This is Part Two of a series of articles on the foreclosure process.

This article does not constitute legal advice.

Foreclosure laws vary from state to state.

Homeowners in financial distress should always hire legal counsel. Call your local state bar association for a referral. Reduced or free legal aid may be available in some states. Ask for a referral from the state bar association or through a LOCAL HUD-Approved Housing Counseling Agency.

For homeowners who are facing financial hardship, denial is a warm, safe comfortable place to stay, where tough decisions can’t hurt and the decision-making process is put off one day at a time. There is FREE help available from your local state non-profit agencies.

Local, HUD-Approved Housing Counseling Agecies received 1.5 million dollars from Washington State when Gov. Gregoire signed SB 6272. State agencies are already whining that they are “overwhelmed”. Hmmm. How much of that 1.5 million dollars was spent hiring and training competent counselors and how much went into executive salaries, high paid consultants and task force meetings? There are plenty of out-of-work mortgage production people who are (at this point) probably willing to work at non-profit agencies. Put them to work. Perhaps I am in denial as to the extent of the problem at our state agencies. If so, agencies: please enlighten me and RCG readers. If the problems are with the banks and their ability to handle the calls, that doesn’t mean we throw more money at the state agencies. In part five of this series, I will ponder about massive government intervention. For now, we’re left dealing with the problems at hand.

If you are a homeowner reading this article, that means you’re starting to come out of denial. Maybe a friend or relative forwarded this to you. Welcome to raincityguide.com How are you? Don’t say “fine” through tears or clenched teeth. Not so good, right? Okay then. Is your financial distress temporary or long term? THIS is perhaps the most important question you’ll need to answer. This is going to require that you get real with where you are in life. Long term, permanent financial distress situations are going open up options that might be different for a homeowner who has a short term financial distress problem. Let’s try to break things down even more. Long Term: You’ve been laid off and have been unable to find work at your former pay level for along time and you have third party confirmation that the chances of being able to reach that pay level again are very low. Short Term: You’ve been laid off and have been unable to find work at your former pay level but your prospects are good or you’ve recently been re-hired at a similar pay level.

Reinstatement

If you are payment or two behind, which may happen with temporary financial distress, your lender will be thrilled beyond your wildest expectations to accept the total amount owed in a lump sum. Reinstatement often happens simultaneously with a forbearance agreement.

Forbearance Agreement

Your lender agrees to reduce or suspend your payments for a short period of time. These two options are good for people whose financial distress situations are temporary.

Repayment Plan

Your lender helps you get “caught up” by allowing you to take missed payments and tack them on to your existing payment each month until you are caught up.

If your financial distress is long term and will permanently affect your ability to continue making your payments:

Consider Selling

With home values going down, if you do have some equity remaining in your home, you may be better off selling NOW rather than waiting until next year when scads of REOs (already foreclosed-upon homes that the lenders must dispose of) will continue to hit the market, driving inventory up and home values down. If you owe more on your home than what the home can be sold for in today’s market, you have probably already heard of the term Short Sales. In this case, the lender is asked to reduce the pricipal balance and allow the loan to be paid off in order to facilitate a sale. Most lenders are not radically motivated to approve short sales unless foreclosure is imminent. This author does not recommend that you stop making your mortgage payment in order to force the bank to approve your short sale. All homeowners in financial distress should have an attorney holding their hand the entire time. If you have assets, you do not qualify for a short sale. Short sales are reserved for homeowners with NO MONEY and you will be asked to provide proof that you have no money. If you have money, this is a different kind of transaction. It’s called “Making Your Downpayment in Arrears” and you’ll be asked to bring that money at closing. Don’t ask anyone to help you hide your assets. Doing so may constitute mortgage fraud which is now a class B felony in Washington State. I could go on and on about short sales. If you need more education in this area, we’ve covered the topic in these RCG articles:

Short Sales

—-

Question From Today’s Short Sale Class

—-

Should You Buy a Short Sale Property?

—-

Is a Short Sale a Bargain?

____

Why Do Banks Take So Long to Approve a Short Sale?

Maybe you would prefer not to sell. Consider taking on a tenant or moving out into more affordable living quarters and renting out your home.

Refinancing is a tough road for homeowners in financial distress. On the one hand, they have been hit by some kind of financial hardship and this typically affects their credit score, which means lender’s rates and fees will be higher. In addition, tightening underwriting guidelines is something banks do in order to help stop the rising tide of foreclosures. People who hold mortgage loans today might not be able to re-qualify for that same loan if they had to requalify under today’s guidelines. Income and assets must be fully documented. Find a licensed, local mortgage lender with FHA-approval to see if you might qualify for an FHA loan. For people who made the conscious decision to state their income higher than reality are out of luck, unless they can prove that they were coached to do so by their lender. Consult a local attorney for further guidance. Since refinancing might only be yesterday’s dream for some, Loan Modifications are all the rage in my spam bin. We’ll cover Loan Mods in Part Three.

While doing research for this blog post, I stumbled upon even more money that went from our state government’s rainy day fund, into a state fund to help low to moderate income Washington State homeowners in foreclosure refinance into new loans through the Wash State Housing Finance Commission. Read more here. I sent an inquiry asking the WSHFC how many WA State Homeowners have been helped this far by this new law and they said, emphasis mine:

Dear Ms. Schlicke:

Thank you for your interest in the Smart Homeownership Choices Program. To date, we have not made a loan to a prospective applicant. The good news is that when we have talked to the delinquent homebuyers, it seems they have not been able to make contact with their lenders to discuss foreclosure options. So, we have been able to facilitate getting them to the right person for loan modifications, etc. There have also been homeowners who have not been pleased with the fact that the assistance is in the form of a loan and not a grant. They believe the government should be giving them the money to save their home. While we cannot respond positively to these folks, we do send them to one of our homeownership counseling partners to help them with other options that might be available.

If you know someone who might benefit from the program, please feel free to give them my contact information.

Sincerely,

Dee Taylor

Director, Homeownership Division

Washington State Housing Finance Commission

1000 Second Avenue, Suite 2700

Seattle, WA 98104-1046

(206) 287-4414

Part one: Foreclosure; Losing the American Dream

Part two: Options for Homeowners Facing Foreclosure

Part three: Loan Modifications

Part four: Government Intervention in Foreclosure

Part five: Foreclosure; Letting Go and Rebuilding

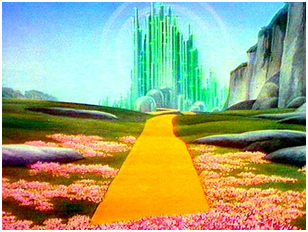

The yellow brick road heading into the

The yellow brick road heading into the