This is a good representation of the emails and blog comments I receive daily over at the NAMF website on the topic of loan originator compensation:

Dear Jillayne, I read your article because I am trying to determine when the loan originator compensation limits will go into effect and what I’m going to do if this acutally happens. As an LO for 10 years, I take great pride in being a member of the lending industry and in my opinion, I have provided an invaluable service to my customers over that period. I will also admit to having earned the ocassional “overage” in a transaction. I did not price my loans to make overage, however if the par price paid less than 1% (as often happened because of the rate sheet) I felt I was entitled to do it.

I do take issue with you on the amount of work that an LO does to earn their compensation, a competent LO not only takes the 1003 loan application, I take an appropriate amount of time on the front end of the transaction to thoroughly explain the loan process. I tell customers exactly what they can anticipate. I then take a complete application and discuss what documentation will be required and why. I spend at least 2 hours reviewing every disclosure, state and federal, that they are signing. I then collect all documentation, prepare the loan package, sort the package to a stacking order, order title, order appraisal, register the loan and submit to processing. I get the conditions which I discuss with the processor, and then collect the conditions and submit for final approval.

My company has just announced that they are discontinuing payment of all overage effective January 1, 2011. Regardless of your opinion on overage, it is a significant component of any LO’s income. While we can debate whether it should or should not be, the fact of the matter is, it is! The companies are not going to increase my compensation to account for that loss in income, and I find myself having to generate 50 or 75% more sources to find loans. How would you approach that change in your income?

Dear Entitled to Overage,

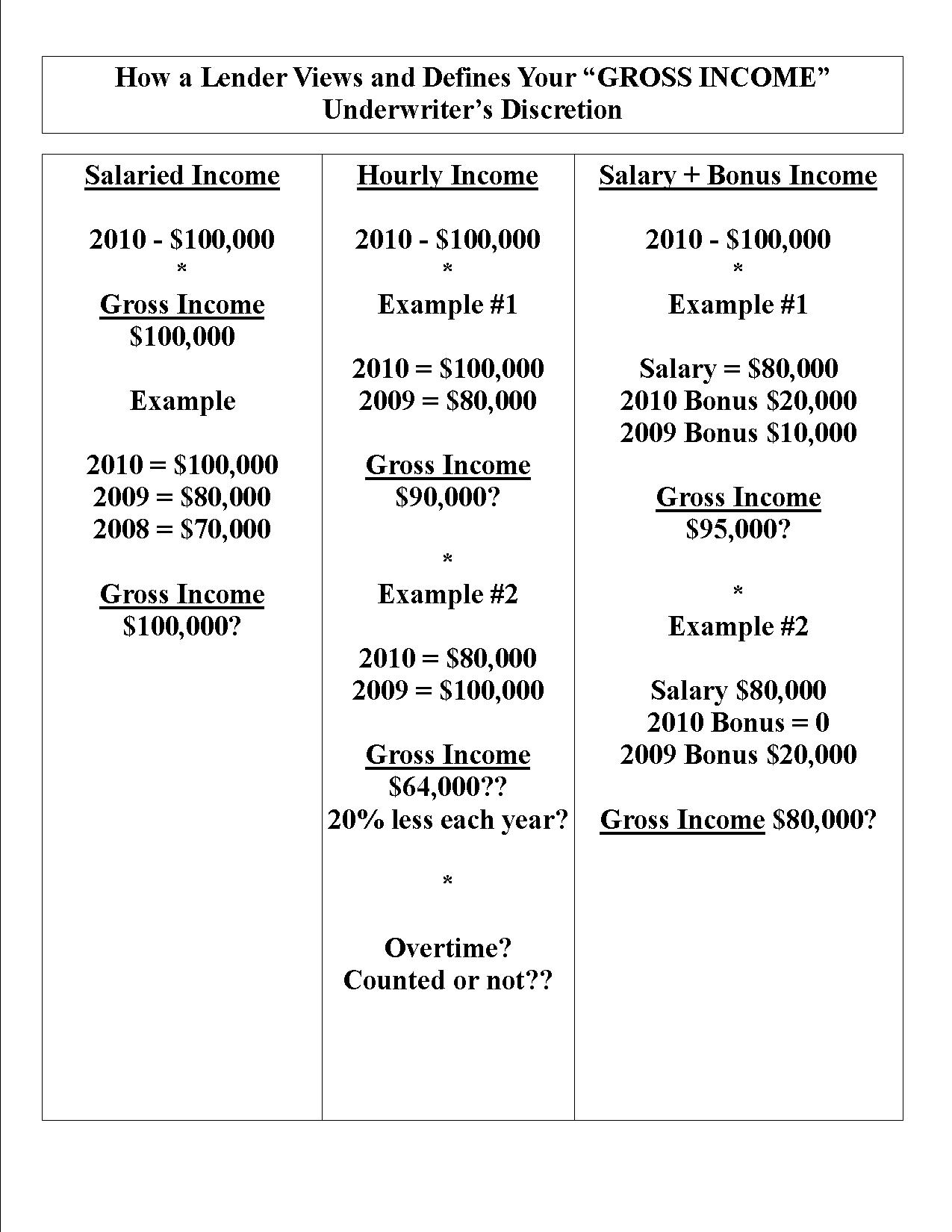

We exchanged two emails in which I asked you how many hours you spend, on average per file and I also asked for your average loan amount. E2O, you said you spend an average of 15 hours originating each loan and your average loan amount is $175,000. Let’s do the math. I’m going to estimate that in today’s competitive market, a loan originator would be hard pressed to get away with earning more than a 1 percent loan amount with a 1 percent overage

Let’s pause and quickly educate readers on overage income: This means marking up the wholesale interest rate and selling the consumer a higher interest rate at retail rates. The lender funding the loan, who is very happy that you’ve sold a much higher rate, rewards the loan originator by paying them a percentage of the loan amount at closing. Mortgage broker LOs disclose ALL their compensation on line 1 of the Good Faith Estimate. Mortgage banker LOs do not have to disclose this overage income as of today. However, two rules at the federal level will change this come April 1, 2011: The Federal Reserve Board Rule and Dodd-Frank Wall St Reform. More on LO Compensation limits in a future blog post.

So E2O, I’m going to estimate low. Let’s say you currently feel entitled to make 2 percent of the loan amount as your fee for working 15 hours. That’s $3500. Let’s divide $3500 by 15 hours. That comes out to $234 per hour. Please help me understand how a position that does not require a high school diploma is worth $234/hour? If a person making this kind of hourly wage works a full, 40 week, that means this same person is grossing $486,720 per year. No wonder loan origination attracted so many people who were only in it for the money. LOs could work as little as 10 hours a week and make a comfortable living.

Let’s get back to your question. You’re saying that your company is going to take away your ability to earn the hidden “overage” income immediately and you’d like my advice on how to approach that change in income.

First of all, I highly doubt that you’re working a full 40 hours per week. If indeed you were actually working that hard, you’d have more business sources than you’d know what to do with so my first suggestion is to honestly reflect back on how many hours you actually spend working on the job of origination. Subtract the hours spent going to the gym, talking sports with the guys over coffees or beers, subtract the hours spent on Mortgage Grapevine and the right wing political conspiracy blogs or Huff Po or wherever you’re currently wasting time and look at the bare bones number of hours spent talking with past clients, getting off your butt and into Realtor offices drumming up business. My first suggestion is to work harder. Don’t like that? Go find another job in another field that will pay you $233/hour.

Second suggestion: Ask yourself how much you love mortgage lending. If you’re only in mortgage lending for the money ONLY, then my second suggestion is to leave the industry. That’s right, get out of mortgage lending and go do something that you really love. Life is short (and life is long. It’s a paradox.)… life is too short to spend it in the mad, mad, mad world of mortgage lending unless you love what you’re doing so much that you wouldn’t dream of spending life any other way. This is the choice in attitude it’s going to take to get you through 2011 and beyond.

Third suggestion: If indeed you really, truly are worth $233/hour then go ahead and charge that! Charge your clients a 2 percent loan origination fee on line 1 of the Good Faith Estimate and when they shop around and find a lower interest rate and lower loan fee, explain to your clients the reason why you are worth that amount.

Fourth suggestion: Accept that you’re not worth $233 an hour. Why? Because if you were, you wouldn’t be asking for help. Banning overage income is going to separate the men from the boys and the women from the girls. Loan originators: You never were worth $233 an hour as a brand new, unexperienced loan originator. All it takes to get a license is a 20 hour prelicensing class, passing a background check and a national and state licensing exam, and to not have any felony convictions in the past 7 years. And if an LO wants to work at a depository bank, NONE of that is required! No loan originator is now or was ever worth $233/hour when they are first licensed. Maybe an extremely experienced LO with, say, 25 years experience (which means they entered the industry before the subprime lending era) is worth that much. Why? Because he/she can originate a loan IN LESS THAN 15 HOURS. That 25 year veteran knows his/her products, knows FHA/VA/USDA, knows the FHA 203K Program which will be highly used as soon as more REOs hit the market. That 25 year veteran has seen the rise and fall of the Savings and Loan crisis, has seen many refi booms, has lived through countless underwriting guideline changes, as lived through the same amount of federal law changes, and has the experience, maturity, and knowledge to help a wide variety of clients. This loan originator is very valuable. A brand new LO was never worth $233/hour and one of the big mistakes company owners made was to recruite people through greed to be LOs.

Fifth suggestion: Now that you’ve accepted that no green LO is or was ever worth $233/hour reset your own worth. If it seriously takes you 15 hours to originate a loan, I’d say that you don’t know as much as you think you know (this is very common for LOs who were hired during the subprime era) or you need to learn how to work more efficiently and spend more of your time procuring new clients. Don’t like Realtors? The majority of LOs who were birthed in subprime boiler rooms despise all Realtors because Realtors tend to hold LOs accountable. So if you don’t like Realtors and you don’t want to work harder to procure more clients…..

E20, my sixth suggestion is to accept that your value to your company is much less than you think it is. Reset your lifestyle and spending patterns to match your worth to your company and client, or prepare to work harder and smarter in 2011 and beyond.

I suppose there’s another option. You could open your own bank or mortgage bank. Now you get to keep the profits for yourself. As I look around the mortgage lending industry I see many faces of company owners who started out as loan originators and worked their way up the ladder to the point where it was time to start their own company. This is always an option for any of us…who want to work that hard.

2. “There’s no good study material available”

2. “There’s no good study material available”