will be higher. In addition, tightening underwriting guidelines is something banks do in order to help stop the rising tide of foreclosures. People who hold mortgage loans today might not be able to re-qualify for that same loan if they had to requalify under today’s guidelines. Income and assets must be fully documented. Find a licensed, local mortgage lender with FHA-approval to see if you might qualify for an FHA loan. For people who made the conscious decision to state their income higher than reality are out of luck, unless they can prove that they were coached to do so by their lender. Consult a local attorney for further guidance. Since refinancing might only be yesterday’s dream for some, Loan Modifications are all the rage in my spam bin. We’ll cover Loan Mods in Part Three.

While doing research for this blog post, I stumbled upon even more money that went from our state government’s rainy day fund, into a state fund to help low to moderate income Washington State homeowners in foreclosure refinance into new loans through the Wash State Housing Finance Commission. Read more here. I sent an inquiry asking the WSHFC how many WA State Homeowners have been helped this far by this new law and they said, emphasis mine:

Dear Ms. Schlicke:

Thank you for your interest in the Smart Homeownership Choices Program. To date, we have not made a loan to a prospective applicant. The good news is that when we have talked to the delinquent homebuyers, it seems they have not been able to make contact with their lenders to discuss foreclosure options. So, we have been able to facilitate getting them to the right person for loan modifications, etc. There have also been homeowners who have not been pleased with the fact that the assistance is in the form of a loan and not a grant. They believe the government should be giving them the money to save their home. While we cannot respond positively to these folks, we do send them to one of our homeownership counseling partners to help them with other options that might be available.

If you know someone who might benefit from the program, please feel free to give them my contact information.

Sincerely,

Dee Taylor

Director, Homeownership Division

Washington State Housing Finance Commission

1000 Second Avenue, Suite 2700

Seattle, WA 98104-1046

(206) 287-4414

Part one: Foreclosure; Losing the American Dream

Part two: Options for Homeowners Facing Foreclosure

Part three: Loan Modifications

Part four: Government Intervention in Foreclosure

Part five: Foreclosure; Letting Go and Rebuilding

Sunday Night Stats on Monday Morning

The Dow’s holding its own so far today. “Hanging in the eights”; as I like to say. I don’t see the day coming yet when my week doesn’t start without checking the Dow when I wake up on Monday morning.

Last night I looked at the homes that sold in Redmond in August for the means of financing. Where once I saw two loans as in 80/20 and 100% financing, I now see two loans as in conforming and jumbo. One loan at exactly $417,000 and another for the difference. I saw a couple of FHA loans in the mix and a couple of cash sales, but by and large the purchases had significant downpayments. $20,000,000 worth of purchases had $13,000,000 worth of debt. So 35% down overall.

Looking at who got a good buy and who didn’t, the new bogey appears to be 1.09 times assessed value, by and large. The fabulous buys went for under assessed value, mostly in the high end near a million dollars. The assessed values I am using are still the ones that 2008 taxes are based on, so be careful there. The new ones for 2009 taxes should not produce this multiple. Up to 1.17 times assessed value is pretty safe, depending on condition of the property, with 1.09 times assessed value being fairly doable and the better sold scenario.

Some of the best buys were those that listed low and sold quickly. Some of the worst buys were listed high, and while the buyer got the property substantially less than asking price, the net result was still too high. Remember to double check the multiple of assessed value against the main floor footprint calculation keep apples to apples as to style of home.

I’m not seeing any short sale closings in the mix. Most are still stuck in pending. The “decent” buys were popular homes dropping from 1.22 and 1.17 times assessed value to about 1.13 times assessed value. Those were newer two story homes built in the mid 90s.

The waiting game is playing out where new construction is competing with resale by the same builder in the same community. It will be very interesting to see what the builders are going to do about that as we head into Winter. Look for some screaming “offers” from builders…BUT check that against the prices of same model resale before being lured by builder offerings.

Still hard to find a good house at a good price in this market, the best values still going quickly. For those who see something that “looks good” out the gate, but need a method to quickly evaluate if it is a good buy, asking price divided by assessed value is still a good rule of thumb. The closer it is to assessed value, the less time you will have to think about it.

Losers in this market are those who take too long to “think about it” and don’t have a good valuation tool. Some of the worst buys were people who bought houses at substantially less than asking price, but still over market value. Don’t fool yourself into thinking you “saved $50,000” just because you paid under asking price.

Mostly these are some tips for people who are buying in today’s market. But sellers can take note as well. After you come up with your list price, divide it by the assessed value used for 2008 NOT 2009 assessments, and see where that leaves you. If you have a view property, the multiples will be higher. Buy if you don’t, and the calculation comes up at 1.5 times assessed value…think again.

Some stats on sold in September homes without basements:

Redmond – median price per square foot $233 in 08 vs. $284 in 07 prices down 18% volume up 25% from 43 to 54. Median price down from just under $700,000 to just under $600,000 plus more home for the money as to total square footage.

Bellevue – MPPSF $332 in 08 vs. $318 in 07 prices up 5% volume unchanged at 37/38. Median price up from $685,000 to $739,750. (lots of very pricey homes in that mix vs. Redmond and Kirkland)

Kirkland – MPPSF $268 in 08 vs. $286 in 07 prices down 6% volume down 25% from 32 to 24. Median price up from $526,500 to $570,000.

King County – MPPSF $193 in 08 vs. $223 in 07 prices down 13% volume down 10% from 788 to 704. Median price down from $449,975 to $382,884

Asking Prices of unsold homes on market today:

Redmond $260 asking vs. $233 sold; 6.5 months of supply.

Bellevue $311 asking vs. $332 sold; 8 months of supply.

Kirkland $284 asking vs. $268 sold; over 12 months of supply.

King County $210 asking vs. $193 sold; just over 8 month supply.

When you consider prices and volume, you see that the deep dip in price sold in Redmond (down 18%) is giving them an increased volume of sales, up by 25%, and a shorter timeframe on existing inventory at 6.5 months in Redmond vs. 12 months plus in Kirkland.

Volume up 25% in Redmond proves that when buyer’s perceive real value, they buy. Buyers with money for downpayments do exist, but they are very, very value conscious. Bellevue stats are a bit screwy, but Kirkland and King County as a whole show that when prices are down slightly the volume is down a lot. When prices are down moderately, the volume is up somewhat.

So buyers appear to be “happy” at 18% down in price, OK with 13% down in price and not so happy about only 6% down in price. Remember, I removed basement square footage to evaluate pure living square footage, and never buy without looking at 2008 assessed value.

Stats not compiled, verified or posted by NWMLS (Required disclosure)

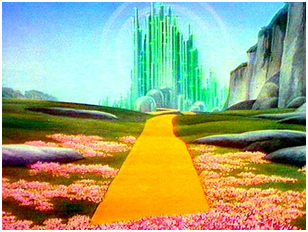

Goodbye Yellow Brick Road

The yellow brick road heading into the Emerald City, has finally lost its shine and turned to stone this past week. If the combined dreariness of fall in the Northwest, Wamu’s funeral, and the Seahawks SLOOOOW start wasn’t enough for us to ask for Lexapro during our next doctor’s visit, the latest batch of bad news certainly is.

The yellow brick road heading into the Emerald City, has finally lost its shine and turned to stone this past week. If the combined dreariness of fall in the Northwest, Wamu’s funeral, and the Seahawks SLOOOOW start wasn’t enough for us to ask for Lexapro during our next doctor’s visit, the latest batch of bad news certainly is.

No sooner than the venture capitalists sound alarms bells and implore startup CEOs to save cash, slash costs, & stay alive, two of Seattle’s Real Estate 2.0 giants, Redfin & Zillow announce workforce reductions.

Zillow announced at 25% cut on Friday, while Redfin announced that it had laid off 20% of its employees last Monday. Granted, it wasn’t like things were much better in the Real Estate 1.0 world. My NWMLS database’s member table has about 3,000 fewer records than a back up from last year did. But it’s another sign that everybody expects a long & cold winter ahead.

If you were one of the few that got axed, I wish you luck finding your future life, beyond the yellow brick road.

Employers can provide affordable housing

I once represented a community of “affordable housing” sponsored by an employer. For what it’s worth, I’d like to tell you how it functioned.

Once upon a time there was a University that was situated in the midst of a community of Million Dollar Plus homes. At some point in the history of the University, they began having great difficulty getting Professors to come to teach at the University, because the Professors could not afford to live anywhere nearby. What to do, what to do!?!

The University purchased a parcel of land and hired a developer to build a housing development of large, 2,500 sf homes. These homes were attached at one party wall. Two homes then a break two homes then a break, a whole community of what I call “twins” and most people call “duplexes”. Large two story homes without basements that attached at the two car garage and were “mirror images” of one another.

The University maintained ownership of the land. Unlike a “condo complex” where the owners of the houses jointly own the land, the land continued to be owned by the University to reduce the cost of housing for the professors.

The increase in value of the homes was controlled by a governing document and the increase in cost of the homes could only go up by the same % that the University used to increase salaries of the Professors. The cost of the homes, which were purchased and not rented, was maintained at an “affordable” level and only Professors could buy them. The gain at time of sale was controlled, but also went to the homeowner and not to the University.

The University received the original purchase price of the homes to offset cost of construction and sold them “at cost” not including the land value, since the buyers bought the houses and not the land. There were a few problems in the ongoing complex of Professors…but not many.

This is but one example that I have personally had first hand experience with, so I assume there are others. When a single employer has thousands of employees, providing a means of good, affordable housing, could help keep salary costs down while giving their employees a place to live close to where they work. Better productivity, less commute time, people tend to work longer hours because it is convenient to stop into the office and catch up on some work.

What do you think? Too Utopian for a quiet Friday morning?

Eastside – A look at "affordable" housing

I need to take a look at “affordable housing” issues after a meeting I had this week on the subject, and in preparation for a meeting I have next week on the subject. I’m primarily looking at Kirkland and comparing Kirkland to places people would move to from there.

While that is not the purpose of this post, this post will also give you some insight as to why there are “Bubble Blogs”. Many of the young people who want to raise a family without moving to Tennessee, are impacted by the same factors I am raising in this post. There was a time when I could (and did) tell them to buy condos and use the appreciation for downpayment on a home. No longer the case in the near distant future. Where are home prices going? Well strip out exotic financing, including FHA 60% backend, and look at realistic financing, and you will immediately know what the “bubbleheads” already knew. Prices have to come down considerably before a young family needing 3 bedrooms and 1,500 square feet can afford to live here.

Median incomes in the last census back in 2000 were $60,000 per household and $73,000 per family in Kirkland, but only 23% of households had children under 18 living with them. The Powers That Be take this to mean they need more affordable housing for 1 and 2 person households, since that represents over 75% of the residents. I disagree. It is my contention that young people in condos move out of Kirkland once they have a child, because affordable homes for families are more prevalent elsewhere. To me that means we need more housing for young people with children, otherwise you get overweighted in young professionals, wealthy empty nesters and “affordable housing” for lower earning singles. That doesn’t diversify the base, and expand the number of households with children under 18 living in the household, up from 23%.

Rather than up the 2000 census incomes, I’m going to call median income $65,000 for a family, as in we want to attract that which we do not have. Also, that number looks like the King County median and more appropriate for this study. I’m going to use 4X annual income plus 20% down as the barometer for housing price and minimum 3 bedrooms and 1,500 sf.

$65,000 times 4 equals a loan amount of $260,000 which is $325,000 with 20% down. This is why the presidential candidates are incorrect when they say we have to get home values back UP. They need to recognize that home values accelerated to the point were only Exotic Loans would make them attainable. So a wish to shore up property values is like a wish for Exotic Loans to make a comeback.

Let’s do an FHA 31/43 ratio double check on that. 31% of Gross Monthly Income of $65,000 is a monthly payment of $1,680. Lets back off $300 of that for taxes and insurance and call that payment 1,380 for principal and interest. That gives us a loan amount of $230,000 plus 20% down is about $290,000. So affordable housing for a family earning $65,000 would be priced at $290,000 to $325,000.

Now let’s look at property with at least 3 bedrooms and $1,500 square feet. For this purpose I am using the Tax Records vs. the MLS. as I am looking for what exists vs. what is for sale or sold. In the system I am using, the assessments for 2009 taxes are not in place, so I am using 1.17 times the assessment used for 2008 tax purposes. That means we are looking for property in the County records assessed between $245,000 and $280,000 with 3 bedrooms and a minimum of 1,500 sf.

Kirkland 98033 comes up with 39 properties, many of which appear to be apartments at the same address.

Kirkland 98034 has 54 all centered in the same vicinity.

Bothell 98011 has 35

Kenmore has 64

Bellevue has 31

Redmond 98052 has 25

Duvall has 53

Monroe has 113

Bothell in Snohomish County vs. King has 76

Mill Creek has 34

Issaquah has 27

Sammamish has 20

Renton has over 1,000

Auburn has over 1,000

Kent has over 1,000

I don’t know how many over 1,000, because there is a pre-set max on the search function. But you can readily see where a family making $65,000 a year working in Bellevue, Redmond or Kirkland needs to go to get just 3 bedrooms and 1,500 sf of living space. I didn’t put any bath requirments or lot size requirements or even separate condos out. Just 3 bedrooms and 1,500 sf and look what your money doesn’t get you.

Seattle has over 1,000 of which

16 are in 98115

28 are in 98103

9 are in 98117

Shoreline has 170

So when you look at Joe Sixpack and his story, and wonder how he got in over his head, remember that very few homes or even condos exist for a family making $65,000 a year within a reasonable distance to where they are curently renting and working. So before you blame Joe for his demise, take into consideration that he really didn’t have options available in the marketplace that would have made for a more conservative decision by his family. This not based on “what is for sale” but “what exists”.

Areas that have housing that fits the $65,000 income, also have lower median incomes.

If the Powers That Be representing Affordable Housing concerns only target 1 and 2 person households, because that is the constituency, then they are doing nothing to solve the REAL problem of “Affordable Housing”. We need more affordable households for 3 or more persons to impact the issue of “Affordable Housing.

If Kirkland only added 20 to 25 of these, they would be increasing affordable housing from 84 to 104 or 109, which would be a increasing affordable housing by 25%! Adding more one and two bedroom units, or increasing the affordability of small one and two bedroom units, continues to force young families out of the demographic.

I was told “but the whole REGION has primarily 1 and 2 bedroom households” so that is why we are targeting that demographic. I said look for WHY the region is primarily 1 and 2 bedroom households…and fix that why.

I need to look at a few more things in preparation for my meeting, if you don’t mind tagging along with me for a few more minutes. I’m raising the assessed value to $280,000 -$375,000, which is like raising the sale price from $325,000 – $440,000 and I’m adding built since 1990 to see how the cities are progressing toward adding affordable housing. It is my contention that Redmond via newer 3 bedroom townhomes is outpacing Kirkland. I need to test my perception.

Kirkland 98033 – 104 (several of these are owned buy builders and developers. Not sure what to make of that)

Kirkland 98034 – 53

Redmond 98052 – 147 (it is true that a lot of that is Rivertrail, which is where my perception comes from to some extent. I need to research how that much land close to Downtown Redmond was available to build Rivertrail. Wait a sec…no I don’t…it’s in a flood zone.

Belleuve – 194 (94 in 98005 – 67 in 98006 – 17 in 98008 – 15 in 98007 -3 in 98004

Seattle 98115 – 44

Seattle 98103 – 84

Seattle 98117 – 58

Shoreline – 219

Lynnwood – over 1,000

Bothell Snohomish – 588

Bothell King – 186

Issaquah – 669

Duvall – 428

Sammamish – 342

Kenmore – 173

Woodinville – 161

It’s about land values. Thinking out of the box, if everyone on a 22,000 to 33,000 square foot lot was allowed to keep their house and shortplat off a couple of 5,000 sf parcels and put up two 1,700 square foot homes…

Thank you for letting me think out loud. Your thoughts appreciated.

P.S. for Jillayne 🙂

Edmonds – 35 for the first group assessed at $245,000 to $280,000, 322 in the 2nd group built since 1990 and assessed at $280,000 to $375,000. hmmm am I missing something by not looking under $245,000 assessed values with no age range? 23 in Edmonds, Kirkland 62, 98052 – 120, Bellevue 43, Shoreline 68, Kenmore 51, Bothell King – 47, Duvall 27, Bothell Snohomish 37

And the Philadelphia Phillies WIN the PENNANT!!!

2008 $7,500 1st Time Buyer "Credit" is a Loan

I’ve been seeing quite a few agents and lenders using the $7,500 1st Time Buyer “Credit” in their promotional materials aimed at first time buyers. Be careful out there as many people “explaining” this “credit” to first time buyers are not including the part where it has to be repaid. The first payment of $500 begins two years after you receive the “Credit” and continues for 15 years. If you sell the property at a profit before the $7,500 is paid back, the balance is due when you sell. On the bright side, it does appear that if you do not have enough “profit” to repay the interest free loan of $7,500…it is forgiven.

Excerpted from FAQ’s On the $7,500 1st Time Buyer “Credit”:

“ …Because the tax credit must be repaid, it operates like a zero-interest loan….The program is called a tax credit because it operates through the tax code and is administered by the IRS. Also like a tax credit, it provides a reduction in tax liability in the year it is claimed.”

“…the tax credit must be repaid. Home buyers will be required to repay the credit to the government, without interest, over 15 years or when they sell the house, if there is sufficient capital gain from the sale…if the tax credit is claimed on the 2008 tax return, a $500 payment is not due until the 2010 tax return is filed.”

“…this will maximize the stimulus for the housing market and the economy, will help stabilize home prices, and will increase home sales.”

It’s not that I’m against a stimulus package for increasing homes sales, but you have to wonder how many people see CREDIT and understand LOAN? They really should call it a $7,500 1st Time Buyer Interest Free LOAN. And for all you mortage and real estate professionals, maybe we understand why the government has to call it a TAX CREDIT, but to be sure your clients know the amount has to be repaid, you should call it an interest free loan when explaining it to your clients.

MILA's Bankruptcy

The bankruptcy trustee in charge of MILA’s Chapter 11 case says there is evidence that MILA’s founder and CEO allegedly collected $32 million from MILA during the years before its demise, “improperly draining the Mountlake Terrace company’s assets as its fortune declined.”

From the Seattle Times:

“I think the executives at MILA knew by 2004 that this bubble was bursting and did their best to take out as much money as they could before it became obvious to everyone else,” says Brian Esler, who represents the bankruptcy trustee in the suit.

The suit claims Sapp, who owned about 90 percent of MILA, paid himself more than $10 million in dividends in 2004 and 2005 when the company was already “functionally insolvent,” meaning it had insufficient capital to continue normal operations and should have been preserving cash.

It also alleges he took $11.5 million in salary for each of those years, though “by March 2005, MILA was already delaying payments, even to important customers, to conserve cash.”

The trustee’s suit also claims that Sapp damaged MILA — and its creditors — in other ways:

He “surreptitiously seized” the mortgage software MILA developed and had another of his companies bill MILA for using it; charged MILA exorbitant amounts for his private yacht and business jets; and, in a “theft of corporate opportunity,” created separate companies to own a four-story office building and a parking lot that were leased to MILA, rather than having MILA buy the properties.

Sapp’s attorney, Jack Cullen, declined to discuss the allegations in detail but said: “We consider the claims nonsense. We don’t think they are founded in law or fact.”

Sapp did not return a call to his Hunts Point home.

Esler is asking the court to freeze $12 million in cash belonging to Sapp, to keep it available to creditors.

Bankruptcy Trustee Esler’s plan is to convince the court that MILA was technically insolvent for over two years before the company abrubtly closed it’s doors in April of 2007. Esler cites improper accounting and a twelve-fold increase in the number of loans MILA was required to repurchase from 2002 to 2004.

To protect creditors, the suit says, as early as 2005 “Sapp should have attempted to sell, liquidate or reorganize MILA at a time when it still had significant value, instead of continuing to manipulate and loot it for personal gain for another two years.”

The suit also takes a microscope to transactions among the various entities owned by Sapp. One example: The company that owned his 130-foot yacht billed MILA $395,374 over two years — although “MILA used that yacht only twice for asserted business reasons,” the suit says.

MILA’s creditor claims have ballooned up to 2 billion dollars. By asking the court to freeze Layne’s personal assets, is the Bankruptcy Trustee is gathering evidence to try and make a case that the corporate veil was pierced? This means Layne might have co-mingled corporate assets with personal assets. An example of that would be if personal expenses were paid for with corporate funds. This will be an interesting local case to follow.

Bankruptcy Trustee:

Miller Nash

Brian Esler

206-622-8484

Lisa Peterson or Bruce Rubin

360-699-4771

MILA Legal Counsel:

Jack Cullen

Foster Pepper

(206) 447-4689