I just published about junk mail that I received on my blog… but it doesn’t even compare to the piece of garbage we received in the mail today. In fact, it was so bad, that I decided to call them to learn more about their services.

I just published about junk mail that I received on my blog… but it doesn’t even compare to the piece of garbage we received in the mail today. In fact, it was so bad, that I decided to call them to learn more about their services.

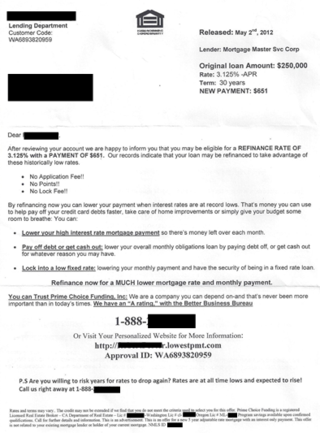

The mailer looks very official. It states “important legal information inside – please open immediately”. No where on this POS does it disclose who this is from. Not on the upper left corner of the envelope and nor in the actual body.

It does reference our mortgage company who originated the mortgage (Mortgage Master Service Corporation) and in the tiniest of small print at the bottom, discloses they’re not related to the mortgage company.

It goes on to say that the letter is from the “Loss Mitigation Administration Office” and that we receiving the notice because we may be eligible for “special modification program guidelines in conjunction with the New 2012 Home Modification Program… HAMP2 is an aggressive update to Obama’s original program. This new program may enable you to modify your existing home loan and reduce your monthly mortgage payments, receive interest rate reductions…without the traditional restrictions of credit history, income or employment status, equity and reserves…”

It goes on to offer a 2% fixed interest rate and says our information is “on file”… and if we don’t respond by July 13, 2012, we may not get this swell deal because “only a limited number of people can qualify”.

GARBAGE!!

So… I decided to call the toll free number after googling it, did not reveal who was sending us this great offer.

The gentleman on the phone had a very pleasant, soothing voice. He answers the phone “Loss Mitigation Department, can I help you?”

Me: Yes, I’d like to know who sent a mailer to my home regarding HAMP?

Him: [He reveals it’s a law firm – I’m not going to promote them here].

Me: Why did I receive this? I’m not behind on my mortgage? Don’t you need to not qualify for a regular refi or HARP to have a HAMP loan modification?”

Him: Our company has done searches to determine who may be at risk for a loan mod, perhaps you’re underwater? Lets say you have a $350,000 mortgage but your home is only worth $250,000.

Me: My home is not underwater and we’re not behind on our payments. I’m confused how I could qualify for a HAMP or why I would want one.

Him: Well you might want to consider a HAMP over a refinance because refi’s are so costly. Most have a 1% origination fee and 3.5% loan cost.

At this point, it’s hard for me to not totally blast him. He’s so far from the truth…

Me: what are your fees?

Him: I really can’t say. There’s a range depending on what you need. Who is this?

Me: You can quote costs for refi’s but you can’t give me a range for you charge?

Him: We have a flat fee of $3700 on many of our transactions. Clients are grateful for the service we provide. We can often do better than what a home owner might when dealing with their mortgage servicer directly.

Me: How are you coming up with the fees you’re comparing for a refi?

Him: You’re sounding like a “professional”, can I help you with a loan mod?

Me: No. You cannot. I am a mortgage originator you the fees you’re telling consumers for a refinance are way off base.

Him: Do you call on every piece of junk mail that you receive?

Me: I see we agree on something – this IS a total piece of junk mail and no, this is a first. It was so disgusting, I had to call to see who sent this to me.

If I were considering a loan mod, I would NOT select assistance by some scammy piece of junk mail. It sickens me when I think of folks who truly need help and might fall hard for something like this.

Why can’t they be upfront and disclose they’re an attorney’s firm and for $X, they’ll try to get you a loan mod.?

I’ll be sending this piece of solicitation to DFI for review.

Here’s information from DFI’s site regarding Loan Modifications and signs to watch out for.

If a second mortgage is not paid off, the new first mortgage will require it to be subordinated. This means that a subordination agreement must be recorded to make it public record that the second mortgage (often times a HELOC) is in second lien position and not first lien–this all boils down to who gets what rights in the event of a foreclosure.

If a second mortgage is not paid off, the new first mortgage will require it to be subordinated. This means that a subordination agreement must be recorded to make it public record that the second mortgage (often times a HELOC) is in second lien position and not first lien–this all boils down to who gets what rights in the event of a foreclosure.