Hopefully you’re following along with our 365 Things to do in Seattle WA…but in case you haven’t heard about it yet we wanted to pass along our day 41 to you. We are involved in a wonderful event raising money for local foster kids and the event is scheduled for this Sunday at Kirkland’s Tech City Bowl. Our team is: Striking Realtors and we’ll be dressed in our pajamas. We would love it if you could make a donation to help these local foster kids and when you do you’ll be entered to win a pair of Seattle Seahawks Tickets 3 rows from the field. Find out more about the drawing and the event on our 365inSeattle event and see how you can help.

We’ve Come a Long Way Baby

The other day, I received an email from someone who wanted to verify some surprising things he had heard about the “old days” of mortgage underwriting. Before I go on any further about the details of the discussion, I feel the need to to give a “Surgeon Generals” type warning: in no way do I nor Mortgage Master condone the outdated underwriting guidelines used in the “old days”. It is interesting to see how much lending practices have changed over the years…for the better.

The other day, I received an email from someone who wanted to verify some surprising things he had heard about the “old days” of mortgage underwriting. Before I go on any further about the details of the discussion, I feel the need to to give a “Surgeon Generals” type warning: in no way do I nor Mortgage Master condone the outdated underwriting guidelines used in the “old days”. It is interesting to see how much lending practices have changed over the years…for the better.

From Curious George:

“Heard some interesting historical information from a long time veteran of the real estate industry today. I seems that at one time, for a woman’s income to be considered when she and her husband were purchasing a home, she needed a note from her doctor stating that she either had a hysterectomy or was going through menopause. Apparently the fear was that if she became pregnant and couldn’t work for some time, they would not be able to pay their mortgage. Then with the development and legalization of the birth control pill, the banks reconsidered and allowed 50% of her income to be used. Eventually banks agreed to 100% of a womans income to be used.

Seriously though, I thought this was interesting. Maybe you can confirm this. It would be interesting to see how all of that affected home prices. I’ll bet with people being to qualify for larger loans, prices got driven up.”

I’ve been trying to find information about this on-line and although I can find plenty about racial discrimination, I’m having a challenging time digging up on how women’s incomes were considered “back in the day”. HUD and FHA’s websites glorify how their part in rescuring the American Dream during the Great Depression…I’m hard pressed to find early underwriting guidelines.

I decided to use my walking encyclopedia of all things mortgage to check the facts of this “almost unbelievable” depiction of lending history: my 85 year old father-in-law who spent sixty years in local real estate, Bob Porter. The first six years (fresh out of the Navy in 1945) selling real estate in North Seattle for Mutual Realty, Broadmor Realty and McPhersons while attending Seattle College (now named Seattle University). The next twenty-two years were spent as a broker/owner of Southend Brokers with several branches in King County. His resume continued as President of Pacific West Mortgage headquartered out of Burien and most recently as Chairman of Mortgage Master in Kent until his retirement in 2005. Now that you know some of Bob’s background, here’s his response to “Curious George”:

“That’s right. The industry led by FHA and VA would consider a wife’s income for short term debt such as car payments. Professional women, teachers, lawyers, doctors and business owners income could qualify for mortgage payments on a case by case basis without a letter from their doctor. Taking loan applications took a lot of diplomacy. We would be sued for discrimination if we asked a woman for a doctors letter today.”

It’s hard to believe that underwriting guidelines were impacted by various forms of birth control and the progression of women’s rights.

CD Release Party tonight for local Seattle band – Kris Orlowski

Local song artists, Kris Orlowski and his band, are having a CD Release party tonight at The Hard Rock Cafe. Doors open at 8 and the show is at 9.

Seattle has long been known for supporting the “up and coming” people in their local areas. So if you have no plans tonight…try to head on out to The Hard Rock Cafe at 116 Pike Street to give some hard working and talented local young people your support.

I first found Kris Orlowski via the YouTube video below (the link was posted on twitter). If you want to get a feel for Seattle, watch this video featuring The Fremont Troll :). There’s a line in Kris’ song “Sweet Little Girl” that was SO very Seattle it cracked me up. “We’re dreaming of a future where the summer always stays.” How “Seattle Culture” is that!

The scenes in this video say more about Seattle than most any written post ever could…so if you are thinking of moving to Seattle, watch this video. It shows many of the best things Seattle has to offer…its people, our troll, people of all ages interacting with one another at Green Lake, and a young man celebrating…”Lou, Lou, Lou” an awesome, everyday, Seattle kind of girl.

Good luck, Kris! Taking a line from your song…”Hope is in my heart that you’ll be great!!!”

So many great things to do in Seattle!

[Editor’s note: I’m super excited to announce Sarah Payson as RCG’s newest contributor. She runs The Payson Group with her husband John Payson, who together are the first “M Agents” in Seattle. I recently had the chance to spend a day with them and was blown away by how two people could be both super-motivated and super-wonderful! One of the things that they will undoubtably bring to RCG is an active involvement in the local community… and an excellent example of that is their active Facebook Page: 365 Things To Do In Seattle that’s grown to over 7,700 fans in about a month. Seeing the success they’re having with this page, I asked Sarah if she’d start her RCG contributions with a post about that project. -Dustin]

Are you new to Seattle WA? Have you been here a while but are tired of the same old routine?

Are you new to Seattle WA? Have you been here a while but are tired of the same old routine?

We want to get you connected with your neighborhoods around Seattle and the Eastside, that’s why we started “365 Things to do in Seattle WA

Mortgage Lender Associations Announce Whining Moratorium on New GFE

Several Mortgage Lender Associations nationwide have announced a 6 month moratorium on the incessant whining regarding the new Good Faith Estimate. Attention will be immediately shifted to proposed rules by the Federal Reserve Board which may eliminate compensation based on placing a consumer into a higher rate loan or a less favorable loan product.

“Flat fee compensation is bad for consumers because only an idiot would originate a loan without the ability to potentially make thousands more by selling the consumer a higher rate loan than they think they could get” said Billie Joe, a loan originator from Tukwila. “This will mean reduced competition for consumers as all the good salespeople will go back to working at the used car lots.” Tre, who goes by his LO gang name, “Tre Cool,” agrees. “At the top of the bubble, I could make a 1 percent loan origination fee, another 1 percent mortgage broker fee, if the customer were stupid enough not to know what a discount point was, I could make another couple of points in discount, toss in $500 for an admin fee, another $500 processing fee and then make upwards of 4 to 5 points on the back end, as long as I sold a Pay Option ARM loan and as long as the dupe THOUGHT they were getting a lower monthly payment, nobody questioned my fee income! That party’s no longer real, man. Today I’m lucky if I can make 1 point.” Originator Mike D has a different perspective. “Dude, like when you think about it, I only spend about 4 hours on a file. My average loan amount is $400,000 so even though I’m makin’ $4,000 on that one transaction, I’m, like still earning $1,000 per hour. That impresses the ladies and pays all my bills so I’m not gonna rock the boat on this new proposed rule. Get back with me when that sh*t becomes real, man.”

Until then, the industry is still working very hard at containing the radical mortgage militia cells who continue to work day and night on repealing the unpleasant Home Valuation Code of Conduct( HVCC,) pledging to change this rule “or die trying.” According to one source, who asked to remain anonymous,

“Mortgage lenders have an enormous capacity for joining together and making our voices heard collectively. When we brought boxes of signed petitions to the New York Attorney General’s office to force an immediate ban on the grave hardship HVCC has caused our industry, and uh, consumers, not one change was made. But if and when anyone actually does listen to our collective voices we’ll all be the first to celebrate a victory that will once again include our ability to influence appraisers and we are already planning the celebration in which we’ll all get extremely drunk and eat free appetizers. A title insurance company has already stepped forward to pay for the food and refreshments. Not one dime of this celebration will be paid for out of taxpayer dollars.”

Three months into the 2010 Good Faith Estimate…and We Still Have Issues

We’ve had three months to work with the “new” good faith estimate designed by HUD. We had an even longer period of time to review this document, however in a mortgage originators defense, I will say that until you can use this GFE “in real practice”, you don’t truly know the nuances. With all the updates to the RESPA FAQs, I’ll argue that HUD’s in the same boat!

On March 18, 2010, HUD posted a new presentation “RESPA 2010 – Implementation Consistency”. I recommend watching the video with access to the slides. Vicki Bott, Deputy Assistant Secretary for Single Family Housing with HUD, covers the information more indepth than if you were to watch the slides alone. During this presentation, it sounds like we should have a newly revised set of FAQs for HUD soon. I’ve actually lost count on how many times it’s been updated…and a part looks forward to the revisions since I have hopes that some of the glaring issues will be addressed and remedied.

Here’s an email I recently received from a mortgage originator:

I have a question that I have been searching the internet for and was wondering if you might know the answer? … I have a rural development loan that I took an application for last week. I didn’t realize before I disclosed to the borrowers that the 2% up front mortgage insurance fee did not populate into my good faith estimate. The borrowers are aware that there is a 2% up front funding fee but since it wasn’t on my originally disclosed good faith, is there anyway to correct that? I mean, it isn’t like I am adding a fee that goes in my pocket or anything, it is a fee that is associated with the loan itself, for anyone who gets a government loan with a funding fee or upfront mortgage insurance.

First of all, I am in no way an expert on the Good Faith Estimate and I’m not a replacement of a mortgage originators compliance department or managers. This LO needs to immediately contact her manager and compliance officers at this point. Emailing a mortgage blogger isn’t going to resolve her issue.

HUD does have what is called a “restrained enforcement” period which is the first four months of this year, which is touched on during this slide show. I have no idea if this mortgage originators mistake would qualify her to call a “mullagan” or if she is obligated to pay the difference between the 2% loan fee factored into the 10% accumulative tolerence bucket. If so, she’s paying to have this loan close…it’s a very expensive mistake that most mortgage origintors cannot afford to make. On a $300,000 mortgage, the 2% fee is $6,000. According to HUD’s powerpoint (slide 5):

“Restrained enforcement…is intended to provide lenders and HUD time to understand the implementation gaps and interpretation inconsistencies and resolve them while providing RESPA benefits to the consumer…. Guidance will be rolled out to the industry regarding specific areas of restrained enforcement.”

I’m hearing that most lenders will not allow re-issue of a good faith estimate once they’ve received it. Mortgage originators are having to pay for upfront FHA mortgage insurance premiums (soon to be 2.25% of the loan amount) even though it was not a case of bait and switch–the borrowers knew about it and it was simply a human error. Good faith estimates can only be modified if there is a qualified “changed circumstance” which must be documented.

Our company is currently using Encompass 360 for our loan operating system and I can tell you that it’s been a lot of effort to make sure that loan fees not only populate, but actually show up in the section they need to be. The 2010 good faith estimate basically puts fees into 3 sets of buckets with different tolerances on how much those fees can change. The funding fee referenced in the email above is subject to a 10 accumulative tolerence. Assuming the rest of that mortgage originators estimate is perfect, she may be responsible for $5,400 ($6000 less 10%) assuming this is a bona fide transaction.

Mortgage originators must be very careful when issuing a good faith estimate. We cannot rely on our loan operating systems to spit out the correct information in the specific spot required. Here’s what I’m doing when I’m working with a client and the good faith estimate:

- I prepare a work sheet first — IF the consumer has not yet identified a property. NOTE: HUD says this is acceptable unless it’s a refinance and you know the property address…ya’ better issue that GFE. (Check out the new HUD video).

- I’m using on-line rate calculators from my preferred title company (who also guarantees their rate quotes).

- Once I have the 6 points of information as deemed by HUD, I create a good faith estimate. LO’s–the only other choice you have is to “deny” the “application” if you do not issue a GFE within 3 days of receiving the 6 points.

- Review–review–review that GFE before you provide it to your client. If you need to, buddy up at your office and help each other be a second set of eyes.

- Especially watch out for FHA Upfront Mortgage Insurance Premiums, VA and USDA Funding Fees (which go on Block 3 of the GFE) and the Owners Title Insurance Policies for purchases (Block 5). Also watch for excise tax if you need to disclose that in your area. (HUD addresses excise tax and owners policies in the recent video).

Most fees aren’t that huge…. I’m finding that I’m typically off very slightly between my good faith estimate and HUD-1 Settlement Statement. A little precaution will really pay off, my fellow Mortgage Professionals.

Last but not least, if you’re not getting the training you need, seek it out for yourself. Seek many–do not rely on your employer or their educators. Are they going to cover your 2% funding fee mistake? Learn from many different educators and formats…visit’s HUD’s RESPA webpage often! …this is what I recommend if you’re committed to sticking around this industry as a mortgage originator.

Good luck!

If a picture is worth a thousand words…

then what does this picture say? And who is the audience?

As professionals in this field, we understand the message. But I’m not so sure about the consuming public. What assumptions do they make about WaLaw, Windermere, and Chuck Houston? Do they know who represented the seller, and who represented the buyer? Do they know the relationship between WaLaw on the one hand, and Windermere and Mr. Houston on the other?

In sharp contrast, all of us (the authors of this blog, many of its readers, most of its commenters) know exactly the answers to these questions. WaLaw listed the property on the MLS, and Mr. Houston (licensed through Windermere) found a buyer. The seller paid WaLaw a sum of money. WaLaw then shared some (or, as in this case, most) of the money with Windermere, which then shared most of it with Mr. Houston. We get it. We perfectly understand the message sent by a “Sold by” sign hung on a yard sign.

So really, the audience must be us, at least in large part. Otherwise, the message would be re-worked to connect with the true audience and not just us. And this raises the question: What’s the point of providing us with this information? What do the “speakers” hope to gain from imparting this message?

Frankly, I’m not sure of the answer. I do know that, in the future, WaLaw will use its own “Sold” sign rather than the selling agent’s “Sold by” sign. That, in my mind, will simplify the message significantly and allow me to connect with the consuming public, the audience I want to reach. Hopefully, a layperson, when seeing the sign, will conclude only that WaLaw Realty helped this seller in selling her property. That’s the message I want to send, and as it stands now, I’m not sure that message is getting across.

Post Script: WaLaw will now be posting “SOLD

School Cancelled because of SUN!

If you are relocating to the Seattle area, or have recently relocated here, a HUGE factor for you to “grasp” is about capturing those great days between October and May. Summer is great here, and you rarely get “snowed in”, but too many gray and rainy days in succession can really get to you.

When I first moved here I remember someone saying “no work today”. When I asked why they said “The Mountain is OUT!”. People jump up from their desks and run over to see Mount Rainier on a clear day. 🙂

School Cancels Classes for a “Sun Day” is a news story today along the same lines.

Seattle weather “progresses”. First you have one sunny day a week, then two sunny days in a week. By the time you hit 5 out of 6 sunny days in a week, you feel like God came down and brought you a huge gift of perpetual sunshine, just in time for the Fremont Summer Solstice Festival.

So when you see all the painted naked cyclists in Fremont in June, remember why and what they are celebrating. NO other area celebrates the simple pleasure of the sun being out…like Seattle.

When will housing prices recover? A national look.

This post is partly a follow on to Ardell’s earlier New Bottom Call post and comments on where our greater Seattle / Bellevue area home prices might go over the next few years.

This post is partly a follow on to Ardell’s earlier New Bottom Call post and comments on where our greater Seattle / Bellevue area home prices might go over the next few years.

When people ask me “How soon are home prices around here going to recover?”, I have been saying that I don’t think they will ‘recover’ for at least 3 to 4 years.

The question usually comes from someone who wants to sell, but is having a hard time dealing with the fact that the value of their home is down about 20% from the peak in summer 2007 – especially if that is when they bought it. Of course if they had bought it in early 2002, the value would have run up about 85% before it peaked, but it is truly much harder to take a loss than it is to take a gain 🙂

The next most common person asking the question is a buyer who is trying to decide if he or she is going to make money or lose money on their investment in a home. Recent history would certainly give one cause to pause on that question.

Of course there have been all kinds of predictions about which way the housing market is headed, and many of those predictions are colored by what is going on in the writer’s home market. But recently a friend sent me a very interesting analytical presentation of what is going on in the market, which included a map graphic showing what that analyst thought would happen. The chart was prepared by Moody’s Analytics, a big player who has a huge interest in figuring out what is most likely to happen, so I thought it was worth sharing with you. Here’s the chart, which is page 13 from the presentation linked at the end of this post.

This is a pretty fascinating chart. Note that some areas near us are predicted to recover to their previous highs within the next 2 to 3 years. And for some of the hardest hit areas, full price recovery may take 20 years. Factor some inflation against that and I’m not sure it is a recovery.

In our own Greater Seattle / Bellevue area, it looks like their prediction is recovery to 2007 price levels in the 4 to 5 year timeframe at best. Still, all in all it doesn’t sound too shabby – that would be about 5% a year from here, or more like 3%/yr if it stretched out to the long side. My guess is that this recovery rate would be back-end loaded – lower (near zero) appreciation rates near term, and higher rates later on as the national economy really gets rolling again. We’ve got a lot of unemplyment to work off before that happens.

The whole presentation is linked here in the 2010 – Housing Recuperates presentation from Moody’s Fall 2009 Economic Outlook Conference. In the chart on mortgage default rates on page 10, the left axis is CLTV – Current Loan to Value Ratio; the chart is a little hard to understand unless you have that information set in your decoder ring.

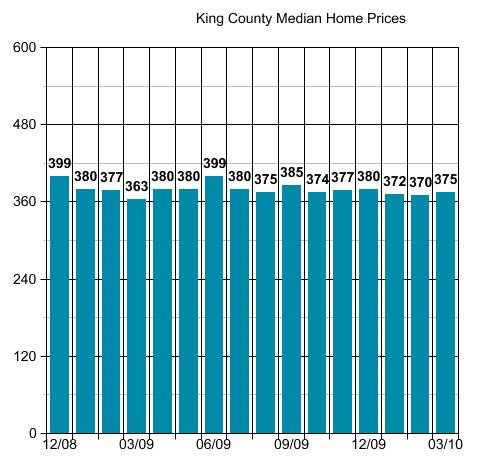

Don’t get too hung up on month-to-month fluctuations in reported median prices. As Ardell’s chart clearly shows, even with a county wide mass of data, the reported median can jiggle up or down a few percent. Our median for the 16 months shown is about $380,000 +/-5%, or swinging about $20,000 on either side in any given month. In January we had a nice 5% blip up in the condominium median price, but for February it was right back down where it had been most of the time for the past year.

A “new” bottom call…King County Home Prices 2010

Earlier today I posted my thoughts on the King County Housing Market for 2010 and received this question on twitter:

@VAF_Investments asks @ARDELLd – This downward price expectation kind of goes against your view late last year… What’s changed?

Generally speaking, my clients are making a short term decision to buy a home to live in based on a compelling reason in their life, vs a long term market timed decision. Consequently, in my world, the question becomes “If I am going to buy a home in the near future, when is the best time to do that? What is the best strategy?

In February of 2009 there was no question in my mind that March closings would likely be the lowest point of 2009. When I “called that bottom” I was greatly surprised that it made front page news, because it seemed like a great big “duh” to me at the time. The graph above shows you how that prediction played out through to present day.

New Year…New Clients…New Bottom Call. Last year I had a few clients purchase homes who I told to wait in 2008 and late 2007. In 2009, I didn’t tell anyone to “wait” but I did tell a few people not to buy at all, and am still doing so. The minute someone says “I’m planning to sell it in 3 years” I do a big “Excuse Me?” One client wanted me to graph “appreciation” for each year over the next three years…I asked him to save me the time by sticking a big fat zero on that for me in each of the three columns on a net basis.

What’s different this year? LOTS! Many people bought in anticipation of the Homebuyer Credit ending. I was at the gym yesterday and a young agent on the next treadmill was telling his friend that buyers had to hurry up before the credit expires. If every agent is telling every buyer to buy before the credit expires, how can they possibly NOT think that the market will go down after it expires? Boggles my mind that the same people saying “you must buy before April 30” are the same people saying the market will not go down AFTER that point.

There are many other factors, of course. But the Homebuyer Credit is not a small one in the big picture. The title of the PI Article last year was “Agent Predicts Housing Slump’s Demise”. In 2010 the “training wheels” will come off. The oxygen supply will be removed, and we will see what the market will do when caused to “stand on its own two feet”.

I don’t think the market will fall dramatically without further government intervention, because I think if it DOES fall dramatically there WILL be continued government intervention. So yes, I do expect Homes Prices will be lower than the median price of $362,700 from March of 2009, at least at some point in the 4th Quarter of 2010, and possibly before. I don’t think we will see another 20% – 25% decline in prices, not because the fundamentals are stronger, but because I believe the government will come up with another plan if needed, to prevent that from happening.

Remember, most of the market decline transpired under the previous Administration. This new regime has proven its desire and ability to stabilize, if not grow, the market. I do think they will let this credit expire, and I do think they will decide what to do next…after they see how the market reacts to “pulling the plug”.

Before they decide what to do next…don’t be surprised to see a “new bottom” where median home prices in King County fall below $362,700. At this moment, without all of the March closings counted, the median for the first Quarter is $370,999 (maybe a little higher if I take out the houseboats) and at $372,475 for the month of March to date (this down from the $375,000 it was a few days ago). If I take out the houseboats and mobile homes…it is $375,000.

(The stats in this post are not compiled, posted or verified by The Northwest Multiple Listing Service)