Was reading the questions in the comments over on The_Tim’s post about “The Bottom Falling Out on the Low Tier”. That prompted me to run some numbers on two cities in King County. One of which is moving more solidly back into the low tier…and quickly. Another that has been in the high tier since before prices started increasing dramatically in the credit boom years.

Before I post the data, I think we should strike the tiers of 2001 and 2011 based on all Single Family Home sales in King County only, since Case-Shiller tiers are based on a different set of criteria. For this purpose I remove single and double wides, houseboats and townhomes and deal only with detached single family homes. I am using the first 5,000- homes sold in each of those years to set the tier values, since my home calculator stops at 5,000 homes. For 2001 that is the 1st quarter sales. For 2011 that is through the end of April.

2001

Low Tier – < $216,000

Mid Tier – $217,000 – $310,000

High Tier – $311,000+

with median of high tier at $400,000

2011

Low Tier – < $274,000

Mid Tier – $274,000 – $447,000

High Tier – $447,000+

with median of high tier at $614,000

For those wondering why these Tier Pricings are so very different from Case-Shiller numbers, it’s because Case-Shiller combines King, Pierce and Snohomish Counties. These are for King County only. ALSO, I’m pretty sure Case-Shiller uses resale (matched pairs) and pretty much excludes New Construction entirely, and a lot of Redmond’s story and the high price tier story is in that New Construction.

The dramatic change in the median price of the high tier tells us A LOT!

Obviously based on median prices, King County is no where near 2001 levels, BUT the following data is a bit startling.

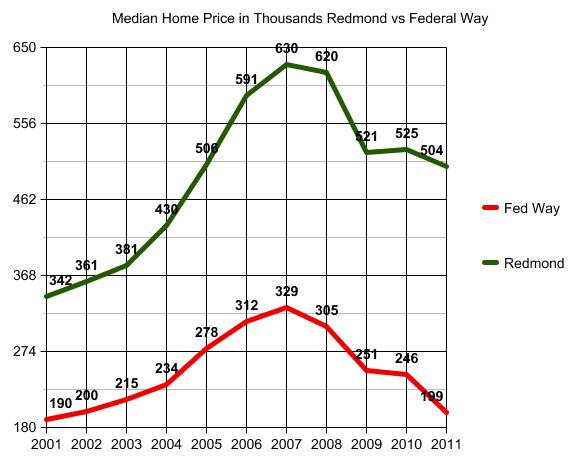

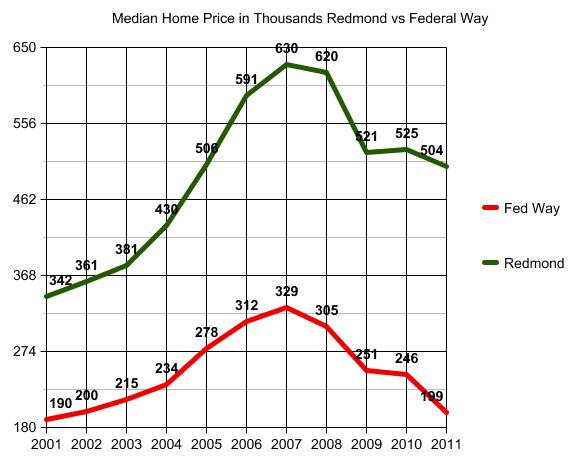

Redmond running a hair under 2005 median home price, but no where near 2004 median pricing. Federal Way on the other hand quickly degenerating toward 2001-2002 pricing.

Of course once you have some more information…you have to keep going to determine the why of it. “Why” never has ONE standout answer…but the mix of foreclosures is clearly a BIG part of the story.

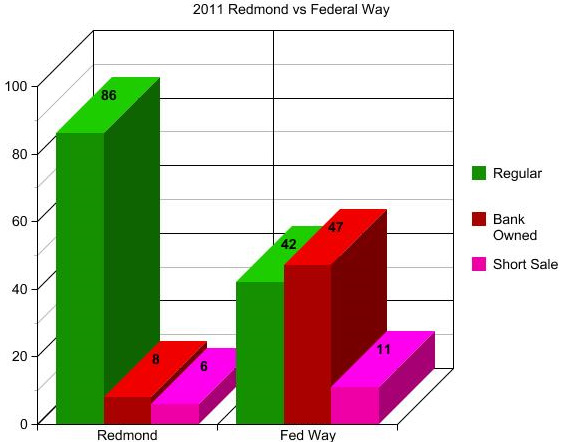

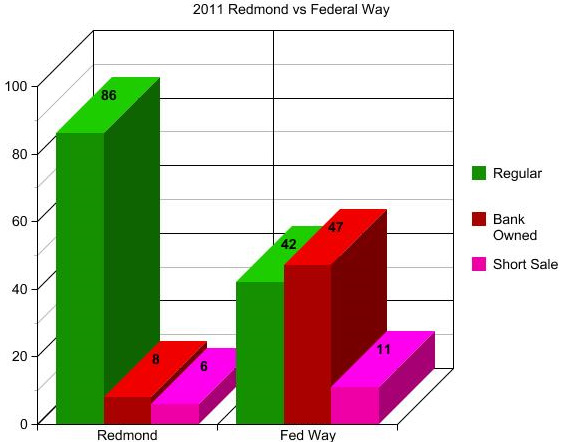

I remember reading a question on a general forum asking why a person can’t find a foreclosure home to buy in their area of preference, when all the news stories are pointing to the DELUGE of foreclosures? Well, ZOMG! that snapshot of the market above “tells a story…don’t it?” to quote Rod Stewart.

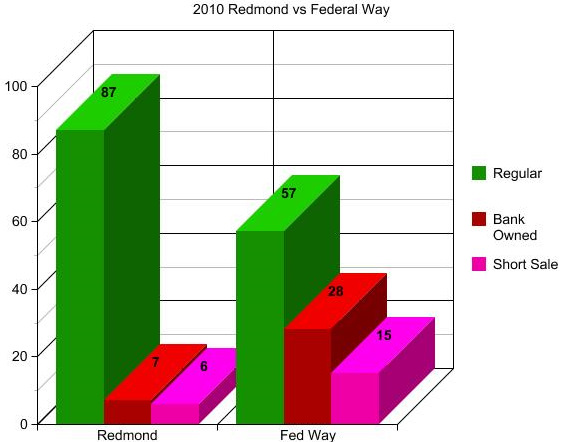

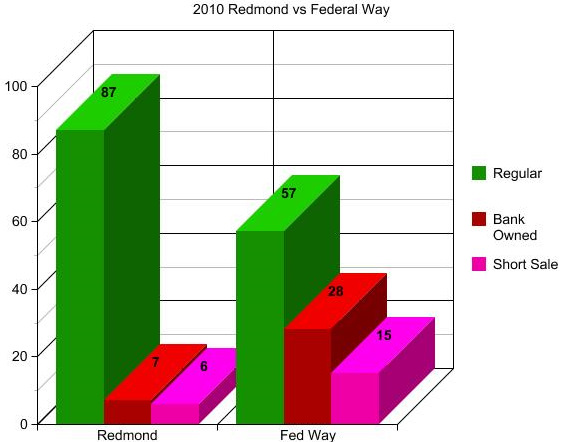

Now compare that to 2010 and you will quickly see why the Bottom Tier is pulling away…and getting HAMMERED!

The % of Foreclosures and Pre-Foreclosures (short-sales) in Redmond has barely changed. Federal Way? Well…maybe they have no place to go but up? Certainly hope so.

Now let’s look at the HUGE decline in Price of Bank Owned Property 2010 to 2011. This is going to knock your socks off.

Sorry…have to throw this in as a link over. The chart won’t load.

The short of it for people who don’t like to click on links is that the Bank Owned Solds in Federal Way not only jumped UP from 28% of total sales to 47% of total sales, but the median price of those Bank Owned sales declined from $191,000 to $156,000. WAY below 2001 pricing, and with the volume of them, they dragged the median overall sold price down from $246,000 in 2010 to $199,000 YTD 2011. Maybe it will swing back a bit by year end. But Holy Caboley!

As you will also see in that link, Redmond Bank Owned solds did not change much at all as a % of total sales, BUT the median price of those dropped from $475,000 to $330,000. Still…not enough of them to impact the overall median sold price much in Redmond.

Redmond is easier for me to explain, since I don’t work in Federal Way. Let’s see if I can get another graph to load up. WordPress is liking graphs better than Raw Data Charts.

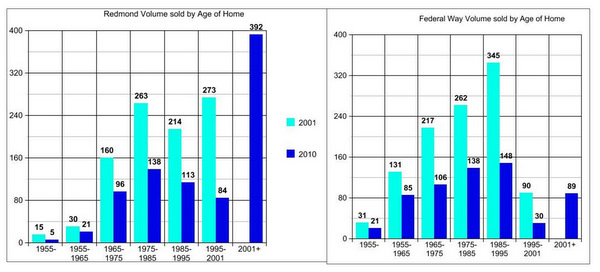

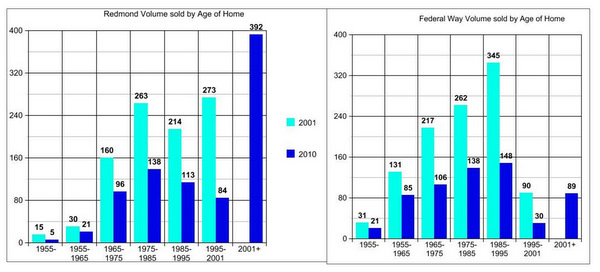

I combined these two so you can see the dramatic difference. Homes Sales in Redmond are being bolstered by the fact that a LOT of new and newer homes are being sold. You may see that change dramatically in 2012 as the builders seem to be shifting over to Sammamish due to the fact that they have used up a lot of the available land in Redmond.

To some extent the shift will move from 98052 to 98053, 98074 and 98075. But will the buyers shift with them? Probably yes, unless there are a lot more newer homes on resale in 98052 to compete with the travelling builders. You may say there are still plenty of newer resale homes in 98052, but track that against school rankings, and you will see what is happening there with regard to Elementary Schools.

So the drastic decline in Redmond Bank Owned Sold Price from 2010 to 2011 has a lot to do with the % of homes that are, or more aptly said WERE, newer homes. It looks like the glut of spec home leftovers here and there were pretty much sucked up in 2010 when 80% of the Bank Owned Sales were NEW…built since 2005…and most never lived in. Those empty new homes, some completely finished…some not so much especially as to landscaping, are pretty much gone.

Scanning at my notes here (my desk looks like the whacky professor after doing all of these stats on scribbles before processing them into charts and graphs) I’m seeing that the total # of foreclosed properties in Redmond 2011 that were built prior to 1980 are equal to the total # of foreclosures in 2010 of which 80% were built after 2005.

So the decline in price of foreclosed homes in Redmond (as noted in the link above) has more to do with the AGE of those homes, than a drop in prices.

Why the big drop in price in Federal Way? Age of homes does not seem to account for that. I don’t work in Federal Way…so it’s not as easy for me to read reality into the data there, as it is for me in Redmond. My best guess is that it is a degenerating market…like a cancer growing…each new set of foreclosures running off a discount of the current median price. Each new wave of foreclosures dragging that median price down due to sheer volume…and the downward spiral is feeding on itself.

Will be interesting to see if any of this swings back into place by year end. My gut tells me 2012 is going to be a wild ride. Looks like Federal Way has no place to go but up, let’s hope so.

Redmond on the other hand is likely going to lose a lot of that huge support from the new construction homes over to Sammamish, unless we start seeing a whole lot more newer home resales coming on market. That may also be good news for people in Redmond who have been trying to sell their built prior to 2000 homes. I have a feeling it will.

I just don’t see all of the Redmond buyers running over to 98074. Some, yes. Relocation Buyers, yes. But for the most part, either sales volume is going to plummet…or people are going to starting getting a whole lot more interested in some of those older homes that have been languishing on market during the new construction surge up on Education Hill. Probably a little of each.

More graphs and data on the above HERE, HERE and HERE. The last one helps you track the median price for these two cities in each year since 2001, so you can see the rise and fall to and from peak.

(Required Disclosure – Stats in this post and it’s graphs and charts are not compiled, verified or published by The Northwest Multiple Listing Service.)

Short Sales continue to be problematic for all concerned. So much so that “right” seems to be the minority “opinion”. At least I think I’m “right”…but apparently so does everyone else with a completely opposite opinion.

Short Sales continue to be problematic for all concerned. So much so that “right” seems to be the minority “opinion”. At least I think I’m “right”…but apparently so does everyone else with a completely opposite opinion.  Back in early October, I wrote

Back in early October, I wrote  Five to one, more people are asking me if they should sell their home vs. if they should buy one. That said, I have more buyer clients than seller clients. Those buyers are simply not asking IF they SHOULD buy. The most difficult scenarios are those who need to do both at the same time, who cannot buy unless they sell, and who don’t want to put their home on the market until they know where they will go if and when it sells.

Five to one, more people are asking me if they should sell their home vs. if they should buy one. That said, I have more buyer clients than seller clients. Those buyers are simply not asking IF they SHOULD buy. The most difficult scenarios are those who need to do both at the same time, who cannot buy unless they sell, and who don’t want to put their home on the market until they know where they will go if and when it sells.