Next Thursday evening, the Washington Association of Mortgage Professionals has organized a “gala event” to celebrate it’s 25th anniversary and recognize “the best of the best” in the real estate industry from mortgage originators and companies to title, escrow and real estate agents.

Next Thursday evening, the Washington Association of Mortgage Professionals has organized a “gala event” to celebrate it’s 25th anniversary and recognize “the best of the best” in the real estate industry from mortgage originators and companies to title, escrow and real estate agents.

I thought I would take a few moments to interview Michael Colagrossi, CEO of First Rate Financial (NMLS #60862 MLO#60242) who has been a member of WAMP for the last seven years and is currently serves as the Vice President and in charge of the Mortgage Broker Council, among other duties.

I thought I would take a few moments to interview Michael Colagrossi, CEO of First Rate Financial (NMLS #60862 MLO#60242) who has been a member of WAMP for the last seven years and is currently serves as the Vice President and in charge of the Mortgage Broker Council, among other duties.

I have had the opportunity to get to know Michael via WAMP and various social media avenues. My questions to Michael are in bold with his answers following in italic.

Michael, how has WAMP benefited you and your company? WAMP has allowed our company to become more involved with the ongoing changes in the mortgage industry and how to be proactive verses taking a reactive stance. I also think as a professional it is important to take time to contribute to ones professional association for building and being involved in a community of professionals allows one to share best practices, knowledge and experiences which benefit everyone.

In your opinion, what are the most 3-5 important contributions WAMP has made to the industry? First and foremost, I believe being in an association that has stood the test of time for 25 years being here are a resource to our industry as well as local and national outlets is a contribution in itself. We interact with local government whether it be meeting with Maria Cantwell’s office to become their source of information for mortgage related questions, or meeting monthly with DFI in Olympia to give feedback on legislation and how we believe it impacts the citizens of Washington and those in our industry.

Secondly our ability to promote our professional among the public is important and what our members have to go through on a yearly basis to maintain their professional status. This can be seen by visiting our newly launched website at www.mywamp.org.

Third, we are an outlet for not only Mortgage Loan Originators but also all industry professionals ranging from appraisers, insurance agents, title and escrow professionals to voice their opinion in a social setting at our events. I think sometimes just getting together helps make us realize everyone has a support system and there are others out there fighting the good fight.

WAMP has made it 25 years – what does the future bring for WAMP? Our organization has gone through ups and downs and we recently reorganized WAMP to better reflect the economy. Flexibility and more important, the people we have that volunteer on our board is what helps keep us going. For this is a volunteer organization and without everyone contributing, we would not be here today. We are currently growing and look forward to continuing our progress into the decades to come!

Can you tell us a little about the event next Thursday that is celebrating WAMP’s 25th anniversary? The event is meant not only to celebrate our organization turning 25, but more importantly to recognize the professionals in our industry who go above and beyond for their clients and fellow business partners. The awards re meant to let the community know more about these individuals and teams and acknowledge their contributions over the last year. This event is also a time for everyone to take a load off and celebrate a great year for with all the ups and downs, sometimes we forget to take a step back and smile and realize that life is not all bad and there is light at the end of the rainbow.

Thanks, Mike! 🙂

If you would like to attend this “black tie optional” event, RSVPs technically close tomorrow with limited rsvps next week. Martin Kooistra, CEO of Habitat of Humanity’s Seattle/South King County is the Key Note Speaker with the awards dinner following.

I hope to see you at the Renaissance Hotel in Seattle on Thursday, October 27th. RSVP here.

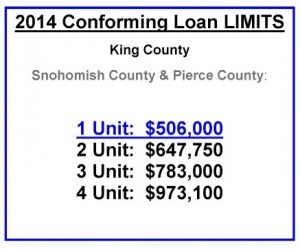

The 2013 mortgage loan limits for the greater Seattle area are for the most part, the same as 2012. The following loan limits apply for homes located in King, Snohomish or Pierce Counties.

The 2013 mortgage loan limits for the greater Seattle area are for the most part, the same as 2012. The following loan limits apply for homes located in King, Snohomish or Pierce Counties.

Yield Spread is a novel written by

Yield Spread is a novel written by