The first step in buying a new construction home, unless it is an already built “spec” home, is to choose the lot. However, not all lots can hold all homes. So to some extent you have to choose both the home to be built and the lot at the same time.

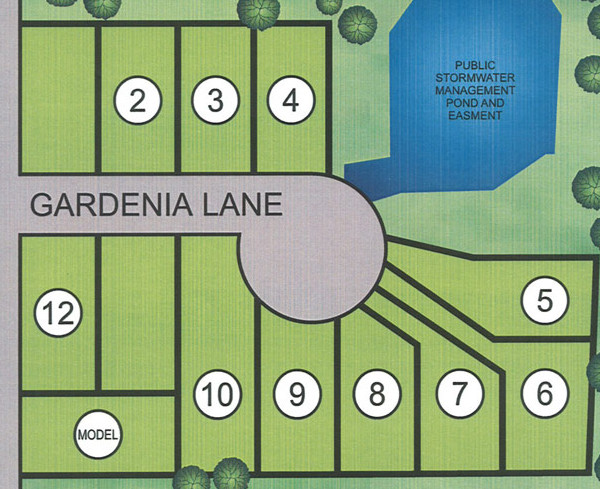

Let’s look at a small subsection of a fairly standard looking new construction development as to variations of lots available.

Choosing the lot is likely the most critical phase of buying a new construction home that is not a spec home. It used to be a lot easier to pick the best lot…or at least a good one. A standard lot was built into the price of the home and there was a “lot premium” for the other lots. Let’s say the lot premiums ranged from $2,000 to $15,000. That gave you a gauge as to how much better than a standard lot, the lot you were selecting was.

Unfortunately those days are gone and most salespeople will tell you they are all “best” lots.

Looking at lots 1,2,3 and 4, lot 4 would usually have a premium as it sides to an “open space”. You might say the same for the corner Lot 1. But if the street to the left of Lot 1 is a very busy road…now it is a lesser lot without benefit of no neighbor to the left. In essence your “neighbor to the left” is a bunch of dirty, noisy traffic. Some people feel the same way about the drainage basin to the right if it is ugly and attracts mosquitos. Sometimes people think the drainage area is going to look like a “pond” the way it states on the site plan…and sometimes it does. But more often it looks like an unkempt ugly drainage pool.

Trees? Good Drainage Issues? Can you see a green, yellow, red blinking street light from your master bedroom window? All too often someone picks the lot without standing on the lot…bring a ladder. Stand higher. 🙂

Choose the best lot and the worst lot and assign values from there. Don’t do this from a site plan like the one above without walking the entire area to see what is on the outside of those perimeters. Will there be more new homes to the North or are there existing run down homes with a few junkyard dogs.

You have to get very close to picturing the home on this lot the same way you would if you were buying an existing home on that lot. This is VERY difficult for most people.

Generally speaking only people who buy the BEST lots choose the lot and build from scratch. It makes little or no sense to build a home on a substandard lot vs waiting to see what the home looks like on that lot.

So if all of the best lots are gone…you are often better off buying a spec home or a newer resale home, than building on a substandard lot with no recourse to not “like” it once the home is put on it.

New Construction is not for everyone. If you can get the biggest and best lot in the neighborhood…go for it! The end result can be very rewarding.