There’s a new designation available for real estate agents called “Earth Eco Bro

There’s a new designation available for real estate agents called “Earth Eco Bro

Loan Originator Compensation… April Fools? NAMB says LO Comp delayed until April 4!

Wow…whether or not you are for or against the Fed’s rule on how mortgage originators can be compensated…you cannot deny that this has been a freaking roller coaster. Here are updates from my earlier post:

UPDATE MARCH 28, 2011: NAMB is reporting via Twitter they have been successful in obtaining a temporary restraining order hearing for tomorrow morning.

UPDATE MARCH 29, 2011: Reading on Twitter that the Judge will rule before April 1, 2011 (by Thursday)…and that the Judge asked great questions and requested NAMB not file their temporary restraining order.

UPDATE 6:30 p.m. MARCH 29, 2011: NAMB and NAIHP feel pretty hopeful that LO Comp may be delayed until July for Frank Dodd. A note from NAMB that’s posted in Facebook is in my comments below.

UPDATE MARCH 30, 2011: The Judge rules against the temporary restraining order. View the Judge’s opinion by clicking here.

And now… http://twitter.com/#!/NAMBlive/status/53664096209477632:

Appellate Court grants a stay. Hearing will be on 4/5. RULE IS DELAYED UNTIL THE HEARING #locomp

Nothing on NAMB’s site tonight… they’ve updated Twitter first. NAIHP has this on their Facebook page as well.

PS: How do you feel about loan originator compensation? If you have a mortgage, or are considering a mortgage to purchase a home or refinance, please answer 3 questions on this survey.

Loan Originators Who Argue That Predatory Lending was Bad Should Welcome the New FRB Rule on LO Compensation Prohibitions

Under the final Federal Reserve Board’s loan originator (LO) compensation rule, effective April 1, 2011, an LO may not receive compensation based on the interest rate or loan terms. This will prevent LOs from increasing their own compensation by raising the consumers’ rate. LOs can continue to receive compensation based on a percentage of the loan amount and consumers can continue to select a loan where loan costs are paid for via a higher rate. The final rule prohibits an LO who receives compensation directly from the consumer from also receiving compensation from the lender or another party.

Under the final Federal Reserve Board’s loan originator (LO) compensation rule, effective April 1, 2011, an LO may not receive compensation based on the interest rate or loan terms. This will prevent LOs from increasing their own compensation by raising the consumers’ rate. LOs can continue to receive compensation based on a percentage of the loan amount and consumers can continue to select a loan where loan costs are paid for via a higher rate. The final rule prohibits an LO who receives compensation directly from the consumer from also receiving compensation from the lender or another party.

The final rule also prohibits LOs from steering a consumer to accept a mortgage loan that is not in the consumer’s interest in order to increase the LO’s compensation.

Though a lawsuit has been filed to stop the changes from going into effect, there has been legal research conducted by the FRB over the course of many years.

The FRB’s research found that consumers do not understand the various ways LOs can be compensated such as yield spread premiums (YSPs), overages, and so forth, so they cannot effectively negotiate their fees. Yes, some LOs spend many hours educating their borrowers but this is not true for all LOs.

YSPs and overages create a conflict of interest between the loan originator and consumer. For consumers to be able to make an educated choice, they would have to know the lowest rate the creditor would have accepted, and determine that the offered rate is higher than the lowest rate available. The consumer also would need to understand the dollar amount of the YSP to figure out what portion will be applied as a credit against their loan fees and what portion is being kept by the LO as additional compensation. Currently, mortgage broker LOs must do this, but LOs who work for non-depository lenders or depository banks are not required to disclose their overage.

LOs argue that consumers ought to read their loan docs and take personal responsibility for negotiating a good deal on their mortgage yet facts related to LO compensation are hidden from consumers when working with depository banks and non-depository lenders.

The FRB’s experience with consumer testing showed that mortgage disclosures are inadequate for the average random consumer to be able to understand the complex mechanisms of YSPs when working with mortgage broker LOs. Consumers in these tests did not understand YSPs and how they create an incentive for loan originators to increase their compensation.

For example, an LO may charge the consumer an LO fee but this may lead the consumer to believe that the LO will act in the best interest of the consumer. The FRB says:

“This may lead reasonable consumers erroneously to believe that loan originators are working on their behalf, and are under a legal or ethical obligation to help them obtain the most favorable loan terms and conditions.”

Consumers may regard loan originators as ‘‘trusted advisors’’ or ‘‘hired experts,’’ and consequently rely on originator’s advice. Consumers who regard loan originators in this manner are far less likely to shop or negotiate to assure themselves that they are being offered competitive mortgage terms. Even for consumers who shop, the lack of transparency in originator compensation arrangements makes it unlikely that consumers will avoid yield spread premiums that unnecessarily increase the cost of their loan.

Consumers generally lack expertise in complex mortgage transactions because they engage in such mortgage transactions infrequently. Their reliance on loan originators is reasonable in light of originators’ greater experience and professional training in the area, the belief that originators are working on their behalf, and the apparent ineffectiveness of disclosures to dispel that belief.

The FRB believes that where loan originators have the capacity to control their own compensation based on the terms or conditions offered to consumers, the incentive to provide consumers with a higher interest rate or other less favorable terms exists. When this unfair practice occurs, it results in direct economic harm to consumers whether the loan originator is a mortgage broker or employed as a loan officer for a bank, credit union, or community bank.

The Feds Loan Originator Comp Plan is a Bad Aprils Joke on YOU, the Consumer

Effective April 1, 2011, residential mortgage originators will be required to follow the Fed’s new rules on how they can be compensated (unless the pending lawsuits or Congress is successful in delaying this). You can follow #LOComp on Twitter to see the dialogue that has been taking place across the industry. In many ways, the new plan will be good for mortgage originators. Our new comp plan was revealed today and after it was announced that out of our office, I was one of the “cheapest” LOs, I discovered that I’m getting a slight raise. Many LOs who like to charge less or to help absorb costs for their clients, will no longer be allowed to do this with the new rule. LOs who were used to making more on loans may find themselves getting a paycut, if not now, then when Frank Dodd’s plans kick in this summer.

I thought to illustrate what is happening, it might be helpful to review an actual transaction I closed a few months ago. It was a rate-term refinance, however, this scenario could happen with a purchase too.

These borrowers selected me to help them with their mortgage after I had been pricing rates for them for months waiting for rates to reach a certain point for their jumbo mortgage. We locked in their rate at zero points (origination or discount) in mid-October. During that time, we were in a refi boom and therefore refi’s were taking longer to close and it was a jumbo (which can also take longer to process) so I priced the rate with a 60 day lock.

The loan was locked with the lender who offered the best pricing at that moment based on their scenario for that time period. Although we’re correspondent with this bank-lender, they do not allow us to underwrite non-conforming loans AND we have to use THEIR AMC. There was a slight time delay (eats into the lock period) where the appraiser had difficulty connecting with the borrowers who had been traveling for a week and forgot to mention this to us.

The appraisal came back slightly lower than we had estimated however, the loan to value came in just slightly under 80% which made no impact to how their loan was priced. We submitted the loan to the bank for full underwriting with the bank’s AMC appraisal. The (out of state) bank underwriter determined that this home was too nice for the Seattle neighborhood and declined this “perfect transaction”.

By now it’s November and we’re dealing with the holidays…which also impacts the lock period…which is getting close to expiring. After much contemplating, the borrowers decide they would like to proceed with a second appraisal to support the value of the first appraisal…but first we have to wait for the bank to confirm they’ll consider…the lock continues to tick down towards expiration… the banks gives us the green light and we decide to try one more time with a 30 day extension to allow time for the 2nd bank appraisal and 2nd bank underwriting, 3 day right of rescission, the holidays… you name it. The cost for the 30 day extension is 0.5% of the loan amount. I decide that I’m going to split this amount with them. This means that it’s costing me 0.25% of my commission to close this loan. I also agreed to pay for half of the second appraisal if the bank approves the loan. The transaction, for my very patient clients, did close.

Effective April 1, 2011 – I will not be allowed to pay for anything on behalf of my clients.

As a mortgage originator, I will no longer be allowed to:

- pay for extension fees, or

- pay to cure items (for example, mistakes made on a good faith estimate that are beyond the allowed tolerances)’

- help pay for a 442 re-inspection;

- reduce my commission to help pay for closing cost.

This means that mortgage companies have to factor this new “cost of business” with how they will be pricing rates. This is going to cost the consumer, mortgage companies and possibly real estate agents when it’s down to the wire and and the mortgage originator is forbidden by the Fed to chip in for the cost to extend a loan. Many in the industry anticipate that rates will be slightly increased at the retail level in order for various types of mortgage companies, including banks, to deal with these costs which were commonly the responsibility of the mortgage originator.

NOTE: I’m not a mortgage broker – I work for a correspondent lender so the rules we follow are far different than those of a broker. I wish we all had the same rules to live by as “mortgage originators” regardless of the type of institution we work for…you’ll have to ask your elected officials back at Congress why this isn’t so.

It’s going to be interesting to see how our system is revised for pricing loans. I will automatically be paid a set amount which is based on the loan amount (allowed per the Fed). Consumers that I work with will be able to see real time pricing and decide what rate at what price they want based on what is available at that moment they elect to lock. My pay is out of the picture–and I do like that part HOWEVER, I do believe that if I want to chip in to help a borrower or reduce my commission because I know a transaction is a going to be a piece of cake, I feel I should have the freedom to do so.

My clients above would have to had either walked away from their transaction or have paid 0.5% of their jumbo loan amount to keep that rate…my hands would have been tied.

There’s so much more to this rule by the Fed but I just wanted to share one example of how I feel this rule is not going to do consumers any favors.

In my opinion, this smacks of HVCC and the 2010 Good Faith Estimate… great intentions from our government and clueless of the unintended consequences to the consumer…and our housing market.

UPDATE MARCH 28, 2011: NAMB is reporting via Twitter they have been successful in obtaining a temporary restraining order hearing for tomorrow morning.

UPDATE MARCH 29, 2011: Reading on Twitter that the Judge will rule before April 1, 2011 (by Thursday)…and that the Judge asked great questions and requested NAMB not file their temporary restraining order.

UPDATE 6:30 p.m. MARCH 29, 2011: NAMB and NAIHP feel pretty hopeful that LO Comp may be delayed until July for Frank Dodd. A note from NAMB that’s posted in Facebook is in my comments below.

UPDATE MARCH 30, 2011: The Judge rules against the temporary restraining order. View the Judge’s opinion by clicking here.

How Brokers Protect Themselves at their Clients’ Expense

When you hire a professional to represent you, your interests should be paramount. If your interests conflict with the interests of that professional, you should be informed of that conflict. Before the representation continues notwithstanding the conflict, you should provide your informed consent to that continued representation. These are some of the hallmarks of “representation.” In at least one regard, real estate brokers — or at least those that use the NWMLS forms — fall far short of this standard.

How, exactly? When a contract fails for pretty much any reason, escrow will typically not disburse the earnest money to either party absent consistent written instructions from both parties. Similarly, before the seller signs another contract for the sale of the same property, it is prudent and proper for the seller to confirm that the first contract truly is dead — selling the same home twice is a sure-fire way to subject yourself to a breach of contract claim. For these and other reasons, it is a near universal practice for the parties to a contract to sign an NWMLS Form 51, a “Rescission of Purchase and Sale Agreement,” when terminating the deal.

NWMLS Form 51 is deeply flawed and totally inconsistent with the notion that the broker “represents” the client, at least in regards to a conflict between the broker and the client. Specifically, the “release” portion of the rescission not only releases the other party to the contract from further liability, it also releases the brokers from all liability. Moreover, it is not too hard to imagine a scenario where the rescission was necessitated by the broker’s own negligence, making inclusion of the release particularly distasteful.

For example, what if the broker failed to timely rescind the contract based on the inspection, and the property has a huge and costly defect? In that circumstance, the buyer might decide to simply walk away, but because the broker blew the inspection deadline the buyer will lose the earnest money. The buyer would then have a good claim against the broker for the loss of the earnest money. But if that buyer signs the Form 51, the buyer releases his broker from this claim.

The irony is that the terms are completely unrelated. There is simply no reason to include the release of the broker in the rescission — other than to protect that broker from a potential claim asserted by the client. In other words, the standard form document used by brokers includes an unrelated and irrelevant term that protects the broker from any adverse claim asserted by the client, even where the adverse claim arose out of the very same facts that led to use of the form document.

So if you’re going to hire a broker for “representation,” be aware that the representation is seriously limited by the broker’s own self-interest. For proof, look no further than the form used by a broker when the deal heads south….

Research Paper Writing Service

Research is a mandatory activity for virtually all students undertaking higher education in any professional field. This is at times a tedious evaluation exercise and it requires a combination of technical and authorship skills, because it entails different types of activities of both a physical and intellectual nature. Students are more often required to engage in research activities that may involve information gathering from both secondary and primary sources, analysis of the collected information and data as well as making inferential conclusions. Students usually encounter numerous challenges when it comes to research paper writing. The kind of challenges and difficulties encountered by these students are usually multi-faceted and they may include the actual gathering of information and data, the compilation of the gathered information and data, the analysis of the information, the making of inferences or the actual writing of the research papers. At times students may also lack enough time to engage in all these activities. The initial stages of initiating the actual research through the writing of the research proposal may also prove to be a challenge, because this section requires greater precision and focus based on the research goals and objectives.

Research is a mandatory activity for virtually all students undertaking higher education in any professional field. This is at times a tedious evaluation exercise and it requires a combination of technical and authorship skills, because it entails different types of activities of both a physical and intellectual nature. Students are more often required to engage in research activities that may involve information gathering from both secondary and primary sources, analysis of the collected information and data as well as making inferential conclusions. Students usually encounter numerous challenges when it comes to research paper writing. The kind of challenges and difficulties encountered by these students are usually multi-faceted and they may include the actual gathering of information and data, the compilation of the gathered information and data, the analysis of the information, the making of inferences or the actual writing of the research papers. At times students may also lack enough time to engage in all these activities. The initial stages of initiating the actual research through the writing of the research proposal may also prove to be a challenge, because this section requires greater precision and focus based on the research goals and objectives.

All these challenges may bog you down and make your research activities and assignments a very complex and tedious process. But this may never be the case if you seek research paper services. There are a number of online firms that specialize in offering online research paper services. The research paper services offered by online research firms vary and they encompass all the research activities and stages involved in conducting an actual research. Research paper services may help even at the very first stage of the initiation of the research process. If you are facing difficulties determining the kind of research you are supposed to do you may get help by seeking online research paper services. Under such circumstances the offered research paper services may include the customization of your research proposal.

In this section research paper services providers try to help the research define his or her research questions and objectives in a more specific manner that helps focus his or her research activities in the right direction that will help his/her answer the questions posed by the researcher. These services may also be sought whenever the student is unable to collect specific information on any topic. Under such circumstances the research paper services providers go out into the field on behalf of the researcher to gather information either from primary or secondary sources. This may then be forwarded to the researcher who will analyze it and use it writing his or her own research. However, for clients that may be unable to conduct their own analysis and inference making, online research firms can offer services in analysis and interpretation of information which is then forwarded to the client who may undertake the final writing of the research paper. In cases where the client feels that s/he may be unable to attend to all her/his research exercises, the research paper services providers may take over the whole of the research process and conduct the whole research and finally deliver a completed draft of the research paper to the client. Research paper services are very essential in helping students that may be caught up with time and unable to attend to their academic activities well. As such research paper services are indispensable in today’s busy academic environment.

Redfin adds “feedback” comments to site features

Yesterday Redfin announced the launch of a new site feature that introduces the concept of “agent feedback” on a broader and more transparent scale.

As with anything new, it will take a bit of time for things to “shake out” on this new feature, as we as an industry continue to balance the obligations to home sellers “IN” an mls system, and the wants and needs of home buyers who do not have any contractual rights within an mls system, the way that sellers do.

I will describe how this new feature appears to function at present, and as I understand it after having tested it.

When you search for property on Redfin and the little house icons appear on the map, some will have a yellow star to denote which properties have been “toured” by a Redfin agent AND the Redfin agent has noted their and/or their buyer client’s thoughts on the property.

If the house has no yellow star, it doesn’t mean it wasn’t EVER “toured” by a Redfin agent, only that the agent did not input a comment to the system after doing so.

If you click on the house icon with the yellow star, the address will appear in a link box. If you click on the link, you will get the property detail, but you will not yet SEE the comment made by the “field” agent. (“Field” agent is the term used by Redfin for agents who view property with prospective home buyers. (Agents “out in the field”.) Redfin “partner” agents also have access to posting comments, even though they are not employees of Redfin. Not sure if they can do that for all of the property they show, or only the property they show to a home buyer who was referred to them “by Redfin”. But I do know they have some access to this new feature as to leaving comments.

What you will see above the map of the parcel, and below the home detail specifics, is this: “Notes About (123 main street) from Redfin Agents Toured (X) Times” along with a Button you press that says “Email Notes to Me”.

Again, I don’t think it is accurate yet as to how many “Times” the home was toured by Redfin, but I’m confused on this issue. I have a listing toured by Redfin at least 2 times that does not have a yellow star, nor does it denote in the detail that it was ever toured by a Redfin “field” agent with a buyer (or Redfin “partner” agent). So I’m pretty sure ALL “tours” are not registering. I thought maybe “Toured 2 Times” meant there were 2 comments, but there is only 1 comment, so maybe that one agent toured it 2 times before making the comment.

Perhaps they should say “1 Comment” vs “Toured 2 Times” in the interest of “accuracy”, as “transparency” carries an obligation of a reasonable degree of accuracy as to factual content. As I said earlier, this is a minor point that will “shake out” vs “shake up” as time goes on.

When you click on the “Email Notes to Me” button, you will fairly instantaneously receive an email with the comment(s).

There is also a feature to receive new notes as they are added later on this property. That appears to be automatic, except if you click on the same property that sent you notes and hit that button again, it will give you an option to receive new notes. So not entirely sure on that one.

To receive these notes you DO NOT have to be a Redfin “CLIENT”. You simply have to be a “registered user” of the Redfin site, as I and most of my clients are.

********

BENEFITS? PROBLEMS?

1) The most notable problem is that at least two of the comments shown publicly in blog posts contain what we call “inappropriate language”. For example the one in this post from Glenn’s post says “ideal for a family” and one of the two comments posted on 1000Watt Consulting Blog by Brian Boero says “not for families with small children”.

The guideline for agents is we must talk ONLY about property and not make broad statements about who should live IN them. Both of those comments mention people vs home attributes, long considered taboo under HUD guidelines.

There are massive writings on this topic, but a good rule of thumb is:

TALK ABOUT THE HOUSE AND NOT THE PEOPLE:

1) WHO LIVE IN IT

2) WHO “SHOULD” BUY IT

3) WHO LIVE IN THE NEIGHBORHOOD.Talk about the home and it’s attributes, and not the people.

A long standing “rule” for real estate advertisements, or most any statements made by licensed agents, is talk about the house and not people.

HOWEVER I often will tell a specific client that a home is not right for them “and their small children” if the house has a master bedroom only on the 2nd floor, and the only other bedrooms are IN the basement, especially if we have already discussed that the master bedroom must on the same floor as their children’s bedrooms.

So I think if Redfin notes a specific “deficiency” of the property in that regard, without mentioning people, like “Master up; children’s bedrooms two floors below and in the basement”. That would be OK. But to simply say “not for families with small children”…well, that’s more about HOW you say it than what you say. Not a huge deal. Just another example of “shake out” of this new feature to come, IMO. What you can say TO a buyer client is different than what you can say “publicly”, and this new feature blurs the lines from a “Fair Housing Guidelines” standpoint.

2) That raises another issue. Let’s say Redfin Agents can say anything because they are speaking to Redfin site “registered users” only. Not saying that is the case, but let’s consider that as potentially the case.

Then the issue of Brian Boero, or any other “registered user”, POSTING those private email comments PUBLICLY becomes a problem.

Can he take a private email and display it publicly? I think Brian can, because I don’t think Brian is a licensed agent. I don’t think I can, unless I am linking to a public place (as I did) and it is not an email I personally received from the site.

If the rationale is ONLY “registered users” can see the comments, then shouldn’t there be an agreement with registered users that they will not publicly post those emailed comments? I think so.

3) The benefit generally is that Redfin continues to try to strike a good balance between the rights of buyers and sellers. But, the seller has a contract as to what their conditions are with regard to an mls being able to display their property information via the mls system. Buyers have no rights in that regard, as they have no written contract with “an mls system”.

I think most mls systems will allow the seller to block this feature, and will recommend that sellers do that, given the seller and the seller’s agent have very limited, if any, control or access to the function. That is generally against most any Listing Contract provision signed by a seller to gain access to the mls system. They are many and varied, but most require the Listing Agent and/or Listing Brokerage to have full control over information on “member” sites, which often limits the info to that available via an “mls” feed, with some and often many restrictions.

Time will tell, but that is my expectation. I think we will be seeing some NEW “mls rules” with regard to this new feature.

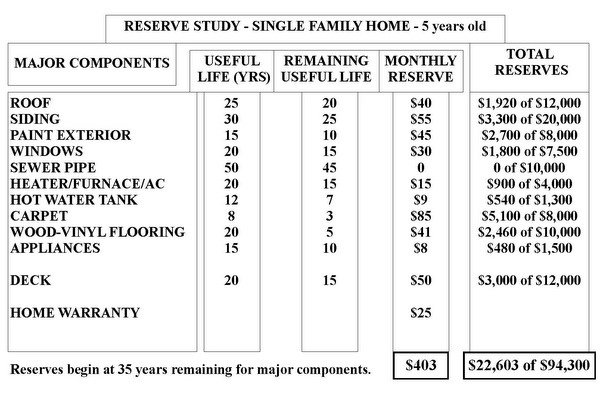

Single Family Home Reserve Study

A Reserve Study tells you how much money to set aside monthly so that you won’t have to borrow money when something needs to be replaced in your home. While monies “in reserve” for replacement costs do not currently convey with a home, condos do. It was determined some time ago that that asking people for $10,000 all at once for a new roof did not make any sense for condos, and the time may have come to look at Single Family Homes in the same light.

Yesterday I posted a Reserve Study for a particular client’s home that will be closing next week. I also did a rough sample of a “quickie” Single Family Reserve Study that you can use to modify an offer price when purchasing a home.

In this post I will do a more generic version that you can use to prepare a Reserve Study for the home you currently own, and are not intending to buy or sell.

A Reserve Study is NOT about what you will SPEND ON your home each year, the same way that gas in your car is not counted when saving money toward buying a new car, or to repair your current car.

A Reserve Study is an EARMARKED savings plan to insure that the cost of REPLACEMENT (not repair or maintenance) is available when the item is ready for full replacement. A common rule of thumb for Reserve Studies is that you do not begin to reserve funds until and unless the item is within 35 years of needing to be replaced. Consequently if you have a 50 year item, as example, you may have to spend some money on maintenance during that 50 year period, but you will not begin saving toward it’s replacement until it is 35 years old. the remaining Useful Life is 35 years.

WARNING: DO NOT READ BELOW THIS LINE IF YOU HAVE HEART PROBLEMS.

While I tend to be fairly analytical, I have to say that chart (which I created) scared the bejeebies out of me! $94,300 for Replacement Costs of ONLY the “MAJOR” Components that have a relatively short “Useful Life”! Holy Caboly!

This is one of the reasons buyers are more and more looking beyond “current defects” when doing a home inspection, and rightly so.

Let’s break this down a bit, as a Reserve Study has a lot of subjectivity vs objectivity. I will give you the benefit of my thinking, so that you can adjust accordingly, if needed.

1) ROOF I used 25 years and $12,000. This assumes a 25 to 30 year composite shingle. This Reserve Study is for a five year old home, but covers most any home with a composite shingle. For the most part 20 year shingles went the way of the dodo bird in the late 1980s or so. Any home with a 5 year old roof, whether the home is new or not, likely used at least a 25 to 30 year shingle. I also don’t expect “lifetime warranty shingle” roofs to last more than 25 years. In the last 5 years, 80% of all homes sold regardless of age had this type of roof and 87% of all homes built in the last 5 years had this type of roof.

Once in awhile you see a 50 year shingle and more often a 35 year shingle. But most are 25 to 30 year shingles. If you have a tile, flat, torch down or shake roof, you will have to adjust the numbers to that style.

I used $12,000 as I have recently seen a very good roof on a large home done for that price, even though the next door neighbor paid $18,000 for his roof. I have also seen an owner put one on using experienced relatives for $4,500. Much depends on the size of the home, the type of roof and the size and configuration of the roof. But $12,000 should be doable for the average home with room to spare as to price.

(NOTE: STOP POWER-WASHING YOUR ROOF EVERY SIX MONTHS! YOU ARE DAMAGING THE SHINGLES AND VOIDING YOUR WARRANTY! There are other and better ways to remove moss from your roof and keep it off.)

$12,000 divided by 25 years divided by 12 months = $40 a month.

2) SIDING Most newer homes use HardiePlank siding, or a reasonable facsimile. This is a cement based product that can last up to 50 years, and normally has a 30 year warranty. If you have a home built in the 90s, especially the early 90s, you may have an inferior pressed wood product that looks similar, but likely has been replaced or needs to be replaced. Wood siding has about the same life expectancy as HardiePlank.

I’ve heard the number of $20,000 used often for Siding replacement to HardiPlank, but that varies based on the size of the home. If you have HardiePlank you may not need new siding at the same time as a new roof, and the siding may even last twice as long as the roof. I’m using $55 a month due to the higher cost of re-siding vs putting on a new roof, but there is some leeway there given I expect HardiePlank to last longer than the 30 year warranty by as much as 10 to 20 years.

3) PAINT EXTERIOR – If you have real wood siding, you likely need to paint it at least every 15 years. If you have HardiePlank siding and like the color, you may not need to paint it at all. Paint usually bonds differently to HardiePlank than wood, and style colors may change every 15 years or so. If you have vinyl siding, you only have to save for replacement cost, and not for painting at all, given you really can’t or shouldn’t paint vinyl siding. Lot’s of subjectivity here. If I were doing a Reserve Study for a newer HardiePlank house, I likely would have ZERO in the monthly here. If you have a brick exterior, you don’t have to paint it, but you do have to “re-point” it, which can be quite costly for large and older brick tudors here in Seattle.

4) WINDOWS Most newer homes have vinyl windows with a life expectancy of 20 years. Often people replace the glass vs the window due to a broken window seal. Some windows are better than others and rarely does someone replace all of their windows at the same time. Wood windows can last indefinitely with repairs vs replacement. Lots of variables here including how many windows do you have? For that reason I’ve skimped on the total amount in reserve for windows to insure that you have enough to do a room or two at any given time, with room to spare. Quality of windows can vary greatly, even when windows “look” about the same. Most homes have a sliding glass door or two as well, so $7,500 cap on reserves is likely about right for most homes and most people who have “newer” windows today.

5)SEWER PIPE You don’t often hear much about Sewer Pipes unless you have an older home. I have no Reserve Amount here given the life expectancy or a sewer pipe, but wanted to mention it because of Root Problems. Tree roots can damage most any sewer pipe, especially on an older home.

Roots in the Sewer Pipe are a significant issue for older homes in Seattle, and sometimes in Bellevue and other Eastside cities as well.

So while I haven’t cautioned to reserve money for replacement cost, this item is worth mentioning because a Home Inspector generally does NOT inspect the sewer pipe, and if you are buying a home you need to have a separate inspection done of the Sewer Line. If there are a lot of trees on the property and the home is 50 years old or more…having a Sewer Scope is pretty much an imperative “additional” inspection.

6) Heater/Furnace/AC The cost I used is for a pretty good furnace without air conditioning. Life expectancy of a gas heater is usually longer. Life expectancy of an electric heatpump that is used for both heating and central air conditioning is usually shorter. Many people buy a house with a $2,500 heater, but spend up to $4,000 (or more) to replace it. That has more to do with air quality in the home than heating it or cooling it.

7) HOT WATER TANK I find there is a huge variance in life expectancy of a cheap electric hot water heater and a glass lined gas hot water heater. Also the cost has skyrocketed recently due to a bunch of added bells and whistles.

WHERE THE HOT WATER TANK SITS IS VERY IMPORTANT!

Consider “resultant damage” from the tank blowing. If the tank is IN the home or in any finished and heated living square footage, just replace it when its time is up. If it is in the garage in an area that would cause little to no damage if it blows, maybe you can push the age to and past its limit. The main issue is what will be damaged if it leaks.

Often if you have an electric tank one of the coils will go before the tank itself. You can’t “see” that, but you will know if you are getting less hot water. Personally I don’t believe in replacing the coil. Just get a new hot water tank if one of the coils goes out. I’d rather see someone skimp on some of the costly bells and whistles than stretch the time to replace the tank by replacing a coil.

8 & 9) FLOORING Lots of variables here. Many homes have lots of wood and little carpet. Others have almost all carpet except in the kitchen and bathrooms. Many people replace carpet with a wood or laminate product instead of carpet. In some homes you can replace the heavily trafficked area, like the steps, without replacing all of the carpet. More people using the home shortens the life expectancy of carpet and fewer people in the home lengthens the life expectancy of carpet.

My biggest concern here is “wood” floors. There was a time when wood floors pretty much NEVER needed to be “replaced” as you just sanded them down and refinished them. More and more even very expensive homes have newer “engineered” wood products, that can’t be sanded at all or can only be sanded lightly a couple of times.

Most people prefer big, thick, wood floors that rarely, if ever, need to be replaced. But many people who THINK they have that type…do not.

10) APPLIANCES I used a fairly low amount here as “appliances” break into two categories. Built-in appliances are part of the home. Usually that is a stove and a dishwasher and a range hood or microwave. Sometimes a cooktop and one or two wall ovens. Then there are appliances that are “personal property” such as your washer, dryer and your refrigerator. Those you can move from house to house…or not…your choice. I am only including the appliances considered to be part of the “real estate” vs “personal property”. Lately people have been paying some insane amounts for Washers and Dryers! Since washers, dryers and refrigerators are personal items, they can vary greatly as to cost. Those are not counted in this Reserve Study.

11) DECKS Another tough one. I’ve seen decks cost as much as $20,000 for a fairly modest sized deck near the ground. Many homes in the Pacific Northwest, even new ones, have extensive decking. Due to rot issues in this climate, we are seeing Trex decking used more and more, but usually only for the flooring and not some of the other components. Once in a while I see a deck that should just be thrown away when it goes, and not replaced at all. I saw a particularly troublesome cantilevered balcony deck like that…just get rid of it! Decks vary to personal taste and lifestyle, and can add considerable maintenance and replacement costs to a home.

12) HOME WARRANTY This is a big catch all that can help with a lot of items not mentioned like ELECTRICAL and PLUMBING. Rarely do you replace ALL of your electrical components or all of your plumbing. Even when you see a home advertised as “all new electrical” or “all new plumbing” that is rarely, if ever, the case. In a new home, you wouldn’t expect to replace either, but a home warranty is likely a good thing to have for both of these and also includes heater, hot water tank and built in appliances. I did not eliminate the other items from the Reserve Study as who knows if warranties will be around in 20 years and rarely does an owner renew that warranty for more than a year or two. Not sure why, but many who get them the year they purchase the home, do not renew them.

As you can see, the total cost to replace these items can often hit during the same 5 year period when the home is 17 to 22 years old!

Preparing in advance, is recommended and warranted. If you are buying a 14 or 15 year old home, knowing what if anything has been replaced since it was built is important, as you likely need to have a lot more in reserves after closing if you are running into that 15 to 25 year period. While buying a 30 year old home might have these things replaced, you may spend as much or more on updating the kitchen and baths. I recently saw a home that needed a new roof that was only 14 years old, but that is rare. But maybe rare in the past tense vs the future tense, depending on the quality of the builder.

If you have any questions, feel free to ask, regarding why I did or did not include certain items. There is really no “guide” for A Single Family Home Reserve Study, as I don’t know anyone else who has done one before.

I think this one is fairly comprehensive and accurate as to the monthly of $400 for a newer home and $700 for an older home with some things already replaced, but that needs more updating in the next 10 years or so.

Real Estate – The #2 Question

The #2 Question in Real Estate is Why Can’t I Find a Good House at a Fair Price?

The #1 Question we covered was How Much is THIS Home Worth? For those who find a house they want to buy, or may want to buy, the question is how much is it worth or how much should I offer on it?

But there are a fair amount of people having trouble finding a house they may want to buy.

OR they find a house they may want to buy, but not at the price they want to pay.

For those people the main question is Why can’t I find a GOOD home at a FAIR price.

At any given time, in any market, if you are looking for a home to live in vs an investment property, you will be lucky to find THREE good choices no matter how many homes are on market.

Every SELLER needs to BE #1, #2 or #3 and every BUYER needs to FIND #1, #2 and #3.

It really is that simple. The only difference between a Buyer’s Market and a Seller’s Market in that regard is the amount of time you have to find those. In a Seller’s market you may only have hours before #1 hits the market and has offers. In a Buyer’s market you usually have up to a week, unless you are trying to beat out everyone else.

In a hot seller’s market, good houses at a fair price are usually about 1 in a 100. In a buyer’s or balanced market, good houses are more often 2 -5 per 100. The only thing this tells you is you have to kiss more than a few frogs to find “the one”. Luckily most people are able to do that using the internet to narrow down the choices.

If you are thinking you are going to narrow down to 20 good houses and choose from those, you are likely incorrect. The danger in that thinking is that you will continue to lose out on #1, #2 and #3 while you are sorting the 20.

Worth Mentioning Here: #1 may move up to #1 after 650 days on market via a massive price reduction. So we are not talking about grabbing “new on market” necessarily. Very few homes come out of the gate at the right price.

Knowing which ones do and which don’t is what separates the men from the boys, and is likely the hardest part of finding a home to buy.

Last but not least is knowing what you want, and what a “good” house is and is not, and what a “fair” price is and is not. Easier said than done, but not as hard as you might think either. Likely the #1 mistake people make is looking at County-wide stats. As you can see from the charts below, that will likely lead you to overpaying in South King County and missing the opportunities in North King County.

I haven’t been doing condo stats for a couple of years, but threw these in so you can see the variance between Homes and Condos.

Condo and Single Family Home prices are not always moving in the same direction, and clearly never to the same degree.

Back to the Question: Why Can’t I Find a Good House at a Fair Price? You might be pricing incorrectly or you may just be taking too long to make a decision. I’m not talking about taking too long to buy the right one, I’m talking about taking too long to sort the “wrong” ones into two piles. One pile is NO and the other pile is MAYBE, but not at this price.

It’s very, very difficult to find the one that is priced right out the gate. I can usually do that, but it is seriously very difficult, and most people don’t have the heart for that in a Buyer’s market.

If you have been LOOKING for the right house at the right price for a long time, you probably need to change the method of HOW you are doing the LOOKING.

********

(Required Disclosure: Stats in this post are not compiled, verified or posted by The Northwest Multiple Listing Service)

Real Estate – From Contract to Close of Escrow

What happens after the seller has accepted your offer? Often a buyer wants to relax and celebrate after their offer is accepted, especially if there were rounds of counter offers and acceptances. But some things need to happen pretty quickly after the contract is signed by all parties. This is a fairly good example of what actually happens most times. Not all contracts are the same. This is just a rough example of what usually happens in my transactions when I represent the buyer of a home, unless the contract requires us to do things differently than “the norm”.

1) SCHEDULE THE HOME INSPECTION

Usually the very first thing I have my buyer clients do once the contract is “signed around” by all parties, is schedule the home inspection. Often people read the contract to mean that they have 5 to 10 days (every contract is different) to DO the inspection. That is not the case.

During that very limited time frame:

a) You have to “DO” The Inspection

b) You have to review the results of The Inspection

c) You have to think about what you may or may not want to ask of the seller as a result of that Inspection

d) You have to cancel the contract, or accept the inspection, or submit any conditions of accepting the Inspection, in writing, so that it is RECEIVED by the seller or seller’s representative by the end of the time frame.

You don’t want to wait until the last minute to “DO” the inspection.

My recommendation is that you call the inspector ASAP after the contract is finalized and DO the inspection at the first available opportunity after the contract is signed around. By scheduling the inspection ASAP for the first available time, you should have sufficient time to digest what the inspector said at the inspection, and also to subsequently review the written inspection report after the inspector has left the property.

You should allow about 3 to 4 hours for the actual inspection in most cases for an average sized single family home.

2) OPEN ESCROW

By the time the contract is “signed around”, the Agent for the Buyer usually has the Earnest Money check in their possession (some exceptions). Opening Escrow can be as simple as bringing a copy of the contract and the Earnest Money check to escrow, and that is often done on the first business day after the contract is accepted. Sometimes I send the contract to escrow during the weekend, if the contract was accepted on a non-business day. This way escrow has everything they need to “open escrow” when they open for business on the first business day after the weekend. The check usually has to be delivered to escrow by the 2nd business day and this is another one of those ASAP situations. Get the check to escrow as soon as practically convenient vs waiting to the last minute. There is no official time frame as to when escrow must be OPENED, there is only a required time frame for when the EM check must be AT escrow. Most escrow holders will not accept a check for an escrow that has not been “opened”, so escrow is usually opened either in advance of that check needing to be delivered to escrow, or at the same time.

Generally this 2nd step is not done by the buyer or the seller, but by the agents in the transaction.

3) APPLY FOR YOUR MORTGAGE

This step is VERY IMPORTANT and often misunderstood.

Common “misconceptions”.

a) Some people think you don’t need to apply for your mortgage until after you complete the Home Inspection phase. Most contracts require that you apply for your mortgage in a shorter time frame than when the inspection needs to be completed.

b) Some people (usually agents) think that the buyer must apply to the same mortgage company who provided the pre-approval letter at time of offer. Usually a buyer has 5 business days or less to “apply” for their mortgage AFTER the contract is signed around and “chooses” which company to apply to during that time frame. It is near impossible in most cases to actually choose a lender prior to contract, because interest rates change during that time AND the interest rate often cannot be locked until there is a signed contract. So choosing lender by comparing rates and costs is usually best done at a point when that rate can be locked in.

b) Some people (usually buyers) think they already “applied for their mortgage” complying with the terms of their contract when they provided the information to a lender before making an offer so as to get a pre-approval letter.

c) Many people think that their rate is locked, or that their rate is locked indefinitely. Rate locks of 60 days are usually more expensive than rate locks for 30 days or 45 days.

In order to preserve your rights under the Finance Contingency you need to apply for your mortgage within the time frame stated in the addendum vs in the main contract.

To me the clear signal that you have “applied” for your mortgage happens when you give the lender a copy of a fully signed around contract to purchase a home, since that is the one thing you do AFTER the contract is fully signed around that you could not have done in advance.

You may have spoken with a few lenders and even gotten pre-approval letters from more than one, but in most cases you only send a copy of the contract to the lender you intend to use to complete the transaction.

Very important to note here that you may not have the ability to switch lenders once you have applied for your mortgage.

Interest rates change frequently, so calling a lender a day may only be telling you the difference in rates from day to day vs from lender to lender. I generally recommend that people set aside a day and time to compare lenders so they are all dealing with the same rate time frame, and be sure to compare all lender fees when comparing rates.

Should you lock the rate or “float” the rate? A combination of both where you can lock the rate but get at least one “float down” option as well, often works best. That way your rate can’t go up but it can go down.

Many other variables as to which type of loan, etc. But the main point here is no matter how long it is from contract to close, you usually have a very limited time frame to apply for your mortgage under the terms of the Finance Contingency, generally 5 days or less.

********

Note: Computation of Time: Sometimes The Home Inspection is Step 3 vs Step 4. That mostly depends on the availability of the inspector you choose. Sometimes you are having the home inspection within a day or two of the contract being signed around. In that case you often do the inspection before you apply for your mortgage.

Every contract is slightly different because of “Computation of Time”. In our standard contracts 5 days or less usually does NOT include weekends and holidays…but 6 days or more does.

So if you have 6 days to do the inspection and 5 days to apply for your mortgage, 5 days can be more than 6 days since the 6 = calendar days and the 5 = business days.

********

4) THE HOME INSPECTION

The inspection is paid for by the buyer, usually before the inspection begins. The buyer usually attends the Home Inspection because it is not a PASS/FAIL kind of thing in most cases. It is also not ONLY about what is wrong with the house. A good home inspection gives the buyer a lot of information that is not all about what the buyer may want the seller to do to correct defects.

Generally a Home Inspector will:

a) Inspect the outside of the home first. Roof, siding, gutters, etc. VERY IMPORTANT: Most inspectors are inspecting “the home” and not the fence or the shed and sometimes not even decks, especially if they are not connected to the house.

b) The inspector is usually not looking at cosmetic things that can be readily seen by the buyer prior to making the offer, such as a stain in the carpet.

c) An inspector cannot see through walls, so having an experienced inspector who likely knows what is behind those walls based on the age of the house is very important.

d) Since an inspector is not looking at cosmetic items, he will usually spend more time in bathrooms and kitchens, the attic and under the house, at the heater and electrical panel and hot water tank, than in a dining room or bedroom. In a bedroom he may check the outlets and the windows and make sure the door latches properly. In a kitchen or bathroom he will be checking appliances, looking for leaks under sinks, making sure the outlets in the rooms with water have appropriate and functioning GFCI (ground fault circuit interrupters) at the outlets. Often one GFCI will operate more than one outlet.

e) Generally you do not need to take notes at an inspection, as the inspector will be providing you with a written report. Hopefully the report will have a summary of major problems and a separate summary of minor problems. Today Inspection Reports can be 85 pages long with lots of tips on home maintenance and other topics. So a one page summary of actual defects is helpful.

IMPORTANT: If something is wrong with the property, you usually know it before you get the written report. If something comes up that causes you to not want the house at all, you may not want to complete the full inspection. In fact if you suspect that to be the case, you may ask the inspector to break from his normal routine and look at that item first.

HOUSES ALMOST NEVER “FAIL” ON INSPECTION. Contracts often fail “on inspection” due to other issues, BUT “HOUSES” RARELY “FAIL” ON INSPECTION.

Most often when a contract “fails on inspection” and “falls out of escrow” it is because of an erroneous or not reasonable expectation. The buyer isn’t doing what the seller expected the buyer to do, or the seller is not doing what the buyer expected the seller to do. Rarely does a real “deal-breaker” issue come up with the house, that the buyer and seller could not have known about in advance of the offer being made. Most often the contract fails because the buyer or the seller is not responding “appropriately” to an issue. That is usually an emotional problem, vs an actual “problem” with the house that can’t be rectified.

Good “Rule of Thumb” is no seller should expect the buyer to want absolutely nothing at inspection, and no buyer should expect a seller to address everything the inspector talks about as needing to be done to the house.

Instead of taking general notes during a home inspection, I find using a chart like this to be helpful during the inspection. The inspector says SO many things over a 3 to 4 hour period, so organizing them a bit while the inspector is there can help you raise questions at the end before the inspector leaves the premises.

Column One – OWNER SHOULD – There are no hard and fast rules here. Many items the Inspector notes as “needing to be done” are things any owner needs to do periodically. Is “The Owner” the Buyer of the Home? Or is “The Owner” the Seller of the home? While contracts often fail over these issues, they should not as they are things the buyer will need to do during their ownership of the home. These are not “once and done” items. If the gutters are so clogged and dirty because the owner never had them cleaned during their ownership, the buyer may ask the seller to have those professionally cleaned prior to closing. The buyer may put this in the “Seller SHOULD” column. Often this has to do with the number of trees dropping debris into the gutters.

Generally a buyer should not decide they do not want the house after all because the gutters are dirty and the seller won’t have them cleaned prior to closing, or because the seller won’t trim a small branch on a tree.

Just because the Inspector tells the buyer “the gutters need to be cleaned” does not mean the seller needs to DO something. The Inspector may simply be saying that at EVERY inspection so the buyer knows that this is a normal owner maintenance item. That statement alone does not mean there is something currently “wrong” with the gutters.

Column Two – OWNER MUST – These are usually things the seller would have fixed had he known they were not functioning properly. They are usually things that have no aesthetic selection element, so that it doesn’t matter if the buyer does them or the seller does them. They are usually things that can cause a problem or additional damage between inspection and closing.

As example, a leaking sink creates damage every day between the time you discover it and the time it is fixed, so having it fixed without delay is recommended. It is very rare that a seller would not want to fix that leak ASAP.

Column Three – SELLER SHOULD – Many items fall in here and are basically not major things. Often whether or not the seller “should” fix them has to do with the price of the home. If the buyer is paying a good and somewhat high “fair market value” then the buyer often expects these things to be done and the seller, happy with the price he got for the home, often does them. If the buyer is getting a screaming deal and the seller is walking away with nothing or less than nothing, the seller usually expects the buyer to accept the home with these issues not being addressed.

Often these are things the seller did not deem important enough to fix while he lived there, and not something the seller did not know about. A small crack in a window. A broken window seal (this is cosmetic in most cases). A bedroom door doesn’t “latch” properly, which is often fixed by tightening knob or hinge screws or adjusting the latch plate. Basically things that can be fixed with little or no cost and a screw driver.

Column Four – ????? – This is where many sales can fall apart. These are usually large items that are “in working order” and not currently defective, but near or past their “life expectancy”. Roof is not leaking but 23 years old. Hot water tank is working just fine, but is 18 years old. Heater is working just fine, but is 30 years old. Again these items usually hinge on the price negotiated. If the Seller got the better end of the deal at initial price negotiation, the buyer’s expectations may be different than if the buyer is getting the home at a “below market” price. Often the seller and the buyer do not agree on THAT, on whether the price was at, above, or below market price and THAT is why the sale fails over one of these items. Not because of the item itself, but because the parties think one or the other is not being reasonable given the home price.

Does a house need a new roof because it is “old” but is not leaking? Does a hot water tank need to be replaced because of it’s age when it is functioning well?

Often these things are viewed differently in a Seller’s Market vs a Buyer’s Market.

5) PROPERTY APPRAISED

This item usually happens “in due course” meaning the buyer and seller do not order or control the time frame of this item. The Lender orders the appraisal and unless there is a problem with the appraisal, the contract simply proceeds toward closing. The Buyer usually pays for the appraisal in advance OR is responsible to pay for the appraisal even if they do not close escrow for some reason.

********

NOTE: MONEY the buyer needs to pay BEFORE closing. Earnest Money Deposit, Inspector Fees and Appraisal Fees. Depending on the size of the house, the inspector fees are usually $500 or so for one inspector/inspection and $450 or so for the appraisal. There could be more than one inspection needed, and if the home is unusually large or small the cost could vary. If you are only paying $199 for a Home Inspection, that is not a good sign. 🙂

6) HOMEOWNER’S/HAZARD INSURANCE

The buyer needs to purchase a full, one year, Hazard/Fire insurance policy AT closing. Once you are finished with the inspection and the lender has everything they need from you to process the loan, you should arrange for your Insurance Policy with your lender and escrow, who both need to coordinate with your insurance provider.

Most often the best rate is obtained by getting this insurance from the same company that does your car insurance, so be sure to get a quote from them.

Note: Title and Title Insurance Issues happen from before the property is listed through to closing. There are Title reviews and Title Insurance Policies and Supplemental updates of Title throughout the entire transaction. Sometimes these issues are critical, but most often they happen “in due course” and are not alarming. Both escrow and your lender are interacting with the Title Company throughout the transaction.

Title Insurance and Reports are usually pre-ordered by the seller before the home is listed for sale. The Buyer’s name is added when the buyer’s name is known. The Owner delivers “clear title” by paying for Owner’s Title and the buyer pays for Lender’s Title as a condition of their mortgage.

IN SUMMARY: MOST EVERYTHING THE BUYER NEEDS TO “DO” IS DONE IN THE FIRST 5 BUSINESS DAYS OR SO AFTER THE CONTRACT IS SIGNED. AT THE END OF THAT PERIOD THE BUYER EITHER CANCELS OR PROCEEDS TO CLOSING.

7) THE CLOSING Loan Documents arrive at escrow. Hopefully at least 3-5 days before the closing date noted in the contract. The buyer signs their closing papers which include the loan documents and the Final Estimated Numbers called the HUD 1 or Buyer’s Closing Statement and some other ancillary escrow forms. The Lender reviews the signed documents and “releases for recording”. Escrow Records the property in the new owner’s name with the County. Keys are available to the buyer after we have County Recording numbers OR on the date of possession noted in the contract.

Closing is a phone call saying “We have Recording Numbers”.

For the most part the buyer is VERY busy for the first 5 business days or so and then again near the end. In between everyone else is working hard. The seller is packing and moving out. Escrow is coordinating with the agents and the lender and the Title Company and the buyer’s insurance company and the County, and getting the seller’s payoffs so liens can be removed as to the seller’s mortgage and utility bills prior to closing.

THE BUYER SHOULD NOT BE PLANNING TO GO IN THE HOME THEY ARE BUYING AFTER THE HOME INSPECTION AND BEFORE CLOSING!

This often comes as a surprise to most home buyers. The seller is packing and usually does not want you IN the home while it is a mess of boxes! That is why you should do EVERYTHING during the inspection phase. Get estimates for new carpet or hardwoods, measure for curtains, measure for a refrigerator or washer and dryer if you plan on buying them before closing. If you don’t do it during inspection, you may have to wait until after closing.

No post like this is “all inclusive”. This one is written from the standpoint of a buyer purchasing a normal tract home on a normal lot with little problems and no HOA.

Here are a few others I wrote about 5 years ago. All good reading for a buyer or a seller after the initial inspection phase and before closing.

Anatomy of a Real Estate Transaction (Some good “extra” notes in the comments on that one.)

– Short Version for the Buyer

– Short Version for the Seller

– The Three Phases of a Real Estate Transaction form Contract to Close