Courtney Cooper broke the news on Easter. The Northwest MLS has voted to add a required field: “Third Party Approval Required” and “Bank/REO Owned.” From the NWMLS (no link):

“NWMLS is excited to announce two new required fields; “3rd Party Approval Required

Category Archives: Ethics

Bottom Calling to Solicit Clients: Is it Ethical?

Dear Renter,

Youve been patient. Youve waited for the perfect time to buy a home. Well this is it. Home prices have bottomed out. Many experts see prices rebounding from current lows. The $8000 Federal Tax Credit is available for a limited time. The….. Buyers Rebate is yours when you use me as your Buyers Agent. And now Mortgages are at their lowest since 1971…Your patience has paid off!”

Seattlerenter asks if this is legal and ethical, specifically, using the phrase “home prices have bottomed out.” Since I do not practice law, I cannot answer the legal side. In this blog post, I will analyze the ethical question.

First we need to differentiate between real estate agents and Realtors. Everyone is an agent but only some are members of the National Assoc of Realtors. In order to solve any ethical dilemma, it’s important to first consult the minimum moral standard; the law. First we would consult the state agency law. Next we would look to other state laws that may answer the question such as consumer protection laws. After that, there may be a federal law that addresses the question. If we still have no answer, we would consult MLS rules. After that, we would check with our own company for policies and procedures and company ethical codes that address honesty and advertising. Perhaps we belong to a professional association. Then we would consult the ethics code of that association for guidance.

Real estate agents who belong to the Realtor association consult their Code. Here is the link to the NAR Code of Ethics.

As we see in Article 1, a duty of honesty is paramount when working with a client. But at this point, we are soliciting to obtain a client. We don’t have a client yet. Standard of Practice 1-3 says, “REALTORS®, in attempting to secure a listing, shall not deliberately mislead the owner as to market value.” In order for the marketing piece to be deceptive, the real estate agent must have known about the falling market in advance and intentionally choose to mislead potential home buyers and sellers. Since we can’t know the future, this article may not fit our situation. Article 2 says “REALTORS® shall avoid exaggeration, misrepresentation, or concealment of pertinent facts relating to the property.” If Realtors have facts that lead them to believe that now is NOT the bottom, then they might be in trouble here. For home sellers, that’s not going to be a problem (since selling NOW in a down market is better than waiting.) This would only be problematic for a buyer who was lead to believe through exaggeration, that we are at the bottom.

Here is what I’ve been waiting for. Article 12:

“REALTORS® shall be honest and truthful in their real estate communications and shall present a true picture in their advertising, marketing, and other representations.”

How would a Realtor put up a defense against an Article 12 ethics violation for sending out the above letter? Well, I suppose what he/she might do is to provide some sort of analytical proof with numbers, statistics, and graphs as to how he/she arrived at an affirmative realization that “now” is the bottom of the market. This Realtor may be able to defend against an ethics complaint by saying that he/she WAS being honest, based on the facts known at the time, and based on his/her analysis.

This leaves homebuyers to make their own decision as to if this particular Realtor’s personal opnion and analysis of the market can be verified by other third parties.

A prudent decision for a Realtor (who is going to embark on a bottom calling ad campaign) to do is to take his/her personal bottom calling statistics and analysis and have it reviewed by a neutral third party for accuracy. Similar to how we had our thesis papers reviewed by professors and then winced when they tore up our paper with obvious errors and made us do more research. We were better students because of those professors, even though we didn’t like doing the extra work, but I digress. Without neutral third party review, a bottom-call is just one person’s opinion.

If ever hauled in for a professional standards committee hearing, there would be ample documentation from a wide variety of local, state, regional, national, and international economists , Nobel Prize Winners, and other real estate industry experts who could provide solid opinions based on known facts as to if we were at the bottom on the day that marketing piece was mailed.

The third to the last step in any professional ethical dilemma is to consult one’s own set of values. What kind of a real estate agent/Realtor do I want to be? What behavior do I value in this world? For example, if I value honesty then I need to also be honest with other people, too. Careful reflection is important when considering all the possible consequences. Realtors value honesty, justice, beneficence and non-maleficence, responsibility, respect for persons, loyalty, and compassion. These values are hidden all throughout the Realtor Code. How does our marketing campaign support the values that we believe in?

The second to the last step is to make the decision.

The last step is to look back and reflect on what we did, how it turned out, and if we’d do anything different next time.

The person making the “bottom call” in the letter claims to have experts who agree with him/her. Who are these experts and where can the letter reader go to get more information? Perhaps the real estate agent who wrote the letter could provide that information in the letter.

At best, the letter brings to mind the viagra, porn, and loan mod spam in my spam bin, and I haven’t even touched the typos and the deception regarding the $8,000 tax credit.

If Realtors care about their ethics as much as they claim to, then Realtors should talk with each other about the possible consequences of calling bottom in marketing material and provide guidelines as to what research to use. It goes without saying that we would have benefitted from guidelines like this when we rode the real estate bubble on the way up.

Using the NAR’s economist as the only source would be a very, very bad decision.

What will they say in 20 years about today's new homes?

When I look at new construction for sale I often wonder if the architect and the builder ever spoke or better yet, if the architect or the builder would ever live in the house they designed/built (I am a builder). I seem to be asking myself that question even more lately as I tour homes built from about 2005+.

When I look at new construction for sale I often wonder if the architect and the builder ever spoke or better yet, if the architect or the builder would ever live in the house they designed/built (I am a builder). I seem to be asking myself that question even more lately as I tour homes built from about 2005+.

I wonder, besides the financial crisis, what will this era’s theme of houses be?

It will for sure be about townhomes, but (on average) I am afraid it will also equate to poorly designed and constructed too.

I was touring a home today that made me wonder if the builder ever asked the question, “where will the couch go

When your financing evaporates, do you lose your earnest money?

This is not legal advice. For legal advice, consult an attorney, not a blog.

In this challenging market, many buyers are discovering that their loan program is no longer available. This is a particular problem with new construction, whether condo or house. The buyer signed a purchase and sale agreement (PSA) several months or even years ago. Back then, in the “good ol’ days,” lenders offered a variety of financing options. Some buyers relied on some of the more “aggressive” options (e.g., an option ARM) in order to qualify for the new home. Today, that financing option is gone, gone, gone, and the buyer can no longer afford to buy the property. What happens then?

Well, the short answer is that the buyer loses the money. In almost every new construction contract, the builder’s addendum will note that the financing contingency, if any, is waived within several weeks of signing the PSA (and months or years before closing). Once the financing contingency is waived, then the risk of a failure of financing rests squarely on the buyer. At that point, if financing fails, it is the buyer’s problem, not the seller’s. Accordingly, if the buyer cannot close as a result, then the buyer will lose the earnest money as the buyer is in default of the PSA.

However, there may be more to the contract than what is seen by the untrained eye. There are a variety of state and even federal laws that apply to the sale of property, and in particular new construction. In many instances, these laws create “loopholes” in the contract that allow the buyer to at least arguably rescind the contract. Thus, depending on the terms of the PSA at issue, these laws can be used to exert negotiating pressure on the seller to at least return some of the earnest money.

Certainly, a buyer should not rely on these laws when signing the PSA originally. Every buyer should be aware of the risks and obligations created by a contract. But sometimes, the buyer’s situation changes (to put “America’s Money Crisis” mildly) and the buyer can no longer perform. Heck, sometimes the buyer may just decide that the purchase is actually a bad idea and not want to complete it. Under those circumstances, the buyer should consult an attorney to determine if there is a mechanism by which the buyer can get some or all of the earnest money back.

Barclays North: "It's a matter of cash flow"

Snohomish County real estate land developer Barclays North is shutting down.

Back in April, CEO Patrick McCourt went public with their financial problems.

Everett-based developer Barclays North has struggled since late last year to repay loans from nearly 100 banks and other lenders, according to court documents. Company officials said in court papers in January that Barclays North and its many affiliates were in default with at least 56 lenders, though most had agreed to hold off any action until the end of March…

“What got Pat into trouble,” said Britsch, was purchasing land in advance to supply “national contracts with very large builders,” who backed out after the housing downturn began in California and the Southwest in mid-2006.

Demand for undeveloped lots in Snohomish County “fell relatively hard and fast,” he said, “and when that happened the builders obviously didn’t need as many lots as anticipated. That left Pat and the banks holding this huge financial burden.”

Local state-chartered banks exposed to loan losses include Frontier Bank, Banner Bank, Shoreline Bank, Cascade Bank, and First Sound Bank.

and from the Everett Herald story:

“It’s fair to say all builders and developers are facing pressures in this market, although every company’s business model is different,” said Mike Pattison of the Master Builders Association of King and Snohomish Counties

I wonder which title insurance companies are on the hook for any outstanding mechanics liens?

Buyer Beware – New Construction Sites

[photopress:images_1_2_3_4_5.jpg,full,alignright] I wrote an article earlier today about a scammer. I can almost appreciate the creative talents of an obvious scammer like that. But when it comes to the real estate industry, I just want to puke.

I stopped into a new construction site yesterday to evaluate it for one of my clients. There are four people in the room. A guy sitting at the site plan talking to a young asian couple and a woman standing a bit on the side. I see the guy giving the “hard sell” about two and only two “available” lots. I’m standing back and looking at the site plan and I see about 50 available lots. Only two of them have “available” stickers and 6-9 have a sold sticker. So doesn’t that mean all the ones with NO sticker are “available”?

For some reason the young couple doesn’t “get” this, but I just keep my mouth shut and wait and watch. Can’t quite figure out who the woman in the room is yet. The guy tells the young couple something about how Tuesday or Wednesday is the deadline for them to get one of those two available lots. They thank him kindly and leave to think about which one they want, if they want one at all.

When they are out of earshot, I ascertain that the woman is an employee of the builder before I step up and say, “I’m here to help one of my client’s pick a lot. Where are those big electrical towers I saw when I drove up, but don’t see on the map here?” At this point point the woman gets obviously “annoyed”. I continue to ask questions about all of the good lots. The woman keeps trying to push me at the two “available” lots. I ignore her and continue to evaluate the better lots in the development.

As I’m leaving I ask about the other developments nearby. The guy knows nothing. The woman gives me the whole run down of the builders other projects.

Then they tell me that HE is the agent for the SELLER and SHE is the on-site agent for the BUYER. What a JOKE! She is obviously the closer of the two. She obviously works for the builder and knows more about the builder’s stuff than the guy posing as the “seller’s agent”. What a “Good Guy; Bad Guy” scam that is! Nauseating, isn’t it?

I have one final question. What is the commission to a Buyer’s Agent who isn’t “the builder’s hired closer/buyer’s agent”. He says “FULL COMMISSION”. I say, “What is FULL”. She says 3%. I say, what does the buyer get if they have no “Buyer’s Agent”. She says, they get ME. LOL What a hoot. I said so the buyer gets nothing if they have no agent? No price reduction? No upgrades? No something for the builder not having to pay an extra $21,000?? Nope. Nada. Not an option. I ask if the buyer had lost the opportunity to have an agent if they had “signed in” already. They said no. Great News!

So I leave, I go to my client to evaluate the property they will be selling. I tell them there’s an extra $21,000 on the table for us to include and negotiate, if they buy that new construction (which they had asked me about), or even if they buy a different property. My fee will be less if they buy the new construction, of course, because they were the ones who asked me to go there in the first place to check it out. Well, no. They just said they were thinking of buying in there before I even met them, and didn’t ask me to check it out.

So by poking my head into the New Construction site, even though they hadn’t asked me to, I found an extra $21,000 that would have been left on the table. Turned out they will not likely buy there, at least not before considering other options. My gut says if the builder is willing to pay 3% to an agent, even though the agent wasn’t with them when the buyer first went in to the new home sales office, there’s probably something wrong with the place.

Every not lot sold in a new construction site is available. Maybe not today. Maybe they WANT to sell two at a time because it squeezes the buyer more into making a quick decision. But if it Ain’t SOLD…I’ts AVAILABLE, regardless of the little stickers. No sticker equals available.

New Construction Tip

When buying new construction, you should try to do at least two walk through inspections before signing your closing papers. Do one early, maybe two weeks ahead of time. Go back BEFORE you sign your closing papers and check to see if everything from the first walk through was done. You can’t really hold up closing for minor items, so more walk through inspections are better than just one. As many as you can get away with.

When buying new construction, you should try to do at least two walk through inspections before signing your closing papers. Do one early, maybe two weeks ahead of time. Go back BEFORE you sign your closing papers and check to see if everything from the first walk through was done. You can’t really hold up closing for minor items, so more walk through inspections are better than just one. As many as you can get away with.

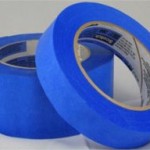

But here’s the TIP of the DAY! I love this one and so do my clients. We bring our own blue tape. The new construction person will usually have blue tape, and when you point out a problem, they usually put a piece of blue tape on it. But sometimes if they think it is a picky item, they don’t, and you have to bug them to put a piece of blue tape on it. So bring your own blue tape. Give everyone blue tape. Then you don’t have to call the new construction person for every piddly little item.

Then everywhere there is blue tape at the end, you make a list of the items, and where you don’t expect the builder to be able to fix an item, you put a credit amount if they can’t fix it. Example, there was a little scratch on the stainless steel refrigerator. It’s a large all new condo complex. You put down that you want a $250 credit (whatever) if they can’t buff it out. The builder can just switch it out if he wants, and give you the one in the unit next door and hope they don’t see it, if he doesn’t want to give you the credit. You’d probably be happier with the one with no scratch, but at least you won’t have to suck up the one with the scratch without a credit. Another example. A little piece of slab granite in the back of the shower, where the two pieces meet, was chipped. You could only feel it, you couldn’t see it. The builder isn’t going to fix that. He’s not going to rip that whole shower apart and bring in a whole new piece of slab granite for a little chip you can’t even see. But you should get a credit for imperfections that can’t be fixed.

When the workers come to fix things, they can’t tell the builder reps tape from everyone else’s tape, so they just fix it all. That’s why it must be BLUE tape. Actually it has to be the same color they use. If you have green and they have blue, they can pull all of your piddly items off. But if it’s all blue, it will be next to impossible for them to sort out whose blue tape was whose.

Works great. And buyers love running around with their own blue tape, and not having to ask the person to PLEASE put a piece of blue tape on this and that. You are more likely to catch everything, if you have your own blue tape.

New Construction Closing Dates

Further to this string of three posts, I think we need to talk about new construction closing dates. I received a call about ten days ago from a former client whose brother was pulling his hair out regarding a new construction purchase. He was TOLD that the home would be ready in July or August, or at least that is what he heard. All of a sudden he got a call telling him that closing was in 2 days.

It was a very large, well known builder of moderate priced homes in this area whose contract stated they had about 60 days to build it and then the buyer had 2 days after that to close it. The buyer’s first language was not English and relied more on what he was told and did not read the contract specifics. I jumped in and resolved the problem for him. All worked out and I won’t give the details of how I did that, as that is not the point of this post.

The point is that buyers of new construction must know that builders ALMOST ALWAYS have a condition in the contract that the buyer must close within X days after the home is completed. Unless the builder takes a contingency on the sale of your home AND a contingency on the fact that the sale CLOSES, you are required to close within 10 days or less usually of the time the home is completed. Builders often do not put close dates unless it is a spec house already built. They do not want to carry that house after it is completed, they want to close. Read your contract carefully with regard to when you will be required to close and do not rely on “proposed completion dates” or verbal representations by the sales people.

Usually there is NO PENALTY to the builder if the home is built later than expected and there is a per diem charge to the buyer if the buyer does not close within the X days of the completion date. Also the builder does not have to extend the close date, so paying the per diem may not even be a viable option for the buyer. If you cannot buy unless you sell, you need to be sure you understand the complexity of meeting these builder contract requirements. Matching a sale to a new construction purchase is extremely challenging and ridden with potential pitfalls.

Condos: Conversion versus New Construction

(Editor’s Note: Please welcome Wendy Leung as the newest contributor to Rain City Guide. She is a real estate professional specializing in the Seattle Condo market. She has been running a very interesting condo blog for a few months now, and I thought we could all benefit from her knowledge on the condo market in Downtown Seattle. if you haven’t read her blog, definitely check out her post on Cars and Condos where she gives insight into the local condos by describing the type of car that they would be. Great stuff! You can always learn more about her at her website or by contacting her directly at 206-321-2493)

With an increasing number of apartment buildings converting into condos as well as a parade of new construction projects being unveiled every day, home buyers may be wondering how to think about these two property types.

At the end of the day, your Realtor should help you evaluate the options based on your goals, budget, needs, and circumstances. Furthermore, every property is unique and generalizing about conversions and new condos is a bit like saying one genre of restaurant will always offer better service than another. That said, there are some fairly consistent differences between the two property types. Here are some of the advantages for each.

Advantages of new condos

- Newer, nicer interiors and exteriors, often come with better amenities and more imaginative architectural designs.

- Better quality construction (at least as far as we know). Gone are the days when builders used leaky Synthetic stucco for every new project. The quality of construction has advanced these days and more and more builders are using hardy plank, a combination of brick veneer, vinyl, metal, concrete, steel and cement.

- Flexibility to customize the interior. Usually, the builder will offer you a variety of upgrades and style options to make the place match your personal style.

Advantages of conversions

- There are fewer surprises. What you see is what you get. The building has been around for a while so generally, if there are any issues with the building, it should already have happened. If the building has issues, you can usually get hold of the information about any issues much easier than a new condo to make a better informed decision.

- There is actual market data available for that building and even that unit to support the rental value for the building if you are purchasing it as an investment. There will also be more insight into peoples’ opinions of the building as opposed to speculation from the new condo sales center.

- Most of the time, conversions are cheaper than buying new construction. When you’re looking at ROI, this can be the biggest factor of all since 3 years from now, a new condo and an apartment conversion will both be older condos in the eyes of most buyers.

If you are not paying a really large premium for new construction (this is getting harder to do these days), it will probably resell for more than a conversion. However, a pricey new construction unit may have a higher absolute price appreciation but may not have a higher return on investment (than a value-priced conversion unit). At the end of the day from an investment point of view, it’s the rate of return on investment and not the absolute resale price growth that maximizes your profits.