The basic Real Estate questions in 2012 have been:

1) Are prices UP or DOWN, going UP or DOWN…at bottom, in recovery, recovered?

2) Is Inventory low…will it get better…where is the shadow inventory?

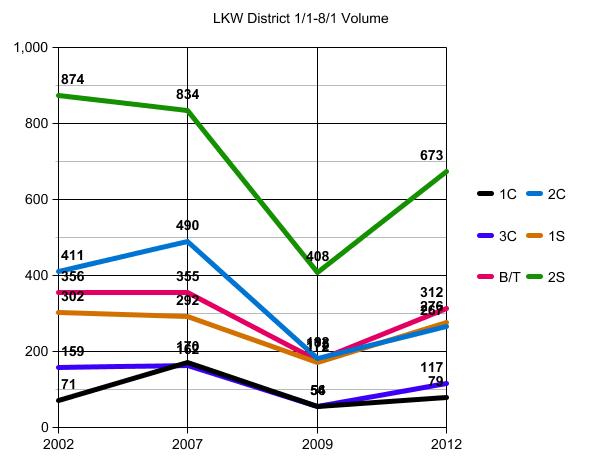

To answer these questions I am using data from the Lake Washington School District, as it represents a good mix of all possible “home” types. It also gives you a framework of how to develop a similar snapshot in your area of interest.

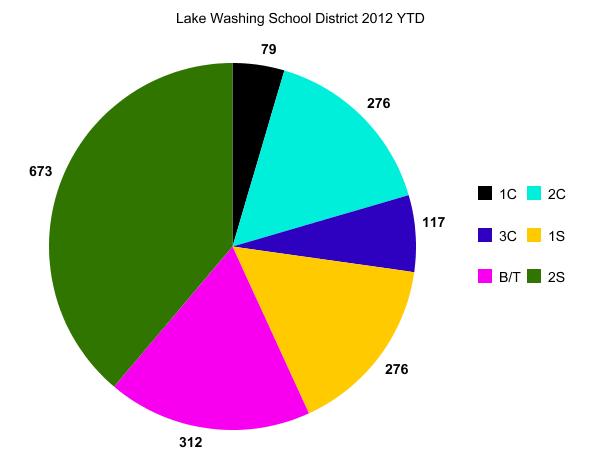

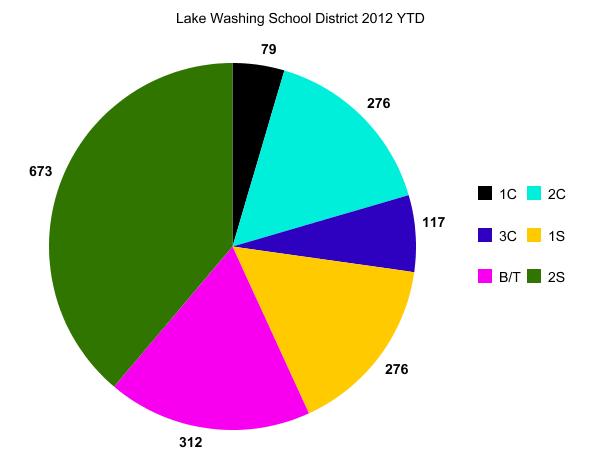

First let’s look at the snapshot of what people chose to purchase YTD 2012.

Key: 1C Black is One Bedroom Condo, 2C Turquoise-Blue is 2 Bedroom Condo, 3C Purple-Blue is 3 bedroom condo/townhouse, 1S Yellow-Gold is a 1 story home, B/T Pink is a Bi-Tri level and 2S Green is a 2 story home with or without a basement.

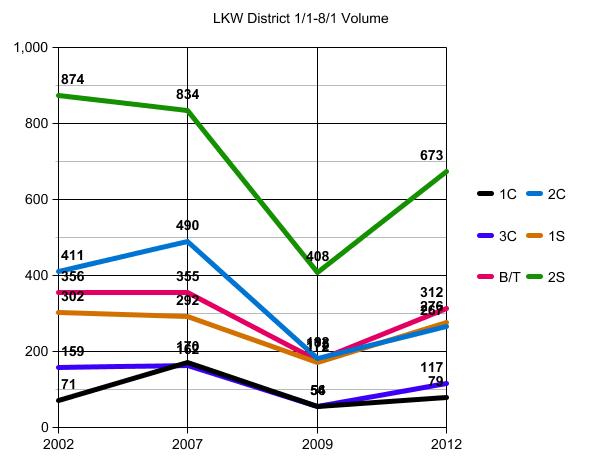

Let’s add to that some historical perspective to see if those current choices represent a shift of any kind.

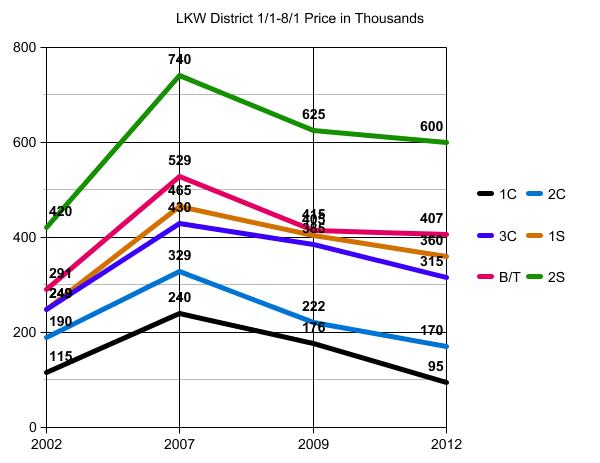

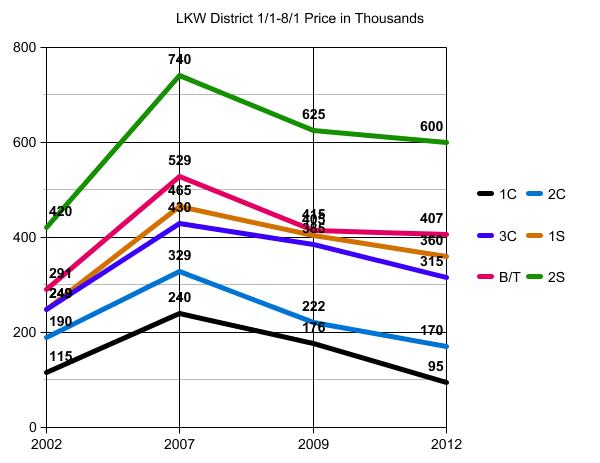

Now we add the impact of price changes on those volume graphs as to what people choose to buy…as prices change.

Back to the original questions…answered by Property Type in the order they are represented as to # of people choosing to buy them.

TWO STORY HOMES

First, let’s be clear as to what a “Two Story Home” is and is not. A two story home is where the children go UP to bed. It is not a 2 level home where the children stay on the same floor as the kitchen when they go to bed or when they go downstairs to bed. I say children as the Master Bedroom can be on the main floor in a two story home. A 2 story home can have a basement or not and in the graphs above these homes are represented in GREEN.

The 2 story home is by far the majority preference, if one can afford anything they want.

Prices have been pretty stable since 2009.

Prices are down roughly 19% from peak pricing.

Volume is pretty much fully recovered given we don’t expect volume to reach “zero down” levels.

Shadow Inventory is in 2 places for the 2 story homes.

First there are the homes ON market that are simply overpriced. Technically you have a 3.65 month supply currently “For Sale”, but only a one month to 1.5 month supply that is actually priced to sell based on current pricing. I’m being generous there allowing for homes to be 10% over where they need to be. A full 60% of 2 story homes for sale are priced at more than 10% of where they need to be…or above 110% of the price at which they will actually sell. These stay “in the shadows” and are basically invisible to those who are buying homes, until they have a price change.

Second are the homes that were bought in volume between 2002 and 2007 that are either underwater or just not yet offered for sale by the people who bought them. About half of those homes will come into the market in dribs and drabs over the next 3 to 5 years. Some will be short sales and foreclosures. Others will simply be homes bought from 2002 through 2006 or so that are not underwater. We don’t expect to see a huge surge of those coming on market all at once, so they should not impact the market by a large amount at any one given time.

Part of the reason for the decline in volume is that builders have shifted over to Northshore School District and Issaquah School District, due to the lack of available land. That probably won’t change in the near future.

TWO BEDROOM CONDOS, B/T SINGLE FAMILY HOMES & 1 Story Homes

Interesting that these three segments represent about the same market share as to real estate purchases overall.

The B/T Single Family Home is a Bi or Tri Level Home. It can be a one story with basement, a split entry or a tri level…sometimes a “multi level”. It is represented as bright PINK in the charts above.

Pretty much fully recovered as to volume, given they are not building more of these.

Prices have really leveled out well at 23% under peak pricing.

I don’t expect much MORE Shadow Inventory to come out of this class of housing that is not already ON market, but overpriced. A FULL 75% of these homes are on market…as overpriced…by a LOT.

The One Story Home has not yet settled into to a recovered position!

Still falling in both volume and price.

The Two Bedroom Condo is in the same boat.

Look at the 2nd graph and you will see these three housing segments, PINK, TURQUOISE & GOLD converging pretty much at the same point in 2009.

It’s important to note that there will be continual shift here for some time to come. When people can buy a B/T home for the same price as a 1 Story home…the 1 Story home suffers. Mostly due to the extra basement square footage in a B/T home. The 2 story condo taking the same place on stage is surprising…and being caused by the stability in price of the 3 bedroom condo-townhome.

LOTS of Shadow Inventory in the 2 Bedroom Condo and prices have much further to fall.

The 3 bedroom condos…mostly townhomes…are hard to call. They are running too close in price to the Single Family Home and way over the price of a 2 bedroom condo. I would have to say they are going to fall until they are closer to the 2 bedroom condo price than the Single Family Home price. But that’s a rough guess.

No Surprise…the One Bedroom Condo is dropping like a stone. They were pushed up in value and favor back when everything else was priced out of reach. For the most part people are just holding them as rental properties. LOTS of Shadow Inventory here, especially the underwater newer ones.

SUMMARY: The 2 story home and the Bi and Tri level homes have pretty much recovered and should stay relatively stable. Everything else has a long way to go before they have settled at a bottom as to both volume and price.

To determine where all that might be headed you might ask yourself these questions.

Looking at the price of a 2 bedroom condo at $170k and the price of a 3 bedroom condo at $315k…which would you buy? Is ONE additional bedroom worth an extra $145,000??? Probably not. That is what is holding up the pricing on the 2 bedroom condo, and why the 3 bedroom condo or townhome has further to fall.

Same goes for the 1 story home and the 3 bedroom condo-townhome. At some point the 3 bedroom newer townhome is winning over an old 1 story house without a basement…for other people not. These two have yet to come to an appropriate balance.

That’s it for now. The market should slow down a bit now that we are at 30 days to school starting. That is only as to new contracts and not August Closings. A good roundup of where we are…until we have the 4th Quarter results. in.

Everything should drop from here a bit and the big question is…Will the year END higher than it began?, and if so…in which market segments.

********

Data in this Post and the Graphs is not Compiled, Verified or Published by The Northwest Multiple Listing Service. The dates used per year are from January 1 to August 1 in each respective year.

I’m very honored to have been included in this years Seattle Bumbershoot. I recently started painting earlier this year for a hobby. I had (have) no expectations where my paintings may take me – it’s all just for fun.

I’m very honored to have been included in this years Seattle Bumbershoot. I recently started painting earlier this year for a hobby. I had (have) no expectations where my paintings may take me – it’s all just for fun.

The Senate Finance Committee recently approved

The Senate Finance Committee recently approved