Everyone wants to live in “the best place”, but how does one determine which is the best place for them…that also fits their budget? As with most of my posts I try to include a tutorial on how to utilize the internet to assist you in choosing wisely…or at least with informed consent.

I’ve talked before about how to use the internet to determine value and offer price. Let’s take that a step further. You don’t want a Great Deal…because you live in a block with drive by shootings and a sex offender in every other house. THAT is NOT a “Great Deal”!

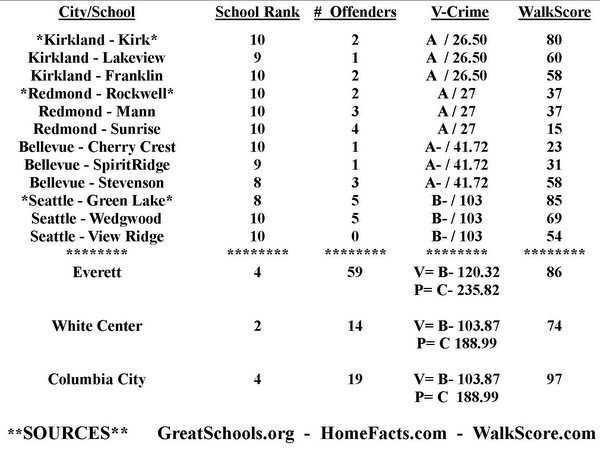

The chart below is based on a one mile radius of a given address in each area mentioned. The sources of the data are at the bottom of the chart. To make your own chart, just put in the address of the homes on your “short list”.

What you personally value or can live with is different for each person.

Some may choose a home where the school is a 4 ranking and has 59 sex offenders within a one mile radius, because they like the house. Others may settle for a split entry or a townhome in an area where there is an 8-10 ranked school and only a few sex offenders and less violent crime. Everyone is different.

I don’t think I’ve ever assisted someone in buying a home that wasn’t in the best area their money can buy, but that’s a client to client process and client decision.

If you are choosing to not use an agent at all, or to use a discounted service that does not assist with home selection, you need to fend for yourself in that regard. Using these tools and making your own chart is not infallible, but it should help to insure that if you do buy in an area of high crime…you are at least doing so with informed consent. Double check the facts…don’t take these as “verbatim”. But they should help point you in the right direction as to getting the additional facts needed.

WalkScore is often hailed as a great site, and some RE websites even show the WalkScore next to the property data. I’m NOT a big fan of WalkScore UNLESS you look at it along with a few other available sites. I AM a big fan of choosing the most highly ranked Elementary School you can afford.

Often…though not always, the best elementary school ranking is an indicator of fewer sex offenders and lower crime. That is why you may find that homes in the best Elementary School boundary lines are more expensive. Not because of the school per se, but because of all that goes with. The reverse, lower ranked school, does not always follow the same pattern. So do your due diligence and check all the details.

Take a look at the chart above. Notice that two of the highest WalkScores also have the most sex offenders and highest Violent Crime score. (V = violent Crime / P = Property Crime) as shown on HomeFacts.com You will also see the reverse. Point being that “WalkScore” does not overlay crime statistics, as some think it does. You need to use a variety of sites and sources to get all of the information available, and not just one site.

HomeFacts will also show you the pictures and addresses of the “offenders” if you open the drop down menu. A handy site.

My “theory” has always been that the highest ranked elementary schools (that have a geographic admission boundary vs “choice” schools) will also have the lowest crime and sex offender stats. That does not mean the reverse is true. You need to pull the data as it applies to your area of interest.

The reason I use Elementary School, vs middle or high school, is it helps you grade the neighborhood on a smaller geographic base than middle or high schools that draw from a larger geographic area.

Another nifty site that I just found is NabeWise and it is no surprise to me that if I put in Seattle Metro and Safety, the two neighborhoods I choose to live in BOTH come up in the TOP EIGHT!

Using the Internet to Find a Home is not ONLY about looking at PRETTY PICTURES and then hiring a Discount Commission service to buy it. The most deeply discounted “Agent” services clearly indicated that HOME SELECTION is YOUR JOB and why you are paying a lower commission. That is not merely about “the house”.

If you are going to use the internet to save on real estate commissions…and I am all FOR that…please…use as many sites as possible to find as much information as you can, before “doing it yourself” to save on commission.

TWENTY ONE years in the Real Estate Biz today.

TWENTY ONE years in the Real Estate Biz today. It’s “YAY DAY” over at Seattle Bubble today, as “The Tim” reveals to his readership that now was HIS “time to buy”, for his own good reasons.

It’s “YAY DAY” over at Seattle Bubble today, as “The Tim” reveals to his readership that now was HIS “time to buy”, for his own good reasons.