1) How long is Escrow?

The correct answer is it can be as long or short as the buyer and seller want it to be. However a long escrow timeframe can cause an escrow to fail, because it can create a situation where the buyer no longer qualifies for the mortgage. Just because the buyer qualified when the offer was submitted, doesn’t mean the buyer will continue to qualify on the day the lender is supposed to fund the loan so the escrow can close.

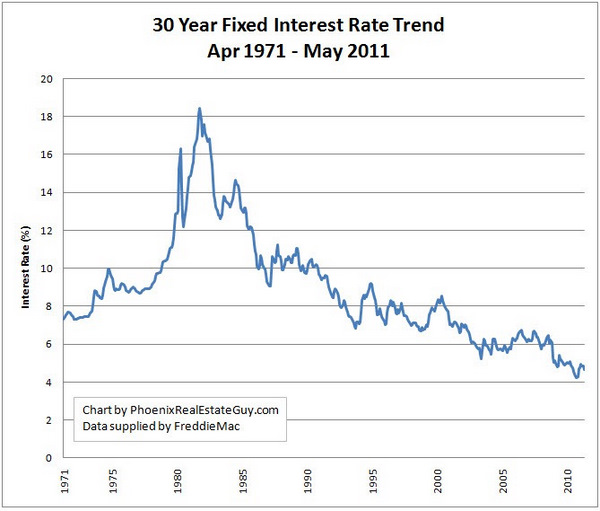

A lender assumes a given interest rate when they qualify the buyer. If that interest rate is different for the reasons detailed below, at time of close, the buyer may not qualify at that changed interest rate.

2) Why do most agents write a contract to close in 30 days or less?

Dan Green of The Mortgage Reports wrote a post today explaining why a shorter escrow timeframe equals a lower mortgage interest rate. His post explains that a 60 day lock “costs more” than a 30 day lock, often in terms of higher interest rate vs. higher cash costs to close.

In order for the buyer to get the rate they think they are getting, they have to be able to lock that rate for no longer than 30 days. While the buyer is not required to lock that rate, it should at least be a possibility. If a buyer looks at a rate quote of 5%, they often are not told that assumes a rate lock period of no more than 30 days. So if they sign a contract to close in 60 days, and then try to lock the rate in the first week of their contract, they will find the rate to do that is higher than the rate they were quoted the day they made the offer.

The rate can change in a few hours without the issues noted in this post. But even if the rate does not change at all, the rate will be higher if you try to lock it through a 60 day closing vs. a 30 day closing.

The honest lender who asks “what is your proposed closing date” and gives you a “60 day lock rate quote” will be higher than the lender who assumes a 30 day lock. Be sure the lenders are using the same parameters when quoting you a rate prior to making an offer, so that you are comparing apples to apples. In this scenario the most trustworthy lender could appear to have a higher rate, when they are being most honest about the potential for rate if you lock for 60 vs. 30 days.

3) How does the closing date timeframe, chosen at time of offer AND ACCEPTANCE, impact the buyer and seller in other ways?

Buyer A gets a pre-approval letter the day they are submitting an offer. The lender pre-approves the buyer for a $300,000 mortgage at 5%.

Seller B accepts the buyer’s offer BUT asks for a 90 day closing, as the home they are moving to is new construction, and won’t be completed for 90 days.

Buyer A accepts the seller’s counter-offer as to closing date.

30 days later the buyer sees interest rates rising and wants to lock the rate. The lender quotes the “lock rate” and the buyer is confused. “I see the rate on your website is 5%. Why are you quoting me 5.25%?” Lender explains that a 60 day lock vs. a 30 day lock adds 1/4 of a % point to the mortgage interest rate.

Here’s where it gets REALLY complicated…if the buyer doesn’t qualify to buy the house if the rate is 5.25% vs. 5%, he can’t lock it. If he chooses to wait until the closing is within 30 days before he locks the rate, the rate could be at 5.5% at that time. If the timeframe for the finance contingency protecting the buyer’s Earnest Money expires prior to that time (and almost all do), the buyer is painted into a corner by circumstance.

Moral of the story is often a buyer CAN let the seller have 90 days to close if they are renting month to month. But a buyer must consider the impact of the interest rate floating out for 60 of those 90 days and/or the cost of locking for more than 30 days at time of contract.

Today, it is near impossible for a seller to stay in the property for more than 60 days from time of offer and acceptance. You can close in 30 days and let the seller stay or rent back from the buyer. BUT the buyer’s lender will not allow that seller to rent bank for an extended period. If the buyer is qualifying at an “owner occupied” interest rate, they will impose a maximum number of days that the buyer can rent it to the seller. Beyond that time period the buyer’s lender will consider it an “investment” mortgage, and higher investor interest rate and higher downpayment requirements, vs. an “owner occupied” purchase money loan.

The “ifs, ands or buts” that happen in a split second during negotiations, can change the “assumptions” made at the time the buyer received their preapproval letter. The lender is often not “in the room” while these negotiations take place, or consulted for every tiny change in close date or rent back terms. They most often don’t see those “changes” until the buyer and seller both sign the contract as finally negotiated.

These small changes can put the buyer’s Earnest Money “at risk” of loss. The agent is the “protector of the buyer’s Earnest Money”, as related to changes in contract terms during negotiations. Yet how many realize the changed position the buyer is put in when the seller counters for a longer close date?

We see thousands of articles on “How to choose an agent?” Perhaps asking the agent “what happens if the seller wants to close in 90 days, or wants to rent back for 90 days?”, is a better question than “How many homes have you ‘sold’ this year?” The cost of closing is VERY important to the buyer. Not closing at all, due to changes no one played out to the likely eventual worst case scenario, affects both the buyer AND the seller.

Agents don’t “sell” houses. Agents represent the buyer OR the seller AND the transaction as a whole, as it appears at time of offer…AND as it changes during negotiations and escrow.

Handing a contract to escrow and waiting for a commission check is no longer an option. Changes in lending BACK TO the old tried and true rules of the game, requires agents to be on their toes all the way to the day escrow closes…or doesn’t close.

Why are so many escrows not closing these days? Everyone asks that question. Truth is the skills needed by an agent have changed dramatically back to old school…and agents still think “it’s the lender’s job” vs. theirs.