What happens after the seller has accepted your offer? Often a buyer wants to relax and celebrate after their offer is accepted, especially if there were rounds of counter offers and acceptances. But some things need to happen pretty quickly after the contract is signed by all parties. This is a fairly good example of what actually happens most times. Not all contracts are the same. This is just a rough example of what usually happens in my transactions when I represent the buyer of a home, unless the contract requires us to do things differently than “the norm”.

1) SCHEDULE THE HOME INSPECTION

Usually the very first thing I have my buyer clients do once the contract is “signed around” by all parties, is schedule the home inspection. Often people read the contract to mean that they have 5 to 10 days (every contract is different) to DO the inspection. That is not the case.

During that very limited time frame:

a) You have to “DO” The Inspection

b) You have to review the results of The Inspection

c) You have to think about what you may or may not want to ask of the seller as a result of that Inspection

d) You have to cancel the contract, or accept the inspection, or submit any conditions of accepting the Inspection, in writing, so that it is RECEIVED by the seller or seller’s representative by the end of the time frame.

You don’t want to wait until the last minute to “DO” the inspection.

My recommendation is that you call the inspector ASAP after the contract is finalized and DO the inspection at the first available opportunity after the contract is signed around. By scheduling the inspection ASAP for the first available time, you should have sufficient time to digest what the inspector said at the inspection, and also to subsequently review the written inspection report after the inspector has left the property.

You should allow about 3 to 4 hours for the actual inspection in most cases for an average sized single family home.

2) OPEN ESCROW

By the time the contract is “signed around”, the Agent for the Buyer usually has the Earnest Money check in their possession (some exceptions). Opening Escrow can be as simple as bringing a copy of the contract and the Earnest Money check to escrow, and that is often done on the first business day after the contract is accepted. Sometimes I send the contract to escrow during the weekend, if the contract was accepted on a non-business day. This way escrow has everything they need to “open escrow” when they open for business on the first business day after the weekend. The check usually has to be delivered to escrow by the 2nd business day and this is another one of those ASAP situations. Get the check to escrow as soon as practically convenient vs waiting to the last minute. There is no official time frame as to when escrow must be OPENED, there is only a required time frame for when the EM check must be AT escrow. Most escrow holders will not accept a check for an escrow that has not been “opened”, so escrow is usually opened either in advance of that check needing to be delivered to escrow, or at the same time.

Generally this 2nd step is not done by the buyer or the seller, but by the agents in the transaction.

3) APPLY FOR YOUR MORTGAGE

This step is VERY IMPORTANT and often misunderstood.

Common “misconceptions”.

a) Some people think you don’t need to apply for your mortgage until after you complete the Home Inspection phase. Most contracts require that you apply for your mortgage in a shorter time frame than when the inspection needs to be completed.

b) Some people (usually agents) think that the buyer must apply to the same mortgage company who provided the pre-approval letter at time of offer. Usually a buyer has 5 business days or less to “apply” for their mortgage AFTER the contract is signed around and “chooses” which company to apply to during that time frame. It is near impossible in most cases to actually choose a lender prior to contract, because interest rates change during that time AND the interest rate often cannot be locked until there is a signed contract. So choosing lender by comparing rates and costs is usually best done at a point when that rate can be locked in.

b) Some people (usually buyers) think they already “applied for their mortgage” complying with the terms of their contract when they provided the information to a lender before making an offer so as to get a pre-approval letter.

c) Many people think that their rate is locked, or that their rate is locked indefinitely. Rate locks of 60 days are usually more expensive than rate locks for 30 days or 45 days.

In order to preserve your rights under the Finance Contingency you need to apply for your mortgage within the time frame stated in the addendum vs in the main contract.

To me the clear signal that you have “applied” for your mortgage happens when you give the lender a copy of a fully signed around contract to purchase a home, since that is the one thing you do AFTER the contract is fully signed around that you could not have done in advance.

You may have spoken with a few lenders and even gotten pre-approval letters from more than one, but in most cases you only send a copy of the contract to the lender you intend to use to complete the transaction.

Very important to note here that you may not have the ability to switch lenders once you have applied for your mortgage.

Interest rates change frequently, so calling a lender a day may only be telling you the difference in rates from day to day vs from lender to lender. I generally recommend that people set aside a day and time to compare lenders so they are all dealing with the same rate time frame, and be sure to compare all lender fees when comparing rates.

Should you lock the rate or “float” the rate? A combination of both where you can lock the rate but get at least one “float down” option as well, often works best. That way your rate can’t go up but it can go down.

Many other variables as to which type of loan, etc. But the main point here is no matter how long it is from contract to close, you usually have a very limited time frame to apply for your mortgage under the terms of the Finance Contingency, generally 5 days or less.

********

Note: Computation of Time: Sometimes The Home Inspection is Step 3 vs Step 4. That mostly depends on the availability of the inspector you choose. Sometimes you are having the home inspection within a day or two of the contract being signed around. In that case you often do the inspection before you apply for your mortgage.

Every contract is slightly different because of “Computation of Time”. In our standard contracts 5 days or less usually does NOT include weekends and holidays…but 6 days or more does.

So if you have 6 days to do the inspection and 5 days to apply for your mortgage, 5 days can be more than 6 days since the 6 = calendar days and the 5 = business days.

********

4) THE HOME INSPECTION

The inspection is paid for by the buyer, usually before the inspection begins. The buyer usually attends the Home Inspection because it is not a PASS/FAIL kind of thing in most cases. It is also not ONLY about what is wrong with the house. A good home inspection gives the buyer a lot of information that is not all about what the buyer may want the seller to do to correct defects.

Generally a Home Inspector will:

a) Inspect the outside of the home first. Roof, siding, gutters, etc. VERY IMPORTANT: Most inspectors are inspecting “the home” and not the fence or the shed and sometimes not even decks, especially if they are not connected to the house.

b) The inspector is usually not looking at cosmetic things that can be readily seen by the buyer prior to making the offer, such as a stain in the carpet.

c) An inspector cannot see through walls, so having an experienced inspector who likely knows what is behind those walls based on the age of the house is very important.

d) Since an inspector is not looking at cosmetic items, he will usually spend more time in bathrooms and kitchens, the attic and under the house, at the heater and electrical panel and hot water tank, than in a dining room or bedroom. In a bedroom he may check the outlets and the windows and make sure the door latches properly. In a kitchen or bathroom he will be checking appliances, looking for leaks under sinks, making sure the outlets in the rooms with water have appropriate and functioning GFCI (ground fault circuit interrupters) at the outlets. Often one GFCI will operate more than one outlet.

e) Generally you do not need to take notes at an inspection, as the inspector will be providing you with a written report. Hopefully the report will have a summary of major problems and a separate summary of minor problems. Today Inspection Reports can be 85 pages long with lots of tips on home maintenance and other topics. So a one page summary of actual defects is helpful.

IMPORTANT: If something is wrong with the property, you usually know it before you get the written report. If something comes up that causes you to not want the house at all, you may not want to complete the full inspection. In fact if you suspect that to be the case, you may ask the inspector to break from his normal routine and look at that item first.

HOUSES ALMOST NEVER “FAIL” ON INSPECTION. Contracts often fail “on inspection” due to other issues, BUT “HOUSES” RARELY “FAIL” ON INSPECTION.

Most often when a contract “fails on inspection” and “falls out of escrow” it is because of an erroneous or not reasonable expectation. The buyer isn’t doing what the seller expected the buyer to do, or the seller is not doing what the buyer expected the seller to do. Rarely does a real “deal-breaker” issue come up with the house, that the buyer and seller could not have known about in advance of the offer being made. Most often the contract fails because the buyer or the seller is not responding “appropriately” to an issue. That is usually an emotional problem, vs an actual “problem” with the house that can’t be rectified.

Good “Rule of Thumb” is no seller should expect the buyer to want absolutely nothing at inspection, and no buyer should expect a seller to address everything the inspector talks about as needing to be done to the house.

Instead of taking general notes during a home inspection, I find using a chart like this to be helpful during the inspection. The inspector says SO many things over a 3 to 4 hour period, so organizing them a bit while the inspector is there can help you raise questions at the end before the inspector leaves the premises.

Column One – OWNER SHOULD – There are no hard and fast rules here. Many items the Inspector notes as “needing to be done” are things any owner needs to do periodically. Is “The Owner” the Buyer of the Home? Or is “The Owner” the Seller of the home? While contracts often fail over these issues, they should not as they are things the buyer will need to do during their ownership of the home. These are not “once and done” items. If the gutters are so clogged and dirty because the owner never had them cleaned during their ownership, the buyer may ask the seller to have those professionally cleaned prior to closing. The buyer may put this in the “Seller SHOULD” column. Often this has to do with the number of trees dropping debris into the gutters.

Generally a buyer should not decide they do not want the house after all because the gutters are dirty and the seller won’t have them cleaned prior to closing, or because the seller won’t trim a small branch on a tree.

Just because the Inspector tells the buyer “the gutters need to be cleaned” does not mean the seller needs to DO something. The Inspector may simply be saying that at EVERY inspection so the buyer knows that this is a normal owner maintenance item. That statement alone does not mean there is something currently “wrong” with the gutters.

Column Two – OWNER MUST – These are usually things the seller would have fixed had he known they were not functioning properly. They are usually things that have no aesthetic selection element, so that it doesn’t matter if the buyer does them or the seller does them. They are usually things that can cause a problem or additional damage between inspection and closing.

As example, a leaking sink creates damage every day between the time you discover it and the time it is fixed, so having it fixed without delay is recommended. It is very rare that a seller would not want to fix that leak ASAP.

Column Three – SELLER SHOULD – Many items fall in here and are basically not major things. Often whether or not the seller “should” fix them has to do with the price of the home. If the buyer is paying a good and somewhat high “fair market value” then the buyer often expects these things to be done and the seller, happy with the price he got for the home, often does them. If the buyer is getting a screaming deal and the seller is walking away with nothing or less than nothing, the seller usually expects the buyer to accept the home with these issues not being addressed.

Often these are things the seller did not deem important enough to fix while he lived there, and not something the seller did not know about. A small crack in a window. A broken window seal (this is cosmetic in most cases). A bedroom door doesn’t “latch” properly, which is often fixed by tightening knob or hinge screws or adjusting the latch plate. Basically things that can be fixed with little or no cost and a screw driver.

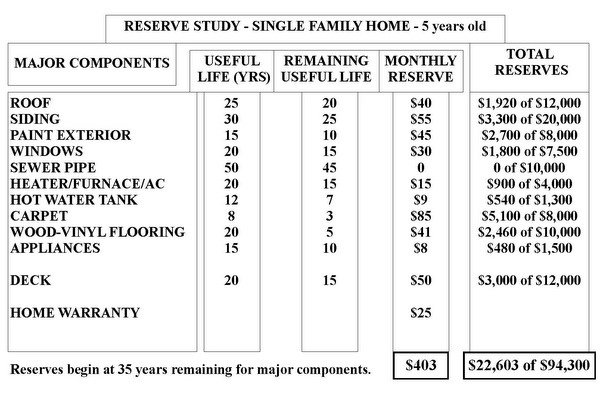

Column Four – ????? – This is where many sales can fall apart. These are usually large items that are “in working order” and not currently defective, but near or past their “life expectancy”. Roof is not leaking but 23 years old. Hot water tank is working just fine, but is 18 years old. Heater is working just fine, but is 30 years old. Again these items usually hinge on the price negotiated. If the Seller got the better end of the deal at initial price negotiation, the buyer’s expectations may be different than if the buyer is getting the home at a “below market” price. Often the seller and the buyer do not agree on THAT, on whether the price was at, above, or below market price and THAT is why the sale fails over one of these items. Not because of the item itself, but because the parties think one or the other is not being reasonable given the home price.

Does a house need a new roof because it is “old” but is not leaking? Does a hot water tank need to be replaced because of it’s age when it is functioning well?

Often these things are viewed differently in a Seller’s Market vs a Buyer’s Market.

5) PROPERTY APPRAISED

This item usually happens “in due course” meaning the buyer and seller do not order or control the time frame of this item. The Lender orders the appraisal and unless there is a problem with the appraisal, the contract simply proceeds toward closing. The Buyer usually pays for the appraisal in advance OR is responsible to pay for the appraisal even if they do not close escrow for some reason.

********

NOTE: MONEY the buyer needs to pay BEFORE closing. Earnest Money Deposit, Inspector Fees and Appraisal Fees. Depending on the size of the house, the inspector fees are usually $500 or so for one inspector/inspection and $450 or so for the appraisal. There could be more than one inspection needed, and if the home is unusually large or small the cost could vary. If you are only paying $199 for a Home Inspection, that is not a good sign. 🙂

6) HOMEOWNER’S/HAZARD INSURANCE

The buyer needs to purchase a full, one year, Hazard/Fire insurance policy AT closing. Once you are finished with the inspection and the lender has everything they need from you to process the loan, you should arrange for your Insurance Policy with your lender and escrow, who both need to coordinate with your insurance provider.

Most often the best rate is obtained by getting this insurance from the same company that does your car insurance, so be sure to get a quote from them.

Note: Title and Title Insurance Issues happen from before the property is listed through to closing. There are Title reviews and Title Insurance Policies and Supplemental updates of Title throughout the entire transaction. Sometimes these issues are critical, but most often they happen “in due course” and are not alarming. Both escrow and your lender are interacting with the Title Company throughout the transaction.

Title Insurance and Reports are usually pre-ordered by the seller before the home is listed for sale. The Buyer’s name is added when the buyer’s name is known. The Owner delivers “clear title” by paying for Owner’s Title and the buyer pays for Lender’s Title as a condition of their mortgage.

IN SUMMARY: MOST EVERYTHING THE BUYER NEEDS TO “DO” IS DONE IN THE FIRST 5 BUSINESS DAYS OR SO AFTER THE CONTRACT IS SIGNED. AT THE END OF THAT PERIOD THE BUYER EITHER CANCELS OR PROCEEDS TO CLOSING.

7) THE CLOSING Loan Documents arrive at escrow. Hopefully at least 3-5 days before the closing date noted in the contract. The buyer signs their closing papers which include the loan documents and the Final Estimated Numbers called the HUD 1 or Buyer’s Closing Statement and some other ancillary escrow forms. The Lender reviews the signed documents and “releases for recording”. Escrow Records the property in the new owner’s name with the County. Keys are available to the buyer after we have County Recording numbers OR on the date of possession noted in the contract.

Closing is a phone call saying “We have Recording Numbers”.

For the most part the buyer is VERY busy for the first 5 business days or so and then again near the end. In between everyone else is working hard. The seller is packing and moving out. Escrow is coordinating with the agents and the lender and the Title Company and the buyer’s insurance company and the County, and getting the seller’s payoffs so liens can be removed as to the seller’s mortgage and utility bills prior to closing.

THE BUYER SHOULD NOT BE PLANNING TO GO IN THE HOME THEY ARE BUYING AFTER THE HOME INSPECTION AND BEFORE CLOSING!

This often comes as a surprise to most home buyers. The seller is packing and usually does not want you IN the home while it is a mess of boxes! That is why you should do EVERYTHING during the inspection phase. Get estimates for new carpet or hardwoods, measure for curtains, measure for a refrigerator or washer and dryer if you plan on buying them before closing. If you don’t do it during inspection, you may have to wait until after closing.

No post like this is “all inclusive”. This one is written from the standpoint of a buyer purchasing a normal tract home on a normal lot with little problems and no HOA.

Here are a few others I wrote about 5 years ago. All good reading for a buyer or a seller after the initial inspection phase and before closing.

Anatomy of a Real Estate Transaction (Some good “extra” notes in the comments on that one.)

– Short Version for the Buyer

– Short Version for the Seller

– The Three Phases of a Real Estate Transaction form Contract to Close

Short Sales continue to be problematic for all concerned. So much so that “right” seems to be the minority “opinion”. At least I think I’m “right”…but apparently so does everyone else with a completely opposite opinion.

Short Sales continue to be problematic for all concerned. So much so that “right” seems to be the minority “opinion”. At least I think I’m “right”…but apparently so does everyone else with a completely opposite opinion.