Homebuyer Tax Credit closing date extension has passed both houses and is awaiting POTUS signature, which is expected to happen today. A homebuyer still had to be in contract by 4/30/2010, but the deadline to close as of yesterday will be extended to by 9/30.

Category Archives: Buying/Selling

Buying a Bank-Owned Home? Ball’s in YOUR Court!

Interestingly, the very same day that Craig wrote his post on assisting a buyer with a bank-owned purchase, I was closing on a very similar transaction.

One difference…mine closed. 🙂

It was even the same servicing company (so possibly and even probably the same bank-owner-seller), and also an FHA loan like Craig’s transaction. Two hurdles that Craig’s transaction may or may not have had was there were multiple offers (hard to win multiple offers if you are the only FHA buyer in the room) and the buyer’s lender at the last minute required that a new roof be put on the house, prior to closing, on a house that was only 14 years old.

I have to agree with Craig, it was absolutely grueling. It’s like being Ray Allen playing against the Lakers, but there is no one else on the Court except Ray!There were too many cooks in the kitchen on the seller side, and it was almost as if they wanted you to be late and wanted the transaction to fail. At the point where the buyer’s lender wanted a new roof on the house prior to closing, I honestly think the seller wanted to move to the back up buyer AND keep my client’s Earnest Money AND collect a $100 per day per diem for as many days as possible running through the Memorial Day weekend and beyond. This is why the SELLER should NEVER be ALLOWED to choose escrow! Somebody wise up and make a law about that!

Think about it. If escrow doesn’t close on time on a bank-owned…who suffers? Buyer can lose their Earnest Money. Buyer can pay $100 per day for every day that it is late (to the seller). So how can the seller be the one who chooses escrow, when the buyer is the one with so much at stake, and the seller with everything to gain if the buyer is late?

Of course my buyer clients did close. My buyer did not close on time BUT he also paid ZERO in per diem costs because I forced the seller’s hand to the point that they were in breach. This is not the first time I have done this with a bank owned, but it takes every ounce of my time and energy for days on end. You have to have your wits about you, stay on your toes, and play every single second, day after day, with the devotion of a Ray Allen or Rondo watching every single move and being always on top of your game. One false move…one split second of incorrect decision, is the difference between the client’s success and failure.

In this corner…the seller side…we have:

Agent for seller…Assistant for agent for seller…off-site transaction coordinator for agent for seller – Escrow Company chosen by seller with TWO closing agents, one working only on the seller side and one working only for the buyer side. FIVE layers before you even get near who the seller is, and the seller has at least a few people in between all those people and the actual selling entity/bank.

…and in this corner we have…ARDELL LOL! Kim and Amy helped do a few end runs on what the buyer was doing AT the house, like choosing new hardwood and getting estimates from painters, etc. I handled the contractual and escrow problems and the buyer’s lender issues…including lender wanting a roof ON the house prior to closing. Trust me, it is no easy feat to put a quality roof on quickly on someone else’s house without their permission. …and of course…then the rain came… If we were not ready to close the buyer would have lost his $10,000 Earnest Money and/or all those many days over the very long holiday weekend in per diem fees.

Like Craig, I can’t give a true blow by blow…but it closed and my buyer clients got the house at roughly $50,000 less than the house around the corner in the same neighborhood, that closed at roughly the same time. It was imperative that THIS be the house, as they maxed out at a price just short of what it would cost for all the things they wanted in a home, school and neighborhood. So a bank-owned was likely the ONLY way for them to get all of those things because of the bank-owned discount.

So yes…for many clients, buying a bank-owned is not only best…but sometimes the ONLY way for them to achieve their goal. The number one thing to remember to be successful in a bank owned transaction is The Ball Is ALWAYS In YOUR Court! You cannot wait ONE SECOND for the other side to do what they are supposed to do. You must do their work…yes they were the ones who needed an extension, but if I did not keep writing the addendums, because it was “their job” and not mine, it never would have closed! I had to do that three times. Banks NEVER answer…they never signed the extensions until it closed…pretty much at the same time.

You cannot ask…you cannot wait for them to answer…you cannot expect them to do what they are supposed to do. You have to run that ball across the Court like you are the only one in the room with the power to make it happen! You can’t worry about what’s fair and not fair…you just have to get it done and do everyone’s work , and figure out who has the authority to move it forward and who does not.

In my case the buyer also had all kinds of things besides dealing with the seller side that made it many times harder, even if it were not a bank-owned transaction. That was a bit distracting. But at the end of the day…it was all worth it, because I truly believe I could not easily find a replacement property for those clients in their price range. THAT is why you do a bank owned…because the discounted price makes it the BEST house for that client…and possibly the only one they can afford that fits their parameters. …and, of course, they also got the $8,000 tax credit on top of that. A grueling work load and struggle…but well worth it.

You don’t do it ONLY for the “bargain” of it…you do it because it is the very BEST house for them.

Similar story: Truliaboy gets his house and a puppy.

It’s “$8,000 Friday”!

The Tax Credit expires today. For some people that means it is $8,000 Friday…for others it is $6,500 Friday, but any way you slice it is a very important day for many people who are currently buying homes.

Oddly, given I have not and never would have, advised my clients to buy to get a tax credit, two of my clients are in “issues” involving the tax credit expiring today, somewhat coincidentally.

There are many buyers who just happened to find the right home that just came on market last week or this week, who are biting their nails waiting for a seller response “by 4/30”. If the seller is a bank or someone out of State or out of Country, this is a serious concern today.

There are other buyers who have a signed around contract before 4/30/2010, but who are in the process of negotiating the home inspection. Cancelling on inspection for a $3,000 item, and losing an $8,000 credit as a result, is part of the decision process on inspection negotiations today for many people. If they choose a different house next week vs. the one they currently have in contract, they lose the opportunity of the tax credit.

Any way you slice it…the clock is ticking…and weighing heavily on many, many people today. For those in a “gray area” as to being eligible for the credit, and there are many and varied gray areas, it is even more difficult.

In my opinion, it IS part a an agent’s job to help you preserve the right to that tax credit, and work hard to that end today. It is also part of their job to lay out the consequence of cancelling on inspection in the next several days and buying a different house instead. But NO agent can guarantee one way or the other that you WILL in fact get the credit. We can only help preserve your right to request it.

For those looking to receive a $6,500 credit, be aware of this:

“Additionally, you must have lived in the same principal residence for any five-consecutive-year period during the eight-year period that ended on the date the replacement home is purchased. For example, if you bought a home on Nov. 30, 2009, the eight-year period would run from Dec. 1, 2001, through Nov. 30, 2009. (11/17/09)”

If you live here in a rental, and still own your previous residence in another State that you lived in for less than five years…as I said…lots of gray areas. At the end of the day…this particular “$8,000 Friday”…some will be better off and some will not. An important day in the lives of many people who are in the process of buying homes.

Seller Contributions: NWMLS Form 22A vague in defining “loan and settlement cost”

Opinion: The definition of what is a “loan and settlement cost” needs more clarity on NWMLS Form 22-A (revised 12/2009).

Background:

The most recent revision (December of 2009) of the Financing Addendum “Form 22-A

When will housing prices recover? A national look.

This post is partly a follow on to Ardell’s earlier New Bottom Call post and comments on where our greater Seattle / Bellevue area home prices might go over the next few years.

This post is partly a follow on to Ardell’s earlier New Bottom Call post and comments on where our greater Seattle / Bellevue area home prices might go over the next few years.

When people ask me “How soon are home prices around here going to recover?”, I have been saying that I don’t think they will ‘recover’ for at least 3 to 4 years.

The question usually comes from someone who wants to sell, but is having a hard time dealing with the fact that the value of their home is down about 20% from the peak in summer 2007 – especially if that is when they bought it. Of course if they had bought it in early 2002, the value would have run up about 85% before it peaked, but it is truly much harder to take a loss than it is to take a gain 🙂

The next most common person asking the question is a buyer who is trying to decide if he or she is going to make money or lose money on their investment in a home. Recent history would certainly give one cause to pause on that question.

Of course there have been all kinds of predictions about which way the housing market is headed, and many of those predictions are colored by what is going on in the writer’s home market. But recently a friend sent me a very interesting analytical presentation of what is going on in the market, which included a map graphic showing what that analyst thought would happen. The chart was prepared by Moody’s Analytics, a big player who has a huge interest in figuring out what is most likely to happen, so I thought it was worth sharing with you. Here’s the chart, which is page 13 from the presentation linked at the end of this post.

This is a pretty fascinating chart. Note that some areas near us are predicted to recover to their previous highs within the next 2 to 3 years. And for some of the hardest hit areas, full price recovery may take 20 years. Factor some inflation against that and I’m not sure it is a recovery.

In our own Greater Seattle / Bellevue area, it looks like their prediction is recovery to 2007 price levels in the 4 to 5 year timeframe at best. Still, all in all it doesn’t sound too shabby – that would be about 5% a year from here, or more like 3%/yr if it stretched out to the long side. My guess is that this recovery rate would be back-end loaded – lower (near zero) appreciation rates near term, and higher rates later on as the national economy really gets rolling again. We’ve got a lot of unemplyment to work off before that happens.

The whole presentation is linked here in the 2010 – Housing Recuperates presentation from Moody’s Fall 2009 Economic Outlook Conference. In the chart on mortgage default rates on page 10, the left axis is CLTV – Current Loan to Value Ratio; the chart is a little hard to understand unless you have that information set in your decoder ring.

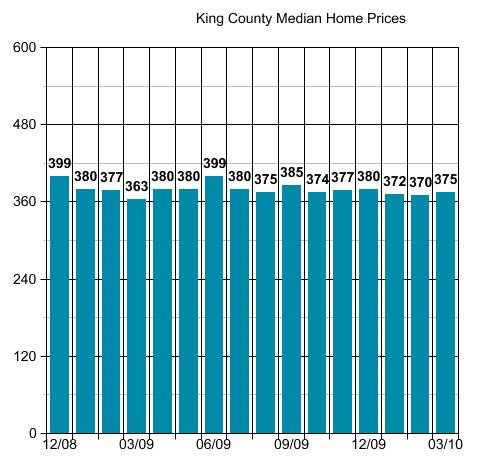

Don’t get too hung up on month-to-month fluctuations in reported median prices. As Ardell’s chart clearly shows, even with a county wide mass of data, the reported median can jiggle up or down a few percent. Our median for the 16 months shown is about $380,000 +/-5%, or swinging about $20,000 on either side in any given month. In January we had a nice 5% blip up in the condominium median price, but for February it was right back down where it had been most of the time for the past year.

A “new” bottom call…King County Home Prices 2010

Earlier today I posted my thoughts on the King County Housing Market for 2010 and received this question on twitter:

@VAF_Investments asks @ARDELLd – This downward price expectation kind of goes against your view late last year… What’s changed?

Generally speaking, my clients are making a short term decision to buy a home to live in based on a compelling reason in their life, vs a long term market timed decision. Consequently, in my world, the question becomes “If I am going to buy a home in the near future, when is the best time to do that? What is the best strategy?

In February of 2009 there was no question in my mind that March closings would likely be the lowest point of 2009. When I “called that bottom” I was greatly surprised that it made front page news, because it seemed like a great big “duh” to me at the time. The graph above shows you how that prediction played out through to present day.

New Year…New Clients…New Bottom Call. Last year I had a few clients purchase homes who I told to wait in 2008 and late 2007. In 2009, I didn’t tell anyone to “wait” but I did tell a few people not to buy at all, and am still doing so. The minute someone says “I’m planning to sell it in 3 years” I do a big “Excuse Me?” One client wanted me to graph “appreciation” for each year over the next three years…I asked him to save me the time by sticking a big fat zero on that for me in each of the three columns on a net basis.

What’s different this year? LOTS! Many people bought in anticipation of the Homebuyer Credit ending. I was at the gym yesterday and a young agent on the next treadmill was telling his friend that buyers had to hurry up before the credit expires. If every agent is telling every buyer to buy before the credit expires, how can they possibly NOT think that the market will go down after it expires? Boggles my mind that the same people saying “you must buy before April 30” are the same people saying the market will not go down AFTER that point.

There are many other factors, of course. But the Homebuyer Credit is not a small one in the big picture. The title of the PI Article last year was “Agent Predicts Housing Slump’s Demise”. In 2010 the “training wheels” will come off. The oxygen supply will be removed, and we will see what the market will do when caused to “stand on its own two feet”.

I don’t think the market will fall dramatically without further government intervention, because I think if it DOES fall dramatically there WILL be continued government intervention. So yes, I do expect Homes Prices will be lower than the median price of $362,700 from March of 2009, at least at some point in the 4th Quarter of 2010, and possibly before. I don’t think we will see another 20% – 25% decline in prices, not because the fundamentals are stronger, but because I believe the government will come up with another plan if needed, to prevent that from happening.

Remember, most of the market decline transpired under the previous Administration. This new regime has proven its desire and ability to stabilize, if not grow, the market. I do think they will let this credit expire, and I do think they will decide what to do next…after they see how the market reacts to “pulling the plug”.

Before they decide what to do next…don’t be surprised to see a “new bottom” where median home prices in King County fall below $362,700. At this moment, without all of the March closings counted, the median for the first Quarter is $370,999 (maybe a little higher if I take out the houseboats) and at $372,475 for the month of March to date (this down from the $375,000 it was a few days ago). If I take out the houseboats and mobile homes…it is $375,000.

(The stats in this post are not compiled, posted or verified by The Northwest Multiple Listing Service)

Paying a fair price for the home you buy.

One of the problems with today’s real estate inventory of homes for sale, is that it is difficult to determine if the asking price is a fair price. Today I received an email noting that the price of a home was reduced by $200,000. It is today $300,000 less than the day it went on market about three months ago.

Think about how scary that is to a would be home buyer! Someone could have paid $300,000 more for it than the asking price today, and who knows? That “new reduced price” could still be $300,000 more than someone will end up paying for it. This is particularly true of the home I am referring to in this post. (as an agent I cannot mention the address, and will have to delete it from the comments if someone else guesses it correctly. Let’s stick to the general point of the post and assume many homes fit this broad description.)

I want to talk to you today about a totally out of the box approach to buying real estate. It isn’t necessarily a new concept, it is simply the same strategy used in the hot market. In the hot market when there were 3 offers “in” when you wrote your offer, you automatically attached an “escalation clause” saying “I will pay X$ more than the highest offer up to X$ cap price”.

There are two homes on market, one each for two of my clients that my clients like, but we are agreeing that the asking price is too high for that home, and higher than any buyer will be willing to pay. In the meantime the seller is not ready to take an offer at what we consider to be a “fair” price for the homes in our “saved homes” watch list. We, the buyers and I, have attached a price to the homes that the buyer would pay, that is substantially less than the current asking price.

The way the market works generally, is buyers save these homes and wait for the price to come down. On the one hand they are afraid someone else will buy it at the price they are willing to pay. On the other hand they don’t want to get into a negotiation stance that might draw them above what they are willing to pay.

Let’s use a hypothetical. Let’s say the asking price is $999,950 and your price is $875,000. It would be fairly simple to put in an offer of $850,000 or X$ more than any other offer received with a cap of $875,000 in the next 30 days. Offer may be withdrawn anytime prior to acceptance or extended at the end of this 30 day period.

Many years ago during the last market like the one we are in now, I did something like this for a client. Slightly different. It was an abandoned very nice home. The owner did not have it on market as a short sale, they simply moved out when they stopped making their payments and moved out of State. The Bank had not foreclosed, and so the Bank could not sell the home or even consider offers to purchase. There were many people who wanted to buy the house. In fact one of the agents whose clients wanted the home, sent that client to me (which is how I got the client in the first place) as they could not determine how the buyer could get the house, it not being for sale. In fact half my business that year came from local agents who sent me situations they could not figure out in the weak market. Odd, but true 🙂

I wrote an offer at a ridiculously low price, which was also the highest price my client could afford to pay. The buyer was willing to give it his best shot, realizing that his best shot might not be good enough. I wrote the offer and sent it to the bank, who did not own it. I wrote a response time of 30 days. Every 30 days I had the buyer and his wife come into my office and rethink whether or not they still wanted that house at that price. If they said yes, I had them sign a short 30 day extension to the offer. This went on for nine months.

One day the Bank was within the time range when they could foreclose on the house. That’s one thing people don’t understand about short sales. The bank can’t always foreclose when they want to foreclose, and the person who put the offers into that file is not the person who opened the file to start the foreclosure proceedings. Banks can’t always answer your short sale offer when you want them to. The day the bank was ready to start the foreclosure process, they opened the file and found an offer inside with nine 30 day extensions. Rather than begin the foreclosure process, they called me and accepted my client’s offer.

There was never a for sale sign on the property as it was technically never for sale. My buyer client asked me to put a sold sign on the property so that would be buyers would stop going inside it while we were “in escrow”. I went over and put a sold sign up. Within two hours 21 people called screaming that they wanted to buy that house, but their agent or attorney told them they had to wait until after it was foreclosed on. One even told me he had already purchased new kitchen cabinets for it, and they were sitting in his basement.

I know there is an old saying that “the early bird gets the worm”, but in a market like this one we need to fall back on a completely different idiom. “patience makes perfect”. If you do the right things while being patient, you just might end up with a perfect result for you and your family.

Should you sell your home?

Five to one, more people are asking me if they should sell their home vs. if they should buy one. That said, I have more buyer clients than seller clients. Those buyers are simply not asking IF they SHOULD buy. The most difficult scenarios are those who need to do both at the same time, who cannot buy unless they sell, and who don’t want to put their home on the market until they know where they will go if and when it sells.

Five to one, more people are asking me if they should sell their home vs. if they should buy one. That said, I have more buyer clients than seller clients. Those buyers are simply not asking IF they SHOULD buy. The most difficult scenarios are those who need to do both at the same time, who cannot buy unless they sell, and who don’t want to put their home on the market until they know where they will go if and when it sells.

I ask three questions when someone calls or emails me asking if they should sell (now).

1) Why are you thinking about selling it?

2) When did you buy it?

3) Have you “cash out” refinanced it since you bought it, and if so, when?

When you read articles like this one, and see that Seattle Area home prices are at April 2005 levels (I agree) and peaked in May of 2007 generally (I say July 2007, but close enough), it should tell you that if you purchased during that timeframe, and even between April 2005 and present, it is highly unlikley that you will be able to sell it without bringing money to closing.

Funny…no one talks much about “bringing money to closing” these days, though it happens probably at least as often as a “short sale”. Everyone assumes “upside down” homes are “short sales”, when in fact many sellers simply walk into closing with a check the same way that buyers do. Even people who are qualified to do a “short sale”, often have to bring money to closing. Just because the home sold for less than was owed, does not automatically mean that the difference was waived permanently or temporarily. Sometimes the owner pays it in full, and sometimes the owner pays it in part.

Let’s take a somewhat ludicrous example to make that point. Say the net proceeds of the sale is $500 short from covering all expenses. Likely that $500 is going to be paid by someone, and not worth going through the “short sale” process. Another example: If someone is making their payments, has $100,000 in the bank and makes $120,000 a year and is “short” $20,000, not as likely that the lienholders are going to approve a short sale. That “seller” should be bringing $20,000 to closing. This is VERY important for agents to understand as many are listing homes as short sales simply because the amount owed is in excess of current fair market value. That is NOT the only criteria to “selling short” without bringing the needed difference to closing. If the owner can choose to stay in the home if they are not approved for a short sale, if they have the means to stay and plan to stay if they are not approved, that home should really not be on the market.

Given the knowledge we have that current prices are at April 2005 levels, give or take, let’s apply that to a specific example:

Should you sell your home if you bought it in January of 2004, and are relocating with your family to another State? Let’s say it is a 2,400 sf home in Redmond in X neighborhood, for example. I see several sales in the tax records of 2,400 sf homes in that neighborhood in the 1st quarter of 2005, all selling at approximately $530,000 which is about $100,000 more than they sold for in early 2004. Cost of sale is about 8%, so let’s call expected net proceeds after sale and possible repairs at inspection at about $90,000. Always best to round down to worst case scenario. Let’s call it $75,000, because you don’t want to put your house on market with the highest of expectations. Great if you get them, but not great if you have a vacant house on market for 6 months because you “want” $90,000 net proceeds.

If you would sell it if you could walk away with $75,000 plus your down payment back, then yes you should probably sell it. One reason you might want to rent it is if you want to “leave the door open” to possibly coming back if you don’t like your new job in that new State.

If you refinanced that same house in 2007 for $650,000, then you likely want to rent it for some period if you can, so you can take the loss as a write off by turning it into a rental property vs. a primary residence before you sell it. Check with your tax accountant before putting it on market for sale.

I can’t go through a lot of examples here in the blog post, but know that:

Why are you selling it?

When did you buy it”

Did you do a cash out refinance after you bought it?

are the three most important questions to be answered, that the person who is advising you needs to know before answering the question.

If an agent says “YES! You should sell it!” without asking these questions before answering, that probably means they just want a listing so they can get buyer calls from the sign and advertising, and use your home as “inventory” to get buyer clients. 🙂

Predatory Short Sale Negotiators

I received a call the other day from a consumer who was in the process of purchasing a short sale home. The homeowner has defaulted on her mortgage and the trustee sale auction has been postponed a few times now that this buyer’s firm offer has finally reached the lender’s loss mitigation decision-maker. Once the offer was accepted by the seller, the homebuyer was surprised to learn that there’s a third party involved, a “Short Sale Negotiator” who is charging an additional $9,000 fee on top of the real estate commissions paid to both the agent for the seller and the agent for the buyer. The Short Sale Negotiator is demanding that the homebuyer sign an agreement that the homebuyer will be responsible for paying the $9,000 fee. The homebuyer emailed me asking what I thought of this additional fee and could I offer some advice.

The first thing I did was to find out the name of the Short Sale Negotiator company, the owner of the company, and the person who is doing the short sale negotiating. I discovered that the negotiation company is owned by the same person who also owns the real estate firm where the listing agent works. I also ran the name of the short sale negotiator and discovered that this person IS a licensed real estate agent.

Readers please note that WA State’s regulators recently changed the real estate licensing laws and there’s a great FAQ section here that answers the question: Does a Short Sale Negotiator have to be a licensed real estate agent? The answer is yes, or a licensed loan originator or otherwise exempt from licensing such as an attorney. (Clicking through from the link, scroll down to “doing business” and see the second question.)

So we have a licensed real estate agent who is earning money as a short sale negotiator who works for a company owned by the same person who owns the listing agent’s real estate company.

There are a couple of things that come to mind here. First of all, isn’t there a bit of a conflict of interest for the real estate broker/owner of that company? Where are your duties? To the home seller, whose listing you’re charged with overseeing, or are your duties to the buyer, a client who signs the agreement to pay your other company $9K? What are the duties of disclosure to BOTH the seller and the buyer?

For example, if I’m the seller in this transaction, charging a buyer an extra $9,000 out of pocket might preclude a number of qualified buyers to make an offer….unless I hold back this information until after the buyer has emotionally fallen in love with the home and is already arranging the furniture in his/her mind. That seems manipulative. Why not tell all possible prospects up front what the short sale negotiator’s fee is: Make it mandatory to display this extra fee in the PUBLIC comment section of the multiple listing service.

You might be thinking: “Yes we could disclose this god-awful fee to the public this but that’s not in the best interest of the home seller.” Well, okay but what happens if you end up attracting a lot of buyers but they all walk when told of this high third party fee? Now the listing agent has wasted everyone’s time. It’s like if someone asks me out on a date and then later he tells me he’s married. Come on! Hey, some women might say yes and it’s nice to know up front how big of an a-hole a guy is. I say the listing agent would actually be attracting the right kind of buyer if they disclosed that their Short Sale Listing comes with baggage. It seems to work fine for the married guys who post personal ads on craigslist day after day.

More: If there is an affiliated business arrangement going on between the two companies that are owned by the same person/people, then a RESPA-required Affiliated Business Arrangement disclosure form should ALSO be required so that the home seller and home buyer are aware of the dual company ownership. Part of that AFBA disclosure form should state that the homebuyer understands that buying this home means he/she does NOT have to use this particular short sale negotiation firm and is free to select another short sale negotiation company to do the same or similar work. However, since a ‘short sale negotiator fee’ might not necessarily be classified as a “settlement service” then this rule might not apply. HUD are you listening? It’s highly possible that the next time a federal regulator makes it out to Washington State, the Seahawks will have won the Superbowl. Knowig this, we should look to the state regulators for assistance.

For a home buyer, a big red flag would be if the listing agent demands that you use this affiliated short sale negotiator. Demanding that a buyer use a real estate broker’s affiliated company is a licensing law violation as well as a violation of federal law when those companies are a title, escrow, appraisal company, and so forth. So why not a short sale negotiations company also?

Even more: Is the listing agent receiving part of that $9,000 fee? One way of structuring this is for the owner of both companies to promise the listing agent something like this: “if the lender cuts your commission, don’t worry, I’ll give you a portion of that $9,000 negotiator fee.” Unearned fees are not allowed under RESPA.

Even worse: Is the short sale negotiator splitting the $9,000 with the home seller? How fast can you say “Mortgage Fraud is now a Class B Felony in Washington State?”

The other logical problem that comes up for me when I see an additional fee of $9,000 is this: what work is being done for NINE THOUSAND DOLLARS? That’s an awful lot of money. I could install all new vinyl windows in my 1959 house with that kind of money. I could put this in my teenager’s college fund. I could accomplish a lot with $9,000 so why would I want to pay that kind of money to a short sale negotiator? Is this like extortion/payola in order to get that particular house for that price?

Maybe not. What is this third party negotiations company doing for their $9,000? Wait, let me go find out. I’ll read their website. Gee, there’s nothing on the website telling a consumer what their company actually does for that fee but the pictures of their team tell me they’re all good looking guys under 30. Not that there’s anything wrong with doing business with good looking guys under 30 but it should make us wonder how much experience the negotiator has at short sale negotiating. In 2009 I believe we added ten million “short sale experts” in the real estate industry.

My advice to the consumer: Negotiate that fee down to somewhere around $1,000 to $2,000. If the home is that close to the auction date, tell your real estate agent that you’re going to buy the home at the auction if the lender won’t approve the short sale and if the negotiators won’t go for a reduced fee. Most of the third party short sale negotiators out there are paid much less than $9,000.

Here’s some help with the math: I asked the consumer to ask the short sale negotiator how many hours he’s spending on this file v. how many hours he’s working on those biceps. Consumer says the SSN said he’s spent 10 hours so far on this transation! !! !!! Wow! Well! Okay then, let’s divide $9,000 by 10 hours. That’s a going rate of $900 per hour. That’s probably close to the hourly rate charged by the Johnnie Cochran law firm for litigation cases and I’m fairly certain that this licensed real estate agent negotiator doesn’t have as much experience or education as the JC legal team. Counter back with $100/hour and settle around $200/hour max.

I am betting they’ll take the $2k.

Ask for the negotiator’s $2K to be put on the HUD I Settlement Statement as a seller’s closing cost. There’s a chance the lender will pay it. If not, the buyer needs to as himself: Is this house worth $2k out of pocket at closing? It’s also important for the buyer’s new lender to know about this additional fee. Insist that it’s paid out through escrow and shows on the buyer’s side of the HUD I Settlement Statement if the lender refuses to pay it as a seller’s cost.

Buyers: do not agree to pay any money after closing, on the side, without disclosing this additional amount to all parties including the lender.

Predatory Short Sale Negotiators: The world is watching you. I wonder if your dreams are haunted the way I was haunted after watching The Hurt Locker. Soon your predatory fees are going to explode in your face. Oh, and loan mod salesmen thinking that being a short sale negotiator is the next big way to “make six figures with no experience,” please go back to the used car lots. I’m sure there are some openings at the Toyota dealerships.

King County Home Prices 2010

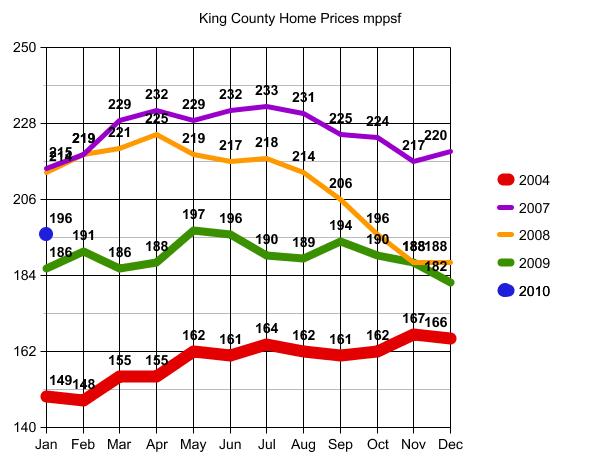

King County Home prices in 2010 will have to escape two mega foreseeable dip factors, in order to keep in the 2005 – 2006 price range. Early last year I called bottom and the end of the downward spiral, when median home price for King County was at $362,700. The year ended at at a median price of $380,000, and early closings for 2010 are running at an unsustainable high of $196 mppsf.

What to watch for in 2010:

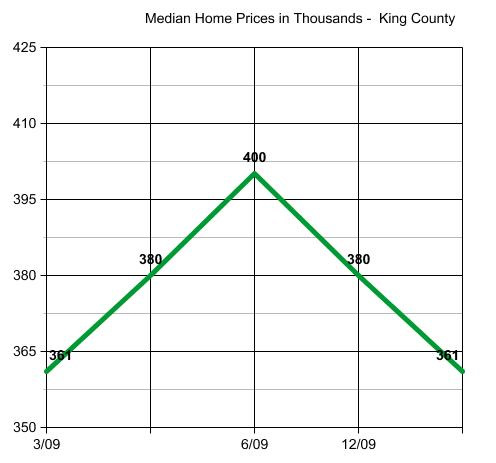

1) Prices should stay in the 5% this way or that range of $380,000. Expect a low of $361,000 to a high of $400,000. We reached that point in June of 2009 when it hit $399,000, and then backed off from there toward year end.

King County median home prices should stay within 5% of $380,000. If they move out of that range on the up or down side, it will be time to “take notice” of which way it is going out of the expected zone and why.

2) Even more important than staying in the 5% this way or that of $380,000 above, would be falling into 2004 price levels. Several times I have been quoted as saying that prices will maintain at 2005 levels, and so far that has been correct. We have a considerable cushion between current home prices and 2004 levels here in King County. For this graph I used median price per square foot, noting 2004 pricing as RED, the danger zone.

While I am still fairly confident that we will stay in 2005 – 2006 levels for the foreseeable future, I have a couple of concerns for 2010. The first, of course, is the end of the Tax Credit for Homebuyers. If we are high enough in that above $380,000 range as to median price by the time that happens, we should stay in the safe range when we take the post credit dip. If we trend down in the first quarter toward bottom, then the end of the credit will be a more worrisome event.

I am more concerned with how 2010 Assessed Values will impact home prices next year and beyond. While I agree that the County needed to back down those prices to cut back on the expensive appeal process, I see a dark cloud on the horizon. Many people have come to use County Assessed Values in some form or another when determining value and fair offer prices. The huge dip in Assessed Values from 2009 to 2010 could trigger a reaction from home buyers forcing prices into another downward spiral. We can only hope that people will look at Automated Valuation Models or “the comps”, instead of County Assessed Values. Dramatically reduced assessed values could have an unwarranted, unexpected and negative impact on home prices in the coming year. Only time will tell. That cloud may come and rain on us…or blow out to sea.

Barring a new event, look for home prices to be in the 2006 range for the strongest of neighborhoods and early 2005 range for the weakest of neighborhoods. Weakest being those with the most foreclosures and strongest being those with the least foreclosures.

East Home Prices by Style and Age of Home

North Seattle Townhome Prices by Zip Code

A Decade of Green Lake Home Prices and Sales Volume

(Required Disclosure – Stats are not compiled, verified or posted by The Northwest Multiple Listing Service)