There are few things more important to me than a home buyer being able to qualify themselves, vs. taking anyone else’s word for the answer to “How Much Home Can You Afford?” Since I am a real estate agent and not a mortgage professional, I like to post a laymen’s view at least a couple of times a year on this topic. This simplistic approach should be any potential homebuyer’s first step in “the process”. I also think that any Buyer’s Agent should go through this detail with their clients before assisting them in making an offer on a house, so consider this an agent tutorial post as well.

There are many easy to use Mortgage Calculators like this one on Zillow. But just as you should know that 6 times 3 is 18 without needing to use a calculator, you should know WHY the online mortgage calculator is spitting out a number. If you know that 6 times 3 is 18, you will know if the calculator sums that out at 37, that you or it did something wrong. Same with Mortgage Calculators and Pre-Approval letters. You should know enough to know when the answer is outside of most people’s “comfort zone”.

Back to the online mortgage calculator. The first data field you need to fill out is “current combined annual income“. You need to know a few things to answer that question correctly.

1) When they say “income” they mean GROSS income, not your take-home pay.

2) If you are salaried, and make the exact same amount every paycheck, then your current salary is what goes in that data field. If any portion of your income is based on an hourly rate or a bonus for production, then your most recent income information is not usable. Unless it is a promise to pay (salary), then your “annual income” is determined by averaging your last two years worth of income AND is subject to subjective changes by the lender’s underwriter. Sometimes that happens a week before closing! So best to qualify yourself using projected, realistic potential outcomes.

If you just got a raise from $75,000 a year to $85,000 a year, and none of that $85,000 is subject to change based on hours worked or bonus income, then the full $85,000 a year goes in that box.

If you made $85,000 a year of which $60,000 is salary and $25,000 is overtime and/or bonus income, then $85,000 is NOT what you put in that box. If you had overtime and bonuses of $15,000 last year and $25,000 this year, then you add the two together and divide by 2, making your annual gross income $60,000 salary plus $20,000 of overtime and bonus pay. HOWEVER, if it is the reverse and you had $25,000 last year and $15,000 this year…not likely the lender is going to look at a figure higher than $15,000. They may impose a continued downward trend on that recent $15,000 earning vs. $25,000 the year before. In fact they could exclude it altogether as an unreliable source of income, unless your employer produces a letter guaranteeing that the overtime and bonus income will not drop below $15,000 for the next year or two.

3) “monthly child support payments” is the next line in that particular “mortgage calculator” and is the only additional income category. That doesn’t seem right at all to me. Best to contact a lender regarding all of your “other income” sources to determine which, if any, they will use. What if your child support payments are ending in 8 months? What about interest income, alimony payments, etc.? Unless you need to use these other income sources to qualify, and expect them to continue for the life of the loan, or at least for 10 years, I would suggest not including this “other” income. It will give you a “cushion” of extra monies if needed. Buy a home you can afford without these extra income considerations, if at all possible. More on this when we get to “back end ratio”.

Back to the handy but not so accurate online mortgage calculator it makes no sense to me why they would ask for HOA dues in the “income-debt” portion and then again when getting to estimated monthly payment for the new loan. In fact the whole “income and monthly debt obligations” section is poorly worded for accuracy. Once you get past income, you want to calculate your monthly “debt” payments. The most common of these are”

Car payments, Student loan payments, credit card payments, alimony or child support payments (though technically not “debt”). What you do not include are regular living expenses like utilities, gas, car insurance…all of these are not “debt’ payments.

Now skip all the way to the bottom and see the terms “front end” and “back end”. The calculator has a pre-set for 28% front end and a 36% back end. it allows you to change these pre-sets, but do not do that until you understand the numbers using the pre-sets. Assume that the pre-sets are the Average Comfort Zone for most people.

“Front-end” is your housing payment. “Back-End” is your total debt PLUS your housing payment. Old school rules work like this:

You make $10,000 a month gross at 28% = $2,800 a month for housing payment “front-end”

You make $10,000 a month gross at 36% = $3,600 a month for housing plus debt payment “back-end”.

IF your debt payments are $1,000 vs the $800 allowed, then your front end should be $2,600 vs. $2,800. $3,600 back end minus $1,000 = $2,600, so your “back end being out” reduces the amount available for housing payment by $200.

BUT that does not work in reverse. If you have NO DEBT, your housing payment stays at $2,800 and DOES NOT increase to $3,600. This based on how likely is it that you will have no debt for 30 years?

That last paragraph is the most important paragraph in this post, so take the time to understand it well.

28% front end and 36% back end has been the long term conservative approach since forever. It is also very rare that a lender will use these ratios when qualifying you for a mortgage, so YOU must do it yourself. Then when you know your payment should be $2,600 and the lender qualifies you for a payment of $3,500, you know just how much your lender is stretching you outside of conservative standards. That tells you how difficult it may be for you to actually make that payment for the next 3-5 years. A family with 4 children might only be able to spend 20% to 25% of their gross income on housing payment. A single person with a high income may be able to stretch to 33% of their gross income on housing payment. If you are a VA buyer…this is very important, as VA uses one ratio and not two (last I looked) allowing you to spend your full back end allowance on housing payment if you have no current debt.

One of the things that prompted me to write this post today was this comment I saw from a lender on Zillow:

The rules are still tightening-to a fault. Fannie Mae will soon be announcing that they are going to a 45% back end ratio and any borrower with a 620 fico score has to put down at least 20 percent. I can live with the 20 percent for a 620 fico,but the 45% back end ratio is going to make it even more difficult…

As you can see, lenders are not used to people qualifying at a conservative standard of a 36% “back end ratio” and are complaining that the rules are too tight when requiring a 45% back end ratio. OUTRAGEOUS! Remember we are using GROSS income and not net income. So 45% of your gross income on housing payment and debt is clearly NOT too “tight” of a rule.

Knowing how to qualify yourself using 28% front end and 36% back end, will help you know for yourself what monthly payment you truly can afford. Here’s my suggestion: If conservative ratios say you can afford $2,800 for a housing payment, and your lender says that number should be $3,500, test it first. If your current rent payment is $1,700, try putting $3,500 minus $1,700 in the bank every month (not on average). If you can’t put an additional $1,700 a month in the bank easily, each and every month for at least 6-9 months, don’t consider buying a house at the max your lender “says” you can afford.

In fact regardless of the ratios, it’s a very good idea for you to pretend you have that new housing payment well in advance of making an offer to purchase. Test for yourself, by banking the difference, before taking on that 30 year obligation to pay.

Buyer Beware of Real Estate “lingo”. The soft language of “making an offer” is really leading you to sign a binding contract. For some this comes as no surprise. But for others who may think they are simply making an offer, and later deciding whether or not they really want to buy the house, this is very important. If the seller signs your offer without any changes, you are in a binding contract to purchase that house.

Buyer Beware of Real Estate “lingo”. The soft language of “making an offer” is really leading you to sign a binding contract. For some this comes as no surprise. But for others who may think they are simply making an offer, and later deciding whether or not they really want to buy the house, this is very important. If the seller signs your offer without any changes, you are in a binding contract to purchase that house.

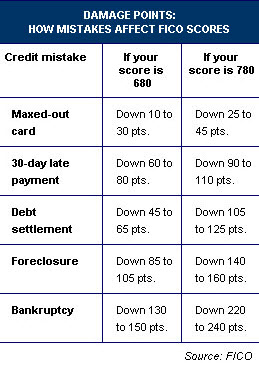

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true.

Did you know that if you have a credit score of 780 or higher, you might damage your score more from a single 30 day late payment, than a 680 score person might get dinged for a Foreclosure? Sad but true.  Well it’s all approved and just needs the President’s Signature, so I think we can pretty much call this Homebuyer Credit Bill a done deal.

Well it’s all approved and just needs the President’s Signature, so I think we can pretty much call this Homebuyer Credit Bill a done deal. I rarely write on investor topics, because most of my topics come from recent issues discussed with one or more of my clients. But this week I was speaking with one of the few investor clients I choose to work with, though I use the term “work with” loosely, as most of the time I tell him “no, I don’t think that’s going to work out well for you.”

I rarely write on investor topics, because most of my topics come from recent issues discussed with one or more of my clients. But this week I was speaking with one of the few investor clients I choose to work with, though I use the term “work with” loosely, as most of the time I tell him “no, I don’t think that’s going to work out well for you.” There are a lot of rumors flying around suggesting that the $8,000 credit has been extended. While that is not the case, as nothing has been signed yet, there seems to be strong support for:

There are a lot of rumors flying around suggesting that the $8,000 credit has been extended. While that is not the case, as nothing has been signed yet, there seems to be strong support for: