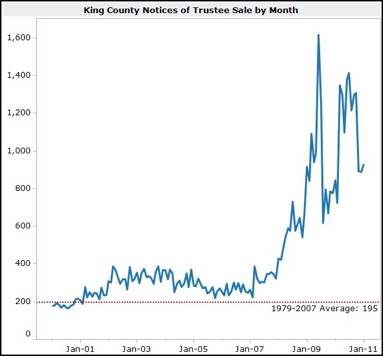

(From near the end of this post: “Looks like of the 1,081 combined pendings since 6/1/09, at least 21% are short sales. But of the 1,379 closed in 30 days, less than 2% were closed short sales.”) Read full post for more info. That indicates a HUGE failure rate on Short Sales, though some of the variance could be attributed to other factors.

It seems that since the mls removed STI (subject to inspection) as a status, more pendings are failing. Is this partly because we are now counting the same property twice, and so only 1 closing for 2 pendings in many cases?

1) IF it is first “Pending Inspection” or “Pending Feasibility” study – Every house that is put into “pending subject to inspection” will “fall out” into “pending”, before it goes to “Closed”.

2) Likewise a large number of bank-owned sales are previous listings that may have been pending as short sales. They DO sell, but by the bank seller vs the owner occupant seller. The house IS sold at the end of the day. We are just showing two pendings for that one sale, with one closing and the other one “failing”, due to the change of seller name from owner to bank.

The only way for us to know this is to track them differently going forward. There is no way to get prior stats of the switch out from Pending Inspection to Pending or failed short sale = closed bank-owned sale, without looking inside each transaction by hand. Too cumbersome. But in recent history I believe these are clearly marked and can be identified for individual study, so if we begin now, we should have some really good data as time moves forward.

Today is the first day of the rest of our…research. Let’s begin on the “right foot”.

I’m going to go to the beginning of June, assuming anything that “went Pending” on June 1 hasn’t closed yet. We can turn it into graphs after several weeks of raw data are obtained. Sticking to “Residential Only” (which in Seattle includes townhomes and on the Eastside does not, by and large). Most stats available are for SFH, such as on Seattle Bubble, so I will exclude “condo” and other types of property. I will also exclude manufactured/mobile homes and houseboats, which may have different #fail as to finance issues. There is also a status called “Pending BU Requested” which indicates the agent is thinking the buyer in escrow may not close and is looking for BU offers. I am going to show them separately as they don’t “fall out” into another Pending status before going to Closed…but should indicate a higher expectancy that the sale will fail.

In future posts containing these Pending stats, I will link to this post and not repeat the parameters each time. If anyone disagrees with the parameters, speak up so we can make the changes at the beginning together.

King County: Went Pending since June 1:

Pending = 456 (PI – 499, PF – 6, PBU – 120)

Note: a property can’t have two statuses at the same time. So the 456 “true” pendings, are not also contained in the other categories. PI used to be STI-subject to inspection. PBU is generally reserved for properties expected not to close with the current buyer who is in escrow. PF always had a high fail rate as the buyer is saying I only want to buy it IF…”. PI and PF should eventually move to “Pending” and only counted there. PBU we will try to break down further:

89 of the 120 PBU (Pending BackUps) are noted as “Short Sales”

7 more appear to be short sales, but some with prior lienholder approval

Many of the remaining properties in PBU are also short sales, but the field is new and some are not yet using it properly, especially if the property went pending since 6/1/09 BUT was listed long before the SS field was implemented. This data should improve over time. For now note that MOST of the 120 PBUs are Short Sales.

In addition, at least 135 of the 499 Pending Inspections are Short Sales.

Closed in the last 30 days – 1,379

Best I can tell, given pendings are closing in longer and undertermined timeframes, we can’t study a relationship between recent pendings and closed sales. Unless someone has some ideas here.

But at least we can track and see if the “true and full” Pendings are increasing or decreasing, if the short sales are increasing or decreasing.

Let me check for one more thing. How many of those closed sales were noted as Short Sales. WOW! only about 24. There you go…as I’ve said before, A Short Sale is not necessarily for sale!

Looks like of the 1,081 of combined pendings since 6/1/09, at least 21% are short sales. But of the 1,379 closed in 30 days, less than 2% were closed short sales. I’m going to leave this here, but also bring it up to the first paragraph.

Now that you can see how we will be able to break down the stats into the future, your thoughts on meaningful arrangement of data much appreciated.

Seems to me we need to note closed since 6/1 here (451) as Pendings will drop as they are Closed.

The primary purpose of this post is to show you what data is available, so that you can request a customized format in the comments below this post. (I am going to tag this “Sunday Night Stats”, just so that tag will pull up the full year and a half of my data related posts. You can get more data in this link of Tracking the Market.)

Required disclosure Stats are not compiled, verified or posted by NWMLS

UPDATE: I am compiling median prices and price per square foot of “normal” sales vs. short sales and bank owned. I just found a drop down vs. check box for identifying bank owned properties. … link HERE to the additional data . Breaking it down to North King vs. South King. There is a huge variance in pricing and the distressed sales are not dragging down other property sales “to their level”. Though I do think as time goes forward, identification of distressed sales will be more and more accurate as the new required field is used often and properly from here forward.

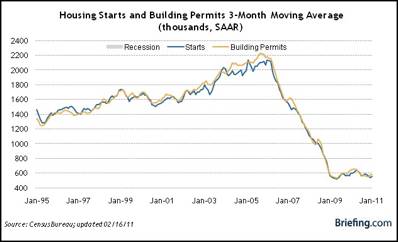

Lots of people want a NEW Construction home, the same way they want a new car vs a used car. However starting the home buying process at “I want NEW” is just as wrong as starting the home buying process at “I want a foreclosure”.

Lots of people want a NEW Construction home, the same way they want a new car vs a used car. However starting the home buying process at “I want NEW” is just as wrong as starting the home buying process at “I want a foreclosure”.