Oddly the winners of the Zillow sponsored Carnival of Real Estate, did not win for the posts submitted. In fact even though I had two week’s worth of posts, there was almost NO winner of “The Carnival of Real Estate”. Did you ever watch The Oscars and wonder why there has to be an award for “Best Picture”, when none were actually worthy of the title of that category? Has there ever been an announcement “Sorry, no ‘Best Picture’ this year”?

Technically I should have TWO winners, since I am judging posts from both the week of August 28th and October 5th…and I do have two “winners”…but no”winning posts”.

“Winner” #1 is:

YG&B of “Foreclosed to Fabulous: A Journey Into Home Rehab” I LOVE this writer, who is apparently a woman who possibly lives in Atlanta. Clearly not tooting her own horn, she says “I work for a non-profit that endeavors to take these houses from foreclosed to fabulous.” Her journey is well written, with fabulous details into the thought process on selecting which homes to buy and how to renovate them, and even some frustrations as to why no one may want them when they are finished in this post titled: “Crappy Old, Crap Crap Market. Crap” Her endless journey to find “a place to pee” in “4 Facts of Life of Low to No Margin Real Estate Work” is both funny and TRUE!

So Ms. YG&B, the post you entered did not win…but YOU clearly did.

Winner #2 is :

Bill Zoller, who submitted what appears to be his first and only post on US Inspect – Federal Pacific Panels and Are They a Danger?

Bill ends his post with: “I encourage each person reading this document to go to the links I’ve included and do further research. And, please communicate to your business community, as a realtor, home inspector, electrician, handyman, etc., the presence of these types of panels must be removed/replaced. No other remedy is satisfactory.”

I especially liked that Bill highlighted the point that an inspector FINDING a problem is not good enough! The remedy is hugely important! How many times do we as agents see the exact same problem when the homebuyer later sells the house? Does a roof leak need a patch or a new roof? Does a hazardous electric panel need a few tweaks or full replacement? A home inspector points out problems. But it takes all of the people in the room to take that red flag and provide the appropriate and “satisfactory” remedy to the problem at hand. “It was that way when I bought it” is NOT a satisfactory response by a seller to a home inspection problem. So make sure the remedy fits the problem…or you may end up paying for that oversight as a buyer, when it is time for you to sell.

Honorable Mention #1:

Patrick of cashmoneylife – Entry: Are Money Merge Accounts a Great Way to Pay Your Mortgage Quickly, or Are They a Scam?

There are many interesting posts on cashmoneylife, and so I give this post “honorable mention” to highlight the blog itself (if anyone can find a last name for Patrick, please let me know). Be sure to read the comments on this post, as many are of equal value to the post itself.

Honorable Mention #2

Jay Thompson of The Phoenix Real Estate Guy – Entry Home Buyer Tax Credit Extension: Yet Another Bill Introduced

When I want to know what is happening with the First Time Homebuyer Tax Credit, I go to Jay Thompson’s blog. There is no answer to the question, but Jay has been keeping us up to date on what exactly is not happening since back in June. To find out what is and isn’t happening…you have to read Jay’s post. I was especially impressed that Jay called Senator Isakson’s office, further proving that if you want to know what’s happening with the Homebuyer Tax Credit…stay with Jay on this one.

A few words about the other entries and entrants:

Reminder: You are supposed to submit your BEST (one) post written within the last two weeks.

NOT a DOZEN posts, written by someone else, that you hope to take credit for…

Not 5 posts, all of which amazingly warrant the name of your town in the post title, and first sentence, and repeatedly throughout most every blog post you “write”! That may make the Search Engines notice you…or not…but it clearly is “bad” blog writing.

A good rant is often noteworthy. But whining, whining, whining about smelly houses, or buyers who are “too reluctant to pull the trigger”, or why people think they can buy a house without “consulting a REALTOR”…is just getting old.

I understand the need to monetize a blog. But when there are FIVE ads between EVERY sentence of the post…well, I just give up on trying to find the post amid the sea of advertisements.

The winner is a gem of a writer, with so many excellent posts and observations that I couldn’t possibly highlight all of them. If she ever writes a book I’ll be the first one in line to buy it, and the first one in line to meet her and have it autographed. Mucho Kudos to Ms. YG&B!

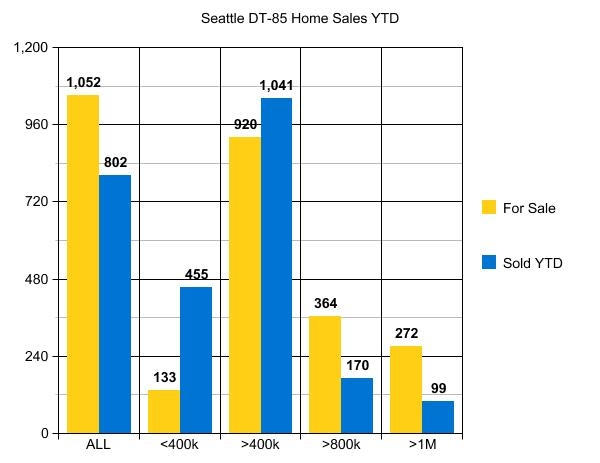

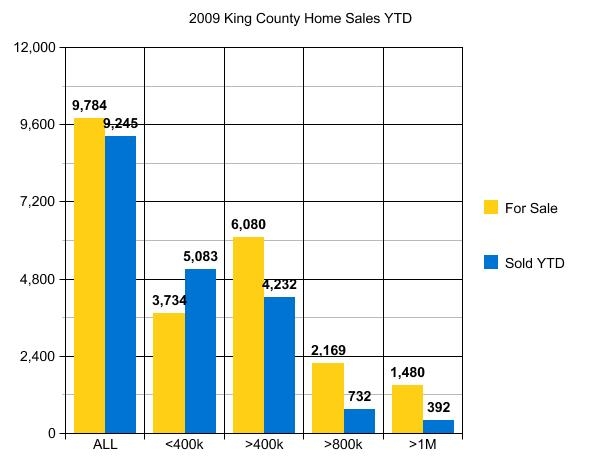

While I am not seeing any huge surprises in the market overall in King County, there were some jaw-dropping results in individual neighborhoods.

While I am not seeing any huge surprises in the market overall in King County, there were some jaw-dropping results in individual neighborhoods.