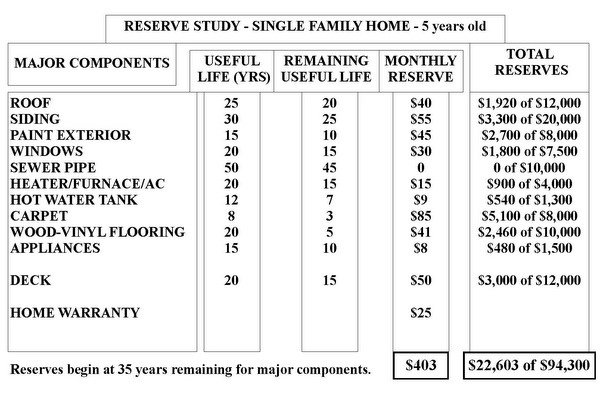

A Reserve Study tells you how much money to set aside monthly so that you won’t have to borrow money when something needs to be replaced in your home. While monies “in reserve” for replacement costs do not currently convey with a home, condos do. It was determined some time ago that that asking people for $10,000 all at once for a new roof did not make any sense for condos, and the time may have come to look at Single Family Homes in the same light.

Yesterday I posted a Reserve Study for a particular client’s home that will be closing next week. I also did a rough sample of a “quickie” Single Family Reserve Study that you can use to modify an offer price when purchasing a home.

In this post I will do a more generic version that you can use to prepare a Reserve Study for the home you currently own, and are not intending to buy or sell.

A Reserve Study is NOT about what you will SPEND ON your home each year, the same way that gas in your car is not counted when saving money toward buying a new car, or to repair your current car.

A Reserve Study is an EARMARKED savings plan to insure that the cost of REPLACEMENT (not repair or maintenance) is available when the item is ready for full replacement. A common rule of thumb for Reserve Studies is that you do not begin to reserve funds until and unless the item is within 35 years of needing to be replaced. Consequently if you have a 50 year item, as example, you may have to spend some money on maintenance during that 50 year period, but you will not begin saving toward it’s replacement until it is 35 years old. the remaining Useful Life is 35 years.

WARNING: DO NOT READ BELOW THIS LINE IF YOU HAVE HEART PROBLEMS.

While I tend to be fairly analytical, I have to say that chart (which I created) scared the bejeebies out of me! $94,300 for Replacement Costs of ONLY the “MAJOR” Components that have a relatively short “Useful Life”! Holy Caboly!

This is one of the reasons buyers are more and more looking beyond “current defects” when doing a home inspection, and rightly so.

Let’s break this down a bit, as a Reserve Study has a lot of subjectivity vs objectivity. I will give you the benefit of my thinking, so that you can adjust accordingly, if needed.

1) ROOF I used 25 years and $12,000. This assumes a 25 to 30 year composite shingle. This Reserve Study is for a five year old home, but covers most any home with a composite shingle. For the most part 20 year shingles went the way of the dodo bird in the late 1980s or so. Any home with a 5 year old roof, whether the home is new or not, likely used at least a 25 to 30 year shingle. I also don’t expect “lifetime warranty shingle” roofs to last more than 25 years. In the last 5 years, 80% of all homes sold regardless of age had this type of roof and 87% of all homes built in the last 5 years had this type of roof.

Once in awhile you see a 50 year shingle and more often a 35 year shingle. But most are 25 to 30 year shingles. If you have a tile, flat, torch down or shake roof, you will have to adjust the numbers to that style.

I used $12,000 as I have recently seen a very good roof on a large home done for that price, even though the next door neighbor paid $18,000 for his roof. I have also seen an owner put one on using experienced relatives for $4,500. Much depends on the size of the home, the type of roof and the size and configuration of the roof. But $12,000 should be doable for the average home with room to spare as to price.

(NOTE: STOP POWER-WASHING YOUR ROOF EVERY SIX MONTHS! YOU ARE DAMAGING THE SHINGLES AND VOIDING YOUR WARRANTY! There are other and better ways to remove moss from your roof and keep it off.)

$12,000 divided by 25 years divided by 12 months = $40 a month.

2) SIDING Most newer homes use HardiePlank siding, or a reasonable facsimile. This is a cement based product that can last up to 50 years, and normally has a 30 year warranty. If you have a home built in the 90s, especially the early 90s, you may have an inferior pressed wood product that looks similar, but likely has been replaced or needs to be replaced. Wood siding has about the same life expectancy as HardiePlank.

I’ve heard the number of $20,000 used often for Siding replacement to HardiPlank, but that varies based on the size of the home. If you have HardiePlank you may not need new siding at the same time as a new roof, and the siding may even last twice as long as the roof. I’m using $55 a month due to the higher cost of re-siding vs putting on a new roof, but there is some leeway there given I expect HardiePlank to last longer than the 30 year warranty by as much as 10 to 20 years.

3) PAINT EXTERIOR – If you have real wood siding, you likely need to paint it at least every 15 years. If you have HardiePlank siding and like the color, you may not need to paint it at all. Paint usually bonds differently to HardiePlank than wood, and style colors may change every 15 years or so. If you have vinyl siding, you only have to save for replacement cost, and not for painting at all, given you really can’t or shouldn’t paint vinyl siding. Lot’s of subjectivity here. If I were doing a Reserve Study for a newer HardiePlank house, I likely would have ZERO in the monthly here. If you have a brick exterior, you don’t have to paint it, but you do have to “re-point” it, which can be quite costly for large and older brick tudors here in Seattle.

4) WINDOWS Most newer homes have vinyl windows with a life expectancy of 20 years. Often people replace the glass vs the window due to a broken window seal. Some windows are better than others and rarely does someone replace all of their windows at the same time. Wood windows can last indefinitely with repairs vs replacement. Lots of variables here including how many windows do you have? For that reason I’ve skimped on the total amount in reserve for windows to insure that you have enough to do a room or two at any given time, with room to spare. Quality of windows can vary greatly, even when windows “look” about the same. Most homes have a sliding glass door or two as well, so $7,500 cap on reserves is likely about right for most homes and most people who have “newer” windows today.

5)SEWER PIPE You don’t often hear much about Sewer Pipes unless you have an older home. I have no Reserve Amount here given the life expectancy or a sewer pipe, but wanted to mention it because of Root Problems. Tree roots can damage most any sewer pipe, especially on an older home.

Roots in the Sewer Pipe are a significant issue for older homes in Seattle, and sometimes in Bellevue and other Eastside cities as well.

So while I haven’t cautioned to reserve money for replacement cost, this item is worth mentioning because a Home Inspector generally does NOT inspect the sewer pipe, and if you are buying a home you need to have a separate inspection done of the Sewer Line. If there are a lot of trees on the property and the home is 50 years old or more…having a Sewer Scope is pretty much an imperative “additional” inspection.

6) Heater/Furnace/AC The cost I used is for a pretty good furnace without air conditioning. Life expectancy of a gas heater is usually longer. Life expectancy of an electric heatpump that is used for both heating and central air conditioning is usually shorter. Many people buy a house with a $2,500 heater, but spend up to $4,000 (or more) to replace it. That has more to do with air quality in the home than heating it or cooling it.

7) HOT WATER TANK I find there is a huge variance in life expectancy of a cheap electric hot water heater and a glass lined gas hot water heater. Also the cost has skyrocketed recently due to a bunch of added bells and whistles.

WHERE THE HOT WATER TANK SITS IS VERY IMPORTANT!

Consider “resultant damage” from the tank blowing. If the tank is IN the home or in any finished and heated living square footage, just replace it when its time is up. If it is in the garage in an area that would cause little to no damage if it blows, maybe you can push the age to and past its limit. The main issue is what will be damaged if it leaks.

Often if you have an electric tank one of the coils will go before the tank itself. You can’t “see” that, but you will know if you are getting less hot water. Personally I don’t believe in replacing the coil. Just get a new hot water tank if one of the coils goes out. I’d rather see someone skimp on some of the costly bells and whistles than stretch the time to replace the tank by replacing a coil.

8 & 9) FLOORING Lots of variables here. Many homes have lots of wood and little carpet. Others have almost all carpet except in the kitchen and bathrooms. Many people replace carpet with a wood or laminate product instead of carpet. In some homes you can replace the heavily trafficked area, like the steps, without replacing all of the carpet. More people using the home shortens the life expectancy of carpet and fewer people in the home lengthens the life expectancy of carpet.

My biggest concern here is “wood” floors. There was a time when wood floors pretty much NEVER needed to be “replaced” as you just sanded them down and refinished them. More and more even very expensive homes have newer “engineered” wood products, that can’t be sanded at all or can only be sanded lightly a couple of times.

Most people prefer big, thick, wood floors that rarely, if ever, need to be replaced. But many people who THINK they have that type…do not.

10) APPLIANCES I used a fairly low amount here as “appliances” break into two categories. Built-in appliances are part of the home. Usually that is a stove and a dishwasher and a range hood or microwave. Sometimes a cooktop and one or two wall ovens. Then there are appliances that are “personal property” such as your washer, dryer and your refrigerator. Those you can move from house to house…or not…your choice. I am only including the appliances considered to be part of the “real estate” vs “personal property”. Lately people have been paying some insane amounts for Washers and Dryers! Since washers, dryers and refrigerators are personal items, they can vary greatly as to cost. Those are not counted in this Reserve Study.

11) DECKS Another tough one. I’ve seen decks cost as much as $20,000 for a fairly modest sized deck near the ground. Many homes in the Pacific Northwest, even new ones, have extensive decking. Due to rot issues in this climate, we are seeing Trex decking used more and more, but usually only for the flooring and not some of the other components. Once in a while I see a deck that should just be thrown away when it goes, and not replaced at all. I saw a particularly troublesome cantilevered balcony deck like that…just get rid of it! Decks vary to personal taste and lifestyle, and can add considerable maintenance and replacement costs to a home.

12) HOME WARRANTY This is a big catch all that can help with a lot of items not mentioned like ELECTRICAL and PLUMBING. Rarely do you replace ALL of your electrical components or all of your plumbing. Even when you see a home advertised as “all new electrical” or “all new plumbing” that is rarely, if ever, the case. In a new home, you wouldn’t expect to replace either, but a home warranty is likely a good thing to have for both of these and also includes heater, hot water tank and built in appliances. I did not eliminate the other items from the Reserve Study as who knows if warranties will be around in 20 years and rarely does an owner renew that warranty for more than a year or two. Not sure why, but many who get them the year they purchase the home, do not renew them.

As you can see, the total cost to replace these items can often hit during the same 5 year period when the home is 17 to 22 years old!

Preparing in advance, is recommended and warranted. If you are buying a 14 or 15 year old home, knowing what if anything has been replaced since it was built is important, as you likely need to have a lot more in reserves after closing if you are running into that 15 to 25 year period. While buying a 30 year old home might have these things replaced, you may spend as much or more on updating the kitchen and baths. I recently saw a home that needed a new roof that was only 14 years old, but that is rare. But maybe rare in the past tense vs the future tense, depending on the quality of the builder.

If you have any questions, feel free to ask, regarding why I did or did not include certain items. There is really no “guide” for A Single Family Home Reserve Study, as I don’t know anyone else who has done one before.

I think this one is fairly comprehensive and accurate as to the monthly of $400 for a newer home and $700 for an older home with some things already replaced, but that needs more updating in the next 10 years or so.